The Problem

Careless spending can affect many people and substantially impact their financial future. For example, excessive spending on one category of products every week can lead to people not knowing where their money is going. Daily stress can also result in compulsive spending on items that seem comforting at the time but are ultimately unavailing. Meanwhile, the process of creating a budgeting plan for a person with numerous debit and credit accounts or a couple or family with several joint and individual accounts can be highly challenging.

The Solution

Creating a spending plan can be made easier with a budgeting app that allows individual and joint accounts. The budget manager app will allow tracking expenditures in different categories, including food, expenses on eating out, rent or mortgage, housing and utilities, transportation, entertainment, and any other categories. Furthermore, it will allow the users to create additional categories and subcategories to help establish what items they spend the most money on. The users can link their bank accounts to the app to automatically create entries from the notifications received from the bank. In addition, the app will be able to analyze printed receipts. The app’s joint accounts will gather data from more than one device. A spending analysis will be available every week or month.

The Benefits of the Solution

The proposed budgeting manager app is highly beneficial for users who have multiple accounts or who want to track the expenses of all family members in one app. The app will store information from all bank accounts and illustrate the overall balance to make budgeting easier. In addition, the user will not need to create most of the transaction entries as they will be added automatically from bank messages and notifications. The main benefit of the app is the analysis of each user’s spending habits and earnings, with charts available to track expenditures in every category in any given period. Finally, the app will help create a budget plan, accounting for all scheduled transactions and planned purchases.

Target Market Segments

The app is aimed at three major market segments: college and university students, working professionals, and family units with multiple accounts. Overall, the described sectors are extremely broad and include persons aged 18 and over of any age, education level, and household income. The broad inclusion of the target market segments is justified as any category of users can be interested in tracking their expenses and learning to budget efficiently. For example, students need to plan their spending to pay for their education, while working professionals and families are likely to plan for significant expenditures such as a mortgage or buying a vehicle.

A Person Interested in the App

A persona in the working professional target market is Nick. Nick is 29 years old male front-end web developer working in a freelance capacity. He has several regular clients and usually works on numerous contracts, ensuring an average yearly income of approximately $85,000. Living alone in a two-bedroom apartment in Santa Monica, Nick pays $4,150 in rent every month. He does not budget his expenses, only setting aside money for the rent. As a result, he often finds himself low on funds. Nick is unsure of what he spends the most money on and finds he needs to plan for even urgent purchases.

Nick has a 2002 Chevrolet Camaro that needs constant maintenance, despite rarely being driven. In addition, although Nick primarily works from home, except for breakfast, he does not cook for himself, preferring to order food from restaurants. He also visits bars and restaurants with his friends weekly. Furthermore, Nick often updates his photography and hiking equipment and buys new guitars for his collection. Overall, the budgeting manager app will help Nick understand his expenses, determine what items he spends the most money on and plan his expenses a month ahead. The app will help him regulate his expenses in specific categories and realize what aspects of his lifestyle are the most costly.

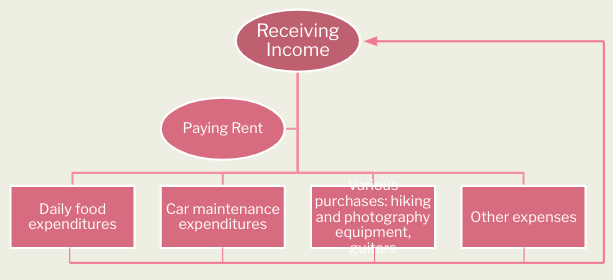

As-Is Spending Flow Diagram

As-Is flow diagram demonstrates how the person from one of the target market segments, Nick, spends money in any given month. After receiving his monthly salary or remuneration for a project, the only planned expenditure Nick plans for is the rent payment. Thus, money for the rent is either set aside or paid to the owner/agent. Expenses, such as food or eating out, car maintenance, purchasing new equipment, hobbies, and others, are not budgeted in advance. The same scheme is repeated in the next month, without the spending being analyzed or a budget plan for the next period being designed. No changes to the spending patterns are made in this scenario.

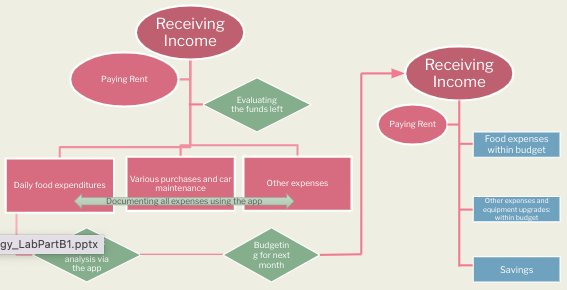

To-be Spending and Budgeting Flow Diagram

The use of a budgeting manager app will help Nick evaluate and plan expenses. Thus, after the salary is received, he can pay the rent and then analyze the funds left to have a general understanding of the money available to him during the period. During the months, the app will allow Nick to document all his expenses, including daily food expenditures, various purchases, car maintenance charges, and other costs. At the end of the tracked period, spending habits are analyzed to determine what categories Nick spends the most money on and how these patterns can be addressed. Then, the budget for the next month can be created considering this information, with the whole process being repeated in the next period. Overall, using the app, Nick will have a better understanding of his expenses and will be able to spend his money with more awareness and have savings.