Introduction

Continental group is a company dealing in the manufacturing work of metal and paper products. It has a wide variety of products and warehouses for the better running of the business. It gives stress on enhancing their returns and further investments. The continental group is mainly dealing with energy products, forest products, and packaging. It is a well-known group with a collection of highly qualified staff members, mainly dealing with the handling of stocks and providing better storage facilities for the products. So the continental group decided to undertake a strategic plan for the coming five years. “Strategic planning determines where an organization is going over the next year or more, how it’s going to get there and how it’ll know if it got there or not. The focus of a strategic plan is usually on the entire organization, while the focus of a business plan is usually on a particular product, service or program.” (Carter McNamara, 1997-2007).

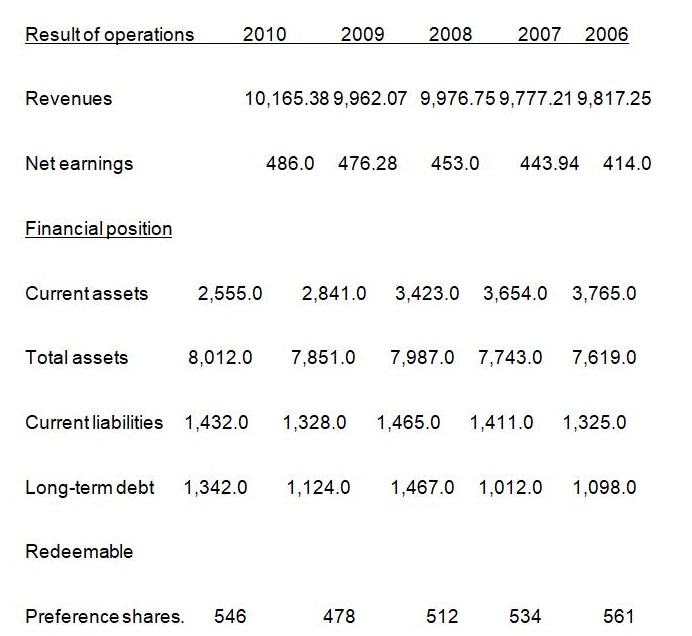

Table 1. Continental Group Projected Financial Statistics- 2006-2014 ($millions).

Assumptions- Assume that this is a projected financial statement, showing the financial position of Continental group for the coming five years, (2006-2014) on a two-year gap basis, figures are approximated and they are based on assumptions.

All the figures mentioned above are based on assumptions. These figures are only a prediction about the strategic plan of Continental Group for the five-year plan. Out of the total asset price, the company proposed to pay off its debt holders @40%. Therefore, it will be:

Table 2. Projected Summary of Payback of Debt out of Total Assets for the period of 2006-2010.

Therefore, after the payback of 40%debt out of the total assets; then there will be no long-term debt in the future years; moreover, the amount of 40% of the asset will cover the whole amount of debt. Therefore, the balance of 60% or the outstanding amount while making the payback of debt will be the value of Total Assets.

Table 3. The projected Balance sheet of Continental Group for the year ended 31st December 2008.

Similarly, the Continental Group is also eager to maintain a positive cash flow during the coming years. For this, the Continental group is highly giving stress to packaging, forest products, insurance, pipeline operations, exploration, and production. All these sectors are the company’s major revenue earning areas; so all of these will come under financing activity.

Table 4. Projected Cash Flow Statement of Continental Group for 12 quarters (or recent 3years-2008, 2009, 2010).

(Assuming that the amount given is only on assumptions, and not exact in nature, just an example.)

The assumptions are given for the Cash flow statement as per AS-3 (Accounting Standard 3) of the ICAI, which is the fundamental source for foreseeing the financial viability of the company. Moreover, while maintaining a strategic plan for a leading business, for the coming three or four years, it is very beneficial to consider ratio analysis, capital budgeting, leverages, etc.

The key reason for the success of the strategic plan of any business is highly based on the accessibility of appropriate funds for the implementation of the business as a whole.

The Continental group at present is having interests in four principal lines of business:

- Financial Services.

- Energy.

- Packaging.

- Forest Produce.

Financial Services

The group would have to maintain 15% sales and Return of assets at the rate of 15-18%. They need to invest heavily in this segment of business to remain competitive. The small size of Continental would pose as a big hindrance since even the nearest rival company is twice its size and is growing @10% per year. Continental needs to invest $250 M yearly, to be increased to $300 M within the next 5 to 7 years. Since its size is a major handicap, it is not in a position to invest heavily in large projects and, also, having to wait for profits to accumulate, nearly for over 5 years.

Energy

This Group has several large projects and they include:

- Erection of a 1500 Mile slurry pipeline for transportation of coal from Eastern Appalachia to Illinois Basin with estimated Investments of 2-3 Billion for nearly 7 years.

- Erection of a 502 Mile long carbon dioxide pipeline in which Continental would have 13% stakes for an investment outlay of $50,000,000 for a period of 5 years.

- They were studying the prospects of converting 890 miles of its 4300-mile gas pipeline into petroleum products at a cost of $100,000,000 spread over 5 years.

- They were also considering investing in four major offshore gas pipelines in the Gulf of Mexico to link the Florida Gas Transmission system. This investment would cost around $400,000,000 within a period of 10 years.

These were concomitant risks involved in these high-cost projects and Continental was counting on the technical expertise of their technical partner, Morgas for the success of these ventures. Offshore explorations are highly risky ventures since firms are entering consolidations in order to reap the advantages of larger capital investments and in such a scenario, where investments attract proven reserves, it may be just difficult for a Company of the size of Continental to invest large amounts for long periods of time, and in hostile areas like Siberia. Although there may be no dearth of innovative ideas and skills, the fact that most of Continental’s competitors are nearly 10 times their financial size, makes the risks, even more significant.

The oil prices rises are also a major constraint, and it is believed, that oil production would peak during the beginning decade of the 21st century (2000 – 2010). If this is so, it is a major cause of concern for Continental as its small size would impede offering strong competition to the other firms in the industry.

For this line of business, the experts believed that they could predict a return on assets of 5-8 %. They also felt that the reserves could be enhanced from the present levels of $500 M to $1000 – 1500 M over the next 8-12 years.

Packaging

The packaging business of Continental seems to be less competitive, with only, 2 or 3 players in the market. However, it is capital intensive in nature, since high doses of Capital expenditures would be required to meet specialized and varying demands of the customers. Therefore, the company needs to generate more cash flows to meet market differentiation and demanding customer requirements. The main thrust would be in Food and Beverages, Specialized packaging, and international business. In order to increase profitability, the Company decided to discontinue unprofitable lines and effect massive cost reductions in existing ones after streamlining operations.

There were paradigm shifts from research and development areas to Business Development and marketing methods. Although the decision to cater to mainly large customers was good, it could affect pricing and use of technology, since some customers would require products with changed technological design. However, the short term and long term goals for the packaging division was seen in terms of the following:

- Introduction of successful products.

- Implementing cost reduction programs even after the product lines have re-established themselves as profitable ones.

- Whether technological obsolescence could be stalled or prevented.

- The negotiating powers of the customers. Despite modernization, and the introduction of new technology, the overall profit prospects seem bleak since the experts envisage a 50% reduction over the next 10 years, and the cash flows were also steeply declining and could reach negative figures within the next 6 years.

Forest Produce

The Company owned its own timberland, and the paperboard was around 380,000 tonnes per year. The risks for Continental would come from the competitors who were planning to install two more paper plants; one expected completion in 2007/8 and the other in 2009/10. The market rates, once these are operationalized, would be at a lower of 10-20% than Continental’s selling prices. As a result of this, the demand for paperboards would rise by 50%. The consultants felt that the paperboard business was a drain on the cash flow of nearly $50,000,000 per year for the next 5 years. The future expectations for cash flow would be in the tune of $ 100M to $125 M in the next 5 years. This unit could be sold off, as a going concern for $600 M.

The experts felt that the timberland was useful as a source of raw materials and was the Company’s own holding, and could hold its own in the face of fluctuating timber prices. However, if the Company decided to sell out its Paperboard unit, the timberland could also be disposed of off, since if retained, having a book value of just $200,000,000, it could not face competitors nearly 10 times their size.

Recommendations

The main aspect that Continental needs to concentrate on is high profits at low capital outlays. This way, the profits, and cash flow would be stabilized and could be invested in high capital-intensive projects. If total funds available with Continental are invested in massive capital investments with long gestational periods, it would have to resort to market borrowings with concomitant heavy interest rates, which would make further incursions into its profit margins and profitability. Therefore, the high-profit zones of the Company need to be utilized, first, and internal resources utilized for funding projects.

Further, in the areas of cost reduction and extra capacity utilization, the company needs to adopt, formulate, and execute programs that could address the Group as a whole, with necessary modifications and restructuring required to meet specialized unit implementations. It is believed that a holistic approach to managing product lines and profitability would best serve the interests of the Company in the future. It has rightly been said that “ the combinations of recently achievable resource and co-ordinated flexibilities is argued to have transformed the competitive environment of many product markets, leading to new kinds of product strategies, new organizational forms and a new dominant logic for competing in dynamic products.” (Sanchez, 1995).

Works Cited

- McNamara, Carter. (1997-2007). Strategic planning (in non-profit or for-profit organizations). Free Management Library. Web.

- Sanchez, Ron. (1995). Strategic Flexibility in Product Competition. Strategic Management Journal, Special Issue: Technological Transformation and the New Competitive Landscape (1995), Vol. 16, p. 135.