Introduction

The Bank of Thailand operates as the Central Bank for the country. Entrusted with the job of carrying out all the central banking operations of the country, the bank has its administrative center in Bangkok with three regional offices working under its supervision. The primary responsibilities of the bank include, among other things, providing effective banking facilities, supervising and controlling the foreign exchange as well as examining the economic growth of the respective regions thereby bringing about an overall improvement in the life of the people of Thailand.

Historical Background

Considered as the pioneer in the field of banking operations in Thailand, the Thai National Banking Bureau was established as early as 1939 as part of the Ministry of Finance. Under the impact of the World War II, the government of Thailand upgraded the status of the Bureau to that of a central bank by passing the Bank of Thailand Act in the year 1942. According to the act, the Bank of Thailand was entrusted with the responsibility of carrying out all the central banking functions (Rajan 2008).

The Central Bank of Thailand aims at sustaining the economic growth of the country by providing stable economic environment. The overall supervision of the bank is in the hands of the Court of Directors comprising of the Governor, the Deputy Governors, and at least five other members. The Governor and Deputy Governors are appointed by His Majesty the King of Thailand whereas the Cabinet appoints the other members on board (Nuntiyagul 2009).

Thailand’s Economic Turmoil – 2006

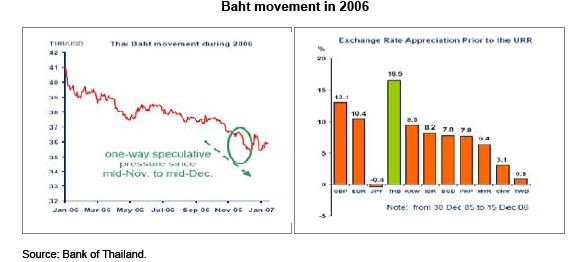

Thailand experienced a brief period of economic instability in 2006 due to rapid appreciation of the Thai baht (Refer to Chart 1 below). The gradual rise of the baht posed a serious threat to the Thai economy due to its direct bearing on the country’s export sector. Thailand’s economy has been dependent, to a large extent, on its export sector which has flourished over the last few years (Rajan 2008).

The increasing dependence on the export sector may be attributed to the gradual shrinking of the domestic market of Thailand. Higher oil prices and political instability have largely contributed to the decline of the domestic market.

The significance of the export sector in the Thai economy can be judged from the fact that the contribution of the value of exports to the country’s GDP has risen from 30% in 1997 to 60% in 2006. Thus, the gradual appreciation of baht, if not properly stemmed, would lead to the loss of price competitiveness thereby threatening the export sector of the country (Sufian 2009).

Not only that, excessive appreciation of the Thai baht would also impact the labor market, especially the agricultural sector, and textiles. Unlike the high–tech industries like electronics or automobiles, these sectors lack the necessary infrastructure to cope up with the consequences of excessive baht appreciation in a limited period of time. These sectors contribute significantly to the country’s overall employment and the lack of price competitiveness for these sectors would mean mass curtailment of jobs.

To warrant the gradual appreciation of the baht, the Bank of Thailand adopted a number of conventional measures like FX intervention, Interest rate policy, and Outflow liberalization as well as a number of anti-speculative measures. However, all the above measures proved ineffective in achieving the desired objectives.

Finally, on December 18, 2006, the Bank of Thailand decided to impose a 30% Unremunerated Reserve Requirement (URR) on short-term capital inflows effective from the very next day (Sufian 2009).

Reasons for the Rapid Appreciation of Baht

In 2006, Thailand’s economy recorded a gradual appreciation of baht due to surpluses in both the current account as well as the capital account. Although the current account recorded a surplus of $2.2 billion, the appreciation has been primarily triggered by the huge amount of capital inflows.

During that period, Thailand experienced unexpected economic growth resulting in the large inflow of capital from the developed nations. They made greater use of the cheap credit offered by Thailand and invested in the market in lieu of larger returns. The flourishing commodities market also played a major role in the rise of capital inflows at that time.

Contrary to the rise in the capital inflows, the capital outflow suffered a rapid decline during that period. The gains from capital outflow have mainly been in the form of investments made by local households or corporations abroad. The setback was a culmination of a number of factors like larger returns from domestic assets, gradual rate of baht appreciation, lack of knowledge about foreign investments, etc. The imbalance between capital inflows and outflows facilitated the rise of the Thai baht transforming it into one of the strong existing currencies (Nuntiyagul 2009).

Moreover, the floating exchange rate regime adopted by the Bank of Thailand after the financial crisis of 1997 further contributed to the rise of baht. As per the prevailing system, excess inflow of foreign currency in the market would automatically appreciate the value of baht.

Motivation Behind the Introduction of the URR Provision

The Bank of Thailand adopted a number of measures to arrest the rapid appreciation of baht by curbing capital inflows in November and December 2006. However, most of the measures proved ineffective in realizing the goals. The introduction of the Unremunerated Reserve Requirement (URR) policy was the last of the measures taken in this context.

- Controlling the movement of baht and aligning it with other regional currencies

- Curbing the rate of capital inflows into the market and

- Providing ample time to the private sector to readjust to the consequences of rapid baht appreciation

According to the URR provision, investments made by the foreigners in debt securities, mutual funds, property funds as well as currency conversion in baht for external borrowing would be required to keep 30% of their funds with the commercial banks which would be returned to them after a period of 1 year. Withdrawal of the amount before the stipulated time would result in the refund of 2/3rd of the funds (Limpaphayom 2009).

Impact of the URR Provision

The URR provision introduced by the Bank of Thailand has been largely successful in realizing the objectives stated above. It has been instrumental in decreasing the pressure on baht and consolidating its position. Additionally, it has also created a number of positive and negative impacts some of which are discussed below.

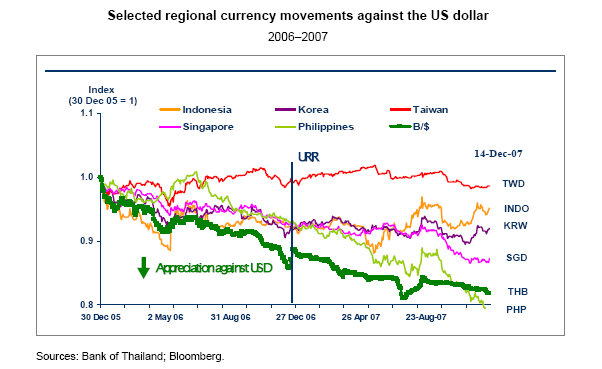

Exchange Rate of Thai Baht With Other Major Currencies Such as USD and Local Currencies

Prior to the implementation of the URR provision, the baht appreciated to more than 16% against the USD. However, the URR provision has been able to bring some stability to the highly volatile situation. In fact, in the next couple of months, the appreciation of Thai baht against the USD was almost equal to zero. Most importantly, the URR provision has helped to make the exchange rate of baht aligned with those of the currencies of Thailand’s major associates and competitors. Singapore is a major competitor. Next is Malaysia in terms of competition. Korea and Taiwan are also forced to recognize in this context. Apart from these, Philippines and Indonesia are also important competitors as well as major associates (Sufian 2009). The above impact can be understood better with the help of the Chart 2 given below.

Thai Financial Markets Like Stock Markets, Bond Markets, and Money Markets

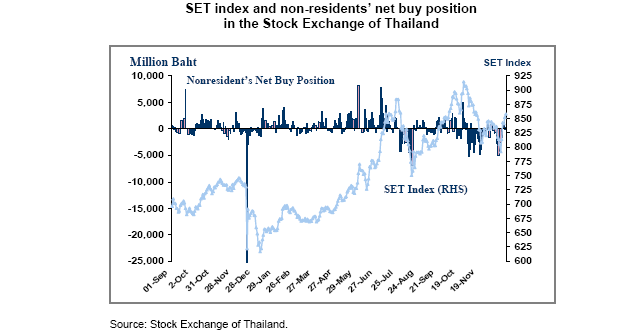

The Stock Market of Thailand (SET) suffered a major collapse on the first trading day after the announcement for the introduction of the URR provision was made by the Bank of Thailand. “The composite index came down to 622.14 on December 19, 2006, from 730.55 at the end of the earlier day” (Rajan 2008). Thus, it recorded a sell-off of 25 billion baths by foreign investors on a single day. The above record highlights the impact of the URR measure on investor confidence. However, the reaction was temporary. The massive collapse of the SET forced the Bank of Thailand to reconsider its preventive measures. Finally, it announced the exemption of investment in Stock Markets from the URR measure. The day after the exemption, SET was able to recover a substantial amount of the loss incurred. Gradually, the economy witnessed a rise in capital inflows from foreign investors indicating the boosting of investor confidence.

The SET index and the net buying position of the foreigners in the Stock Exchange of Thailand have been shown in Chart 3 below. Sufian (2009) indicated that it created a same impact on the Thai bond market. Prior to the introduction of the URR provision, the non-residents’ investment in the Thai bond market was pretty limited. The investment participation of foreigners was roughly 15% in 2005 and 19% in 2006 respectively. However, after the implementation of the new measure, the foreigners’ investment spiraled up to almost 30% of the total bond market volume (Sufian 2009).

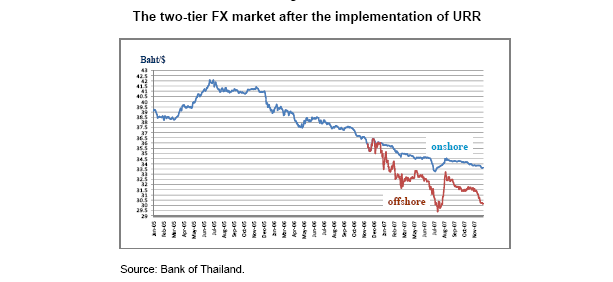

The URR also lead to the creation of a two-tier FX market in which the baht became more expensive offshore than onshore. The difference in the two rates confused the exporters and it led to the panic selling of dollar especially in the initial phase of the URR implementation. (Please refer to Chart 4 below).

Neighboring Financial Markets Like Malaysia, Philippines, Singapore, and Korea

The sudden collapse of the Stock Exchange of Thailand (SET) on December 19, 2006, following the introduction of the URR provision by the Bank of Thailand had its effect on the neighboring stock markets as well. The composite index of the stock market of Jakarta (Indonesia) went down by 2.85%, that of Kuala Lumpur (Malaysia) by 2%, and of Singapore by 2.23% (Limpaphayom 2009).

Impact of the Neighboring Financial Markets in the Long Term

In the era of close contact economy, it is impossible to stay away from the effects of a meltdown or crisis in a country in vicinity. However, same as the negative impacts, there are positive sides too, and in a long term these become obviously beneficial because a neighboring state tends to harvest the positive results of economic boom while during crisis the same state suffers as by then the economic balance becomes inter-dependable. Thus, the economic impact of growth or crisis is obvious in case of a neighboring country and it is felt over the years in a long term basis.

Conclusion

Over the last few years, Thailand as well as other emerging countries has experienced challenging situations in the field of financial integration. Conventional preventive measures, in most cases, have proved pretty ineffective. Capital control measures like the URR can prove to be a favorable option but in specific situations. Thus, the need of the hour is to devise strategic measures to minimize the potential adverse effects on the economy.

References

Limpaphayom, P. (2009). Bank Relationship and Firm Performance: Evidence From Thailand. Journal of Business Finance & Accounting 31(9-10), 1577-1600.

Nuntiyagul, A. (2009). URR on Thai Financial Markets. Banking Intelligence 23(1), 28-44.

Rajan, R. (2008). Does devaluation lead to economic recovery or contraction? Theory and policy with reference to Thailand. Journal of International Development 16(2), 141-156.

Sufian, F. (2009). The impact of the Asian financial crisis on bank efficiency: The experience of Malaysia And Thailand. Journal of International Development 17(3), 122-134.