This project is a real estate project and the cost of the structures includes the cost of land on which the project is constructed. The cost of construction is also included when valuing such a project; this includes the cost of the material used in the construction, as well as the labor. All the costs are determined using the current costs of building the structure and the current value of land. After all these cost have been added together, the accrued depreciation of the property of the project is determined then subtracted from the costs of the project (Maguire and Robinson 145). The final value is what the property is worth.

The revenue of the project includes all the incomes generated from the property (Maguire and Robinson 189). This project has a hotel and suites, and since the project is expected to generate a regular income the annual gross income is calculated according to what the property can when the market study is done. During activities that generate income, the project incur expenses such as management and advertising expenses, repairs, maintenance, utilities, insurance and taxes, and all these should be factored when calculating the revenues of the project (Smith 315). The rate of return on capital should also be determined.

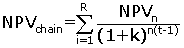

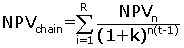

The replacement chain NPV

Financial analysis is done to projects to determine which project is financially viable; however, projects can differ in their lifespan like in this case study. The two projects have a different useful life; one might be durable than the other, and this means that the managerial options are replaced at the end of the project. Therefore, a capital budgeting proposal evaluation of projects with different life pans can be done using replacement chain analysis method (Smith 417). The analysis uses the replacement chain NPV, and this chain is simply the NPV for replacing the each project.

- R = replication times

- NPVn = net present value for one replication

- K = average weighted cost of capital

- t = time period

- n = size of the replication

The NPV for each project is calculated for each year until the last useful year of the project, NPVs for each project are summed up to determine the overall NPV for each project. After finding the NPV for each project, the difference in the NPV is not used to determine the project that is more financially viable; this is because of the difference in the projects’ life times (Baum and Crosby 274). Therefore, the NPV Replacement Chain for the two projects need to be determined using the formula below but with a common useful time; assume that t is the same for the two projects.

Comparing two projects’ NPV, the project with the highest NPV should be chosen over the other.

The equivalent–annual-annuity method

Sometimes, using the replacement chain method can be involving, in such a case, the equivalent –annual-annuity method can be used to compare two projects of different life span. When using this method, NPVs for each project are determined, then using the NPVs, the Equivalent-Annual-annuity for each project is determined to find the expected payment over each project’s useful life (Baum and Crosby 392). This is done with an assumption that the future value of each project at the end of the useful life will equal to zero. The equivalent-annual-annuities for two projects are then compared, and the one with a high Equivalent-Annual-Annuity is chosen over the other.

References

Baum, Andrew & Crosby Neil. Property Investment Appraisal. London: Routledge, 2005. Print.

Maguire, Peter & Robinson Jackson. Building evaluation by prospective lessees. Brisbane: Queensland University of Technology, 2000. Print.

Smith, Peter. “Occupancy Cost Analysis”. Building in Value – Pre-Design Issues. London: Arnold, 2009. Print.