Executive Summary

The purpose of this report was to identify and to analyze the factors that influence production in the world car manufacturing industry. The macro-environment was analyzed using the PESTEL model. The competitive environment, on the other hand, was analyzed using Porter’s Five Forces framework.

The findings indicate that the industry has grown by over 30% in the last twenty years (Nunes &Bennett 2010, pp. 396-420). The industry’s annual growth rate is expected to reach 5.5% by the year 2015 (Nunes &Bennett 2010, pp. 396-420). The industry is characterized by a high threat of substitutes and competition.

Moreover, the suppliers have a high bargaining power. Tariff and non-tariff barriers to entry also exist in various regions. These threats are expected to reduce the industry’s future growth rate. Nonetheless, the industry has a low threat of new entrants. Besides, changing tastes and preferences have presented opportunities for new product developed.

Advanced technologies are facilitating the production of cars that meet customers’ expectations. The incumbent firms are expected to minimize the threats and to take advantage of the opportunities in order to sustain their competitiveness.

Introduction

The world car manufacturing industry is a leading driver of growth in the global economy. The industry has grown by over 30% in the last two decades (Nunes & Bennett 2010, pp. 396-420). Its annual growth rate is expected to reach 5.5% by the year 2015. In 2010, the industry was worth $2.2 trillion, and its size is expected to increase to $5.1 trillion by the year 2015 (Nunes & Bennett 2010, pp. 396-420).

China, Japan and Germany are the top three car producing countries in the world. The top three car manufacturers include Toyota, General Motors and Volkswagen. The achievements of the industry have been attained in an environment that is characterized by challenges such as environmental concerns, rising fuel costs and changing consumer preferences.

In this paper, PESTEL analysis will be used to identify the macro-environmental factors that influence the industry. Additionally, Porter’s Five Forces framework will be used to analyze the factors that influence competition in the industry. The scope of the paper will be limited to the mass car market segment of the industry.

Macro-environment Analysis

Political

Government intervention and tax policies present both challenges and opportunities in the industry. The Chinese and Russian markets have the highest level of government intervention. In Russia, the government protects its automobile industry through non-tariff barriers. In particular, foreign firms are required to have an annual production capacity of at least 300,000 cars (KPMG 2012, pp. 2-52).

Moreover, 60% of the parts that are used to assemble the cars must be produced in Russia (KPMG 2012, pp. 2-52). These policies benefit Russian car manufacturers since they prevent foreign companies from joining the Russian market. Concisely, foreign firms have to incur the cost of establishing production plants in Russia in order to meet the aforementioned requirements. In China, the government uses high taxes to reduce car importation.

In 2011, the government introduced a 15% tax on cars imported from America (Leachman, Pegels & Shin 2011). The tax increased the cost of American cars by at least 25%, thereby making them uncompetitive in the Chinese market (Leachman, Pegels & Shin 2011).

In India, the government has proposed a reduction in import duty from 60% to 10% on cars imported from the European Union (Roberto, Chun & Jiang 2011, pp. 56-78). However, the European Union will be allowed to export only 40,000 cars per year to India in the next five years (Roberto, Chun & Jiang 2011, pp. 56-78).

Economic

The 2007/2008 financial crisis resulted into a reduction in car production and sales in nearly all markets. In the US, the recession caused a reduction in car sales from 16.5 million in 2007 to 10 million in 2009 (Roberto, Chun & Jiang 2011, pp. 56-78). In 2012, USA’s GDP is expected to expand by 2%.

Consequently, car sales are expected to increase by at least 10% in 2012 (Seetharaman & Woodall 2012). In the last three years, the BRIC countries (Brazil, Russia, India and China) have emerged as the leading car markets due to their rapid economic growth. These countries have recorded an average GDP growth rate of 5% in the last six years as shown in table 1.

Table 1: GDP Growth in BRIC Countries

This growth rate has been characterized by high disposable income and low interest rate, thereby encouraging car sales. For instance, China which is the largest car market recorded a 5% increase in car sales in 2011 (Roberto, Chun & Jiang 2011, pp. 56-78). The economic crisis in Europe has severely affected car production.

Economic growth is expected to stagnate in the European Union and to reduce by -0.3% in the Euro-zone in 2012 (Gill & Raiser 2012, pp. 10-20). This trend is expected to change in 2013 with the projected GPD increasing by 1.3% in the European Union and by 1% in the Euro-zone (Gill & Raiser 2012, pp. 10-20). Poor economic growth in Europe has been characterized by high unemployment rate and austerity measures such as job cuts. This has led to a significant decline in car sales.

Social

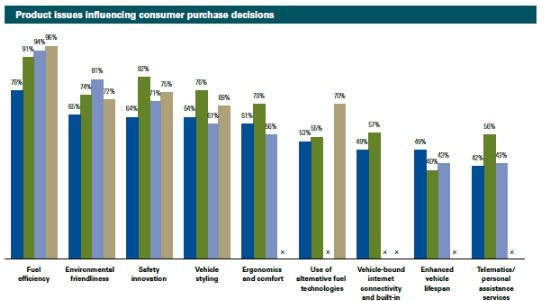

There are several factors that customers take into account before buying a car as shown in figure 1. However, fuel efficiency is the most important determinant of customers’ purchasing behavior (KPMG 2012, pp. 2-52). Following the sharp increase in fuel prices across the world, motorists have focused their attention on fuel consumption.

Figure 1: Product Issues Influencing Consumer Purchase Decisions

Most middle class motorists have shown preference for low engine capacity vehicles in order to reduce their expenditure on fuel. In-car internet connectivity is increasingly becoming important, especially, among young motorists (KPMG 2012, pp. 2-52). This generation is interested in cars that can enable them to use the internet for entertainment, navigation and communication as they travel.

Rapid urbanization in major car markets such as China, India and Brazil presents both threats and opportunities in the industry. According to KPMG (2012, pp. 2-52), urban planning will influence the size and shape of cars, as well as, the technologies that will be used to manufacture them in the near future.

In mature markets such as Europe and China, major cities have restricted car ownership through municipal bylaws in order to reduce pollution and traffic congestion. By 2050, nearly 70% of the world population will be living in urban centers (KPMG 2012, pp. 2-52).

This is likely to cause a shift from personal cars to mass transportation systems such as trains in developed countries. In developing countries where new cities are still under construction, rapid urbanization is an opportunity for growth. This is because car producers can collaborate with city planners in order to design cars that will meet the cities’ transportation needs.

Technology

In response to high fuel costs and concerns about air pollution, most car producers are developing technologies that reduce fuel consumption and emission. This involves producing cars that use alternative energy sources such as rechargeable batteries, fuel cells and gas.

Car producers are also shifting from the use of heavy metals to light-weight body materials such as plastics in order to improve the efficiency of their cars. Commercial production of fuel cells is expected to start in 2025 (KPMG 2012, pp. 2-52). At least 9 million electric cars will be in use by 2026 in the TRIAD and BRIC countries (KPMG 2012, pp. 2-52). For instance, China intends to produce 1 million e-vehicles by 2015.

In this regard, it has invested $15 billion in the construction of 2000 charging stations, as well as, 400,000 charging poles (KPMG 2012, pp. 2-52). Using fuel cells is considered to be cheaper than using batteries. The threat that is associated with these technologies is that they require heavy investment in production plants and refueling facilities.

Most car manufacturers do not consider any of these technologies to be a source of differentiation. Consequently, they prefer to develop them through joint ventures in order to reduce their production costs.

Environment

Car emission is a major concern in developed countries. These countries have emission standards that must be met by the vehicles that are operating on their roads.

Car emission taxes are often used to control environmental pollution. These taxes range from as high as 83% in Israel to zero in East Africa (Nunes &Bennett 2010, pp. 396-420). Emission regulations have led to the production of fuel-efficient cars. Additionally, capping the age of cars that are allowed in public roads in developed countries has led to an increase in car production.

Legal

Car safety regulation is one of the most influential legal factors in the industry. These regulations are a set of safety standards that vehicles must meet. The safety standards vary from region to region. However, the US and Israel are leading in the enforcement of car safety standards.

In developed countries, the safety standards have presented an opportunity for growth because defective cars are often replaced with new ones (Khanna, Shankar & Gautam 2003, pp. 94-101). In most cases, the used cars are dumped in Africa where safety standards are hardly enforced. Consequently, most infant automobile industries in Africa have failed to grow.

Porter’s Five Forces Analysis

Threat of Substitutes

The threat of substitutes is quite high in the world car manufacturing industry. The main substitutes to cars include trains, cycling, buses and aircrafts. Developed countries are shifting from the use of private cars to mass transportation systems such as trains in order to reduce traffic congestion and air pollution (Nunes &Bennett 2010, pp. 396-420).

This can be seen in cities such as New York, Chicago, Tokyo and Beijing. In developing countries such as India, travelling by train is cheaper than using a personal car (Nunes &Bennett 2010, pp. 396-420). The high threat of substitutes is likely to reduce the demand for cars.

Threat of New Entrants

The threat of new entrants is fairly low in the industry. The world car manufacturing industry is characterized by barriers to entry. These include high tariffs on imported cars (applicable in China) and local production requirements (applicable in Russia). Nearly all car producers have economies of scale which enables them to engage in mass car production (KPMG 2012, pp. 2-52).

For instance, the top five car producers which include Toyota, General Motors and Volkswagen among others have several production plants in different countries. The industry is capital intensive due to its reliance on machines for production. Thus, the high cost of joining it discourages potential entrants from investing in it. The low threat of new entrants will enable the incumbents to increase their productivity in order to serve the entire market.

Power of the Suppliers

The suppliers have a fairly high power in the industry. This is attributed to the fact that suppliers’ products are highly differentiated. There are “few fully generic parts or subsystems that can be used in a wide variety of end products without extensive customization” (Sturgeon, Biesebroeck & Gereffi 2009, pp. 8-22).

For example, Toyota’s parts can not be used to manufacture Nissan cars without extensive customization. The suppliers normally produce parts that are meant for particular car models. Hence, there are no substitutes for the suppliers’ products. The high power of the suppliers is likely to have negative effects in the car manufacturing industry. For example, the suppliers can raise their prices in order to increase their revenues. Consequently, car prices will increase and their demand will decline.

Power of the Buyer

The buyers (car producers) have a mild bargaining power in the industry due to the following reasons. One factor that limits car manufacturers’ bargaining power is the fact that suppliers’ products are highly differentiated. The suppliers’ products are also very important to the car manufacturers since they determine the quality of the end product. In most cases, car manufacturers have just one or two suppliers who supply them with specific car parts such as engines.

Thus, the buyers’ switching costs are very high. Nonetheless, the car manufacturers have been able to improve their bargaining power through backward integration. Most car producers lack the competence and the financial resources that can enable them to develop new technologies on their own (KPMG 2012, pp. 2-52).

This has facilitated alliances between the car producers and the suppliers of parts such as batteries and electric components. For instance, Toyota has bought shares in the companies that supply its car engines (Toyota 2011). The alliances enable the car producers to negotiate for low prices for their supplies. Moreover, they enable the car producers to monitor the quality of their suppliers’ products.

Competitive Rivalry

The intensity of competition in the industry is very high due to the following reasons. First, there are over one hundred car producers, and more firms are expected to join the industry, especially, in emerging economies. The industry is expected to have an excess capacity of 30% by the year 2016 due to increased car production and a reduction in demand (KPMG 2012, pp. 2-52).

Consequently, the competition will increase as firms try to sell all their cars. Nonetheless, the concentration of the industry is low. The top four car manufacturers include Toyota, General Motors, Volkswagen and Hyundai Motors. These firms control only 33.7% of the market (Leachman, Pegels & Shin 2011).

Consequently, small firms have the opportunity to penetrate the market through cutting-edge production technologies and effective marketing strategies.

High competition is also attributed to high fixed costs. Concisely, high wage rates in developed markets such as France ($9.5 per hour) and the USA ($7.0 per hour) has significantly reduced the competitiveness of local car producers (Babones 2012, pp. 29-41). On the contrary, Chinese car producers are more competitive because they are able to benefit from cheap labor ($2.0 per hour) in their domestic market (Babones 2012, pp. 29-41).

Attractiveness of the Market

Based on the PESTEL and Porter’s Five Forces analyses, the industry has the following opportunities. First, technological advancements such as the development of hybrid cars and fuel cells will enable car manufacturers to produce fuel-efficient vehicles (Fujimoto 2011, pp. 25-49).

Consequently, they will benefit from high demand since consumers prefer fuel-efficient cars due to the perceived low cost of operating them. Furthermore, environmentalists are not likely to resist the production of fuel-efficient cars since they are associated with low pollution.

Second, the positive economic outlook in major car markets such as Europe and the USA is likely to promote car sales in the next three years (Fujimoto 2011, pp. 25-49). Third, the low threat of new entrants is an opportunity for the incumbents to increase production in order to serve every segment of the market.

Finally, changing tastes and preferences is an opportunity for car manufacturers to develop new products that are needed in the market. For example, car manufacturers can differentiate their products by introducing in-car internet connectivity technologies which are rapidly gaining popularity among motorists.

The industry is also associated with the following threats. First, the high power of the suppliers is likely to limit car producers’ ability to access car parts at low prices. Hence, their production costs will increase if the suppliers increase the prices of their products. Second, high competition can significantly reduce the profit margins in the industry. Besides, uncompetitive firms might collapse. Third, the high threat of substitutes is likely to reduce the future demand for cars.

Finally, barriers to entry such as high car import tariffs and local production requirements will limit the firms’ ability to expand (Leachman, Pegels & Shin 2011). However, this threat is likely to be addressed by the fact that most car producing countries have agreed to comply with the World Trade Organization’s free trade regulations. Based on these observations, the industry is only attractive to firms that are capable of minimizing the threats and taking advantage of the opportunities.

Conclusion

The world car manufacturing industry has recorded a rapid growth in the last decade. The industry is expected to grow at an annual rate of 5.5% by the year 2015 (Nunes &Bennett 2010, pp. 396-420). However, the industry has also grappled with several challenges which include environmental concerns, rising fuel costs and changing consumer behavior.

In this regard, the opportunities that are associated with the industry include a low threat of new entrants, availability of new technologies and a positive economic outlook in major markets. The threats that are associated with the industry include barriers to entry, high threat of substitutes and high competition. The incumbents should minimize the threats and take advantage of the opportunities in order to improve their competitiveness.

References

Babones, S 2012, ‘A Structuralist Perspective on Economic Growth in China and India’, International Journal of Sociology and Social Policy, vol. 32 no. 1, pp. 29-41.

Fujimoto, T 2011, ‘Complexity Explosion and Capability Building in the World Auto Industry’, Journal of Industrial and Business Economics, vol. 2 no. 1, pp. 25-49.

Gill, I & Raiser, M 2012, The Golden Growth: Restoring the Luster of the European Economic Model, World Bank, London.

Khanna, V, Shankar, R & Gautam, A 2003, ‘TQM Modeling of the Automobile Manufacturing Sector’, International Journal of Technological learning, Innovation and Development, vol. 52 no. 2, pp. 94-101.

KPMG 2012, KPMG’s Global Automotive Executive Survey 2012, KPMG International, New York.

Leachman, C, Pegels, C & Shin, K 2011, ‘Manufacturing Performance: Evaluation and Determinants’, International Journal of Operations and Production Management, vol. 25 no. 9, pp. 851-874.

Nunes, B & Bennett, D 2012, ‘Green Operations Initiatives in the Automotive Industry’, International Journal of Benchmarking, vol. 17 no. 3, pp. 396-420.

Roberto, G, Chun, G & Jiang, C, 2011, ‘Chang’an Automobile and the Chinese Automotive Industry’, International Journal of Operations and Production Management, vol. 3 no. 2, pp. 56-78.

Seetharaman, D & Woodall, B, 2012, U.S Auto Sales Last Month Posted their Best Showing in 4 Years, Helped by Cheap Financing, Rising Consumer Confidence and a Major Rebound by Toyota Motor Corporation. Web.

Sturgeon, T, Biesebroeck, J & Gereffi, G 2009, ‘Globalization of the Automotive Industry: Main Features and Trends’, International Journal of Technological learning, Innovation and Development, vol. 2 no. 2, pp. 8-22.

Toyota 2011, Annual Financial Report: FY 2011. Web.