Abstract

Subway Company is a leading fast-food chain of stores. It operates around the globe, but with its main offices in North America. The company is classified as a service sector organization that offers healthier foods as a replacement of pizza and hamburgers, which have been linked to problems such as obesity.

Its main goals entail producing customized foods that meet clients’ tastes and preferences. The company has experienced continuous growth since its inception in 1965. Its operational environment is competitive. Many organizations, which pose a threat of substitution, influence its strategic decisions.

The company has the potential to secure long-term success considering that its strategy of focusing on healthy fast foods aligns well with the growing consumer attention to the consumption of low-calorie foods.

Introduction

Subway is a US incorporated organization that operates in the fast-food industry. Mainly concentrating on sea sandwiches, the company expands through the area monopoly strategy. Doctor’s Associate Inc. not only owns the fast-food supply chain, but also operates it.

Subway constitutes one of the first growing single brands across the globe. As at the end of 2014, the organization had an excess of 43,000 different outlets in over 108 operational territories (Covert & Gibson, 2015). The company’s central offices are situated in Connecticut. Different operations centers support the functionalities of the company.

Rationale for Selecting Subway

Subway operates in a highly aggressive fast-food industry that has giants such as McDonald’s and Yum Food Company, which are constantly changing their growth and operational strategies to derive their competitive advantage from their people.

The process of analyzing the effective operational strategies of an organization, which can be deployed as a benchmark, is well accomplished by considering an organization that operates in a highly competitive environment. This assertion forms the rationale behind the selection of Subway as the company on which to base the analysis.

Indeed, it is interesting to identify why Subway remains such a successful single brand across the globe, considering that its competitors have been engaging in business partnerships to secure long-term business success, yet Subway is still able to withstand the competitive forces.

Brief History

Subway was born in 1965 when Fred DeLuca, its founder, sought the help of USD1000 from a friend, Peter Buck, to initiate what he called Pete’s Super Submarine.’ The location of the business was chosen to be Connecticut. In 1966, Peter and Fred registered a company called Doctor’s Associates Inc.

The main task of this entity was to manage the operations of the restaurants since its number of franchises continued to grow to the extent of penetrating the American market even deeper (Subway, 2012). The name of the company arose from the desire of Peter to pursue a course in medicine and the fact that Peter had a doctorate degree.

Hence, the name of the business was not in any way associated or linked with any medical school. However, in 1968, the organization got a new trade name, namely Subway (Subway, 2012).

Between 1965 and 1978, Subway mainly focused on the North American markets. Indeed, in 1978, it opened its first outlets in California. In 1984, Subway opened an outlet in Bahrain.

As Jargon (2011) confirms, “In 2004, Subway began opening stores in Wal-Mart Supercenters where it surpassed the number of McDonald’s locations in the US Wal-Mart stores in 2007” (Para.5).

This observation suggests that Wal-Mart has been critical in enhancing the growth of Subway in terms of helping it in the selection of strategic outlet centers. From 2007, Subway has always been ranked in the top positions in the list of the best-performing entrepreneurial franchises in the US.

For example, in 2012, it was listed number 2 in the best performing 500 franchises on the Entrepreneur Magazine. Indeed, at the end of 2010, Subway was larger than McDonald’s by about 1,012 outlets globally (Covert & Gibson, 2015).

The Type of market

Organizations operate in different types of markets. Economists identify ideal competitive, monopolistic aggressive, oligopoly, and monopolistic bazaars as the four chief souks in which an organization can operate.

The ideal competitive bazaar is marked by an increasingly high number of small business entities, which cannot determine prices of the offered products by themselves.

The cost of commodities is determined by clientele requirements and the conditions under which the various service providers operate. The monopolistic souk has only one seller within a given geographical area (McGuigan, Moyer & Harris, 2010). Subway’s market has many organizations that deal with fast foods.

Therefore, it does not certainly operate in the monopolistic or ideal aggressive market since many of its competitors are large-sized corporations.

Many vendors operate in oligopolistic markets. Every seller supplies large quantities of products that are offered on the market for sale. However, the high cost of entry limits the number of new entrants. The companies have control over the prices of products and services they offer. The products are similar and often not differentiated.

Since Subway offers differentiated products by the way of branding and customer experience, it does not operate in the oligopoly markets. Monopolistic rival bazaars possess a high number of retailers.

Although they offer products that serve similar purposes, the products are somewhat differentiated by either awareness of value, trade name, fashion, and/or place of offer among other aspects (McGuigan et al., 2010). Subway operates in the monopolistic aggressive bazaar.

Price Elasticity of Demand (PED) for Subway’s Products

Subway operates in a monopolistically competitive market in which different substitutes are only differentiated through branding and perception of quality and other aspects of the brand image. PED is obtained by dividing the change in the demanded quantity with change in prices.

A quotient of 1 indicates a unitary PED. A quotient of less than 1 indicates an inelastic PED while a quotient of more than 1 indicates an elastic PED.

The price elasticity of Subway products can be described as unitary elastic, which means that an increase in the price of one of the core products such as the foot-long Black Forest Ham results in a proportionate change in the quantity demanded.

Illustration

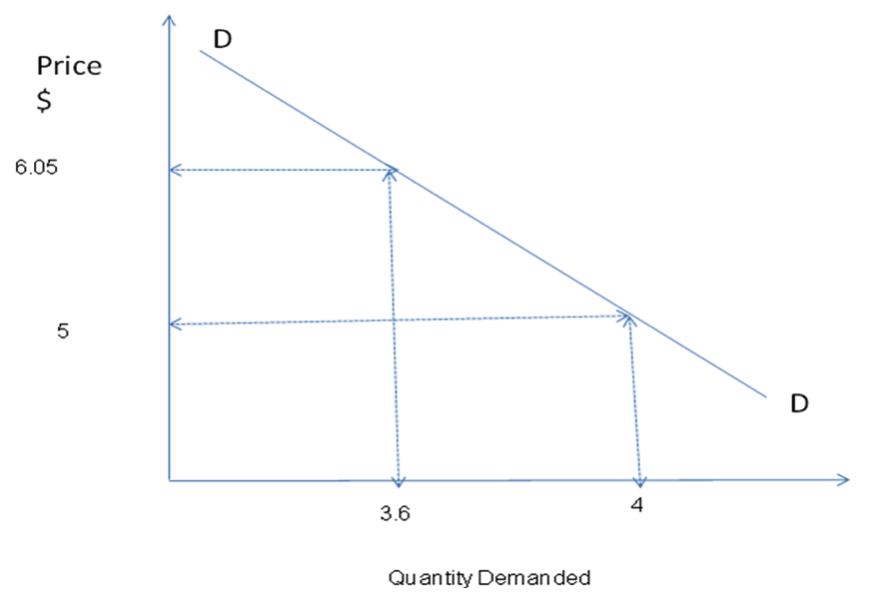

The price of Subway’s foot-long Black Forest Ham is $5. At this price, Jonathan is able to purchase 4 such products. If the firm increases the price of the product by 10% to $ 6.05 [cetiris paribus], Jonathan will reduce the quantity demanded to 3.6 units. Table 1 and graph 1 in the Appendix (a) illustrates the resulting changes.

The graph shows that change in price of the firm’s product makes consumers move along the demand curve (DD).

Income Elasticity for Subway’s Products

McGuigan et al. (2010) define income elasticity of demand as a measure used to determine the consumers’ response to changes in the level of their disposable income. As a fast-food company, Subway Company’s products can be described as normal necessities [foods and beverages].

Ghosh and Choudhury (2008) emphasize that normal goods have a positive income elasticity of demand. Therefore, an increase in the consumers’ disposable income is likely to increase the quantity of products that customers can afford to purchase from Subway.

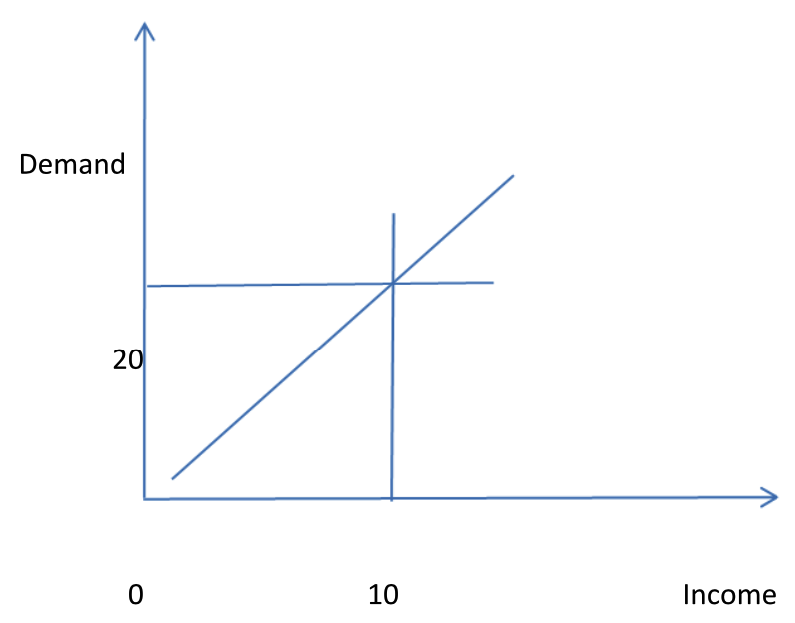

The income elasticity of the normal products ranges between 0 and +1. Thus, if the consumers’ income increases by 10%, the demand for normal products changes by 4%. The implication is that the income elasticity for such products is +0.4.

Therefore, a change in the consumers’ income leads to a proportional change in demand for fast-food products. However, fast-food products are ranked amongst luxuries.

Hence, as shown in appendix (b), if consumers’ income increases by 10%, their demand for Subway’s fast foods will increase by 20%, which indicates that the income elasticity of the firm’s products is +2.0, which is greater than 1.

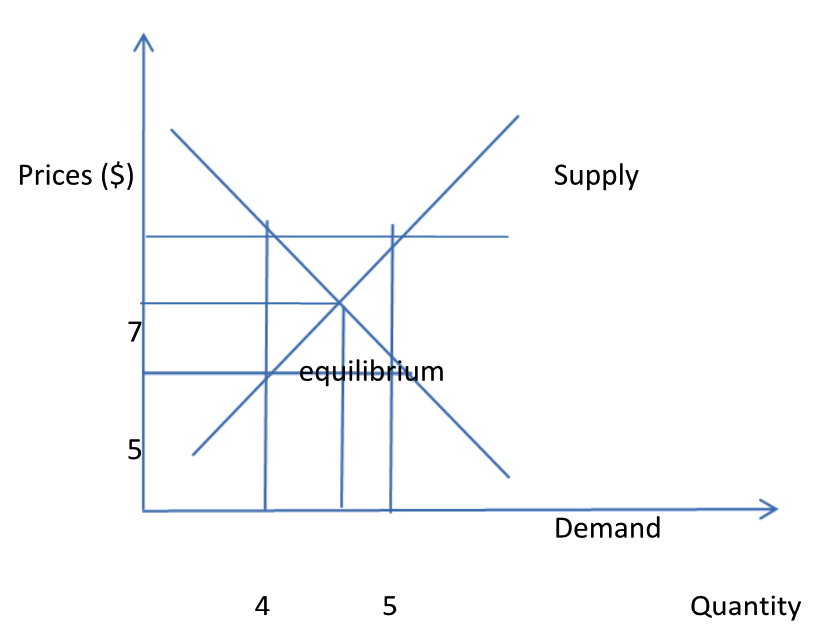

An increase in Subway’s fast-food product prices prompts an increase in the amount of supply and demand for the commodities. Changing of Subway’s product prices is influenced by the number of clients. In the past three years, the trend of price changing has been constant, especially during holidays when many people are out with their families.

At this time, Subway’s BMT goes for $6. It is crucial to understand that luxurious commodities such as sandwiches are elastic, unlike normal commodities whose prices have to remain the same for a long time.

Hence, if the price of its main product, namely the BMT, shifts from $5 to $6, because of its high demand, the supply will also increase as shown in the Appendix c.

Close Competitors

Subway operates in an industry in which other organizations engage in the production and selling of similar products to the extent that they serve similar purposes (Simon, 2007).

Its competitors include McDonald’s, Wendy, Yum Foods, and Burger King.

Through the adoption of appropriate promotional techniques and other mechanisms for building customer loyalty, Subway has developed the capability to cope with the competitive environment so that it comes just second after McDonald’s in terms of its ability to push its products into the market.

Indeed, its most powerful competitors who deal with similar products include Wendy and the Daily Queen.

Close Substitutes or Complements

In economics, all products have some associations in the form of complements or substitutes. A complement of product A is the one that is consumed together with it while its substitute commodity is the one, which is consumed in its place. For Subway, close substitutes to fresh salads are fresh vegetable salads that are offered by McDonald’s.

Yum foods’ and McDonald’s humbuggers act as substitutes for Subway’s sandwiches. Many business entities manufacture bread in the US and in other markets that are served by Subway’s bread. French fries and beverages such as Seattle best coffee form important complements for Subway’s products.

Indeed, coffee is a major complement of Subway’s products that are served in breakfast (Maze, 2013).

Changes in Demand for Subway’s Products

Growth in demand for Subway’s merchandise is influenced by different factors such as competition and the inability of target consumers to purchase due to financial hardships.

According to Maze (2013), in terms of revenues, Subway falls in the fifth position, making it far larger than “Panera Bread, Arby’s, Jimmy John’s, Firehouse Subs, Quiznos, Jersey Mike’s, McAlister’s Deli, and Jason’s Deli” (p. 42). However, no evidence indicates that these organizations are taking away the demand for Subway’s products.

Instead, there is an increasing commoditization of sandwiches so that they become easily available in places, including lifts and churches. This observation suggests an increasing access to the products. Such accessibility implies a rising demand.

While the aftermaths of the global economic crisis greatly influenced the incomes of Subway’s low-end consumers, economies in Subway’s market have greatly recovered by now. Therefore, the theory that low-end income earners struggle to eat remains invalid (Maze, 2013).

An assertion that the demand growth for Subway has reached its peak is also inconsequential. The company focuses on low-calorie foods whose demand is on the rise, as people have become more conscious about eating high-calorie foods such as hamburgers and French fries. Consequently, the demand for Subway’s products is growing.

Training of the Company’s Labor Force

Productivity of the labor force of an organization is critical in enhancing competitive advantage. In the fast-food industry, quality customer service is critical to increasing and improving buyer experience whilst reducing service rate times (Armstrong, 2009).

For Subway, further training of customers is important in reducing lead times and throughput time. This strategy can reduce costs by ensuring efficient utilization of the labor force. Training of Subway employees on how to increase customer experience can help to attract ‘repeat customers’ and new ones such that the sales level can increase.

Increased trade translates into increased economies of scale, which cut on the total costs of running the organization. In technological savvy operational environment, work is done with the aid of information processing systems (Dusanka & Aleksandar, 2013).

Since the technology keeps on changing, a room exists for training Subway’s employees on effective use of technological systems in increasing their productivity.

Profitability and Sustainability of Subway Business

Profits are computed from the knowledge of fixed and variable costs. However, although it is clear that a 12-inch sandwich costs $5, Rotelli (2013) reckons that the company is still privately owned and that it does not share particular numbers.

One way of computing Subway’s profitability is by identifying the profit margin on every product and then multiplying it by the total number of products. Profits for all product categories can then be summed up.

However, this step is not possible for an organization that is not required by law to make public filings of its financial statements. Indeed, stating profits for each Subway’s restaurant is incredibly difficult, as it varies depending on sales and location.

Although the company posted profits amounting to $16.6billion in 2011, and that the profits have grown over the years, specific numbers are required in determining the sustainability of the organization’s business.

Strategies for Increasing Profitability

Profits increase with increased sales (Camillus, 2010). This situation can occur upon the mitigation of various weakness and threats to an organization’s operations. Subway needs to mitigate the problem of high turnover to reduce the cost of replacing employees and training them.

It also needs to encourage uniformity in customer service in different stores to help in building long-term customer relationships. It needs to benchmark from McDonald’s and develop drive-thru restaurants.

Another important strategy entails increasing its focus on healthier foods by developing more commitments to reducing salt and fat levels and adding nutritious product lines to the subs. Instead of just waiting for customers in its restaurants, Subway can also focus on home delivery services.

This plan can help in increasing and expanding its target customers to boost its sales levels.

Company Strategy, Prices, Target Customers, Production, and Cost Advertisement

Subway’s growth strategy entails opening franchises as the main centers for pushing its products to the global market. Through franchises, the company sublets its rights and saves on administrative costs and overheads. In the franchises, the company offers healthy low-calorie foods to attract healthy eating cautious consumers.

Its pricing strategies vary from one product to another and depending on the location of its outlets. A 6-inch sub costs an average of $2.49 while a foot-long sub goes for $5.89 at a restaurant in Alberta. The organization also sells salads between $3.49 and $4.89 at the restaurant. To an average American worker, these products are highly affordable.

Subway targets people who do not carry home-cooked foods at work. It also targets people who wish to eat during breakfast and evening dinners. It has products that fit all demographic groups of people. Fresh raw materials are acquired from farmers and distributed to the franchises.

Although variations may occur, production takes place in-house, but consistent with Subway’s established standards to ensure uniformity. For the individual restaurants, fixed costs include rent, supply and logistics, the cost of insurance, and premise cleaning.

Additionally, the salary for each owner is in most cases consistent for every restaurant. The cost of purchasing may vary depending on demand forecasts at different times of the year. This claim means that it constitutes a variable cost.

Other unpredictable overheads include oil fees, worker wages, and different utilities that are connected to these expenses. Advertising is a major variable cost for Subway. It takes the second position in advertisement spending, after McDonald’s.

Maze (2013) informs that in 2012, Subway spent more than $516million in advertisement. Its advertisements feature its slogan of ‘eat fresh.’ It shows employees whom the organization refers as ‘Subway Sandwich Artists’ making fresh breads using highly clean ingredients.

New Markets and Strategies for gaining Market Share

Subway opens new stores not only in the US but also in other parts of the world, including Britain. The internationalization strategy of the company is evidenced by its opening of outlets in Brazil in 2009, Portugal in 2013, and even in Bahrain in 1984. During early 2000, the company also established another outlet in India.

Indeed, at the start of 2013, the company had close to 400 operational eating places located in almost 70 major towns across India. It also has restaurants in Russia and China among other nations. In fact, new markets are important for increasing the distribution density for Subway’s products.

While attempting to gain market share in new markets and in existing markets, Subway commits its resource to promotional strategies. It creates awareness of its products among its target customers. It places itself as an organization that offers high-quality and fresh products.

The Amount of Customer Purchases and the Most Successful Products

As revealed before, Subway does not provide specific statistics to permit the computation of the total amount of customer purchases since it is privately owned. However, submarine sandwiches account for most of the sales. Indeed, the sandwiches form Subway’s flagship product.

Its most successful sandwich is the BMT, which has acted as the company’s main source of revenue. Subway (2012) reckons that this commodity contains “pepperoni, salami, and ham” (Para.11). Although the BMT previously meant ‘Brooklyn Manhattan Transit’, it now means ‘better, meatier, and tastier’.

Although it is not highly profitable, Subway also makes pizzas on order. However, the product is not available in all the organization’s outlets around the globe.

Sources of Revenue

Subway generates its revenues from sales of its fast foods, specifically the BMT sandwich as mentioned above. Products that are meant for different markets are designed to meet the needs and preferences of a given market to ensure higher revenues.

For example, in the New Delhi restaurant in India, Subway does not sell pork and products from beef since they are inconsistent with the Islamic and Hindu faith. Rather, it sells vegetable-based commodities.

Recommendations and Conclusion

Subway’s franchise model of growth is instrumental in ensuring a reduction in its operations cost. The franchises offer high-quality foods in a fast manner without compromising freshness. Although the company has shown some steady growth since inception, it is recommended that it makes some changes.

For example, it loses customers due to lack of a drive-through. This situation makes customers who are in a hurry not to get into its outlets. Thus, it is recommended that Subway gets drive-through restaurants to become convenient for customers in a hurry such as in the case of Wendy, McDonald’s, and Dairy Queen.

It should also consider delivering meals at homes to boost its sales in a bid to raise its profitability.

Appendix 1

Table 1.

Reference List

Armstrong, S. (2009). Prediction of Consumer Behavior by Experts and Novices. Journal of Consumer Research, 18(6), 251–256.

Camillus, J. (2010). Putting Strategy to Work. Quarterly Journal on Management, 2(4), 83-105

Covert, J., & Gibson, R. (2015). Wal-Mart dumps McDonald’s for Subway as in-store restaurateur. Web.

Dusanka, L., & Aleksandar, K. (2013). The Impacts of MIS on Business Decision Making. TEM Journal, 2(4), 323-326.

Ghosh, P., & Choudhury, P. (2008). Managerial economics. New Delhi: Tata McGraw-Hill.

Jargon, J. (2011). Subway runs past McDonald’s Chain. Web.

Maze, J. (2013). Are competitors biting into Subway? Restaurant Finance Monitor, 2(1), 41-47.

McGuigan, J., Moyer, R., & Harris, F. (2010). Managerial Economics: Applications, Strategy and Tactics. New York, NY: Cengage Learning.

Rotelli, W. (2013). How Does Subway Profit From the $5 Foot-Long Deal? Web.

Simon, H. (2007). Rational decision making in business organizations. American Economic Review, 3(4), 123-129.

Subway. (2012). Subway Timeline. Web.