Introduction

Businesses embrace various approaches to ensure they achieve their objectives without struggling. The importance of strategic positioning enables companies to compete with others and stand high chances of winning a reasonable market size (Ferreira 2011). This paper presents an analysis of British Petroleum’s strategic and competitive position.

Background

British Petroleum was established in 1909, and its origin is linked to the establishment of the Anglo-Persian Oil Company (Dyck 2008). The company expanded its operations through mergers and acquisitions. Its original name was Anglo-Iranian Oil Company to show that it was a merger between two investors. The name British Petroleum was established and became the trademark of this company in 1954. This move enabled this company to be autonomous and start investing in other regions located beyond the Middle East. British Petroleum was the first company to start drilling oil in the North East in 1959 (Frazer 1958). This move enabled it to acquire other companies like Standard Oil-Ohio that had failed to meet their targets.

In addition, it merged with Amoco in 1998 after undergoing privatisation in different stages between 1979 and 1987. It made major strides that expanded its operations and boosted its income by acquiring ARCO and Burmah Castrol in 2000 and established a partnership with TNK to form the TNK-BP joint venture (Hymowitz 2013). This includes exploration, refining, production, distribution, marketing and trading. The 2012 revenues show that this is the fifth-largest company in the world.

BP has branches in more than 80 countries and produces more than 3.2 million barrels per day of oil (British Petroleum, 2013). This company is managed by Carl-Henric Svanberg (Chairman), Bob Dudley (CEO) and Brian Gilvary (CFO) (British Petroleum 2013). It specialises in the drilling, production, distribution and marketing of petroleum, natural gas, motor fuels, aviation fuels and petrochemicals. Its revenue was 396.217 billion (USD) according to the 2013 survey (British Petroleum 2013). Its operating income was 31.310, profit 23.451 billion, total assets 305.69 billion, total equity 129.302 billion (all figures in USD) and it has more than 83, 900 permanent employees working in its branches located in various parts of the globe (British Petroleum 2013).

Strategic and Competitive Position

SWOT Analysis

British Petroleum is a multinational company that specialises in offering oil and gas services and products. Its competitors continue to struggle to regain their operations and statuses, especially after global inflation, but this company finds it easy to navigate through economic turbulence that characterises the international oil industry (British Petroleum 2013). This company has enjoyed a near-monopoly in oil and gas production because of its strength in the following ways.

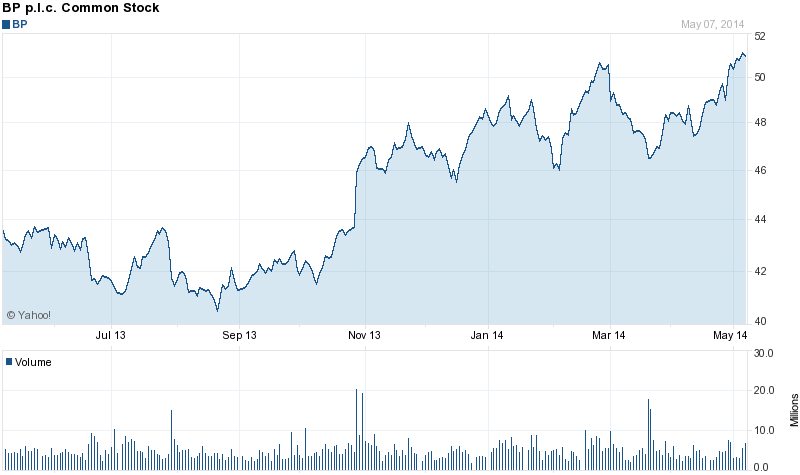

BP has various strengths that help it to remain relevant in the oil and gas industry. First, it has a long history in this field, and this has equipped this company with the relevant experience in the oil and gas industry. In addition, other companies failed to offer quality services because they did not have adequate experience, and this enabled British Petroleum to merge or acquire them (Garven 1996). The market price of its share remained stable for a period between July 2013 and May 2014, as shown in the figure below (British Petroleum 2013).

This company had control over the operations of this industry, and that is why it never suffered major losses during the Great Economic Depression and 2007-2010 economic crisis. The company knows how to drill, process, distribute and market oil, and that is why it has continued to expand its operations beyond the national borders of its origin.

Therefore, experience gives investors an added advantage in ensuring that they understand the operations of their businesses (Mangena 2007). Other companies struggled to maintain their clients and navigate through the turbulence of inflation and high standards set by international trade organisations. However, this company did not find any hurdle in its operations because of its vast experience.

Secondly, it has a huge capital base that allows it to invest in various aspects that enable it to improve its production processes and boost sales. The huge capital is an asset in ensuring that this company invests in modern technology that will ensure it generates profits under minimal expenses (Stone 2013).

It is necessary to explain that the use of modern technology improves the efficiency of a company’s operations and ensures that investors have high returns on their capital. This capital is important in ensuring that this company pays its worker’s reasonable salaries, and this explains why there have never been any salary-related strikes by its employees.

The use of modern technology by this company ensures that all its operations are managed from a central location. The management can track the performance of its branches without having to travel there (Longstreth 1990). Computerised management and supervisory systems ensure that managers can monitor the performance of all employees without struggling to do so. This has become an effective way of ensuring there are transparency and accountability of all workers.

In addition, it has diversified its capital by investing its operations in many countries (Mishra 2001). This ensures that if a region is affected by natural or human disasters, this company will not stop its operations in other areas. In addition, it enjoys a huge client base offered by customers and companies from different locations. The fact that this is a reputable international organisation enables this company to focus on producing goods and services that aim at availing needs of consumers (Connelly 2007).

It does not have a market preference and gives all markets reasonable attention. Thirdly, British Petroleum has a well developed and effective management style that focuses on ensuring there are improved efficiency, coordination and unity in its branches. First, it ensures that its subsidiaries are managed by people from the host country, and this is an effective way of identifying with local communities and their government (Bamberg 2000). This strategy creates job opportunities and improves the image of this company. Therefore, it becomes very easy to persuade the local population to use its products, and this makes this company stand high chances of winning the trust of consumers.

On the other hand, this company has weaknesses that limit its abilities to empower its branches to maximise on their production potential. First, it has a centralised management structure that ensures all decisions are made by the highest office in the company. This is a multinational company, and thus it has to delegate its key decision-making processes to managers in various branches. It is necessary to explain that some decisions made in the highest offices may not be useful in branches located in different countries (Jeffers 1969).

Nations have different cultural, political and economic practices, and this means that they differ in the ways they manage their affairs. A multinational company should not have rigid policies because of the differences in the practices between developed and developing nations. Therefore, this makes this company to be perceived to be western-based. However, British Petroleum has maintained a centralised management system that ensures decisions made in high offices are implemented in all its branches regardless of the practices of the host nations. The Table below shows the market segmentation of shareholders of this company (British Petroleum 2013).

Another weakness facing this company is that it heavily relies on acquisitions and mergers to expand its operations despite its large capital to do so. It is necessary to explain that this is a dangerous strategy if caution is not taken when making these plans. Some investors may decide to sell their companies because they predict a dark future in their locations. This may be caused by civil wars, political instability or poor reputation. Therefore, British Petroleum will inherit these weaknesses, and this may be transmitted to its other branches and cause inefficiency in its operations.

The opportunities available for this company to improve its performance are many. First, the Arab region, which is a large producer of oil and gas experiences regular conflicts, and this means that companies located in this area do not operate effectively (Hernandez 1998). Therefore, British Petroleum should make use of this opportunity to ensure the clients lost by other companies during political instability are attracted to its products and services. It should ensure that it developed marketing strategies that target clients that seek services and products from the Middle East to ensure they are made part of its clientele.

British Petroleum faces serious threats from different areas. First, critics argue that this company is responsible for a huge percentage of today’s pollution. Cases of oil spillage in water bodies have been reported, and their losses have hampered the performance of this company (Spillane 2014). Spillage on water bodies causes deaths of aquatic life and pollutes this important natural resource. In addition, it endangers the lives of many people that directly or indirectly depend on water for their economic activities like fishing and sports. Moreover, this company has been blamed for releasing dangerous smoke and fumes into the atmosphere, and this has polluted air and depleted the ozone layer.

There are fears that international environmental bodies may soon impose strict measures that will ensure the use of biofuels is prohibited or minimised. This is a serious threat to the operations of this company because it may cause it to close its multi-billion operations (Norburn 2007). Competition from other sources of energy like solar and electricity is giving the management of this company sleepless nights. People have realised the importance of environmental conservation and are working hard to ensure they embrace the use of fuels that do not produce harmful smoke or gases.

The introduction of cars and engines that use electricity or solar will revolutionise the energy sector by reducing over-reliance on fossil fuels. This company should be prepared and invest in alternative economic activities because the future of using fossil fuels to produce energy is bleak (Milzoff 2013). In addition, it is important to explain that oil and gas are non-renewable resources. Therefore, their supply is limited, and this should be a wake-up call for this company to start thinking of other viable investments. Fossil fuels take too long to mature, and this means that this company will have no raw materials if it depletes the existing ones.

Automobile companies have started manufacturing vehicles that do not use fossil fuels because they know that the supply of this energy is limited and may be depleted very soon (Lustgarten 2012). This should challenge this company to realise that its future is not bright and thus it should start to think about what it will do with its infrastructure, employees, clients and capital before it is too late to salvage the situation

PESTEL Analysis

British Petroleum is an international company, and this means that it has to deal with numerous political challenges that affect the operations of companies of this nature. Governments have different ways of managing their affairs and controlling their economic activities. The tax policies of most countries favour the operations of this company, and there are no instances where it has been forced to close its operations due to unfavourable taxation policies.

Most developing countries do not have stringent taxation policies because they are ready and willing to attract foreign investors. In addition, this company has major links with America and other developed countries, and this gives it an upper hand in working with favourable taxation policies. Moreover, this company has a centralised management system that ensures its labour policies reflect the demands of the regulations that govern workers in various countries.

Most labour laws are established to meet global standards stipulated by the International Labour Organisation; therefore, this company does not have difficulties in taking care of its workers (Masulis 2007). However, some aspects of environmental laws do not favour its operations, especially when it comes to pollution. Incidences of water and air pollution have been reported in this company, and this has caused major standoffs between its managers and local authorities. The reputation of this company has been marred by various events that had devastating effects on the environment (Reuer 2011).

The 1965 Sea Gem oil disaster led to the suspension of fishing activities and several bays were declared unfit for vessels. Moreover, the Prudhoe Bay and Texas City refinery explosions and Caspian Sea gas leak and blowout and Texas City chemical leak of 2008 and 2010 led to the establishment of stringent policies to regulate the activities of oil and gas drilling companies (Bianco 2007). The 2007/2008 post-election violence witnessed in Kenya led to the destruction of this company’s stations leading to losses of more than a billion dollars.

In addition, America’s attack on Afghanistan and Iraq were major blows that affected the operations of this company in Iran. There were fears that terrorists would take advantage of the fragile political situation in this region and attack companies that were perceived to have links with America. In addition, tension in the Arab region has never subsided and this means that it has experienced a shortage of raw materials in its production processes.

Economic growth spurred by globalisation and the introduction of modern technology in Africa and some parts of Asia has widened the market for the products of this company. America, France and other developed countries offer foreign aid to developing nations and this has helped them to improve their infrastructure and security (Shulman 2006). This has offered room for foreign investments and this company has maximised on this opportunity to invest in developing countries.

The interest and exchange rates of international currencies favour the operations of this company because it enjoys a good balance of trade when exporting its products to developing countries. Inflation has never affected the operations of this company to an extent that it had to close its operations in some countries. However, the 2007/2008 economic recession reduced the profits it generated from its companies that are located in America.

Some social factors like health concerns and career attitudes have reduced the use of fossil fuels in some countries. Americans are very cautious when it comes to matters of health and thus most of them have abandoned the use of gas and fossil fuels and are using electric and solar powered vehicles and engines. Emphasis on safety has reduced the popularity of this company’s products and people are paying attention to the need to conserve the environment and keep themselves healthy.

Lastly, this company has invested heavily in modern technology to ensure there is efficiency in its processes. The use of automated machines reduces the costs of labour, supervision and training of employees (Gine 2012). In addition, it has focused on acquiring modern machines that will reduce pollution and ensure there is little wastage of raw materials. Supervision and management of staff have become easier because of the use of computerised systems. In addition, it is easy to monitor the drilling, processing, distribution and marketing processes because of improved tracking systems.

Porter’s Five Forces

Michael Porter presented five forces he believed are important in shaping the operations of a company. He argued that the threat of new entrants compels managers to develop defensive strategies that ensure their clients are not attracted to their competitors. Porter believed that new entrants have an advantage over existing ones because they do not have to introduce products. The markets are already established by existing companies. British Petroleum ensures it develops strategies of limiting the impacts of new entrants on its sales. Its managers usually have prior knowledge of any threat posed by new competitors and manage them by regulating the prices and offering incentive packages that will attract and retain its customers.

Secondly, the threat of substitute products and services like electricity and solar energy is a nightmare for this company. However, it has embraced the use of modern technology to ensure its products have less negative impacts on the environment to attract customers that want to embrace environmental conservation initiatives (Morrison 2009). It has introduced modern technology in its drilling, manufacturing and distribution processes to ensure it lowers the amount of pollutants it releases to the atmosphere.

The ability and bargaining power of customers is not totally within the abilities of this company to regulate it. However, it has established measures like price reduction, use of incentives and improving the quality of its services and products to ensure consumers get the value for their money (Akhter 2008). This means that the company has focused on producing high quality products and offering impeccable services to attract consumers. This will ensure they do not trade quality with price and would rather get a good service at a higher value than vice versa.

The bargaining power of suppliers has been a serious headache for this company. The threat posed by new entrants due to liberalised economies in oil producing countries has increased the number of investors in this industry yet there are limited suppliers (Pomeranz 1998). Therefore, suppliers have become reluctant to offer their raw materials to companies that do not meet their standards. Ineffective guidelines that regulate the behaviour of stakeholders in supplying raw materials make this company to face stiff competition from those that enjoy good relations with suppliers.

Lastly, the intensity of competitive rivalry from Shell, Total and Oil Libya are forcing this company to conform to their standards. It is necessary to explain that most clients do not focus on the quality of products or brand names and this means that this company cannot attract their attention if it does not follow the trends exhibited by its rivals. Therefore, it faces stiff competition that arm-twists it to follow practices that may not be considered effective in achieving its objectives.

Income Statement

British Petroleum (2013) shows that the trading period between 2011 and 2013 saw an increase of sales and other operating revenues. The company started registering an increase in these figures from $239,272.00, $ 297,107.00, $375,517.00, $375,580.00 to $379,136.00 in 2009, 2010, 2011, 2012 and 2013 respectively (British Petroleum 2013). The total cost of operating revenues was $186,974.00, $280,826.00, $309,763.00, $327,153.00 and $325,878.00 in 2009, 2010, 2011, 2012 and 2013 respectively (British Petroleum 2013). This means that the company registered an average gross profit of $47,203.30 and it registered its highest gross profit in 2011 by generating $65,754.00 (British Petroleum 2013).

It also registered its highest operating profit of $28,871.00 (2011), interest and other income $1,590.00 (2012) and net profit of $26,097 (2011) (British Petroleum 2013). The decline in BP’s profit between 2011 and 2012 is attributed to shareholders withdrawal even though the number increased in 2013 even though it did not surpass the previous highest revenue generated (British Petroleum 2013). The table below presents a summary of BP’s financial position between 2009 and 2013(British Petroleum 2013).

Balance Sheet

The balance sheet of this company shows an improved performance between 2009 and 2013. The turnover increased from $239,272.00 in 2009 to $379,136.00 in 2013 and this shows an improved investment by shareholders and translated into a $305,690.00 value of tangible and intangible assets (British Petroleum 2013). The stock also improved from $22605.00 in 2009 to $29231.00 in 2013 and it registered a high liability of $180714.00 in 2012 and low of $133855.00 in 2011(British Petroleum 2013). Its 2013 results shows a decrease in creditors and this translated to a total liability of $175283.00 (British Petroleum 2013). Therefore, the results of this company show a positive development from 2009 to 2013 even though the results of 2012 were not good.

Stock Evaluation

British Petroleum (2013) shows that the value of this company’s shares increased steadily between 2009 and 2011 and 2012 and 2013. In addition, the following information is available in www.bp.com. Investors earned $0.88 per share in 2009 and $1.24 in 2013; therefore, they received high dividends of $1.36 per share in 2011(British Petroleum 2013). These figures show that the company’s dividend yield per share was $4.22. 2012 registered a high dividend yield of $4.70 even though 2011 had the highest dividend per share growth of 38% (British Petroleum 2013).

The price per share in 2012 was very high at 12.40 and this attracted investors that in turn led to a low demand that caused the decline of its value to $6.7 in 2013 (British Petroleum 2013).The table below shows the stock valuation of this company between 2009 and 2013 (British Petroleum 2013).

Investment Opportunities

British Petroleum registered an improved performance from 2009 to 2013 even though its 2012 results were not good (British Petroleum 2013). However, there is a high possibility that this company is going to show positive developments in its 2014 results and this means that it is wise to invest in its shares. There are hopes that this company will maintain positive performance because it has established effective monetary policies like buying back shares to ensure they are in steady but reasonable supply (British Petroleum 2013).

This will help to stabilise its value and ensure investors get high dividends. Financial analysts predict that this company may register a high of $1.8 earnings per share in 2014. In addition, the company predicts a dividend yield rate of between $4.7 and $5.0 this year (British Petroleum 2013). Therefore, potential investors should think about investing their money in the shares of this company because it has a bright future.

Conclusion and Recommendations

British Petroleum is a reputable organisation because it makes use of its strengths to enter new markets, expand its operations and improve the quality of its products. It focuses on improving the quality of its products and services by investing in research, technology and training its workers to meet international standards. However, its future is dark because of the ongoing efforts to embrace environmental conservation measures to reduce pollution. In addition, competition from new entrants and other sources of energy lowers the popularity of this company and forces it to invest more money in marketing its products.

Appendices

SWOT Analysis

PESTEL Analysis

Porter’s Five Forces

References

Akhter, S 2008, ‘Multinational corporations and the impact of public advocacy on corporate strategy: nestle and the infant formula controversy’, Journal of International Business Studies, vol. 25, no. 3, pp. 658-660.

Bamberg, J 2000, British Petroleum and Global Oil, 1950-1975: the challenge of nationalism, Cambridge University Press, Cambridge.

Bianco, C 2007, ‘The impact of corporate governance on the performance of REITs’, The Journal of Portfolio Management, vol. 33, no. 5, pp. 175-191.

British Petroleum 2013, Archive: An archive of BP annual reporting publications and presentations. Web.

Connelly, T 2007, ‘Do investors really value corporate governance? Evidence from the Hong Kong market’, Journal of International Management and Accounting, vol. 18, no. 2, pp. 86-122.

Dyck, A 2008, ‘The corporate governance role of the media: evidence from Russia’, Journal of Finance, vol. 43, no. 3, pp. 71-74.

Ferreira, M 2011, ‘Corporate governance, idiosyncratic risk and information flow’, Journal of Finance, vol. 62, no. 3, pp. 71-19.

Frazer, W 1958, ‘Large manufacturing corporations as suppliers of funds to fuel corporate governance responsibilities’, Journal of Finance, vol. 13, no. 4, pp. 41-52.

Garven, G 1996, ‘Keeping good company: a study of corporate governance in five countries’, Journal of International Business Studies, vol. 21, no. 2, pp. 807-811.

Gin, M 2012, ‘the vote is cast: the effect of corporate governance on shareholder value’, Journal of Finance, vol. 67, no. 5, pp. 69-74.

Hernandez, W 1998, ‘corporate governance: there is danger in new orthodoxies’, The Journal of Portfolio Management, vol. 21, no. 3, pp. 47-52.

Hymowitz, C 2013, ‘Corporate directors get older, hold their seats longer’, Bloomberg Businessweek, vol. 56, no. 3, pp. 21-27.

Jeffers, J 1969, ‘A portfolio to corporate demands for government securities’, Journal of Finance, vol. 24 no. 5, pp. 231-237.

Lustgarten, A 2012, Run to failure: BP and the making of the deepwater horizon disaster, W. W. Norton and Company, New York.

Longstreth, B 1990, ‘Takeovers, corporate governance and stoke ownership’, The Journal of Portfolio Management, vol. 6, no. 3, pp. 44-59.

Mangena, M 2007, ‘Disclosure, corporate governance and foreign share ownership on the Zimbabwe stock exchange’, Journal of International Management and Accounting, vol.18, no. 2, pp. 53-85.

Masulis, R 2007, ‘Corporate governance and acquirer returns’, Journal of Finance, vol. 67, no. 5, pp. 13-16.

Milzoff, R 2013, ‘Corporate sponsorship is a broadway hit’, Businesssweek, vol. 32, no. 2, pp. 37-38.

Mishra, C 2001, ‘The effect of founding family influence on firm value and corporate governance’, Journal of International Management and Accounting, vol. 12, no. 3, pp. 235-259.

Morrison, B 2009, ‘Roto-Rooter supporting hospice care to go corporate’, Businessweek, vol. 9, no. 2, pp. 44.

Norburn, D 2007, ‘A four nation of the relationship between marketing effectiveness, corporate culture, corporate values and market orientation’, Journal of International Business Studies, vol. 21, no. 4, pp. 451-468.

Pomeranz, F 1998, ‘Corporate governance: opportunity for institutions’, The Journal of Portfolio Management, vol. 7, no.3, pp. 25-29.

Reuer, J 2011, ‘Managing in the turbulent world economy: corporate performance and risk exposure’, Journal of International Business Studies, vol. 30, no. 11, pp. 219-222.

Shulman, R 2006, ‘Corporate treatment of exchange risk’, Journal of International Business Studies, vol. 14, no. 2, pp. 83-88.

Spillane, C 2014, ‘Telkom CEO sent on corporate-governance course after CFO loan’, Businessweek, vol. 6, no. 12, pp. 5-13.

Stone, B 2013, ‘Meet the Ava 500, the Roomba’s corporate cousin’, Businessweek, vol. 11, no. 21, pp. 11-12.