The purpose of this company analysis is to discuss the strengths, weaknesses, opportunities, and threats of Procter & Gamble. However, this report concentrates more on Porter’s five forces, resources, and capabilities of P&G, present strategies, and Resource Base View (RBV) model to recommend the company.

Current Strategic Situation

Growth Strategy

Chairman and CEO of P&G Bob McDonald stated that Purpose-inspired growth strategy is beginning to work because this strategy is touching and improving more consumers’ lives in all over the world, for instance, expansion tasks of Ambi Pur with Febreze contract.

Operational strategy

Procter & Gamble reported that it would carry out an environmental sustainability program throughout its operations to reduce carbon emission by 20% and it would also focus on water and energy utilization and waste removal from corporate plants.

Product development strategy

P&G always interested in introducing new products considering consumer demand and they concentrate more on product innovation, and it has already developed few new brands, such as introduce of the second wave in toothpaste or oral care brand, coverage of Western Europe by Pampers Dry Max and ingredient variation in Pantene and so on. However, Home Care, Fabric Care, Hair Care, and Oral Care are the most successful segments.

Customer Relationship Management

Now, P&G is concentrating more on serving more customers by implementing new CRM policies along with continuous innovation and expansion of brand portfolio upper, vertical or downward value integration.

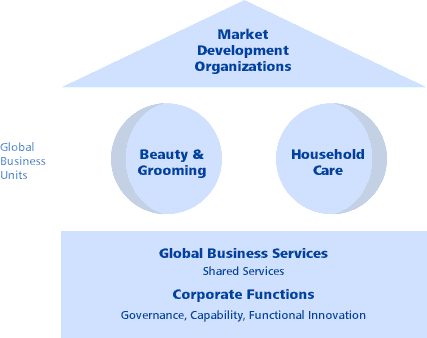

Organizational Chart

It reshaped organizational chart to implement its strategies properly where global business units focus more on global buyers, competitors, and brands, which function as the media of intended innovation, profitability, and ROI by using its efficient and expert employees to deliver the best performances to gain competitive advantage; however, the following figure shows the organizational chart of P&G.

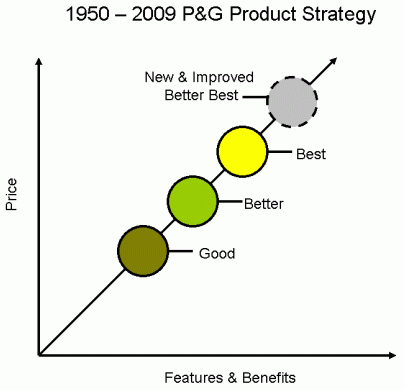

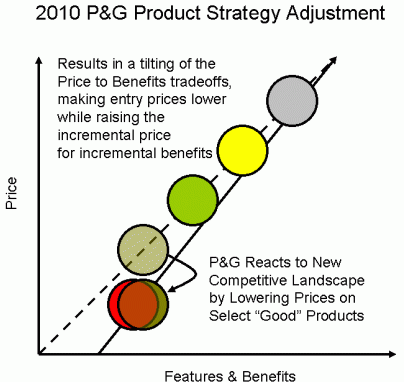

Pricing Strategy

Smith (1) pointed out the view of the CEO and argued that P&G offers low price to introduce new products in the existing market, and the aim of CEO is to increase competition and at the bottom and the decade long stagnation to decline in middle-class income; however, P&G offers only 10% price reduction on average.

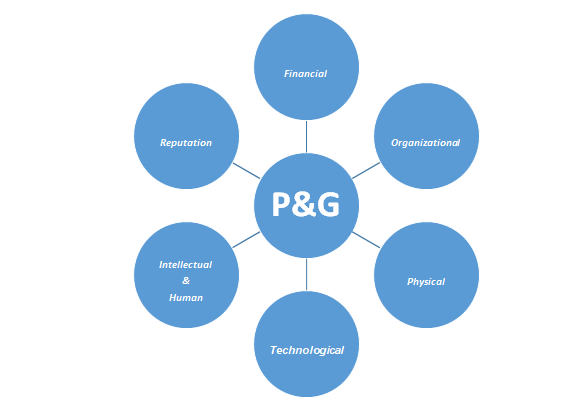

Resources and capabilities of P&G

Financial Resources

According to the annual report, the financial position 2010-11 was outstanding as P&G’s organic sales grew 4%, Organic volume grew 5%, Core earnings per share grew 8%, P&G’s dividend has increased at an annual compound average rate of approximately 9.5%; however, it returned about $7 billion to shareholders through the repurchase of P&G stock. According to the income statement, balance sheet and cash flow statement of P&G, its present key financial variables are –

Table 1: – Financial information of P&G. Source: self-generated from Yahoo Finance (1).

Organizational resources

Staff of the P&G is one of the significant assets, and it has 127,000 employees according to the annual report 2011 of P&G who worked in inside and outside the US market and the help the company expanding business;

Physical resources

This resource includes constructions, property, equipment, furniture, and so on; however, the following table shows the total amount of property of P&G –

Technological resources

Graul et al. (54) reported that this company invests more than $2 billion for the development of technology in 2005, it has more than 29,000 patented technologies along with twenty technical centers in four continents.

Intellectual and human resources

According to the annual report of the P&G, R&D teams enrich with more than 200 scientists, chemists, and so on; besides, they are responsible for identifying, developing, and using leading health care technologies to develop health care products.

Reputation resources

Procter & Gamble affords a high brand value, which tends to expand in the future and this reputation is the outcome of consumer perceptions about the quality, trust, and ethical factors in every market segment; however, the subsequent table demonstrates goodwill of P&G for three years –

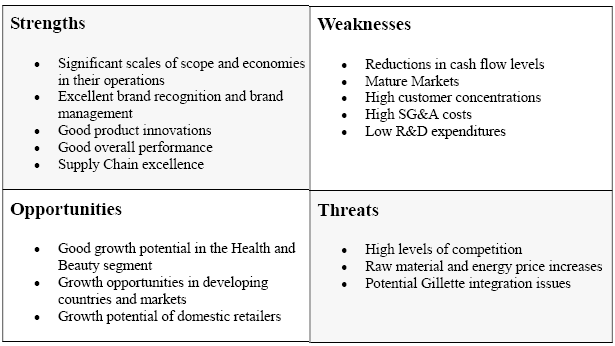

SWOT Analysis of P&G

Strengths

The internal strengths of P&G are significant scales of scope and economies, share price, sales growth, human resources, financial capabilities, supply chain, product innovation and overall performance in the global market.

- Leadership Brands: According to the annual report of P&G, its fifty leadership brands are some of the world’s most famous household names and twenty-four of these fifty brands each make above $1 billion every year, which indicates 90% profits generate from these brands;

- Market Share: it has a worldwide business operation and has a significant share in the global market;

- Innovation: It is one of the most critical factors for this company to compete with high customer satisfaction. Also, the demand of the customers change on time, and the management of P&G maintains a specific strategy to meet the demand of the buyers;

- Sales Volume: Sales revenue from the consumer product line has increased all over the world;

- Human Resources: P&G has more than 127,000 dynamic and high educated employees to carry on the business in the adverse economic situation, and it also has research team to introduce new products;

- Experience: P&G established in 1837 and served the US Army, so, it has long-experience along with the glorious historical background to operate global market with strong brand awareness;

- Other: Corporate social responsibility, investment plan, human resource management are key strategies of the company.

Weaknesses

Besides strong points, P&G has to concentrate on many other factors, such as –

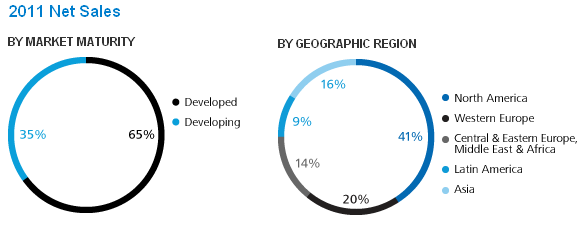

- Market expansion: It has many familiar brands in global market, but the perforce of the company in developing countries is not outstanding as it earned only 35% of total profits from the operation in developing countries; however, it has opportunity to increase loyal customer base in developing countries by decreasing price of the products;

- Operating expenses: The total operating expenses of P&G are increasing each year, for instance, these expenses were $25,973 million in 2011, which was more than $985 million from last year expenses;

- Political factors: Unrest situation in many countries may effect on the supply chain management system of the company, and it could adversely affect sales revenue;

- Strategic decision: Unilever, Johnson & Johnson and other competitors have taken measures to diversify product line and implemented new marketing strategies; for instance, these companies arranged integrated marketing communication campaign to increase customer base.

Opportunities

External opportunities of P&G includes:

- New product development: P&G has a strong capability of developing new products using existing resources and capabilities along with long experience perform; thus, it has the opportunity to capture marketing leading position;

- Joint venture: It has the financial strength to joint venture with large competitors like Unilever to reduce market competition;

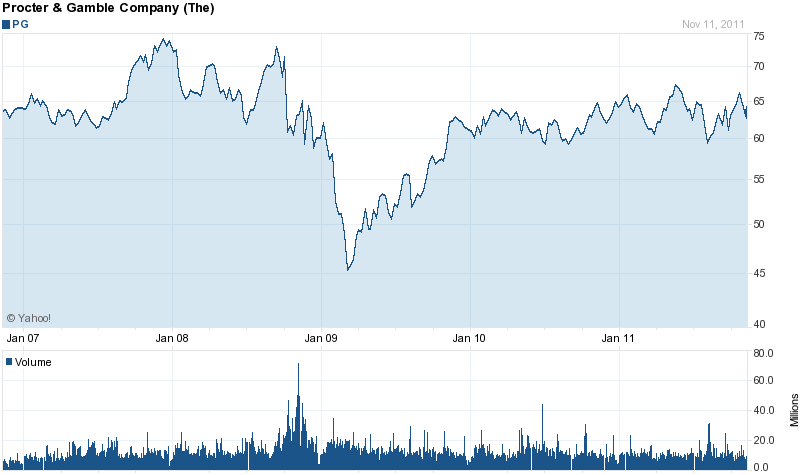

- Stock Performance: the performance of P&G in Stock market is satisfactory from the very beginning though the share price of the company decreased in 2009; however, the following figure demonstrates the position of P&G in Nasdaq –

- Performance in Recessionary Economy: P&G has experienced huge success in spite of global financial crisis while most of the companies have endeavored to survive, which gives confidence to the management of the company to go ahead with existing resources and capabilities;

Threats

External threats of P&G includes:

- Legal: Nowadays, multinational companies need to concentrate more on the legal issue to reduce unexpected costs, for instance, BBC News (1) reported that P&G was fined €211.20 million to fixing the price of washing powder in eight European countries;

- Competition: Strong competition among the market players is one of the main challenges for P&G because competitors captured a significant market share of consumer products, for instance, Sunsilk of Unilever captured shampoo market;

- Compensation: Controversial issues could adversely affect on the company such as toxic shock syndrome and tampons, price fixing controversy and logo controversy created hindrance for the business operation and increased costs.

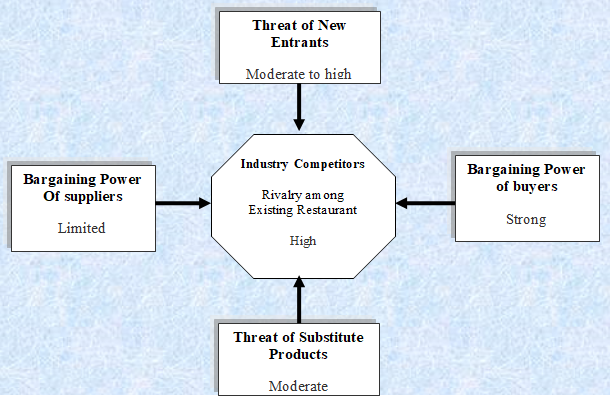

Porter’s five forces model analysis of P&G

Barriers of new entrants

The consumer product industry has to face intense competition both in the national and international market due to the existence of local competitors of different products and many brand items have produced by these companies to attract segmented customers. As a result, threats of new entrants are moderate to high for this company while it should not require high investment to produce few items in the local market, but the aggregate risk is low; thus, it not difficult for the new companies to occupy the market share of P&G;

Bargaining power of suppliers

The bargaining power of suppliers is moderate because of the availability of suppliers; however, this power accelerates when P&G like to switching off suppliers;

Bargaining power of buyers

The bargaining power of buyers is now high because of the current pressure of the global economic crisis, low switching off costs, availability of similar products, frequent change of customers’ demand, and unrest political position in Asian and European countries and so on;

Threats of substitute products

P&G faced intense competition from direct and indirect competitors, and these companies produced many consumer products those can reduce the demand of any brand of P&G, for instance, P&G’s feminine products replaced by the substitute due to toxic shock syndrome and tampons controversy;

Rivalry among existing firms

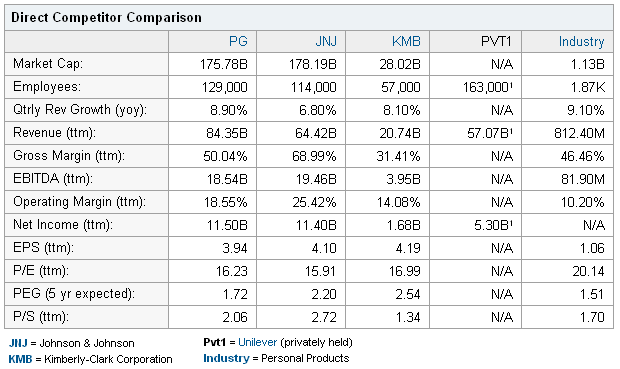

P&G has to compete with many direct and indirect companies at both home and abroad, for example, major competitors of this company are Unilever, Kimberly-Clark Corporation, Johnson & Johnson, Clorox, Colgate-Palmolive, etc. However, the rivalry among existing companies is extremely high, and these companies frequently change their functional plans to increase sales volume and take measures to get undue advantages from the market, for example, P&G and Unilever fixed the price of washing powder in eight EU nations to increase sales. To compare the position of P&G in industry, the subsequent figure shows direct comparison.

Resource Base View (RBV) model:

Recommendation

Strategy 1: Integrated Marketing Communication (IMC) Campaign

Strategy 2: Reformation of the Pricing Strategy

Strategy 3: Reduction of operating costs

Works Cited

BBC News. Unilever and Procter & Gamble in price-fixing fine. 2011. Web.

Graul, Lee Ann, et al. Procter & Gamble, Unilever, and the Personal Products Industry. 2006. Web.

Procter & Gamble. Annual report 2010-11 of P&G. 2011. Web.

Smith, Tim. “P&G Shifts Pricing Strategy to Meet Post-Recession Market.” The Wiglaf Journal. 2010. Web.

Yahoo Finance. Balance Sheet of Procter & Gamble Co. 2011. Web.

Yahoo Finance. Direct Competitor Comparison of Procter & Gamble Co. 2011. Web.

Yahoo Finance. Income Statement of Procter & Gamble Co. 2011. Web.