Introduction

The purpose of this report is to analyze Unilever’s Personal Care Products, review data with TOWS matrix, PESTLE, and VIRO analysis, competitive analysis using competitive perceptual map, segmentation strategy and buying behaviors for each segment, corporate and marketing strategies to reach target market and discuss product life cycle along with investment strategy and business level strategy for each SBU.

Company Background

A leading global manufacturer of packaged consumer goods, Unilever started its formal journey in 1930 through the merger of Lever Brothers and Margarine Unie; however, eleven of its brands had annual profits worldwide of more than $1.0 billion (Deighton 1 and Graul 13).

According to the annual report 2011 of this company, it has more than 171,000 efficient employees all over the world and it has plan to double the size of the company in the near future, which would help the company to implement expansion plan of the company.

Graul (14) stated that personal care is one of the segments of Unilever, which competes directly with Procter & Gamble; however, the following figure shows that Unilever occupied about 7.8% global personal products industry.

Dove

Deighton (1) stated that Dove was the world’s number-one “cleansing” brand of this company by competing with Procter and Gamble’s Ivory, Kao’s Jergens, and other related products; however, it was launched in 1957 and contained high levels of natural skin moisturizers.

According to the annual report 2011 of this company, the management team conducted research and integrated marketing campaign to position this brand in global market and became market leader in personal care sector; therefore, sales of Dove exceeded €3.0 billion in 2011, underlying sales growth was 8.20%, and turnover was more than €15.50 billion.

At the same time, Deighton (1) pointed out that Unilever interviewed 3,000 respondents of ten countries to assess their view to develop effective marketing plan and media plan, enhance relationship with customer and conduct IMC campaign.

Axe

Unilever launched Axe in France in 1983 and expanded business with this brand in more than 60 countries; however, this brand captured about 20% market share of male grooming brand in all continents (Joachimsthaler 16).

- This brand controlled a whopping 83% share of the $180.0 million market in 2005;

- On the other hand, the target market of this brand was 18 to 24 years old men and this target group played vital role to become number one brands in the US and European market;

- However, 35% of young men aged eleven to twenty-four used Axe’s summer;

- According to the annual report 2011, value market shares up overall with strong gains in the US market;

- Unilever developed new products using brang awareness of Axe, for example, the fragrance variant Essence was created and introduced in 2003 and Touch ‘modern, fresh, watery, woody fragrance’ introduced in the summer of 2004 (Joachimsthaler 21).

Rexona

Unilever considered Rexona as one of the most prominent and wing brands for this company and the world’s largest deodorant brands; in addition, this company launched Motionsense technology in 2011 with this brand (Unilever 10).

Other renowned personal care brands are –

- Lux: Lux soaps are one of the best selling products of Unilever, which have a wide range of forms, such as flakes, bars, and liquids (all of which are gentle to skin as Unilever conforms to all product safety regulations)

- Sunsilk: Chiefly intended for females, this is the globe’s foremost brand in hair-conditioning and the second-largest in shampoo market, and is sold in sixty- nine nations globally

- Close-up: It is also one of the most profitable toothpaste-brands that claims to keep teeth whiter, brighter and stronger; moreover, it is the first gel toothpaste in the world, which was brought in market in 1967

- Lifebuoy: It was launched in the UK in 1895, which today has the maximum market-penetration in the soap product group (almost ninety- one percent); moreover, it is reasonable and easily available to assist global communities to develop cleanliness

- Fair & lovely: Karnani (2) stated that Unilever marketed a skin whitening cream ‘Fair & Lovely,’ and it is profitable and fast growing brand; however, 90% of Indian women want to use whiteners though it contains harmful chemicals;

- Clear Shampoo: Unilever launched its hair care product ‘Clear’ and developed this product with unique ingredients to effectively eliminate dandruff with every wash and it has already sold in 42 countries;

TOWS Matrix for Unilever

The table below shows the TOWS Matrix for Unilever by scrutinizing its present position and future prospects throughout the global market:

Table 6: TOWS Matrix of Unilever. Source: Self generated.

PESTLE analysis

Political Factors

Unilever concentrates on political factors (unstable political position, hostile government attitude, tax policy, etc.) and set a standard or tactical way of handling political issues to create favorable business environment to sustain national and international market, for instance, it uses experience and goodwill to bargain with government to change policy towards foreign companies, new entrants, tax exemption and so on.

Economic Factors

The main economic concerns are the purchasing power of the customer falls significantly all over the world, customers reluctant to buy expensive product, the personal care business environment becomes extremely competitive in European market for EU free trade policy, and uncertainty about duties due to inflation and fluctuation of currency.

Socio-cultural factors

The company is very much committed to ensure conformity with its corporate social responsibility guidelines that highly focuses on endorsing social and cultural factors in its operational areas; for example, it is working to improve hygiene and better nutrition to people in Asia, Africa and Latin America, and recruiting about 100 nationalities to ensure diversity in workplace.

Technological factors

The company is investing more on its IT infrastructure to enhance its business particularly in e-business; moreover, the company is also trying to diminish cost through IT-efficiencies at international level; additionally, Unilever Technology Venture works in partnership with Unilever R&D group to meet consumers’ demands in areas of genomics, advanced bioscience, advanced materials science and nanotechnology

Legal factors

According to the annual report, the company is bound to follow the provincial and international laws, especially legislation regarding product-safety, product-claims, patents, competition, corporate governance, employment and so on, as inability to conform to these can expose Unilever to lawsuits leading to damages, fines, and criminal-sanctions with potential harm to its commercial status

Environmental factors

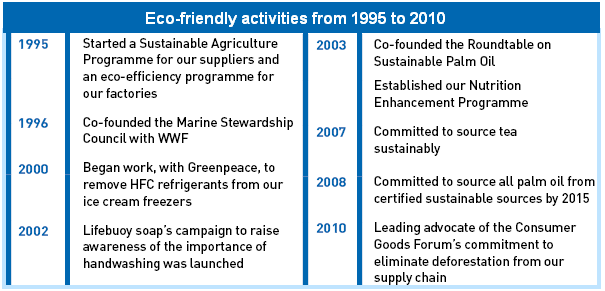

The company is extremely cautious to ensure environmentally friendly production process by focusing on sustainable solutions. The following figure shows the company’s sustainable drives from 1995 to 2010:

The following figure demonstrates the company’s greenhouse gas footprint:

The chart below illustrates the company’s water footprint:

VIRO Analysis

Unilever has raised its value over the rivals, but its resources are imitable and the competencies are rare; however, the following table evaluates its position:

Table 6: VIRO framework for Unilever. Source: Self generated.

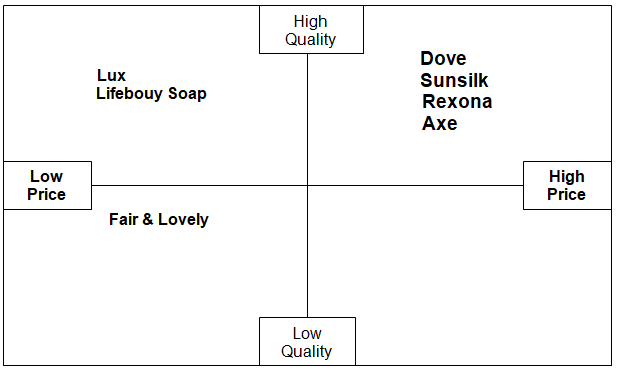

Competitive Perceptual Map

Mullins, Orville and Harper (325) stated that customers may have limited knowledge the necessary physical attributes of the brands, but they6 can purchase or using considering competitive offerings; in addition, perceptual positioning is important factor since many customers may not bother with brand’s physical characteristics.

Mullins, Orville and Harper (325) further addressed that it gives a visual representation of the positions of various products or brands that show the differences and similarities in perceptions; however, it is essential for the companies to find out determinant attributes to prepare poisoning map to help the customers to evaluate competing brands.

Most of the time, Unilever collects data about customer’s perceptions for goods and uses value along with quality of the products as determinant attributes so far customers can select right one; however, the following figure shows perceptual mapping for personal care products –

BCG’s Market Growth Share Matrix

The following figure illustrates growth share matrix of Unilever and identifies key competitiveness including brand image, innovation, technologies, and large market share of national and international market (Cescau and Richard 7).

Segmentation Strategy and Buying Behaviours for Each Segment

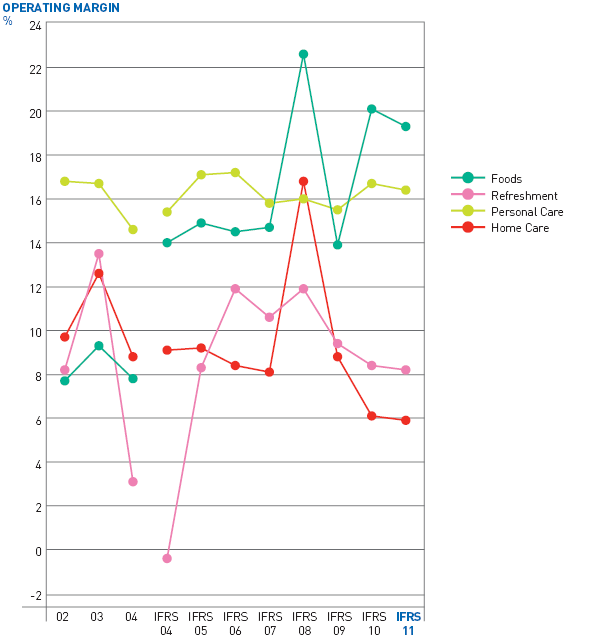

The graph below illustrates the buying behaviour of the customers through the operating margin in particular segments.

In personal care segment, there is a fixed customer base providing sound buying behaviour, in home care segment, there is random buying tendency with declining drift in 2010 and 2011, in foods segment, there is a variable customer base with highest sales in 2008, and in refreshment segment, there is an irregular buying behaviour with better sales than 2004.

Table 6: Segmentation strategy and buying behaviours.

Corporate and Marketing Strategies to Reach Target Market in a Segment

To reach the target market in the personal care segment, Unilever follows the corporate strategies of targeting a mass-market (by attracting a wide variety of customers in numerous demographic groups) and being a cost leader (by offering lower prices than that of the competitors).

The marketing strategies to reach the target market includes bringing out new-products, spreading out circulation and product supply, entering into new foreign-markets, and spending more on promotional activities.

Origin of Need for New Product/Service Based On PESTLE

The origin of need for new product is the demand of consumers in the areas of genomics, advanced-bioscience, advanced-materials-science, and nanotechnology; moreover, as suggested in the technological factors of the PESTLE-analysis, Unilever-Technology-Venture works in partnership with Unilever research and development group to meet consumers’ demands in those areas; this has led the company to bring out innovations like Men+Care.

Most importantly, Unilever (4) pointed out that the new product range under the Men+ Care has raised the turnover above thirty percent

Product Portfolio Analysis

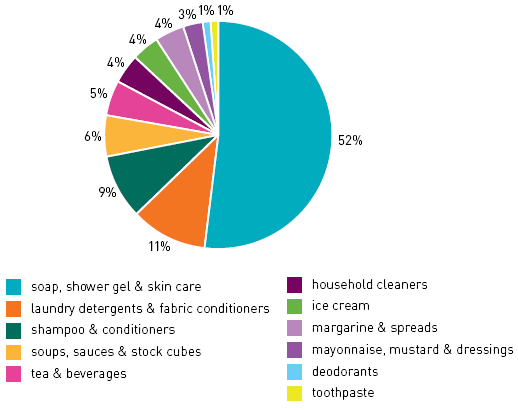

Personal Care: According to the annual report 2011 of this company, personal care consists of skin care (Dove, Lux, Fair & Lovely) and daily hair care products (Clear, Sunsilk, etc.), deodorants (Axe, Rexona) and oral care products,

Table 1: Financial overview of Personal Care segment.

- Home Care: Dish wash (VIM), Fabric softeners, Fabric wash, Household cleaner, and Mosquito coil

- Foods: Beverages, Margarine, Snack, Seasoning, and Other products

- Refreshment: Ice cream and drinks brands, weight-management products, and tea-based beverages, for instance, Lipton is one of the world’s great refreshment brands

Product life cycle

Unilever possesses a huge number of personal care products, but the leading products are Lux, Dove, Sunsilk, Lifebuoy, Clear, Axe, Men+Care, Rexona and Close- up; moreover, according to Management Paradise (1), Lux and Dove is in the maturity stage of the lifecycle.

Although Sunsilk was heading towards the maturity stage, introduction of fresh fragrances and new packaging together with new features has raised the sales, putting it in the growth stage (Unilever, 8). In addition, Lifebuoy, Clear, Axe, Rexona, and Close- up all are in the maturity stage, with the highest profits generated from Axe; however, Men+Care, being a new product range, is in the introduction stage.

SBU Analysis investment strategy

Business level strategy for each SBU

With 12 brands that each goes above 1b Euro yearly sales, Unilever’s growth has sustained because its cost leadership strategy in all of its SBUs; in addition, in each SBU Unilever maintains adequate differentiation; moreover, Unilever is the leader in five of six food-segments and two of six segments in Home and Personal Care, and it holds the second position in two of the six Home and Personal Care segments

Works Cited

Cescau, Patrick and Richard Rivers. Unilever’s Growth Strategy. 2010. Web.

Deighton, John. 2008. Dove: Evolution of a Brand. Web.

Graul, Lee Ann. 2006. Procter & Gamble, Unilever and the Personal Products Industry. 2006. Web.

Joachimsthaler, Erich. 2012. Formulating a Strategic Blueprint for Action. Web.

Karnani, Aneel. 2007. Case Study: ‘Fair & Lovely’ Whitening Cream. Web.

Management Paradise. Lux- A Comprehensive Study. 2009. Web.

Mullins, John. Orville Walker. & Harper Boyd. Marketing. Web.

Scribd. Strategic Marketing & Planning. 2010. Web.

Uhmhoabhi, Fredrick Albert. Pestle analysis: a report on Unilever. Web.

Unilever. 2011. Annual report 2011 of Unilever. Web.

Unilever. 2011. Unilever Charts 2011. Web.

Unilever. 2011. Unilever Sustainable Living Plan. Web.