Executive Summary

This report consists of cumulative recommendation plans to be applied towards corporate strategy and financial goals of Christine Dior Group for the year 2008-09. With its global presence and brand recognition value, Christine Dior is considered a formidable player in the fashion and retail sector operating in a diverse portfolio of innovative products: perfumes and cosmetics, fashion and leather goods, jewellery, wines and spirits and haute couture.

The purpose of this case study is to present key recommendation strategies to ensure the group’s vision for success in an uncertain global market scenario: volatile currency rates, rising interest rates, declining consumer confidence in major markets such as the United States etc.

The global market for high-end luxury goods is currently witnessing a tectonic shift from developed markets such as the US and Western Europe to the emerging economies of China, India, the Middle East, Russia and Eastern Europe. Despite its growing presence in these countries, the Christine Dior group is also sensitive to the environment, equity and interest rate risks which can be counteracted by suitable corporate-level interventions mentioned in this paper. A simulated financial report with profit/revenue projections, cash flow statements and rates of return has been prepared to understand the long-term business strategy outlined in this case study.

Introduction

Objectives of Strategy Plan and Financial Forecast

This case study pursues a number of interconnected strategies relevant to our aims in addressing current business decisions of Christine Dior Group for the following intended company objectives (The aims and objectives of this case study are derived from Christine Dior’s Annual General Report 2007-08.): higher revenue, increased operating profits, reduced debt, building and expansion of new brands, selective investment strategy focusing on emerging markets and preparing the groundwork for future market penetration strategies through newly-developing brands. Based on the present financial status of the organisation and its own long-term vision, the following strategies are being recommended here:

- Increasing market presence in the emerging markets of China, India, Middle-East Countries, Russia and East European countries.

- Investment goals focused on building a large number of retail chains in these markets

- Continuing with Christine Dior’s USP of flagship innovative products –some useful tips and strategies are suggested.

In order to back up recommended strategies, a consolidated financial report has been prepared. This consists of a financial forecast, profit projections, cash flow statement and impact on equity markets. The most recently available accounting and stock market data for Christine Dior has been used.

Background of Christine Dior

The Christine Dior Group is a Paris-based luxury goods giant founded 60 years ago by the famous fashion designer Christine Dior. After being acquired by the LVMH group in 1996, it has expanded its presence in a variety of fashion segments and is today, considered a leading player in a diverse portfolio of high-end fashion products: perfumes and cosmetics (the group’s flagship product line), menswear and accessories, wines and spirits, haute couture, jewellery, footwear, watches and leather goods.

Many brands under this group’s umbrella are instantly recognised worldwide for their immense brand value and market presence (Dior Official Website, 2008): Louis Vuitton, Givenchy, Fahrenheit, Dolce Vita, J’adore, Hennessy, Dom Perignon, Moët and Chandon, Tag Heuer and many others.(Refer to the group’s official website for a full assortment of product ranges and categories.) The country’s USP of success lies in its creative talent pool consisting of fashion designers, product wizards, experienced retailers, strong R&D efforts and resulting in successful brands.

Corporate Statement

Bernard Arnault, the Chairman of Christine Dior group issued the following statement for the financial year 2007-08. The undertone of the statement indicates a strong concern about flagging consumer confidence in existing markets and a desire to develop penetration strategies in emerging markets for the long-term interests of the company.

“The Group’s excellent performance is all the more remarkable since 2007 was characterized by considerable volatility in foreign exchange markets and financial markets in general. These results confirm the relevance of our ambitious strategy as well as the strong growth momentum of the Group, which is well-positioned to increase its market shares and maintain its leadership in the worldwide luxury market in 2008, and well into the future”.

Directors of Christine Dior

The board of directors team for Christine Dior consists of the following members: Bernand Arnault (Chairman), Eric Guerlain (Vice-Chairman), Sidney Toledano (CEO) and six other directors. The company’s management also consists of a performance audit committee, a nominating and compensation committee and statutory auditors represented by independent agencies such as Ernst & Young Co.

Strategic Plan

Concentration on Emerging Markets: Asia, Russia, Eastern Europe

It is widely held by consultancy firms that emerging economies such as China, India, Middle-Eastern countries, Eastern Europe and Russia offer the plentiful opportunity for a firm like Christine Dior. The following evidence is submitted towards a strategic initiative in aggressively increasing the fashion giant’s foothold in upcoming markets:

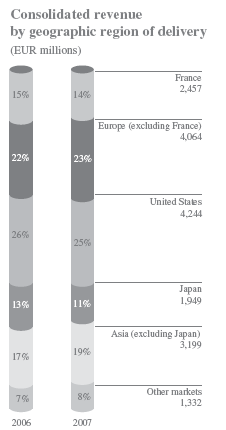

- The markets of Asia (including China, Middle-Eastern countries, India and excluding Japan) and Eastern Europe (including Russia) reported a 2% increase in consolidated revenues from 2006 to 2007. The total market-share for this region continues to grow as market-share for both France and the United States reduces by 1% in the same time period [refer Appendix 6.1]. Clearly, this follows modern-day economic trends which indicate a strong shift of consumption patterns towards emerging economies as confirmed by the McKinsey Consultancy report (Poncet, 2006). 3

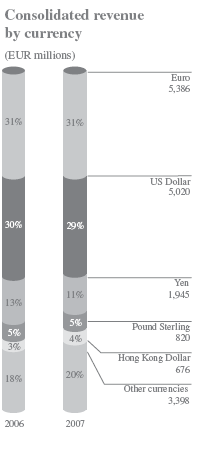

- The markets above have also shown a consolidated increase in revenue by currency. At a time period when Dior’s annual revenues in US Dollar, British Pound and Euro remains static, emerging market currencies have shown a consistent rise in overall market share for the company by at least 5% [refer to Appendix 6.2]. This is a significant figure considering the net profit for Christine Dior increased by only 8% in a given time period [refer to Appendix 6.7].

- According to Christine Dior’s recent market findings, the following company products/brands have shown a dramatic rise in revenue figures due to dynamic momentum in the economies and increased purchasing power. Parfums Christine Dior recorded huge sales in Russia and the Middle East (Dior Official Website, 2008). Parfums Kenzo and Givenchy have shown huge sales figures in Asian countries and Russia. Louis Vuitton products have shown consistently similar appeal in China and India.

Investment for expansion in Retail Presence

Christine Dior’s own past experience has shown that the popularity of its branded products has always coincided with a similar investment increase in boutiques that aim at high-end luxury segments in a given market scenario (Christine Dior Official Website, 2008). In line with its strategy for targeted expansion in markets such as China (Hong Kong and Shanghai), London, Singapore, Russia and the Middle East, boutiques were opened in each and every targeted market (Christine Dior Official Website, 2008).

These markets have been identified based on the firm’s own experiences with affluent, high-end customers who reside in these premium destinations. According to literature evidence, products in the luxury segment should be always complemented by a strong company initiative to push for sales among customers who crave for highest quality luxury products (Bruce, Moore & Birtwhistle, 2004; Pradhan, 2007). According to its current investment plans, Dior should continue with its following overseas activities (Christine Dior Official Website, 2008):

- Increasing watch-making operations for Tag Heuer and increasing its network of boutiques in target emerging markets.

- Selective retailing in Japan, China and India through its chains DFS and Sephora. This selective retailing is based on the premise Asian markets offer the plentiful opportunity for Dior products at a lower cost of operations (lower real estate costs in Asian countries are a major reason why it is more cost-effective to develop retail in there). The development of selective retail will boost sales and profitability while at the same time keeping the operations cost-effective.

Tips for newer innovative products

Ever since its inception, the very hallmark of Dior products has been their association with founder values: creativity, refinement, elegance and excellence (Christine Dior Official Website, 2008). In keeping with these core values and the Dior mission USP of providing innovative products, the company must increase its R&D spending to come with the following products in emerging markets:

- Increased localisation: Since Dior has to compete with an array of local products in each of its target selected markets, it must come with uniquely designed products that reflect the target country’s unique cultural achievements – brand values which evoke a sharp reaction from the target consumer’s taste in luxury products. E.g. in the event of China’s Beijing Olympics, Dior could have partnered with the National Olympic Committee to place an Olympic Logo in perfume products sold in Chinese retail. In order to achieve this, it’s high time Dior got rid of its uniquely Westernised conceptualisation in favour of symbols that have more meaning for a given target market.

- Local brand ambassadors: Dior products are associated with style and sophistication. If the company wishes to penetrate deeper into emerging markets, it must hire local brand ambassadors such as celebrities, sports persons and famous people belonging to a given target market. Annual contracts with these celebrities may require huge investment plans but they will pay in the long run.

Financial forecast

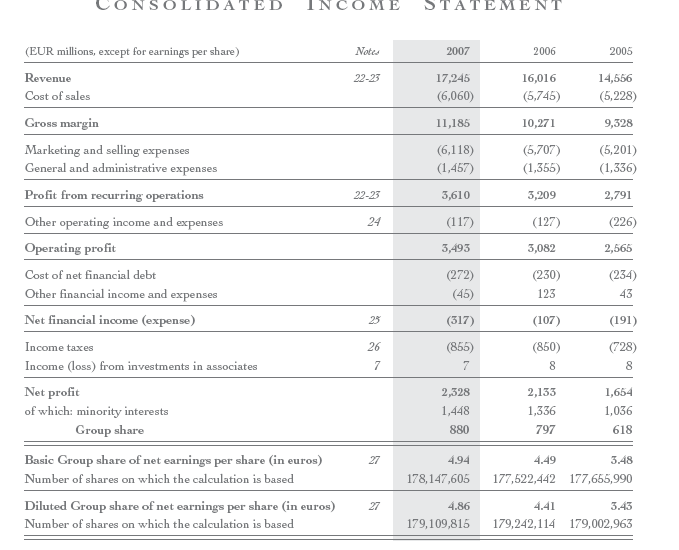

Basal revenue forecast

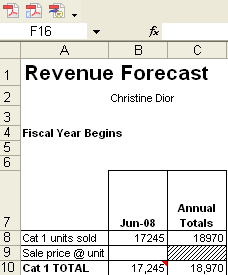

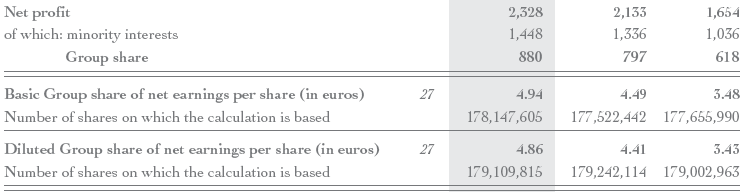

A basal revenue forecast for a company is based on past performance and existing market conditions. Based on market conditions for 2007-08, the following forecasts have been prepared which indicate a minimum revenue increase of 8% over the previous year. (revenue increase from 16,016 million Euros to 17,245 million Euros). Assuming the current business scenario and the increased sales accrued from emerging markets of Asia, the Middle-East, Russia and Eastern Europe, a 10% revenue rate has been forecasted [refer Appendix 6.3].

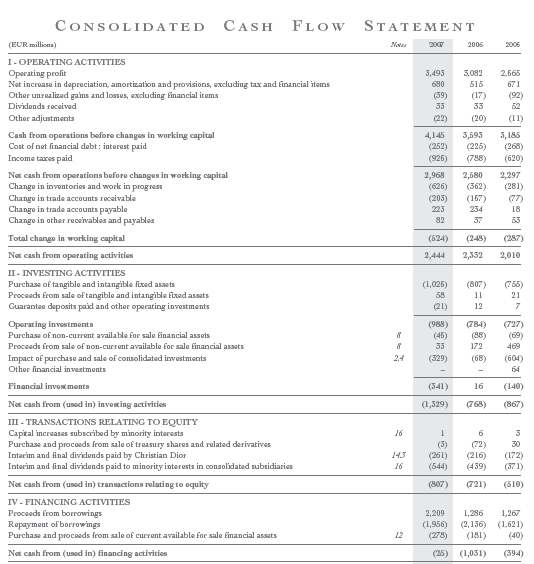

Cash Flow Statement

Christine Dior’s incoming and outgoing money exchange is better expressed using the following set of assumptions (valid according to International accounting standards IAS 7 as recognised by the company’s audit department). The impact of market penetration strategies using methods recommended can be seen in the cash flow statement of 2007-08 [refer Appendix.

The following set of assumptions have been made about this model (Epstein, 2007):

- Cash flow included proceeds from issued shares.

- Proceeds from issued short-term and long-term debt.

- Payments of dividends.

- Payments for repurchase of company shares.

- Receipts from sales of goods.

The following cash flow statement has been predicted based on a 10% growth model for our present business strategies (also refer to Appendix 6.5)(2008 projections are estimates and not accurate values for the 10% basal revenue growth model.):

Table 3.1: Cash Flow Statements Projection for Christine Dior (2008-09).

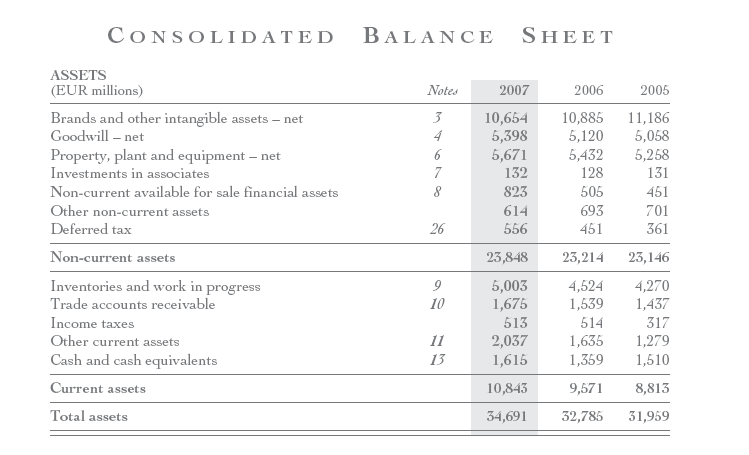

Residual Income Model

In order to calculate the residual income model for Christine Dior, the following parameters were considered: company’s book value B (Net Asset Value), present value (based on accounting profits and owner’s equity) and the desired rate of return r (10% in our case). Gross value, B as of 2007-08 was 8519 million Euros (Christine Dior Official Website, 2008). Using the formula for residual return (R-r) X B where R stands for Net Profit/B, we get the following residual return for 2008-09.

(3610/8519-0.1) X 8519 = 2767.1 million Euros!

This represents an extra income over 2007-08 and can be rounded off to 2000 million Euros when one takes into account various business uncertainties such as business liabilities, investment plan in the retail sector in emerging economies and the company’s own policy to reward long-term shareholders with a reward for their commitment towards the company. The strategies suggested in this case study clearly reflect the elements of increasing profitability.

Impact on Equity markets

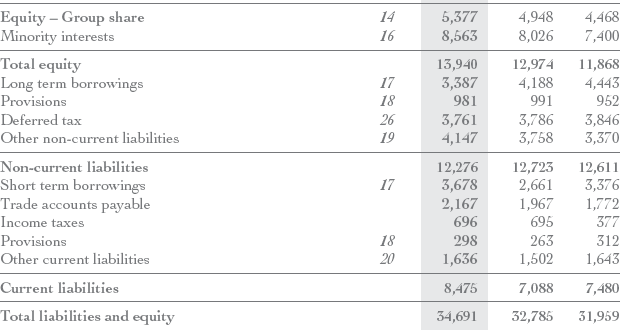

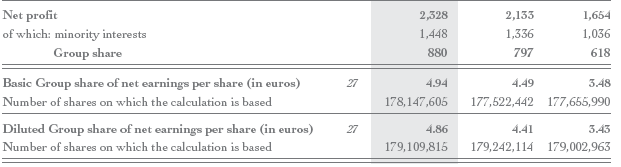

With the current basal revenue forecast for the company, the equity markets will have the following necessary impact (Table 3.2). [also, refer to Appendix 6.4, the consolidated balance sheet for the year 2007-08, also refer to Appendix 6.7].

Table 3.2: Impact on Equity markets (forecast for 2008-09).

A Critique of the Financial Model

Christine Dior being a market-savvy enterprise, it is important to mention the following set of assumptions for the present financial model:

- The financial residual pricing model used in section 3.3 is derived from basic assumptions about the company’s current growth scenario. It does not take into account complex parameters present in sophisticated valuation models e.g. the capital asset pricing model (CAPM) which comes with more sensitive variables such as Beta β, measuring diverse risks, calculating price arbitrage etc (Rees, 1995; Ward, 2002). The CAPM model gives a more precise estimation of any valuation risks associated with sensitivity analysis concerning given data. The reason for choosing the simple basic model over CAPM was the flexibility of dealing with parameters attached to it. Given present trends in market volatility, there should not be much difference in the way the market foresees itself in the near future (Ward, 2002). It is hereby conceded for the sake of the present study, the valuation model will serve Christine Dior’s purpose.

- The cash flow statement used in section 3.2 is derived from GAAP and IAS 7 rules for companies maintaining account standards based on market norms. This follows a general assumption that the company’s earnings follow a consistent 10% level of growth for the purpose of comparison and analysis.

- Absence of risk parameters in the report is based on the fact Christine Dior’s company balance sheet has no mention of operational risk parameters. Since, our business strategy revolves around market mechanisms of China, India, Russia, the Middle-East and Eastern Europe, risk parameters have to be kept in mind (Lecture Notes, 2008):

- Investment in technology with a fixed cost base increases systematic risk

- Investment in specific use assets increases information asymmetry and specific risk

- Both types of risk arise from major advances in technology, e.g. communication infrastructure, telecoms, internet etc. Developing an integrated communication system is central to the business strategy of Christine Dior.

- In capital markets, informed vs. uninformed investors

No market penetration strategy is complete without a thorough analysis of risk parameters associated with the given market. Operationalisation of risk parameters is central to understanding business plans.

Appendix

References

Bruce, M., Moore, C., Birtwhistle, G., (2004), International Retail Marketing: A Case Study Approach, Butterworth-Heinenmann.

Dior Official Website, (2008), Dior Financial Report for 2007-08. Web.

Dior Official Website, (2008), Product Range. Web.

Epstein, B.J. & Jermakowicz, E.K., (2007), Interpretation and Application of International Financial Reporting Standards, John Wiley & Sons, New York, NY.

Lecture Notes, (2008).

Poncet, C., (2006), The Long-term Growth Prospects of the World Economy: Horizon 2050. Web.

Pradhan, S., (2007), Retailing Management 2e, Tata Mc-Graw Hill.

Rees, W. (1995), Financial Analysis, Prentice Hall, 2nd Edition

Ward, K. (2002) Corporate Financial Strategy (2nd edn). Butterwoth-Heinemann.