Economics explains the agents as market actors such as consumers and organizations that influence a specific market’s behavior. Conversely, the standard economic model assumes that individuals choose actions that optimize their expected utility. This paper investigates how players’ existence impacts economic agents’ behavior in various frequently studied corporate environments. Moreover, it intends to analyze the market behavior of organizations in monopolistic and competitive marketplaces, the way such environments affect the performance of an industry, and the benefits society gains from market competition.

The monopolistic market is a type of commercial organization that exists when an organization is the lone dealer of particular merchandise. As such, monopolies are described as an absence of competition within the marketplace that produces products and services. First, firms in such markets enjoy high profits due to a lack of competition; thus, they can charge prices above those existing in economic marketplaces (Thaler, 2016). For example, Microsoft Corporation had a monopoly on computer operating systems and software, thus making it generate significant revenue and becoming among the leading multinational corporations (Thaler, 2016).

Furthermore, in a monopoly, the firm can change the quantity of a product; thus, inelastic markets, the organization is expected to sell a significant quantity of the good despite its low price. Conversely, if the price is high, the company will sell a reduced quantity in a flexible marketplace. Firms in monopolistic markets set policies that focus on goods production and consumer satisfaction, thus preventing new entrants into the market. The organizations usually influence the terms and conditions of exchange, thus controlling the pricing of products (Thaler, 2016). Moreover, companies in such markets have patents over their products, preventing competition from developing similar products. Finally, organizations in controlled markets are usually the sole producers of the output of commodities and services.

Perfectly competitive markets are known as price takers because competing corporations compel them into accepting the prevailing balanced rate in the marketplace. If a firm in a completely economical marketplace increases its merchandise prices, it will lose its sales to competitors. Supply and demand in such markets determine the market’s price rather than an individual producer (Thaler, 2016). The total revenue for a corporation in the market is calculated by dividing its total return by quantity. Simultaneously, the marginal income is analyzed by dividing the variation in profits by the change in capacity produced (Thaler, 2016). Therefore, a perfectly competitive company should be a small player in the overall market to regulate productivity without influencing the price and amount of goods distributed in the marketplace.

Moreover, an economical market is a hypothetical margin despite manufacturers in various businesses facing competitors who produce similar goods, forcing them to act as price takers. For example, in 2015, American corn producers established a standard rate of $6 per bushel, and farmers who endeavored to retail at $7 per bushel did not have any consumers (Thaler, 2016). Producers in the marketplace should also be vigilant while valuing their products as over-pricing may influence their profits to be either negative, positive, or zero (Thaler, 2016). Therefore, a firm in such a market should not sell its products below or above the equilibrium price.

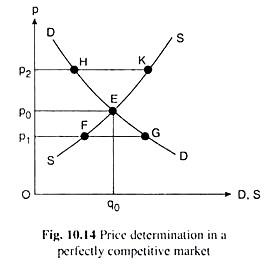

Equilibrium price determination in the market is done through the process of interaction between marketplace demand and supply or the aggregate. Consequently, if the price, supply, and need are equivalent at any given time, then both the purchasers and traders remain satisfied. The seller will therefore trade what the consumers demand, and the customers demand what the retailers sell. Economies use the DD curve to explain price determination further since it outlines the buyers’ aggregate demand for goods at a specific price (Thaler, 2016). As such, the curve is the parallel sum of the individual demand curve for all the dealers. For example, from the DD curve, the price=P, the need for products is P1G, thus at P=P2, the marketplace demand will amount to P2H.

Considering the regulation on demand, the consumer necessity curve is descending and dropping to the right, explaining why the marketplace demand curve, which is the sum of consumer requests, slopes to the right. Conversely, the SS curve represents the product’s market supply curve; thus, it denotes the horizontal summation of the wholesalers’ individual supply curve (Thaler, 2016). For example, from the SS curve, it can be concluded that if P=P1, the distribution of goods is P1F or at P=P2, and the flea market supply will be P2K (Thaler, 2016). Therefore, as the sale curve of retailers slopes downwards towards the right and the supply curve slopes upwards towards the right, the price of a product, P0, will be obtained at the point of intersection, E.

The economic agents which influence competition have affected business profits in various ways. First, the competition provides consumers with the freedom and choice to make their own decision. As such, buyers’ loyalty to a specific company would mean that the company will experience increased sales of its products against that of its competitors. Second, it encourages innovation, reactiveness and helps companies to gain insights into the target market, and avoid complacency (Thaler, 2016). Despite benefiting organizations’ profitability, competition can result in prices being driven down, thus paralyzing their operations. Competition plays a significant role in capitalism; hence it directly influences the profitability of a firm.

Competition benefits a society when the group and individual interests and incentives are aligned. However, challenges may arise when consumers’ interests are different. For example, when a company forms partnerships with other competitors, prices are likely to rise, and the quality reduces, thus, influencing the change in consumption within a specific market. The competition also creates opportunities for citizens to enter the marketplace and establish businesses (Thaler, 2016). It creates employment and presents individuals with the choice of workplaces and employers. Moreover, competition boosts innovation within society. It encourages the invention of new products and services that can be used to solve current and future concerns within the global marketplace. Competition can help companies identify society’s consumption gaps and develop new goods and services to meet those needs. It also reduces the need for state intrusion through control of commerce in competitive markets which do not adhere to government policies. Therefore, a free market that is competitive benefits customers and society and preserves individual freedoms.

In conclusion, economic agents such as consumers have a significant influence on both monopolies and competitive marketplaces. However, extensive research on the markets will help organizations understand the actors’ behaviors within the market and formulate strategies that will enable them to meet the buyers’ demands. Further research should be conducted on the perfectly competitive and monopolistic markets to understand each environment’s impacts on an organization fully.

Reference

Thaler, R. H. (2016). Behavioral economics: Past, present, and future. American Economic Review, 106(7), 1577–1600.