Introduction

It is noted that a business model of an organization is the most critical piece of intellectual Property that drives business activities. It shows how organizations generate revenues (Kendall 9). This case focuses on some aspects of the business model of Bank of America.

The Basis of Bank of America Organizational Structure

Bank of America is among the top ten largest banks by assets in the US. It is headquartered in Charlotte, North Carolina and has more than 5,000 retail-banking offices and more than 17,000 ATMs all over the US (Hess 1). The success of Bank of America can be associated with its leveraging aspects, including the organizational structure.

The organizational structure leverages Bank of America in the following ways. First, specific sectors are assigned specific duties. With a clear sense of duties, employees optimize individual output and consequently improve organizational productivity. Second, the divisional hierarchy enhances proper communication and, therefore, improving efficacy in services delivery and feedback system. Third, with such an elaborate organizational structure, Bank of America is able to monitor the whole system’s operations and, thus, it ensures proper use of economic resources.

At the helm of the bank leadership is Chief executive officer. Generally, the bank CEO supervises and manages all chief corporate functions. Other employees are assigned specific duties depending on their qualification, expertise, and job descriptions.

Although the Bank of America has one of the best organizational structures, it has not realized its full potential. Partly, the hierarchical nature of the organizational structure creates bureaucracy and consequently hinders effective and timely communication. For decisions to be made and implemented, relevant approval must be sought and in the process, time is wasted and the probability of misinformation and information alteration increases. A case in point, bureaucracy and incorrect information led to the bank classifying a living customer as deceased for three years (Goyette 1). As such, the organizational structure impedes full realization of service delivery potential and affecting the business model negatively.

Organizational Throughputs

Bank of America has categorized its throughputs into five categories, which are the core products, processes, and services offered.

Banking solutions consist of checking, savings, CDs, student banking, online banking, and mobile banking. The bank’s credit cards products and services include regular credit cards, cash reward cards, travel and air reward cards and cards to build or rebuild credit. In addition, Bank of America provides credit cards for small businesses and even offers customized credit card facilities.

Loan products are tailored around mortgage, refinance, auto loan, and business loans.

Investing and trading products and services offered through Merrill Edge are diverse, including stocks, options, ETFs, mutual funds, fixed income, and bonds, managed portfolios and annuities. Bank of America has developed unique tools such as online, mobile, and Merrill Edge Market Pro to assist investors.

Learning also comes as a part of the bank’s services to its customers. Merrill Edge, for instance, offers investor education based on the proficiency of the investor.

Overall, it is imperative to recognize that Bank of America offers more products designed for specific states based on regulations and unique customer needs.

Bank of America has developed several supporting processes to deliver its products and services to customers. These include senior executives that make strategic business decisions, finance, human resource, strategy and marketing, legal affairs, legacy assets servicing, risk management and IT departments among others.

The bank has adopted organic growth strategy to implement its model. In addition, it strives to offer unparalleled customer service, expertise, convenience, product innovation and a wide range of financial services to more than 30 million customers.

Analysis of the Model

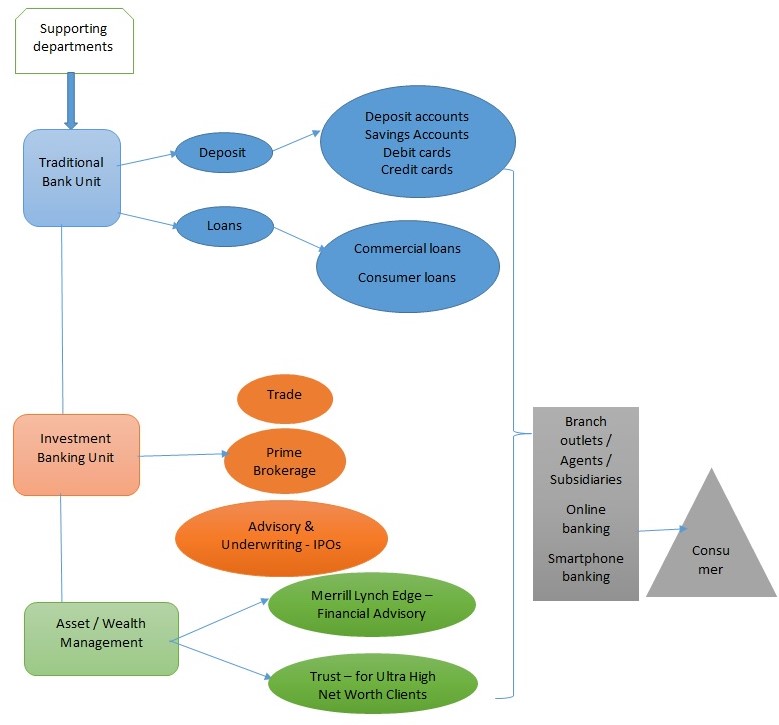

Bank of America has three critical elements in its business model. These are the traditional banking unit, investment banking unit, and asset and wealth management unit. It is observed that this model can cater for any given customer throughout their lifetime and, thus, making it one of the most powerful models in the global banking industry (Hanson 1). All these units of the bank are developed to generate revenues (throughputs) in different ways.

The traditional banking unit consists of the normal deposits and loans. However, the bank has created several products around deposits and loans to meet unique needs of customers. First, customers can use savings accounts and regular deposit or checking accounts, and then take the banks credit and debit cards. To mobilize deposits for loans, the company offers a small interest on savings held. Thus, it costs the bank to hold such cash. Nevertheless, the bank expects to generate revenues through transactional activities. For instance, the bank receives revenues in terms of interchange fees whenever its customers swipe their debit and credit cards. Perhaps these are the least sophisticated revenue generation schemes developed by the bank. Revenues may also originate from foreign exchange transactions.

A Systems Diagram

The traditional banking unit also allows Bank of America to offer both commercial and consumer loans. Loans are designed to generate profits from interest and processing fees charged. Over the past years, the bank has continuously reviewed and realigned its model. It has combined “Consumer Banking, Consumer Products, and Small Business Banking into a single major business line” (Bank of America 1) to enhance efficiency and save costs. In the recent past, analysts observed that the bank was shifting its focus to commercial loans rather than consumer loans for various reasons (Maxfield 1). First, it is noted that commercial loans normally have relatively shorter maturity periods. A typical mortgage loan can last for 30 years while a commercial loan may not exceed ten years. Second, commercial loan interest rates are based on a short-term rate benchmark given by regulatory authorities while consumer loans are normally underwritten at specific, fixed rates. Third, it is noted that commercial loans have more profits and better economies of scale relative to consumer loans. Finally, the bank has traditionally performed well in commercial lending rather than consumer financing.

The bank can deliver its products and services to consumers using various channels, mortar-and-brick branches, ATMs, online banking, smartphone apps, subsidiaries, and agents among others. Every channel aims at maximizing revenues and profits while enhancing efficiency.

The investment banking unit consists of trade, prime brokerage, and advisory and underwriting, including IPOs. The bank generates substantial revenues from these transactions and advisory roles.

Finally, Bank of America business model also consists of Asset/Wealth Management. Merrill Lynch Edge that offers financial advisory and Trust that is dedicated to ultra-high net worth clients handle these transactions. Bank of America conducts constant realignment of its model to reflect market dynamics. For instance, it has moved Premier Banking into Wealth and Investment units.

These realignment initiatives often lead to adoption of new technologies, improved service delivery and revamped operations through reviewed organizational structures. The banks streamline its services while leveraging process improvement opportunities for profitability and efficiency. In addition, the bank always looks for new developments in the banking industry, specifically on the latest phenomenon driven by FinTech startups that promise to disrupt the traditional banking model that has not changed for more than 200 years. Consequently, the bank is keen to find a suitable fintech startup to drive innovations and deliver value to customers (Calvey 1). This approach will certainly change its current business model.

Conclusion

Bank of America business model can evolve to be the most sophisticated, unmatched profit machine, but only if the company management can use its organizational structure to enhance communication and service delivery across all business units. For several years, the bank has struggled to improve its customer service. Only efficient customer service can demonstrate the robustness of this business model.

It is imperative for the current management to initiate changes that would transform customer service and lead to greater customer satisfaction. The management structure should be redesigned to clear the legacy issue while concentrating on profitability to impress shareholders with its profit-generating abilities and ultimately demonstrate the full potential of its current model.

Works Cited

Bank of America. Bank of America Business Model Simplification and Merger Transition Yield Additional Savings Opportunities. 2004. Web.

Calvey, Mark. Bank of America courts fintech startups as banks scramble for innovation. 2016. Web.

Goyette, Braden. “Bureaucracy kills: Bank of America listed living customer as dead for three years.” New York Daily News. 2012. Web.

Hanson, David. “Bank of America’s Simple and Ingenious Business Model.” The Motley Fool. 2013. Web.

Hess, Alexander E.M. Banks With the Most Branches. 2014. Web.

Kendall, Gerald I. Viable Vision: Transforming Total Sales into Net Profits. Plantation, FL: J. Ross Publishing, 2004. Print.

Maxfield, John. “A Notable Shift in Bank of America’s Business Model.” The Motley Fool. 2015. Web.