Introduction

British Petroleum (BP Plc) is a multinational firm that deals in the exploration, production, as well as marketing of fuel. The company was founded in 1909 as Anglo-Persian Oil Company with the main aim of exploring the Persian oilfields, the present day Iran.

The firm’s production and marketing activities spread over several countries in the world, including Angola, Australia, Azerbaijan, Egypt, Canada, the United Kingdom, and in the United States of America, particularly in the Gulf of Mexico.

BP also owns several facilities involved in the production and processing of crude oil, including pipelines and refineries.

During the year 2012, BP’s production averaged more than 2.31 million barrels of oil per day, with the leading production being from the USA at 34%, Trinidad at 19%, and the UK at 8% (Reuters para 1).

The BP Crisis

In April 2010, one of BP’s production points located in the Gulf of Mexico exploded from deep within the sea, causing a huge fire and killing up to 11 workers who were operating the production site at the time.

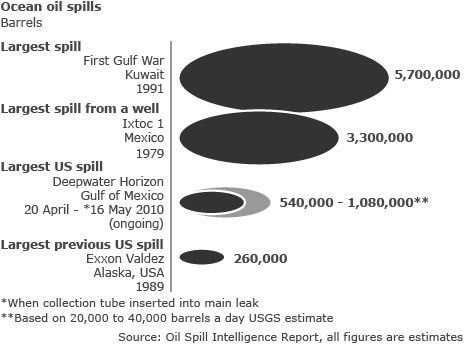

The resultant explosion saw oil spill from the site into the Gulf of Mexico, occasioning a huge environmental disaster. This is so far considered to be the greatest oil spill in the USA and the third largest in the global history of oil spills (Reuters para 3).

Source: BBC news

Initial communication released by BP immediately after the explosion indicated that the leak was approximately at 1000 barrels each day. However, it later emerged that the initial estimation by the company was erroneous as the actual oil spill was at 5000 barrels a day.

Before the leaking well was eventually capped, it is estimated that 4.9 million barrels of crude oil leaked into the water, causing a huge environmental disaster to the marine life.

The firm equally suffered business losses as its shares dropped by a massive 17% just in a day. This was estimated to have cost the firm about $23 billion in terms of market value (BBC news para 4).

Underlying Causations

BP was blamed for using poor quality materials in its efforts to save costs at the drilling point. A report detailing findings by the US government particularly mentioned the use of defective cement that the contractor company Halliburton was using for construction at the well.

A separate finding blamed the US government for lacking direct policies that would have been critical in directing BP’s operations in the US (Goldenberg para 1). The report further accused BP of lacking proper safety mechanisms for handling its exploration and production exercises.

BP’s idea of drilling the well more than a mile below the surface of the ocean was also blamed for the accident. This was particularly because it was more dangerous to drill an oil well that deep below the ocean bed despite the fact that the company had serious safety deficiencies (Aym para 8).

The US Minerals Management Service, which is a government agency involved in ascertaining such activities, was equally to blame for its insufficient efforts in overseeing the whole drilling process.

Impact on Stakeholders

Stakeholders of the company were hard hit by the crisis immediately news spread across the world. Groups of environmentalists and other interested persons organized street protests that sought to dissuade consumers of oil from buying the product from BP.

This saw the company’s stock reduce in price and value by up to 17% within one day (BBC news para 4).

During the entire period that BP struggled to plug the leaking well, up to $23 billion of the company’s market value were lost, further spelling a difficult future for the company’s stakeholders (Honnungar 2).

Britain’s pensioners were particularly affected by the BP crisis. It is worth noting that quite a significant number of pension funds in Britain have invested BP stock by virtue of the company’s high profitability and stability (Honnungar 2).

Thus, the pension funds suffered declined value because of the crisis. The result was a poorer community of pensioners in the whole of Britain as their funds grappled with the negative effects of the crisis. The diagram below shows total payments by BP to US states following the oil spill.

Source: BP

Response of the Organization to the Crisis

While the explosion of the drilling rig at the deepwater horizon in the Gulf of Mexico occurred in April 20 2010, the first communication by BP was in April 24 2010. In its communiqué, BP indicated that the leak occasioned by the accident was at 1,000 barrels a day.

Three days later, on April 27 2010, BP communicated Twitter that the company pledged its full support to Deepwater Horizon, which was BP’s contract partner in the drilling exploration of the well.

On April 28 2010, BP announced that its initial communication about the leak was an underestimation. The company indicated that the actual amount of oil that had been spilling from the well was actually 5,000 barrels.

BP’s CEO, Tony Hayward, spoke for the first time on April 30 2010, to the global news firm Reuters. Hayward told Reuters that the accident was not BP’s fault (Reuters para 5).

BP set up a web page, BP.com Gulf of Mexico response, on which it indicated on May 1 2010 about the relief efforts that it was undertaking. It issued contact numbers on which details about the relief efforts could be acquired.

May 3 2010, three days after his initial interview with Reuters, CEO Hayward changed stance and admitted that BP was liable for the incident. Hayward also announced that the firm would meet all legitimate legal claims, as well as pay to have the ocean cleaned up.

On May 15 2010, CEO Hayward told Sky News that the spill would have a modest impact because of the large ocean size.

In May 24 2010, BP spokesman Toby Odone disclosed that people have their own views about the company’s response to the disaster and there was little the company could do to change it.

He was responding to questions about a parody account on Twitter, @BpGlobalPR, which had indicated in May 16 2010 that the company regretted and fully admitted the occurrences at the Gulf Coast.

On May 31 2010, CEO Hayward proclaimed that he wanted his life back, responding to too much pressure concerning the disaster.

On June 2 2010, CEO Hayward admitted that the company did not have any preparations concerning the leak. A day after, June 3 2010, Hayward regretted having made a thoughtless and hurtful comment by declaring that he wanted his life back.

He apologized particularly to the families of the 11 workers who died following the explosion. A press release by BP in May 6 2011 indicated that the firm had devised a new approach in which 10,500 barrels of the spilt oil were being captured after every 24 hours.

Evaluation of the Response

BP did not have a policy on crisis management in place. This is evidenced by CEO Hayward’s admission that BP was not prepared for the oil leak. The response given by the firm also lacked any consistence in terms of the individual responses and press releases that were being issued.

CEO Hayward being the face of the firm issued conflicting statements every time he spoke about the incident. This also highlights the fact that he was not honest in his numerous communications.

At one point, he told Sky News that the oil leak would have a modest impact because the ocean was very big and the leak was comparatively too tiny.

The lack of preparedness to handle crises at BP was also highlighted by the poor public relations practice at the firm. BP spokesperson, Tony Odone, only spoke for the first time in May 24 2010 more than a month after the accident had taken place.

Tony’s response was not satisfactory as it only served to indicate the lack of answers to the crisis that was being faced by the firm.

Every individual from BP who spoke on the behalf of the firm appeared to be speaking from a personal point of view and not as the true and informed position of the firm.

For instance, while the official Twitter account of the company announced on April 27 2010 that it would offer full support to Deepwater Horizon, CEO Hayward spoke on April 30 2010 declaring that BP was not liable for the accident.

An efficient crisis communication requires that contact information is open to everyone throughout as the crisis is being sorted out. This was not the case with BP.

The first response from the company about its relief efforts were given out on May 1, which was more than ten days after the disaster had occurred. It was on this date that BP also issued the contact numbers for the first time following the disaster.

The individual communications by representatives from the firm indicate very little concern about the audiences and their feelings.

At one point, CEO Hayward proclaims that he wanted his life back. This was his reaction after what appeared to him as too much grilling from every quarter concerning the crisis.

The CEO’s response was in total disregard of the pain and suffering of the friends and family members of the 11 workers who died out of the explosion. Equally, BP was not sharing information at its disposal in a timely manner.

The first communication from the firm, for instance, was made on April 24, which was the fourth day after the disaster had taken place. The company’s CEO did not say anything until ten days later, on April 30, when he spoke to the media and absolved his company from any blame.

The different media outlets set up their own special segments that consistently reported the matter as opposed to BP itself. BP did not have any such segments that offered the much needed expertise and explanations.

For instance, the New York Times created its own ‘Oil Spill Tracker’ in an effort to view as well as make predictions and determine the actual spread of the spilling oil.

Much of the discussions about the crisis were being done by reporters and the press. This was a mistake that mainly highlighted BP’s inefficiency to handle the crisis.

CEO Hayward was particularly guilty of this mistake as he, more than often, appeared to discuss issues without any preparations. His first communiqué about the crisis was incidentally after a discussion he had held with Reuters.

Hayward’s lack of preparedness to discuss the matter showed when he declared that BP was after all not to blame for the incident. Hayward also spoke on Sky News where he downplayed the impact of the crisis that had been caused by his company.

From his lack of preparedness, he noted that the crisis would after all have a modest implication because the oil spill was very small compared to the large size of the ocean.

The photograph below displays angry protestors outside the CNN building in June 2010 expressing their dissatisfaction in the manner in which CEO Hayward was attempting to cover crimes by his company.

In general, BP failed to act professionally in the face of the crisis. The too many voices speaking on behalf of the firm spoke from contradictory points of view and definitely did not have any prior discussions before issuing statements.

The company’s CEO appeared to mainly protect and absolve his firm from any blame. This was unprofessional of him because the actual information was already in the public domain and he did not help matters by appearing to feign BP’s innocence.

His remorsefulness later on after appearing to get the true picture of the crisis highlights the casual manner in which he was handling the issue.

Possible Alternative Responses

BP should have issued its official communication immediately after the incident by informing the public that it regretted the incident that had also caused loss of life to 11 of its workers.

In its initial communication, response contacts should have been issued and an announcement issued to the effect that it was still estimating the amount of the spillage before it could issue the actual figures.

This communication should have been issued on either the very day the incident occurred, April 20 2010, or the following day.

An internal meeting should have been held involving the CEO and the company’s spokesperson among other senior officials prior to issuing the information.

A resolution should have been arrived at during the meeting to declare the persons who would officially issue statements on behalf of the company.

The company should have arranged media briefings prior to inviting the different media houses. All briefings should have been written and thorough preparations done by the officer in charge on the possible questions and answers that could have arisen.

On the variation between the initial and actual spillage amount, BP should have began by expressing its regrets following the difference.

A message should have been included to highlight the fact that BP had conducted repeated analyses and determined that the information indicating a leakage of 1,000 barrels a day was erroneous and that the actual figure stood at 5,000.

It was important that BP’s chief executive officer Tony Hayward speak about the incident early enough. However, his communiqué should have waited for preliminary results concerning the crisis.

He should have begun by expressing his condolences to the families and friends of the 11 workers whose lives were claimed in the accident.

The CEO needed to have reassured the public that though the accident had occurred and losses were being counted, BP was working extra hard to contain it from worsening.

He should have taken time to accept liability early on but reassure the public and the world at large that his company had learnt important lessons from the crisis on how to prevent any such happenings from occurring in the future.

Conclusion

The BP crisis occurred in April 2010 when a BP exploration well in the Gulf of Mexico exploded and spilled out an estimated 4.9 million barrels of crude oil into the ocean. The disaster also left 11 of the firm’s workers dead following the explosion.

BP failed to handle the crisis professionally, particularly on the manner in which it handled its communication. The company’s CEO Tony Hayward was quick to speak about the crisis, but never prepared himself before speaking out.

His responses were always given out to the media and were never in written form. Internally, BP also lacked any tangible preparations on how to handle such crises. The firm took more than three days to officially respond about the crisis after it had occurred.

CEO Hayward was particularly keen on absolving BP from any wrongdoing and watered down the implications of the crisis. Although he later changed stance and admitted full liability, his initial talk and the general lack of preparedness of the firm did more harm to its corporate reputation.

Works Cited

Aym, Terrence. “Doomsday Methane Bubble Rupture? How the BP Gulf Disaster May Have Triggered a ‘World-Killing’ Event.” Global Research. 2010. Web.

BBC News. “Experts Double Estimate of BP Oil Spill Size.” BBC US & Canada. 2010. Web.

BP. Gulf of Mexico: Progress of Restoration Efforts. Web.

Goldenberg, Suzzane. “BP Oil Spill Blamed on Management and Communication Failures.” Guardian [London] 2010. Web.

Greengarden. Seize BP Protest at CNN Building. 2010. Web.

Honnungar, Vijayakumar. British Petroleum Oil Spill Crisis and Aftermath: Corporate Governance and Communication at BP During the Disaster. Munich: GRIN Verlag, 2011. Print.

Reuters. “BP PLC.” Reuters. Web.