Company

Walmart is an American-based corporation that is currently one of the largest retailers in the world. The company is headquartered in Bentonville, a city in Arkansas. However, its stores can be found throughout the United States and in other countries as well. This report is aimed at discussing the financial performance of this organization, its current strategies and ways of achieving further growth.

Sales and profits

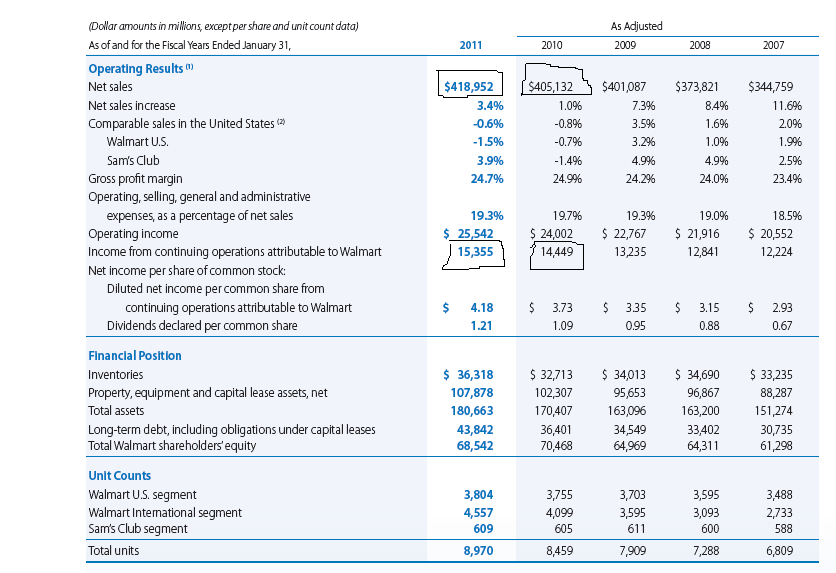

In order to evaluate the recent financial performance of this company, one should look at its annual reports. In particular, it is necessary to examine such financial indicators as sales and net revenues in 2010 and 2011 because they can throw light on the economic health of this organization. The findings can be presented in the following table:

These are the main findings that one can derive by looking at the annual reports of this corporation.

Strengths and weaknesses

These results suggest that Walmart was able to improve its financial performance in 2011; in particular, this organization increased its sales and revenues even despite the fact that global economy was strongly affected by the recession. Moreover, this corporation opened new stores both in America and abroad.

Therefore, their business model can be considered successful. Thus, one can say that many customers prefer to use the services of this company. To a great extent, this comparison shows that the economic viability of Walmart has not been impaired. It should be noted that in 2011 other retailers were also able to increase its profitability in comparison with the previous year (NFR Stores, 2012, unpaged).

So, the rivals of Walmart are also trying to remain competitive. They are also willing to adopt the strategies and models used by Walmart because these approaches have proved to be successful. This is one of the main issues that one should pay attention to.

On the whole, it is possible to identify several strengths of this organization. One of the points that researchers mention is the well-developed supply chain of Walmart (Kneer, 2009, p. 2). In particular, this corporation adopts automated distribution networks and other technologies that enable them to better cooperate with their vendors and transportation companies (Kneer, 2009, p. 2).

To a great extent, the supply chain is essential for maintaining the low cost of products and efficiency of operations. The investment in infrastructure allowed the company to gain competitive edge and achieve leading positions among other retailers. Additionally, one should take into account that Walmart is one of the most recognized brands in the world. The name of this company can be familiar to people who may live in countries with different languages, political systems or cultures.

This strength enables the company to expand its operations at a global level. Its stores can be found in Mexico, China, Brazil and many other countries. Finally, one should note that the company has established partnerships with a variety of vendors that may be located both inside and outside the United States (Kneer, 2009, p. 2).

Again this cooperation is also essential for the competitive strength of the organization because its customers have purchase a vast variety of products. These are the main strengths of Walmart and the management of this company understands that they are essential for the growth of this organization. The core policies of the corporation will not alter significantly in the future.

Certainly, one should not forget about the possible weaknesses of this organization, in particular, the negative publicity that Walmart receives from mass media. For example, one can mention the low wages of their workers or even discrimination against women (Kneer, 2009).

There, the reputation of Walmart cannot be viewed as impeccable. This is the main issue that the management of the corporation should take into consideration because this negative publicity may affect the decisions of many consumers who can choose among many retailers. Thus, the corporate leaders should think about the ways of improving the image of Walmart. Nevertheless, despite these limitations, the positions of this corporation are still very strong because buyers in many countries are very price sensitive.

At this point, Walmart still has a potential for growth and development. For instance, this organization can still open more stores in developing countries such as China, Brazil or India. The services of Walmart can greatly appeal to people living in these countries because these customers also attach importance to the price of the product.

So, this company can achieve leading positions in these countries. Furthermore, the management of this corporation attaches importance to online commerce because information technologies are also essential for attracting potential clients (Walmart, 2012b, p. 9).

These are the main opportunities that the company should take advantage of. In the future, the strategies of this company will not change significantly. Overall, this corporation can be regarded as an example of corporate efficiency and sustainability. The successes of this retailer show that it is important how to work with customers and suppliers.

2012 Business

It is also important to examine the performance of Walmart during 2012. Although at this point, it is too early to speak about the annual profitability of the organization, this information provided by the company can determine whether this corporation can attain its goals. First of all, one should note that the projected net sales are going to be $. 443.845 billion (Walmart, 2012b, p. 32). Thus, the sales are expected to increase by 1, 03 percent (Walmart, 2012b, p. 32).

Apart from that, the net revenues of this organization have also increased during 2012. In particular, it will grow by $411 million in comparison with the previous year (Walmart, 2012, p. 17). Moreover, in 2012 this corporation has opened 1,160 stores in different countries of the world (Duke, 2012, unpaged).

This is one of the most important indicators because it shows that customers from different countries want to buy goods at Walmart. Overall, this trend indicates that the corporation still looks appealing to many buyers. Therefore, one can say that this organization has been able to sustain growth even at the time when global economy tries to overcome the effects of crisis. The efficiency of this organization has not declined.

Additionally, these data can also throw some light on the development of the retail industry in the United States. This information suggests that consumers have become price-sensitive in part because of the economic crisis that still affects many households. They prefer to work with companies that are able to reduce their operational costs and reduce the prices.

This trend can greatly contribute to the development of retailing companies like Walmart or Target. These organizations are more likely to gain the loyalty of clients in the United States as well as other countries.

Moreover, one can tell that Walmart still retains leading positions among other retailing companies such as Kroger, Costco, or Target. Overall, the information provided by the company suggests that the management is willing to improve the organizational performance of Walmart.

In particular, they invest more capital in online retailing in effort to attract more clients (Walmart, 2012b, p. 9). This corporation accepts the importance of Internet as means of distributing products.

Apart from that, the company has expanded its operations overseas. For instance, one can mention that it opened stores in such countries as Canada, Brazil and China, South Africa, or the United K (Walmart, 2012, p. 9). On the whole, these examples suggest that this company takes advantages of the opportunities that are available to them. This is one of the reasons why the company remains the leader of the retail market.

Additionally, this organization emphasizes the necessity of reducing operating expenses. For example, they invest into the development of supply chain and distribution networks that enable the company to keep the prices low (Walmart 2012). On the whole, operational efficiency is essential for remaining competitive in the market. In the future, the supply chain of the will also play an important role for the corporation because it remains the source of their competitive advantage over others.

Summary

The performance and current strategies of Walmart can indicate at several important trends. First of all, one can say that the management of this corporation attaches importance to innovation and exploration of new opportunities. For instance, their policies are aimed at reducing the costs of daily operations.

Yet, at the same time, they try to develop new ways of attracting customers. In particular, one can refer to their online retailing activities. Moreover, one can assume that in the future, the financial performance of Walmart will not decline, in part because many customers in the United States have become price-sensitive as a result of the ongoing recession.

Finally, the example of Walmart demonstrates that brand is essential for sustainable growth of any company. The name of this organization is recognizable in many countries of the world; Walmart successfully competes at an international level.

Nonetheless, the corporate leaders should bear in mind that other retailers are also willing to use improve their performance and Walmart should expect significant competition from them. These issues are important for understanding the corporate strategies and policies of Walmart.

Copy of the Financial Summary

The following image will present a summary of Walmart’s financial report. This table will highlight the most important quantitative data used in this paper. By looking at this information, one can see how this company achieved its growth within the period between 2007 and 2011.

On the whole, these data illustrates that even at the time, when international economy was engulfed in a financial crisis, Walmart still achieved growth. These examples illustrate the efficiency of their business model.

Reference List

Kneer, C. (2009). The Wal-Mart Success Story. New York: GRIN Verlag.

Duke M. (2012). To our shareholders, associates and customers. Web.

NFR Stores. Top 100 Retailers. Web.

Walmart. (2012). Walmart: 2011 Financial Review. Web.