Introduction

Unilever is one of the most significant consumer goods companies offering cleaning agents and detergents. This report analyzes the opportunity to target the low-income segment in the Northeast of Brazil the company has. It presents the argument for the actions the organization should take, discusses Unilever’s brand portfolio, and addresses the aspects of repositioning. Moreover, the paper provides a Marketing Mix, discussing the details of the new product’s formulation, packaging, promotion, and distribution. Finally, the report features personal thoughts on the presented case and possible recommendations.

Targeting Low-Income Segment in the Northeast

It is possible to say that Unilever should target the low-income segment of consumers in the Northeast because they represent a large and unengaged market that has a distinct customer base. The case study reveals that there are almost 50 million customers coming from economically disadvantaged backgrounds in the area, which is a significant population segment the company can work with (Guimaraes and Chandon 3). Moreover, low-income customers tend to use soap and laundry detergents frequently, although less than 30% of them have washing machines (Guimaraes and Chandon 3). It is evident that doing laundry is a significant part of the community’s life, as it is considered a recreational activity.

Notably, the Northeastern region is one of the most appropriate segments for targeting the country. The reason for it is that the consumers value the perceived power of the detergent, its smell, and the ability to remove stains (Guimaraes and Chandon 4). At the same time, they do not consider the product’s impact on color fading and packaging as significant factors affecting its quality. These preferences can be considered beneficial for Unilever because the consumers from the low-income segment may be interested in the products the company already offers, which means that it does not need to develop a new brand.

The detergent market is notable in the area, too, as it has shown more than 15% of growth and is expected to grow more (Guimaraes and Chandon 5). Unilever is one of the strongest competitors in the market, which means that it has all the resources needed to target the segment.

At the same time, it is vital to mention that the population of the Northeast region has a relatively low level of income. It comprises only $2,250 per capita, which is similar to the income of individuals living in Peru or Jamaica (Guimaraes and Chandon 3). Notably, the population’s level of income is not the same throughout the whole country. For instance, the case study reveals that the Northeast region shows a poorer level of performance and lags other areas of Brazil on all development indicators. In addition, 40% of the individuals living in the area are illiterate; more than 50% of the population lives on less than two minimum wages (Guimaraes and Chandon 3).

It means that potential customers have low purchasing power. Thus, the company should pay attention to the strategies it utilizes to ensure that the products are not overly expensive for local consumers. Otherwise, it will not be feasible to target the low-income segment of consumers in the region.

All in all, it is possible to conclude that expanding to the local market is beneficial for the organization because the area is still untapped. Moreover, low-income customers in the Northeast of Brazil may be highly interested in Unilever’s products. However, as mentioned above, the firm should develop its strategies carefully and only present the products that will be popular among local consumers to be successful in the market.

Unilever’s Brand Portfolio

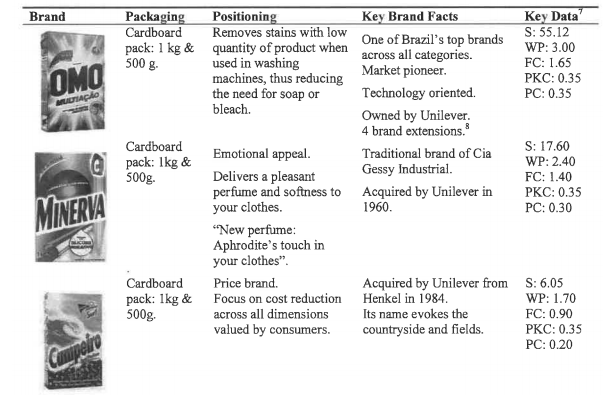

Unilever is an England-Netherlands-based company that is present in more than 150 countries, having more than 300,000 employees (Guimaraes and Chandon 5). In 1996, the organization had more than 1,500 brands that included 45 detergent brands. The company’s most successful brand is Omo, which was launched in 1957 as the first detergent power in Brazil (Guimaraes and Chandon 5). In 1996, the organization started to operate in three dimensions, including personal care, home care, and food. At the same time, detergents remained the most profitable category Unilever Brazil presented, supporting the development of other segments due to a high level of profit (Guimaraes and Chandon 5). In 1996, the company had a more than 80% market share in the detergent powder segment in the country with three brands, including Minerva, Omo, and Campeiro; these figures remain the same.

Omo could be considered one of the most popular and favorite brands among Brazilian customers across all categories. It had a more than 50% market share; its price for retailers was $3 per kg (Guimaraes and Chandon 6). Minerva, in its turn, was the only brand the company sold both as laundry soap and detergent powder. It had less than 20% share in the market and its retail price comprised more than 80% of Omo’s one; it constituted around $1,5 per kg (Guimaraes and Chandon 6).

Finally, Campeiro was the cheapest brand Unilever presented, as its cost was less than 60% of that Omo had. However, its market share was only slightly above 5% (Guimaraes and Chandon 6). More detailed data on these three brands are presented in Figure 1 below.

It is possible to say that creating a new brand is not necessary for the company; moreover, it may be counterproductive for the organization considering its desire to reduce its brand portfolio (Shah 371). Repositioning one of the existing brands seems the most feasible solution because it may help Unilever to reduce the potential costs associated with establishing a new brand for the low-cost market of the Northeastern region of Brazil specifically. In addition, it may lead to a positive perception of the altered product (Zhang et al. 1235). The most feasible decision, in this case, is to work with the already existing Unilever brand that is not present in Brazil.

For the local consumers, it will seem like the new product is presented on the market, but for the organization, there will be no need to develop a new formula and spend additional funds on it. The product that can be repositioned is Bio Presto because it is a detergent that is not present in the country (Guimaraes and Chandon 14). The new name for the product will be Lavando because it is a word local communities are familiar with. The detailed information about the product, its price, and its promotion and distribution methods will be discussed in detail in the following section of the paper.

Marketing Mix

Product

The product should be designed in reference to the features consumers value in detergents. As mentioned above, they include presenting an excellent ability to remove stains, high cleaning power, and pleasant smell. The company should concentrate on these three features in developing its product. The analysis presented above shows that the organization should reposition its existing product and present it in the local market. Although the name of the detergent powder will be changed to Lavando, the formulation of the product will remain the same. Lavender has all the characteristics the customers of the region value. It has high cleaning power, is effective for stain removal, and has a pleasant smell due to the fragrances in its formula. The product will be supplied with several types of fragrances, they will include the smells of flowers, fruits, and berries.

The packaging of the product will not be different from that of other Unilever’s products and will be made of cardboard. The company will not focus on eco-packaging, as it may be associated with higher costs, and the local customers do not list packaging as one of their values. The packaging will have blue packaging similar to the one Campeiro has because this way, it will be easier for consumers to recognize it. Depending on the fragrance of the product, the packaging will have decorations of flowers, fruits, or berries.

Price

It may be feasible to produce the product in two packaging formats, for instance, packs of 500 g and 1 kg. It will be more beneficial for customers to buy bigger packages because they will have a lower cost per kg. The price for both formats will be low, and the price for kg will be similar to the one for Campeiro, as it is the cheapest detergent on the market (6). For example, Unilever can set the price for the new product at 125% of Campeiro’s price. The recommended retail price will also be set; it will be suggested that retailers should add not more than 15% to the initial price.

Promotion

The objectives of the promotion will be to attract customers and increase their interest in the new product and Unilever’s items in general. It will be crucial to help consumers to feel connected to the brand and understand that Lavoro is a useful and affordable product for them. The primary message the organization will use is “?ansado de lavar � moda antiga? Lavar com Lavaro!” (Tired of washing in an old way? Wash with Lavoro!). A simple message has been selected because it should be understandable for consumers and convey the idea that doing laundry with the new product is easy and effective.

The company will utilize several strategies to promote the new product and deliver its message. First, the company will offer free samples in stores to customers after the launch of the product, asking them to try Lavaro and share their opinions. Such an approach will help Unilever to enhance the customer’s interest and motivate them to purchase bigger packages of detergent. Second, the organization will offer discounts for retailers in the first three months after the launch. It will help Unilever to motivate stores to promote the product during this period because this way, retailers will be able to gain higher profit from sales. Third, the company will also offer benefits for the consumers directly.

During the first month after the launch, customers will receive an additional 100 g of the detergent with each small package and 200 g with 1 kg packages. All of these strategies will allow the local population to test Lavaro and become more loyal to the brand.

It is vital to mention that the company will use advertisements to promote Lavaro as well. Unilever will create a short video in which individuals from the Northeastern community will take part. In the video, the group of men and women, dressed simply, will wash their clothes using Lavaro. At the beginning of the video, dirty clothes will be presented to show how the detergent can remove stains. At the end of the advertisement, the clothes will be clean. Along with this advertisement, the company will use posters with Lavaro and the company’s slogan.

Distribution

It will be important for the company not to focus on selling Lavaro in supermarkets and large retail chains because they may be unpopular among low-income customers. Instead, Unilever should distribute the product to small local shops, where many individuals from the area buy food and cleaning products. This way, the company will support local businesses while also promoting their product through the most appropriate channel considering potential customers’ purchasing power. It is crucial to mention that distributing Lavaro to the local stores primarily may be associated with several challenges for the organization.

First, the company already has contracts with large retailer chains because it is one of the leading firms in the market. It means that collaboration with local suppliers may be associated with additional costs for Unilever and may be less feasible from the financial perspective compared to working with bigger stores. Second, the company may encounter difficulties due to the problems the Northeastern region may have, including decreased availability of transportation methods and the lack of electricity infrastructures.

Final Thoughts and Recommendations

The presented case study is significant because it addresses one of the challenging decisions many organizations have to make today. On the one hand, it is feasible for companies to expand their share of the market and distribute their products to new locations. On the other hand, populations of some areas, such as the Northeast of Brazil, may encounter economic difficulties, due to which their purchasing power and potential interest in new products may be decreased.

The case provides the opportunity for reflecting on the issues large companies may encounter. If Unilever decided to sell Lavaro to large retailers only, which would be easier for the company, it would likely be ineffective because the local population buys the majority of products from small local stores. Moreover, it would force smaller retailers to compete with larger ones and place an unnecessary burden on them. At the same time, if the organization decided to work with local shops only, it would potentially encounter the challenges presented above. It would be difficult for the company to deliver its products to sales points; moreover, other problems could arise because local retailers may have less organized inner systems compared to larger ones. It means that there is no particular decision that would not be associated with challenges.

However, the approach described in this paper may be considered the most feasible one compared to the existing alternatives.

I would recommend the case to others because it offers an excellent opportunity to learn how to make decisions on the organizational level while considering all significant aspects that may affect the outcomes. The case has helped me to analyze the benefits and disadvantages of targeting low-income segments. In addition, it has shown me the aspects the companies should pay attention to while deciding to establish a new brand or reposition an existing one.

Works Cited

Guimaraes, Pedro, and Pierre Chandon. “Unilever in Brazil 1997-2007: Marketing Strategies for Low-Income Consumers.” 2004.

Shah, Purvi. “Culling the Brand Portfolio: Brand Deletion Outcomes and Success Factors.” Management Research Review, vol. 40, no. 4, 2017, pp. 370-377.

Zhang, Chrystal et al. “Investigating the Effectiveness of Repositioning Strategies: The Customers’ Perspective.” Journal of Travel & Tourism Marketing, vol. 33, no. 9, 2016, pp. 1235-1250.