Thesis

Is the traditional retail industry dying? That’s one of the first questions that comes to mind as you see many retailers performing poorly, closing stores, and even going bankrupt. However, after digging deeper into the elements that contributed to the fall of retail, one of the main reasons was the changing nature of consumer behavior as e-commerce started to rise. Retailers are taking initiatives in order to adapt to the changes by having smaller store footprints, invest in technology innovation and going digital, and creating an experience for the consumers.

Context

Retail is one of the largest and most diverse industries of commercial real estate. They are basically used to market and sell consumer goods and services and range from shopping centers, individual stores, and pop-up shops to big box stores like Walmart, Home Depot, and Ikea. This sector is consumer-driven and is sensitive to the state of the economy. It will suffer if the economy was bad or if the consumer changed his/her behavior as a result of a rise in another industry like e-commerce, which is the case nowadays.

E-commerce is marketing and selling goods and services using the internet as a platform for the consumers to interact with instead of actual brick and mortar stores. The rise of this industry is attributed to five forces that include price, selection, convenience, distribution, and cost structure. The model of this industry of providing the goods to the consumers using an online platform is more convenient to some customers and can fulfill the changing consumer need.

Methods

In order to dig further into the outlook of retail and how it is changing, I spoke to a couple of experts to gain insight into the retail sector, what strategies are retailers using to adapt to the changes caused by e-commerce, and a potential relationship between the rise of e-commerce and increasing demand in data centers. Afterward, I used their insights as guidance to research the retail sector, its relation to e-commerce, and the potential outlook of where it is headed.

Findings

The old model of brick-and-mortar stores does not fulfill the current consumer’s need anymore in most sectors of retail, and there is a need for a newer model that includes providing an experience to the customers. In this paper, we will be looking at the effects of e-commerce on retail by looking at the performance of malls and centers lately and will dig further into tenants and the next steps needed to adapt to the change of consumer behavior.

Malls and Centers

A shopping mall is a building, typically large in size, with many stores inside that, are usually leased to retailers, and is considered a shopping destination for customers. Shopping centers, on the other hand, are typically just destinations with many shops just like a mall but not constrained by a building. It could be an open-air shopping area where people can walk outside from one store to the other.

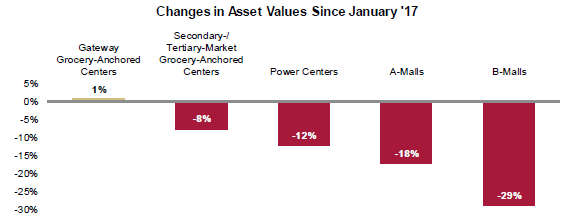

Decrease in Asset Values

There is a significant decrease in nearly all retail real estate asset values these past few years, as shown in the graph, with the exception of Gateway Grocery-Anchored Centers. This decrease is a result of the deteriorating outlook of the retail sector that is caused by the changing consumer behavior where they prefer the freedom of shopping using their computers or phones to avoid trips to a store.

“There are three segments in retail that are affected differently by e-commerce, High-End segment, Middle segment, and Lower segment. The High-End part is focused on selling luxury goods and high-end products that are not considered necessities, but wants and it is not as affected by e-commerce since

The decline varied by property type, with low productivity malls (B-Malls) declining the most by around 30% since the beginning of 2017.

On the other hand, Gateway Grocery-Anchored Centers, which are community centers in gateway markets that have a grocery store as their anchor tenant, are showing no decrease in value at all because of the impact of e-commerce on the grocery business has been minimal. The physical store is still the centerpiece of the grocery business model, but big grocers like Wal-Mart and Kroger are still investing heavily in e-grocery innovation for both pick-up and delivery to adapt to the potential change.

Recent Performance

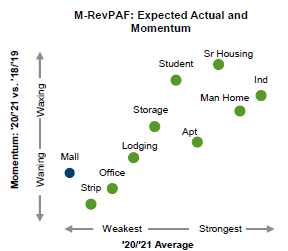

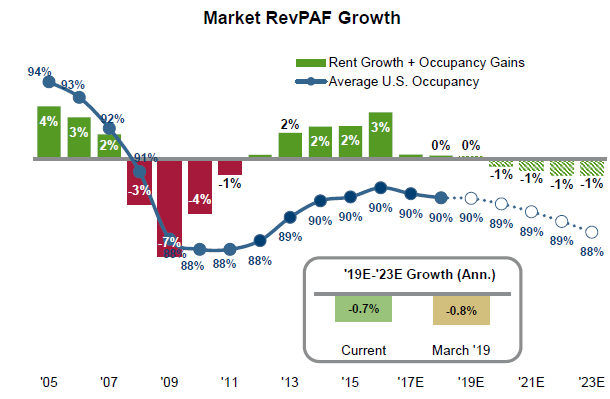

Revenue per Available Foot – RevPAR is a performance metric that is used in real estate. In retail real estate, it is calculated by dividing the asset’s total revenue by the entire available space, or by multiplying the percentage occupancy of tenants by the average rent throughout the year. As more tenants go close stores, pursue resizing initiatives, or go bankrupt, the occupancy will decrease, which would decrease RevPAF in return. Also, as new tenants come in, higher rents can be charged to them, which would increase average rent and RevPAF eventually.

Looking at the performance of the sectors within real estate, malls, and strips are the weakest expected performance in terms of Market RevPAF for the next couple of years. The store closures weakened the landlord’s negotiating power resulting in a declining average rent and occupancy. It also led to an oversupply of retail space in the market with no demand matching the supply resulting in a declining average rent

Overview

In the context of globalization of business, retail trade-in large cities are developing mainly as a result of the opening of stores of network companies, shopping centers. In the current decade, special attention has been paid to the construction of a shopping mall and shopping centers. Investors are private companies and individual entrepreneurs. In shopping centers, there is a concentration of shopping facilities of various specializations and catering facilities (Oh and Polidan 39). A shopping center is a group of architecturally united trading enterprises built on a specially planned, developed, and owned site, which is managed as a whole. At the same time, the size and type of stores exactly correspond to the served shopping area and are provided with parking lots on the adjacent site in strict accordance with the kind of shopping center. The idea of a new type of commercial building – a spacious, light-flooded space in which the buyer can enjoy the spectacle of a variety of goods collected under one roof – came about after the 1851 World Exhibition in London, when the Crystal Palace Pavilion appeared to the amazed visitors (Ives et al. 3). The construction was striking in its size: the total area of the pavilion in three levels 2 was 92,000 m2, and at that time the Crystal Palace was the largest building. With a length of 564 m and a height of 33 m, it accommodated up to 14,000 visitors (Nickson et al. 701). Now, this pavilion is rightfully considered the prototype of a store.

In many European countries, there is a tendency toward the enlargement of shopping centers. Not only shopping and entertainment centers are being built, but also trade and exhibition centers, as well as business centers. According to the British Council of Shopping Centers, 40% of shopping centers in Europe have a leisure and entertainment part (Oh and Polidan 41). In France, where the process of creating large shopping centers was going very fast, the authorities were forced to adopt a law prohibiting their construction. In Germany, where entertainment and fitness centers are well developed, the mall format has not become popular (Nickson et al. 704). German shopping centers focus on trade, domestic services, and food courts, while the entertainment part is allocated only 2.4% of the rented area (Kushwaha et al. 281).

In addition, a separate category of specialized shopping centers stands out. Depending on the specialization in various areas, shopping centers have distinctive features. Anchor tenants in such shopping centers are one or more operators with a specialized profile. The coverage area depends on the area of the shopping center and, as a rule, it is more extensive than the coverage area of a shopping center of a similar format without specialization. In the regions, shopping centers are developing in the same way as in the capitals, and the corresponding operators work there (Lange et al. 15). A significant advantage is lower land costs and associated costs, so entertainment there is relatively cheaper and, accordingly, is developing faster. Starting with a slight lag, regional shopping and leisure centers are quickly catching up with metropolitan malls in terms of supply and quality of services.

In small cities, there are examples of a balanced approach to the design and construction of shopping centers. The traditional range of services – billiards, bowling, slot machines, multiplexes, fitness – will last on the market for another 2-3 years (Oh and Polidan 44). Many owners of regional shopping and entertainment centers have begun to realize that their city or region needs a full-fledged entertainment component. However, it is evident that then the market will need innovations, and what they need to be in order to meet new needs, must be done as soon as possible (Sivagnanasundaram 103). Those who will be able to think over the concept of the shopping and entertainment center and satisfy the needs of consumers by providing them with more diverse services will win. The purpose of entertainment in the mall is to maintain or increase the level of rental rates for retail tenants, to create additional attendance at the expense of those whose needs are mainly satisfied – prosperous young people or middle-aged people (Ives et al. 3). By placing a bowling alley and a children’s entertainment complex nearby, including a cinema in the shopping center concept, the investor seeks to increase the number of visitors in general and separately for each operator.

The fact that shopping centers continue to expand their area for non-commercial purposes indicates the economic feasibility of such a solution. The more needs the shopping center can satisfy, the more people will stay there for a long time, which means more stores will be visited and more purchases will be made. Cinemas, bowling alleys, and children’s entertainment centers are less cost-effective than the trade-in goods. Entertainment enterprises are distinguished from the business by a large volume of investment and a longer return on investment (Lange et al. 8). The cinema has a low efficiency since significant areas in it can conditionally be called commercial – these are projection, foyer, corridors, etc. Bowling is even less effective. Game paths occupy a large area, and patency in bowling is much less than in a movie theater.

The construction of the shopping center is ahead of the development of retail chains. This creates a shortage of quality tenants. According to entrepreneurs, there is a shortage of professional entertainment professionals in the country who can offer new ideas and put them into practice (Kushwaha et al. 277). The profitability of shopping and entertainment centers is low. Existing alternative investment opportunities do not allow investing in entertainment centers that have low profitability compared to shopping centers unless the investor is an entertainment operator. In addition to high rental rates for land, the municipality to which the property belongs puts forward a lot of burdens – from the overestimated share of the city, social responsibilities to “highly recommended” designers, on whose participation the building permit depends.

In such a complex and new area as the construction of shopping centers, there are no standard solutions. Each project requires fresh thought, thorough research, and unique solutions. The development of shopping centers should be preceded by an analysis of the provision of territories with retail space and socio-cultural facilities (Oh and Polidan 35). The oversaturation of shopping centers leads both to loss of profit by entrepreneurs and a deterioration in the quality of trade services.

Retailers

Basic requirements for the characteristics of shopping centers are a single site, easily accessible location inside the trading area, a sufficient number of parking spaces, and the ability to deliver goods to the warehouse, as well as to points of sale of goods (Ives et al. 10). It also includes environment infrastructure around the shopping center, the composition of tenants from the same price category, suitable for a single concept, and an atmosphere conducive to shopping. Entertainment objects are becoming an integral part of many modern shopping centers. Each project requires rigorous studies of the environment, environment, and coverage area (Ives et al. 11). The picture is constantly changing, as retail trade is keenly responsive to changing specific conditions, the level of technical knowledge is increasing, and economic and physical requirements are changing.

The next sign of the classification of retail trade organizations is the level of integration. It should be noted that the systematization of trade organizations, depending on the level of integration in one interpretation or another, is present in modern classifications presented in economic and regulatory literature. At the same time, the process of developing trade integrations is dynamic. Therefore, it is suggested to expand the classification of trade organizations by the level of integration, further highlighting the following characteristics – according to organizational, economic, and spatial forms of unifying transformations of business structures. The proposed classification meets the requirements of globalization, is more variable, and reflects the emergence of ever new types of trade integrations.

The integration of business structures is closely related to the diversification of capital and the penetration of trade organizations into various segments of the market and industries. Therefore, it is safe to consider it appropriate to highlight the classification sign – the level of diversification. In accordance with the proposed feature, all retail trade organizations are divided into non-diversified and diversified, including a focus on intra-industry and inter-industry diversification (Kushwaha et al. 279). Intra-industry diversification is an association of functionally independent organizations of various industries within a single trading organization. Thus, most of the classic retail chains are represented by shops, wholesale distribution centers, workshops for the production of semi-finished products, salads, pastries for confectionery and culinary products, transport units, and others. Intersectoral diversification involves the integration of functionally independent retail trade organizations and enterprises of other industries. Examples of inter-sectoral diversification in the trading sector are trading business networks, financial-industrial-trade groups, multinational retail trading corporations, and others (Lange et al. 9).

In the future, retailers in the United States and Europe will continue to search for new markets outside their countries, expanding their geographic footprint. For such retailers, merging with similar companies in an already developed market will take advantage of global supplies, and the natural expansion of activities into new markets will allow large corporations to be in the wake of growing consumer demand and offer better services compared to local retail market operators (Lange et al. 11). It should be noted that some of the most successful attempts to expand activities in foreign markets were made by retailers from developing countries while entering the markets of other developing countries and countries with transformational economies.

Market Shifts

Furthermore, according to experts, in the long run, three types of companies will have a chance of survival: large manufacturers that produce a wide range of products and actively invest in R&D and promotion of new products; manufacturers of goods for sale through retail chains under the trademarks of these chains; operators operating in separate market “niches” (Nickson et al. 698). Manufacturers whose trademarks have failed to occupy the first or second position in the market are often forced to choose between turning large industrial companies into subcontractors and releasing products under the brand name of a retail network.

It is important to note that many retail companies take initiatives in order to match the current market shifts. For example, Wall-Mart and similar companies aim to construct delivery services in order to be able to compete with e-commerce leaders, such as Amazon (Ives et al., 8). Trends in increasing the share of sales in retail product chain stores, creating their own production facilities, changing the balance of market power from manufacturers towards retail chain magnates have identified yet another modern global trend in the development of retail chains: companies began to play the role of world-class marketers. Until recently, the leading marketers in the global market were considered manufacturers of consumer goods (Lange et al. 14). They monitored customer sentiment, allocated significant funds to market research, and skillfully used the media to label their brand. As retail companies grew and gained influence, suppliers had to shift their focus from end-user relationships to relationships with their customers.

The formation of trade relations has become more important than advertising in the media. The main place in relationships with consumers began to occupy retail companies. In addition, by promoting the sale of goods under their own brand, they themselves became leading suppliers (Lange et al. 7). At the same time, retailers still lacked relevant marketing skills and experience. In modern conditions, this trend is undergoing changes. Some of the largest retail companies in the world pursue an aggressive policy aimed at luring the leading marketers from manufacturers of consumer goods. They set themselves the goal of becoming centers of influence in the field of marketing, creating a unique corporate identity, successfully competing with other retail companies, and increasingly with manufacturers through the sale of goods under their own brand (Sivagnanasundaram 106). In fact, owned brands are no longer just a way to offer low prices but become an important channel for brand promotion and a way to increase profits.

It is also important to note that a client can receive a different number of services, depending on one or another organizational form. Thus, for example, in the market, subject to low prices, the buyer can count on their minimum set. Although the discounter provides a greater number of services compared to the market, this, however, is not its main competitive advantage, since its instrument of struggle for survival prices. In the discount store, only the main trading service is provided, and the variable of additional services, taking into account the mathematical expression “store formula”, tends to zero, since in this case the strategy chosen by the store is aimed at reducing costs and increasing profits (Lange et al. 9). However, this can lead to a decrease in the loyalty of customers with middle and above-average incomes, as a result of which they can become followers of other stores with a higher level of service.

Conclusion

In conclusion, analyzing the above trends in the development of global retail trade, it is safe to conclude that network trade is becoming a significant and influential force in the global economy, which largely determines the development of competition in the domestic markets of countries. At the same time, the development of retail is still not given due attention in programs of socio-economic development of any level (national, macro-regional, regional, and municipal). Without its organic inclusion in the general concept and strategy, programs, and plans of socio-economic development, the modernization of the modern economic system will remain incomplete, which will necessarily negatively affect the proportions and scale of its reproduction in the future.

Works Cited

Ives, Blake, et al. “Amazon Go: Disrupting Retail?” Journal of Information Technology Teaching Cases, vol. 9, no. 1, 2019, pp. 2-12.

Kushwaha, Tarun, et al. “Factors Influencing Selection of Shopping Malls: An Exploratory Study of Consumer Perception.” Vision, vol. 21, no. 3, 2017, pp. 274-283.

Lange, Fredrik, et al. “Bridging Theory and Practice in an Applied Retail Track.” Journal of Marketing Education, vol. 40, no. 1, 2018, pp. 6-16.

Nickson, Dennis, et al. “Skill Requirements in Retail Work: The Case of High-End Fashion Retailing.” Work, Employment and Society, vol. 31, no. 4, 2017, pp. 692-708.

Oh, Hyunjoo, and Mary Polidan. “Retail Consulting Class: Experiential Learning Platform to Develop Future Retail Talents.” Journal of Marketing Education, vol. 40, no. 1, 2018, pp. 31-46.

Sivagnanasundaram, M. “Sustainability Practices in Indian Retail Industry: A Comparison with Top Global Retailers.” Emerging Economy Studies, vol. 4, no. 1, 2018, pp. 102-111.