Project Description

As the entertainment industry in Dubai is expanding due to robust economic growth, the demand for recreational centers such as parks, resorts, and other related establishments has been on the rise. The increase in demand for such services in the Dubai market necessitates the need for the Dubai Parks and Resorts Project. The proposed project will consist of products such as Motiongate, Legoland, Legoland Water Park, Bollywood Parks, Riverland, and Lupita. The project aims at addressing the needs of customers in the family segment, who are interested in family-friendly park services since the proposed Dubai Parks and Resorts Project will offer customized services to a myriad of customers.

Despite the existence of more than twenty establishments in Dubai currently offering similar services that the proposed project intends to present, very few parks offer customized and family-friendly services despite the existence of more than three million potential clients. Therefore, the actualization of the proposed Dubai Parks and Resorts Project will bridge the existing gap by integrating the aspect of service customization and targeting the family segment. The findings of research in the Dubai parks and resorts industry reveal that only seven parks currently offer customized services against a surging demand that they cannot meet. It was also established that the existing parks and resorts charge uncompetitive prices for their services, which very few locals can afford. Therefore, the proposed Dubai Parks and Resort Project will be modeled around the affordability of the services as a strategy for ensuring sustainable competitive advantage and prompt market penetration.

Project Governance

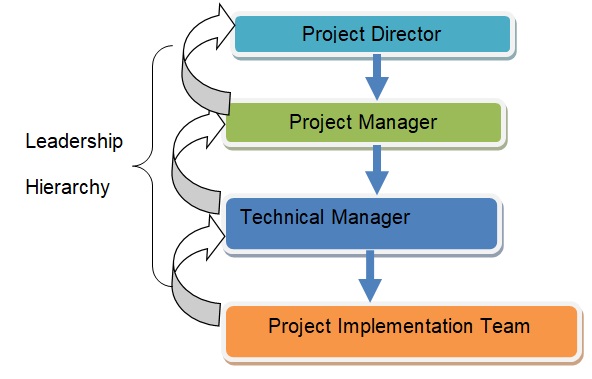

Since the proposed project is capital intensive, the governance will be accomplished by a team of three experts supported by a team of 30 implementers. The project director will head the project planning implementation phases assisted by a project manager, who will be the primary supervisor of project implementation strategies put in place. The last expert, the technical project manager, will be mandated with the role of providing technical skills in the implementation of the project since the role will be taken by an expert in the field construction. Therefore, the hierarchal ladder in terms of project leadership will begin with the project director and end with the project technical manager (Bloom 29). The technical manager will manage the implementation team. The summary of project governance is presented in figure 1 below.

Structure of Financing the Project

Start-up costs

The proposed Dubai Parks and Resorts Project is quite capital intensive. Some of the start-up costs will be incurred in putting up the centre, purchase of land (approximately 25 acres), and other activities. The capital will be raised through three ways. The first approach is through the seed investors. This group of investors is made up of the company management team and the seed investors. This is a form of investment in which the investors purchase a part of the business. Their investment is quite risky and is based on the success of the business (Drucker 33). The seed investors will be five in number. Secondly, capital will be raised through the start-up investors. This form of investment is secure because the investors get both the controlling and voting rights (Finnerty 15). These investors will be four in number. Finally, capital will be raised through a loan from financial institutions. The loans will both short and long-term. The table presented below shows a summary of the start-up items that need funding.

The table presented below shows a breakdown of the items.

The table presented below shows a summary of the capital raised

Assumptions

The business will be set up on land that is approximately 25 acres. The traffic in the region is about 62,700 cars per day. The business intends to offer a variety of services that will target various age groups. Based on the recent census that was carried out, the total population in the region consists of 956,554. The business targets a population that is aged between 5 and 70 years. The total population in the range is 836,798. The median age of this population is 28. The ratio of female to male is 0.5. Further, 79% of this population is white. Further, 49% of this population is aged between 27 and 55 years. The population is expected to grow annually by 6.65%.

The company targets 15% of the population aged between 5 and 70 years. Thus, the number of estimated customers is 125,520. Further, it is expected that each person will spend approximately UAD56.74 per year at the park. This will amount to UAD7, 122,216 for the entire year. The sales and other costs will be estimated based on the assumption that the company is operating at 40% of the full capacity. The start-up costs will be amortized over a period of five years. The massive amount borrowed will be repaid over a period of twenty years at 10% per year. The pricing used by the company is based on the averages in the industry. The company will outsource several services such as cable TV, payroll services, and waste management among others. Also, the projection of the staff salaries will be based on the assumption that they are full-time employees working seven hours per day. The tax rate in the country currently stands at UAD 20 for every UAD2, 000 of evaluated value. Property tax is currently at 0.000087 of the buying price of the property. The license for building space is UAD75 for every 150,000 square feet. An additional area will be charged at UAD10 for every 2000 square feet. The corporation tax rate is estimated at 32.75% (Bloom 28).

Risk and Return Structure of the Project

Pro forma financial statements

Forecasts

Sales and direct costs forecast.

Personnel expenses forecast

The company will have four categories of personnel. The total number of employees will be 40. The table presented below shows the summary of the personnel expenses.

Open day balance sheet

Dubai Parks and Resorts Project. Balance sheet. As at 31st January 2016

Dubai Parks and Resorts Project. Profit and loss projection. For the 12 month period ended 31st December 2016.

Dubai Parks and Resorts Project

Cash flow projections. For the 12 month period ended 31st December 2016.

Dubai Parks and Resorts Project

Balance Sheet. As at 31st December 2016.

Ratio analysis

The table presented below shows a summary of the ratios for the Dubai Parks and Resorts Project.

The non-current assets account for a larger proportion of the total assets, that is, 86%. Further, the ratios show that the company will heavily depend on debt to finance the projects (Arjoon 45). The value of debt is about three times that of capital raised. The gross profit margin is slightly above average. The other profitability ratios are high. Further, the liquidity ratios are low. They show that the company may face difficulties in paying short-term obligations using current assets during the first year of operation.

Break even analysis

The break-even point is calculated based on the assumption that the fixed cost is made up of loan repayments, a section of the payroll and other expenses. The break-even analysis gives the minimum number of units of output that must be produced and sold to enable the business to pay the total cost of operation (Subramanyam 16). Thus, at break-even point;

Total revenue (P * Q) = total cost [Variable (VC * Q) + fixed cost]

The approximated percentage of variable cost is 33.5% while the approximately monthly fixed costs are UAD69, 450. The average selling price is UAD56.74. Therefore, the corresponding variable cost per unit is UAD18.95.

56.74 * Q = (18.95 *Q) + 69,450

37.79Q = 69,450

Q = UAD1, 837.71

From the calculations, the break-even number of units is UAD1, 837.71 while the break-even monthly sales units amount to UAD104, 274.53. Therefore, for the company to be able to meet all the running expenses, then it needs to generate revenue amounting to UAD104, 274.53 per month. The value equals to UAD1, 251,294.3 for the entire year. The estimated annual revenue for the year 2016 is UAD7, 122,216. This value exceeds the break-even annual sales. This shows that the project is profitable (Manas 31).

Risks in the proposed project

Since the project is capital intensive and has a fixed deadline for implementation, the main risks that might affect its execution are financial, environment, and operational. Besides, risks such as currency fluctuations and economic swings in the Dubai market might also affect the project are negligible proportion. The risks are discussed below.

Environmental risk

The aspects of sustainability, pollution, environmental degradation and other environmental concerns must be reviewed in the course of this project. However, the risk is low since the project will have very little negative impact on the environment.

Operational risk

From the definite time frame for implementation, it is apparent that this project has clear specific and period of implementation. Besides, the inflexible time allocation for completion of the project may be faced with challenges in channels of reporting progress that is critical in ensuring clear communication from one stage to another. The risk level in this category is high.

Financial risk

The main financiers of the project are the financial institutions and the seed investors who have clear demands for a completion of the project with its deadline without any major huddles. This risk in this classification is medium.

Recommendations

The probability that the projections will be met is very high since the appraisal was based on the minimum of the maximum data. However, in the event of mismatch in the breakeven projection, the project leadership team is in a position to employee alternatives such as extra financing and streamlining the execution team to guarantee sustainability. Besides, the project may franchise some implementation components to established businesses as a risk reduction strategy. Lastly, the project execution team will be empowered to ensure that there is proactive communication in each stage of project execution as a remedy for conflicts and inefficiency tracking.

Conclusion

The proposed Dubai Parks and Resorts Project is expected to breakeven within two years. The business targets clients within and without Dubai interested in park and resort services that are very affordable. The main threats that might affect the project are financial, environmental, and operational risks. However, the project is likely to survive these risks since the project team is qualified, finances are adequate, and the project can be implemented in phases.

Works Cited

Arjoon, Surendra. Corporate Governance: An Ethical Perspective, Trinidad: University of the West Indies, 2009. Print.

Bloom, Paula. Circle of Influence: Implementing Shared Decision Making and Participative Management. Lake Forest, IL: New Horizons, 2004. Print.

Drucker, Peter. People and Performance. Massachusetts, Boston: Harvard Business School Publishing, 2007. Print.

Finnerty, John. Project Financing: Asset-Based Financial Engineering. 3rd ed. 2013. New York, NY: John Wiley & Sons. Print.

Manas, John. Napoleon on Project Management: Timeless Lessons in Planning, Execution, and Leadership, Nashville, Tennessee: Thomas Nelson Inc, 2008. Print.

Subramanyam, John. Financial Statement Analysis. 11th ed. 2013. New York, NY: McGraw- Hill Education. Print.