Introduction

There has been a phenomenal growth of the Chinese economy over the last decade. The exceptional growth in China has been forecasted to continue in most of the sectors. The main problem faced by China is the lack of mobility of resources from one place to where they are needed. China’s GDP in 2000 grew more than six times that of 1980;it exceeded US$ 1,000billion (Wang & Liu, 2006, p.8).

There has been tremendous growth of the total economic volume which has improved commodity supply to the economy as well as improving the people’s living conditions. Industrialization has also accelerated moving from lower level of uneven development to levels of balanced development. China has strong prospects of sustaining strong economic growth and trade expansion in the future.

China GDP

The GDP represent the total market value of all final goods and services produced within a country in a given time period (Makiw 2008, p.496). GDP is viewed as the total expenditure in the economy. To help us understand GDP, I will discuss the composition of GDP.GDP is given by Y= C + I + G + NX.

Where,

- Y represents the GDP,

- C denotes consumption by household,

- I denote investment,

- G – Government expenditure,

- NX – Net export (Mankiw 2009, p. 496).

According to the World Bank Report (2000), the total GDP for China stood at $5.879 Trillion in the year 2010.

Annual GDP growth rate

(Source: World Bank)

The double digit growth rate for over a decade has made China the second largest economy in the world. Some economists believe that the growth rate might go down and stabilize at 8% due to global meltdown of exports. China growing export has been the key driving force of the country’s economy.

Since the global downturn is hurting China’s economy, the government is adjusting the development pattern with the growing domestic consumption. According to World Bank Report (2000), the country’s annual trade surplus is expected to be around 2 percent of the GDP this year.

China has experienced an average of 10 percent of GDP. With 10.3 percent growth of GDP in 2010 China overtook Japan as the second largest economy after Japan. China is expected to post an annual growth of 9 percent in the year 2011 despite the sluggish growth in the world economy.

Reasons for Rapid Economic Growth

The rapid economic growth of China over the last 30 years has astonished many people. The growth has been consistent despite varying economic trends in the world economy. There is an economic law that the country applied in order to achieve such growth. The driving forces of the China economy include high quality human capital and market institutions that are functional (Chow, 2010, p. 43).

Human capital entails the capabilities of the working society, the skills and the work ethics of the labor force. It also includes the resourcefulness of entrepreneurs who take charge of business enterprises. Quality human capital is something that has been historically integrated in the cultural tradition of the Chinese society.

The quality of human capital cannot be measured by the year of schooling only. Economists should incorporate the work ethics and ingenuity of the labor force. These qualities have been improved over time and passed over from one generation to another.

Unemployment in China

Unemployment is determined by the number of people who are not working but are able to work and are therefore looking for employment in a given time period.

Unemployment Rate

(Source: State Statistical Bureau)

Despite China registering economic growth of more than 10 percent for a decade, unemployment remains one of the economic problems facing the country with the unemployment rate standing at 4.1 percent. There has been wide spread urban unemployment crisis since 1990 (Warner, 2007, p.4).

Although there is an economic growth that has contributed to the creation of jobs, the level of unemployment remain high because the jobs created cannot absorb all seeking employment. After adopting communism China promised its citizens jobs.

Many years later, enterprises have leaned towards capitalistic ideologies which have led to inefficiencies in the state owned enterprises. Competition and introduction has made the enterprises relieve employees of their duties in an attempt to maintain the enterprises. The enterprises adopted the reforms to be able to compete in the global market.

Current Account

China pegs its currency, the Yuan to the U.S. dollar and maintains a fixed exchange rate. Net Current Account is given by:

Net Current Account = Net Capital Account [(Exports – Imports) + Net Unilateral = [(Private Capital outflow – Inflow) + Transfers] change in foreign Exchange Reserves] (Morrison, Labonte & Sanford, 2006, p.15). Any increase in net exports or net private capital must be matched with an equal increase in foreign exchange reserves so as to maintain the exchange rate peg.

The most important part of current account is the balance of trade. The changes in pattern of trades with other trading partners remain the key drivers in the current account of China.

Positive net export causes a surplus in the current account of an economy and the amount of surplus depends on the amount of positive net export. A deficit in the current account is accounted for by negative net export. Current account surplus will significantly depend on the exports.

China Surplus on Current Account, percent of GDP

(Source: International Monetary Fund, World Economic Outlook 2011, Table 2.4 p. 73)

China Fiscal Indicators

Government Revenue and their ratio t GDP

(Source: National Bureau of Statistics of PRC, Statistical Yearbook of China, 2006-2010).

The revenue from the China government has been on the rise over the years reflecting a tremendous growth in the year 2006-2010.Comparing between years 2009 and 2010,China’s revenue growth rate is about 14% which is higher than the increase in GDP for the same period.

The government revenue is majorly derived from taxes through consumption, corporate income and imports. Revenue increase has been the main objective of the government so as to finance public expenditure and prevent deficit.

Government Expenditure and their ratio to GDP

(Source: The government’s budget statement 2008-09, Hang Seng Bank).

It can be observed that there has been deficit in year 2008 and 2009. This trend is expected to continue in the coming years since the government will require extensive amount of revenue to finance its numerous development plans despite the economic slowdown.

Monetary Indicators

The major monetary indicators of the China economy are money supply and the rate of inflation. China is the country with the largest money supply and has been printing its currency at a very fast rate. According to statistics from the central People’s Bank of China, China’s broad money supply rose to 7103 trillion Yuan in the year 2010.

The money supply is larger than that of US and Japan. The regulations carried out by People’s Bank of China require that for every US$1 increase in foreign exchange reserves, the bank has to release an equivalent amount of Yuan into the economy (Financial Times, 2010a).

China exports and Imports

According to World Bank report (2000), China exports were worth 1.575 Trillion USD 2010.The growth of export has continued to be the support of China rapid economic growth. China exports of goods and services constitute around 39.7 % of its GDP.

Major exports include: office machines, telecommunication equipment, electrical machinery and clothing. Major markets for China exports include European Union, USA, Japan and South Korea.

Imports in the year 2010 1.33 Trillion USD

China’s import surged in the month of October 2011 as export grew at a slower rate. This has led to China focusing on domestic demand so as to cushion it against economic the decreasing exports. Imports from the major trading partners have increased significantly.

The increase in imports is attributable to the increase of living standards in China allowing people to imports goods from the international markets. The growth of export is as a result of increased competitiveness of China goods and increased foreign investments.

China foreign reserve

According to people’s Bank of China, China foreign exchange reserve stood at US $ 3.2 Trillion in June 2011. When China joined World Trade Organization (WTO) in 2001, there was rapid growth in both imports and exports. Foreign direct investment flows exceeded US$ 60 billion by the year 2006. For the first time, China’s foreign exchange reserves exceeded USD 1 trillion in October 2006. The continuous development of the country’s economy has led to the rapid growth of foreign exchange reserve with China attracting international investment in terms of foreign trade and foreign capital utilization.

Rising Oil Prices Effect on China’s Economy

It is no doubt that China national economy is been threatened by the rising international oil prices. The price of oil has recently gone up and this has affected the Chinese economy. The oil prices in China have even hit US$32 per barrel and this has a significant effect on the economy.

According to experts, this skyrocketing of prices has threatened the Chinese national economy stability. However, the effect may not be felt much because the economy’s dependence on international oil is still very low; that is within 20% warning mark.

The large fluctuation in oil prices has benefited the Chinese petroleum industry. In 2000, for example, the China Petroleum and Natural Gas Group had higher performance in terms of profitability compared to the same period in 1999. It made a 4.4-fold increase from the same period in 1999. The total earnings were 29.1 billion Yuan which was a high mark that period.

Statistics has it that petrochemical industry was put under much pressure by the fluctuation of oil prices. To curb the challenge the industry has introduced management style that will cut on expenditure and in unison reduce the material use.

Since Chinas Crude oil as well as refined oil value was ranked together with those in the international market, the costs have increased simultaneously with those of the international markets. Consequently, a recession’s step in when the costs are raise and the demand depreciates. Moreover, investments are reduced.

Petroleum accounts for a large proportion of economy which is the reason why the government of China seeks to intervene in the situation. The imbalance between companies that benefit from high oil prices while others realize low profit is a concern to the Chinese government.

The government is capable of making appropriate amendments in macroeconomics to influence the national economy positively. It is capable of adjusting to fluctuations in the globe.

Impacts of global slowdown on China

Global market recession has had negative impacts in different parts of the globe. Less production and daunting job markets have been witnessed. China has been affected and shows quick recovery. Industrial, construction and manufacturing sectors have been affected negatively (Diao et al, 2010, p. 32).

China has indicated resistance besides relying on exports. Although the exports have declined other factors like political, social and market strategies have been seen as the reason for the resistance.

Unlike in the west, the society in China is characterized by equality. China advocates for socialism and views capitalism as the cause for inequality in the west. Changes in the economy to advocate for free market have been adopted. However, the government controls over 50 percent of the states property. This makes it easy to implement policies that enable economic growth.

The confidence of the consumer is secured and contributes to the stability of the market. Propaganda when effectively utilized makes the citizens lift negative sentiments of global recession. The media is not allowed to freely release government information that may cause anxiety to investors and citizens. Moreover, the possibly of the media exaggerating and blowing the scene out of proportion is eliminated (Wang, 2010, p. 1).

China has experienced low demand for its export owing to the global slowdown. A number of industries have reduced the production and labor force while other have closed down. The government in response set aside fund for increase in infrastructure and environmental protection.

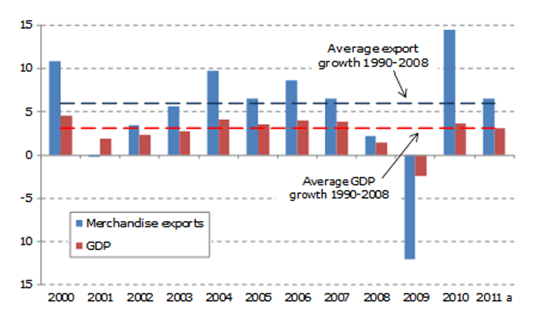

The chart shows that the number of merchandise has increased in the past years allowing China to have a high GDP growth in 2011.

The future of business in China

The economy of China is expected to grow in the future. China has the potential to grow. It lays emphasis on education and funds schools. Moreover, it has invested heavily in research. Research enables the Chinese government to make note of key areas for development. China has maintained a steady growth of economy in the past years and has reduced the level of poverty in the region (Zhongmin, 2009).

The Chinese population is aging and in the future the younger generation will be employed and contributing to the national economy (State statistical Bureau, 2010). It is inappropriate to assume that in the future the economy will be prevailing without considering the aging population.

Consequently, China should continually recruit and train the younger generation to replace the workforce. Political factors play a major role in determining the economy of a state. China is not exception and political factors may positively or negatively affect the economy (Newberry, 2007, p. 1).

China is improving the domestic demand and improving industrial structure to increase the exports and focuses on rural development. On changing strategy, China will be able to overcome global slowdown and lead in the global market (Chiu, 2011, p. 1).

Conclusion

China is the Second largest Economy in the world. It has maintained an economic grow of above 9 percent. The economic growth is as a result of the increasing exports. After the global recession Chinas economy has been affected with a decline in the number of exports. China’s GDP has been 10 percent. Economists fear that the GDP may reduce to 8 percent with the effects of global slowdown.

High quality human capital and functional market institutions have been the strong holds of the Chinese economy. China has a large number of unemployment contrary to the economic growth (Financial Times, 2011c). Chinese currency has maintained affixed exchange rate to the dollar.

The revenue growth rate stands at 14 percent in 2010. The revenue is collected from taxes on consumption, corporate income and imports. According to People, s daily (2011), China has experienced a deficit and requires more revenue especially in the period of economic slowdown.

China has a large supply of money and in 2010 7103 trillion Yuan were printed. 5.1 percent inflation has been realized in China. The government of China has intervened with commodity prices of basic commodities to create social and economic stability.

Reference List

Chiu, L., 2011. China’s response to the Global Finance Crisis. Web.

Chow, G. C., 2010. Interpreting China’s Economy. London: World Scientific

Diao, X., Zhang., & Chen, K. Z., 2010. Country- Level Impact of Global Recession and China’s Stimulus Package. Web.

Financial Times., 2010a. “China Inflation Surges to 25-Month High”. Financial Times, 11 November.

Financial Times., 2011c. “China Steps up Fight against Inflation”. Financial Times.

Mankiw, G. N., 2008. Principles of Economics. Mason: South-Western 7th edition.

Morrison, W. M., Labonte, M., Sanford, J. E., 2006. China’s currency and Economic Issues. New York: Nova Science.

Newberry, D., 2007. The Future of Business in China. Web.

People, s daily. 2011. Rising Oil Prices effect on China’s Economy. Web.

State statistical Bureau., 2010. China Labour Statistical Year Book 2010. Beijing:China Statistics Press.

Wang, J., 2010. Why China is so resistant to global recession? Web.

Wang, M. & Liu, B., 2006. China’s Economy. China: China Intercontinental Press

Warner, M., 2007. Unemployment in China: Economy, Human resources and Labor markets. New York: Routledge.

World Bank Report. 2000. Entering the 21st Century: World Development Report 1999/2000. New York: Oxford University Press for the World Bank.1

Zhongmin, W., 2009. China in the World Economy. New York: Routledge