Executive Summary

Discovery Communications is a leading nonfiction company that has a presence in all the continents. Discovery Communications is characterized by about one hundred and ninety television networks that provide investigative programs. The major channels present in Discovery Communications are Discovery Channel, Science Channel, TLC, and Animal Planet. Discovery Communications co-operates with media channels, for example, Oprah Winfrey Networks, to provide an entertaining view to consumers. Nonfiction content is the major specialization of the firm; it teams up with local producers in the US to offer entertainment programs, movies, and sports. Discovery Communications also participates in curricular activities like K-12 series contexts of digital textbooks, digital leadership, and online curriculum portfolio improvement. All the activities present in Discovery Communications aim to bring excellent entertainment and give subscribers opportunities to obtain knowledge

The objective of the corporate governance assessment of Discovery Communications is to check the company’s progress in its endeavor to become the world’s favorite network. The assessment will analyze the leadership realignment present in the organization and how the leadership influences the management of the company. The participation of Discovery Communications in educational programs and co-operation with other networks like Hub Networks has the advantage of the prosperity of the media company. The assessment will explore the factors that trigger the expansion of the business establishment to more countries and territories. Discovery Communications produces its financial reports every quarter. The assessment will investigate the impact of quarterly reporting on the financial progress of the company. The company has set targets that need to be achieved every quarter. The management team motivates the employees to achieve the set targets and goals of the company.

The assessment will check on the CG rating score of companies and the CG information on Discovery Communications. According to CG rating score, Discovery Communications has a rating of ninety-two percent (92%), which gives it a rank of five. The major information present at CG is the number of shareholders, separation between the chief executive officer and chairman of the company, the number of board members, and the number of independent directors. The financial report will establish the basis of the current stock price, earnings-per-share (EPS), Price-Earnings Ratio (P/E), the price-to-book value (P/BV), annual revenues, and return on equity (ROE). The current stock price of the Discovery Communications share ranges between $85.01 and $85.98. Annual report of Discovery Communications is present in the Form 10-K and collectively gives information on digital distribution, ownership interests, Discovery Formation, distribution platforms, successor reports, an overview of the Discovery Communication media company, and programming partnership.

The company’s diagnostics involve discovering the internal affairs that make the organization remain the world’s favourite media network. The firm offers the rights of ownership to all shareholders, which attract investors to the company. The leadership of Discovery Communications gives the shareholders their rights, especially in the monitoring, making decisions, and electing board members. The shareholders have the rights of voting, accessing share ownership information, and accessing all financial information. All the shareholders of the firm are treated equally. The shareholders have the rights of contesting for leadership positions without any form of discrimination. Subscribers of the company participate in making crucial policies like compensation schemes. Transparency in all the activities of Discovery Communications is essential since it creates confidence in the stakeholders of the organization. Sharing of profits and receiving of a company’s dividends requires transparency.

Discovery Communications (DISCA)

The giant communications firm specializes in nonfiction airing of programs on a global platform. The US Networks consists of local cables and domestic satellite television airwaves and digital services. The International Networks consist of international websites, cables, and digital media signals. The Education Networks consist of audio production and curriculum programs in line with the US education system. The prosperity of Discovery Communications made it attain a primary digital education system in the Education Networks. Also, the firm acquired Raw TV Ltd based in the United Kingdom to offer the education curriculum in line with the European Education system. Subscribers of Discovery media receive original programs purchased from producers all over the world. Discovery Communications also owns some of the programs through employing producers to produce their programs under the umbrella of Discovery media.

The genres present in International Networks include exploration, natural history, science, survival, technology, environmental sustainability, lifestyle, current events, and civilization. The company promotes local programs and nurtures young talents in the media field. The Discovery US Networks gets its revenue from subscription fees on direct to home (DTH) and cable satellite providers. Revenues of the US Networks also come from the advertisements aired television networks. The US Networks system uses the revenues generated to pay sales representatives and network service providers. Ownership of television networks boosts the firm to reach a large population. The Discovery US Network generated net revenue of sixty-two percent (62%) at the end of the 2011 financial year. The net revenue increased in the following year to seventy-two percent (72%) due to an increase in the distribution and advertising revenues. Also, the Animal Planet, TLC, and Discovery Channel make a huge contribution towards the increase of revenue.

Discovery Communications is under the category of broadcasting and television channels. The slogan of Discovery Communications is “a world exploration; it is just…awesome.” Discovery Communications has its internal strengths and weaknesses and external threats and opportunities. One of the internal strengths of the organization is the diversification of its services in over two hundred and twenty countries. The firm is marked by loyal customers who renew their subscriptions promptly and focus on improving the media platform. The company has the highest rate of market ratio and the number of shareholders in the US. It has entertaining programs that attract an audience, hence increasing subscription rates. The internal weakness of the company is a limited number of target consumers due to a high level of competition. The technology of using digital cables in transmitting airwaves is facing technological hitches due to the slow growth rate. The method of transmission is expensive to execute and maintain.

The external opportunities present in Discovery Communications are an improvement in technology and the creation of extra online channels of marketing the brand of the company. Also, the organization has a chance to expand its products and services to subscribers. It is enjoying the monopoly of curriculum education system both in the United States and the United Kingdom. Similar channels do not have television cables and producers to run the curriculum education programs on an international platform. The education system is interactive and provides reality shows to the audience, making it entertaining and enjoyable. The major external threat of Discovery Communications is competition from the BBC, YouTube, and National Geography international channels. Discovery Communications is facing high taxes from the government, and political influence on the programs to place on public gallery. The media platform is growing, and Discovery Communications may not get international frequencies if it does not improve the quality of its programs.

The Survey

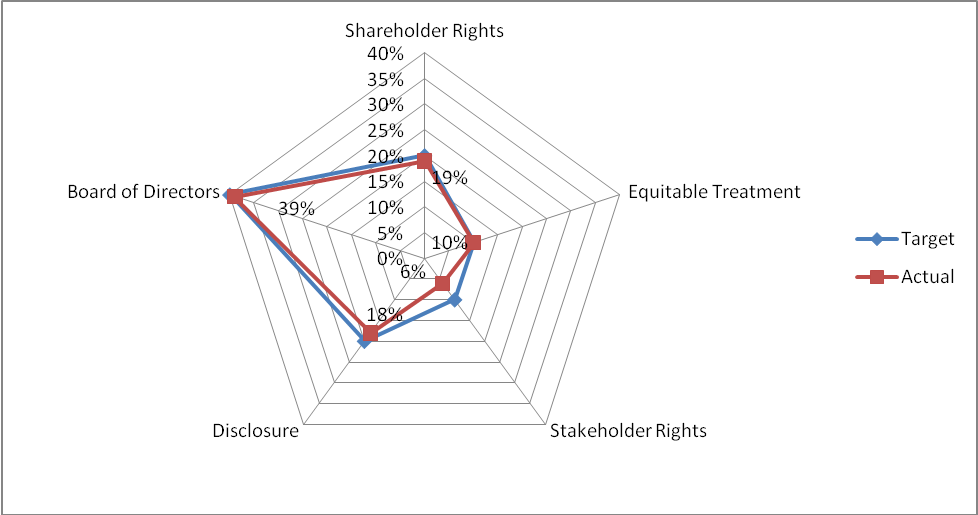

The survey of Discovery Communications utilized questionnaires and interview sessions on the shareholders, stakeholders, audit committee, corporate governance committee, and executive committee. The survey involved four categories of internal investigations of Discovery Communications. The first category examined the rights of shareholders and ownership functions. The shareholders were in unison that the company fully recognizes the rights of shareholders and protects their rights. The second category of the survey of corporate governance involved the equitable treatment of shareholders. The shareholders claimed that the company kept an up-to-date register of all shareholders and ensured equitable treatment, including foreign shareholders.

The role of stakeholders was the third category of the survey. Some of the participants did not differentiate the stakeholders and shareholders of the Discovery Company hence, could not differentiate their roles. The fourth category of the survey examined the disclosure of Discovery Communications. The participants claimed that stakeholders sought advice on some of the transactions or investments the company was given the right responses. The fifth category of the survey involved evaluating the responsibilities of the board of directors. The participants agreed that the board is performing its duties but requires close monitoring for increased efficiency.

Findings and Recommendations

The survey results show that companies in the corporate world do not maintain corporate websites. The price to book value ratio started to rise from the year 2011. Price-to-Book Value is a ratio obtained after the division of the market price and book value per share. The total assets within the firm will assist in budget planning in the future. The financial parameters assist the executive stakeholders in making appropriate decisions towards development and investing in Discovery Communications. The company’s return on equity (ROE) measures the amount invested by the shareholders and the retained amount from the previous financial year. According to ROE report, the Discovery Company has an increasing rate from the previous years. The Discovery Communications financial information will assist in identifying the progress of the Company and future trends in terms of investments.

Active monitoring and participation of the shareholders in the decision-making process will ensure fair representation and participation of all the members of the firm. The company’s board of directors has the role of distributing important information to the shareholders. The CG score of the company shows good cooperation between the leadership of Discovery media and the Shareholders. The CG information shows that the market capitalization of Discovery Company is above $25, meaning that it has a more than quarter global share. The corporate branding campaign allows the subsidiary networks to own individual logos, but in the end, they should show the parent logo of the Discovery Communications. The financial information of Discovery Communications involves a combination of all the financial statements of the subsidiary networks and summary of market capitalization, current stock price, earnings per share, price-earnings ratio, price-to-book value, annual revenues, and return on equity.