Company Background

Unilever is among the leading home care, personal care, as well as food product producing and supplying firms in the world today. It has two parent firms; Unilever PLC and NV. Unilever NV is a Dutch registered company whilst Unilever PLC is registered in Wales and England. Along with their relevant group firms, both Unilever PLC and Unilever NV run effectively as a sole fiscal entity (Global Data 1).

The products of Unilever group are currently offered in more than 170 nations of the world. What’s more, the firm takes pleasure in leading international positions in 7 dissimilar categories. Unilever runs in 4 different business segments, which are dressings and spreads, personal care, home care and beverages and ice cream plus others.

The firm as well encompasses sturdy concentration on research and development which assists it introduces new products to the market, thereby safeguarding its leadership position.

In addition, products emanating from Unilever Group are supplied via distribution centers, satellite warehouses, storage depots, co-operatives, wholesalers, group-operated facilities, independent grocery stores, including a number of food service suppliers (Global Data 3). This paper discusses the financial and TOWS matrix analyses of Unilever Group. Also, it sheds light of the competitive and generic strategies employed by this global leading firm in home care, personal care and other products.

Financial Analysis

Financial strength of any enterprise strongly depends on a number of metrics including sales revenue, profits, stock market share price and other key variable like financial ratios. Unilever PLC is a multinational company with operations across the globe. With this wide operational network, it is expected that the company has capacity to develop huge financial resources, competences and operational leverage.

Fig. 1.1 Unilever PLC three year Annual Revenue and Profit

Unilever PLC has financially performed considerably well over the years. However the profits have slightly declined over the last three years, majorly due to the global economic recession. The company reported annual revenue of USD 54,472 millions in the year 2007, USD53, 594 in 2008 and USD 52, 668 in 2009.

On the other hand company net earnings increased from USD 5470 million in 2007 to USD 6989 million in the year2008. In 2009, the profits declined to USD 4839 million (Unilever 1). However, despite the slight decline which has been as a result of worldwide economic shocks, it can be said that Unilever PLC has maintained a strong financial performance over the years. The levels of sales revenue and net income over the last three years are shown in the diagram above.

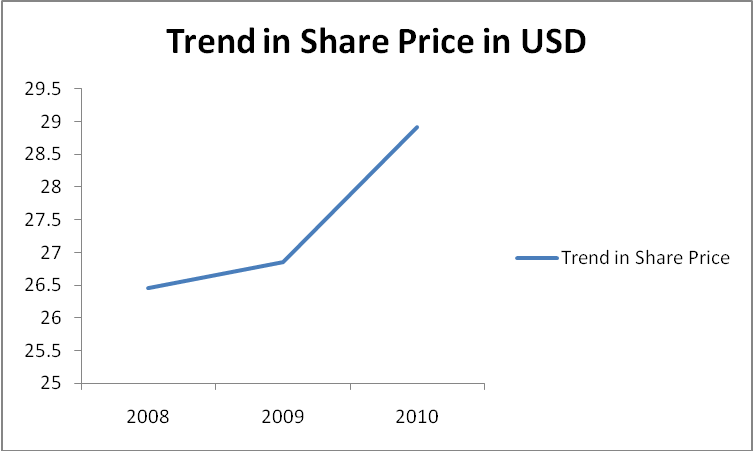

Fig. 1.2 Trend Unilever PLC’s Market Value for Share

The market share of a company’s stocks indicates investors’ confidence in the company’s ability to generate future earnings and therefore a vote of confidence in its financial position. Unliver PLC’s market price has grown steadly since 2008 to the average price eleven months in 2010.

The share price grew from an average USD26.46 in 2008 to USD26.85 in 2009 and then shot up to an average USD28.92 for eleven months in 2010. This represents an overall growth of 9.3% in three years time. The trend in the market price of Unilever PLC share indicate that investors (the market) has confidence in the companies futures financial soundess (Proctor 126).

Internal and External Environments Analysis

According to Bohm, when a firm is in a particular perhaps crucial market scenario, it requires strategic tools to evaluate its present circumstance and ascertain the pertinent strategy for triumphant development (9). An analysis of internal and external factors is an imperative part of a company’s overall growth strategic plan.

This is exactly where the TOWS matrix comes in. As opposed to the SWOT analysis, which is static and rarely leads to the development of specific alternative strategies, the TOWS matrix has a wider scope and has led to the development of four specific sets of alternatives that are strategic.

This is a conceptual structure that is intended to analytically analyze through a facilitated matching of the exterior pressure and opportunities with the interior weaknesses and strengths of a specified firm. Moreover, the TOWS matrix has been introduced to identify strategic choices.

T stands for threats, O for opportunities, W for weaknesses and finally S for strengths. It is noteworthy that this model starts with threats because most organizations will pursue strategic planning out of a perceived crisis or threat (Koontz and Weihrich 107).

The Four Alternative Strategies

Unilever Group employs the four alternative strategies of the TOWS matrix. One is the WT strategy that aims to minimize both weaknesses and threats. This may require a given company like Unilever to form a joint venture, retrench or worse still liquidate.

Unilever Group is a joint venture between two public limited companies, Unilever N.V. (NV), located in the Netherlands, and Unilever PLC (PLC), located in England and Wales. Out of this shared business enterprise, the two mother companies together with their group companies function as one financial entity, that is, the Unilever Group, which is also referred to as Unilever or the assemblage (The Unilever Group 1).

The second one is the WO alternative strategy. This one tries as much as possible to reduce the weaknesses and maximize the opportunities available. This may involve a given company developing the area of weakness within the enterprise or get the required expertise or competencies such as technology or people who can offer the much needed expertise.

Unilever has invested in technology and Research and Development (R & D). In addition, it has 13 global product development and regional implementation centers. This has been very successful as the firm remains the leader in innovations world over. The opportunities available for Unilever are well catered for as more and more new products are produced to the world market (Birkin 119).

The third alternative strategy deals with ST where an organization uses its strengths to deal with the available threats in the environment. The fourth strategy is SO where a company uses its strengths to take advantage of its opportunities. Unilever Group uses its superior Research and Development centers around the world as strength to deal with the threats of products quality being compromised and its products being on the receiving end in terms of packaging and content flaws.

On the fourth strategy, Unilever Group uses its global market presence as strength to take advantage of the increasing population worldwide and hence more demand for their high quality products. This has worked so well for the company and it hopes to maintain its market leadership in terms of ensuring that more and more products are produced to meet the increasing demand (Srinivasan 95).

Competitive Analysis Using Porter Model

Porter points out that the whole idea of formulating a competitive strategy is to try and relate a company to its environment (2). He suggests that there are ‘five forces driving industry competition’:

Force 1 – ‘potential entrants’ which presupposes ‘threat of new entrants’

Force 2 – ‘suppliers’ or ‘bargaining power of suppliers’ if to be more precise

Force 3 – ‘industry competitors’, i.e. competitive rivalry

Force 4 – ‘buyers’ or ‘bargaining power’ if to be more precise

Force 5 – ‘substitutes’ which presupposes ‘threat of substitute products or services’ (Porter 4).

The profitability of the Group can be influenced by new entrants; first, by reducing the prices or by reducing economies of scale.

The second force which is the bargaining power of suppliers can also affect the company’s competitiveness. Suppliers of Unilever have the powers to bargain their terms of engagement or end up supplying to Unilever’s competitors at a much cheaper price. Hence the company needs to listen to them and act accordingly.

On the third force, there can is competitive rivalry between Unilever N.V and Unilever PLC (Mahon 32). Unilever needs to find the best way to counter this for example by doing a thorough market research and ensuring that the loopholes are sealed as soon as they are noticed.

The fourth force according to Porter is the bargaining power of buyers (4). The buyers will always want to fight for lower prices and improved quality of products and services. In the long run this will affect on the profitability of the Unilever Group. If the products are undifferentiated, the buyer will concentrate on the price and the most important buying criterion (Kozak and Luisa 29). Finally, substitute products force another force.

They include the following: those products that satisfy the same need much as they are technically different. For Unilever Group, home care and food products from other companies will affect its profits if they put an upper limit on the prices which can make the industry to undergo certain changes with no large-scale sales losses on the substitute products. This force will depend on the extent of switching costs and the relative price and performance (Norton 13).

Strategies for Unilever Group’s Success and Growth

Unilever Group’s success story can be attributed to various strategies that have worked out very successfully. The first strategy is high quality product diversification. According to its website, in a single day, someone in the world chooses a Unilever product 160 million times (Proctor 41).

This is a success story most definitely. Unilever’s superior products have developed a niche in the foods, home care and personal care market. The consumers have developed a special bond with these products and cannot survive a day without them. Unilever deals with thousands of products which provide the consumer with a wide range of options to choose from.

Moreover, its market has been expanding and growing steadily due to the highly rated products that speak for themselves. This also helps the company to easily reduce the prices to attract more customers. Millions of people around the world choose their brands and their biggest challenge is offer them high quality. In addition, offering customers satisfactory choice without inevitably compromising affordability, taste and convenience (Global Data 1).

The second strategy is technology based innovativeness. Unilever group applies its scientific capabilities and consumer contributions and insights to make tremendous advances in nutrition, health and well- being of their consumers. It has (R & D) centers located around the world to assist in quick response to changing needs, trends and tastes of their consumers (Mahon and McGowan 17).

The company has a (SEAC) mandated to grant the company the essential skills, guidance and recommendation so that it can reduce and manage any occurring safety perils for consumers, the milieu and employees. The technology used to produce the sumptuous and sensuous soaps, highly nutritious food products and all of its products are highly advanced and up to date with the latest trends in technology.

The third strategy is Unilever’s long-term sustainability plan and responsible business practice. Unilever group has successfully drawn sustainability plans in the areas of agriculture, biodiversity, climate change, economic development, education, its employees, water, the environment, health, nutrition and hygiene.

Through highly committed, qualified and visionary leaders at its elm, this company has endeavored in making the world a better place in its day to day operations. This is despite the fact that there is competition to beat. Through its corporate social responsibility, more and more people are being attracted to Unilever’s world of products and thereby competition easily dealt with.

Works Cited

Global Data. Unilever PLC-Financial & Strategic Analysis Review. 2010. Web.

Birkin, Malcolm. Building the Integrated Company. Hampshire: Gower Publishing, 2000.

Bohm, Anja. The SWOT Analysis. Norderstedt: GRIN-Verlag, 2009.

Koontz, Harold and Weihrich, Heinz. Essentials of Management. New Delhi: McGraw-Hill, 2006.

Kozak, Metin and Andreu, Luisa. Progress in Tourism Marketing. Amsterdam: Elsevier, 2006.

Mahon, John and McGowan, Richard. Industry as a Player in the Political and Social Arena. Westport, CT: Greenwood Publishing Group, 1996.

Norton, Ann. CIMA Official Learning System Integrated Management. Burlington: Butterworth, 2008.

Porter, Michael E. Competitive Strategy: Techniques for Analyzing Industries and Competitors. Free Press: New York, 1980.

Proctor, Tony. Strategic Marketing: An Introduction. London: Routledge, 2000.

Srinivasan, Srini. Strategic Management the Indian Context. Second edition. New Delhi: PHI Learning Pvt. Ltd, 2006.