Abstract

Immigrants to the United States have historically elicited passionate debates on whether they are of economic benefit or an economic burden to the country. Those who hold the view that immigrants are of economic benefit have advanced views including that with the coming of immigrants into the country there is availability of cheap labor force who, besides contributing to the numbers of available labor, are also contributing to making businesses by locals benefit since they buy goods.

According to this thinking too, immigrants, besides contributing to consumer base for goods and services are also important for setting up new business ventures which open-up employment opportunities for the locals. For those of the opposite view, the immigrants are an economic burden since they consume the government resources allocated for the people as well as contribute to making low-pay packages since they are ready to accept low-pays.

In the last few decades, immigrants to the United States have surged in numbers. By the year 2005, there were more than 38 million immigrants in the country. This represented 13% in the total population, in the country, as being foreign-born (Burman 56). For some economists, this trend has been a cause of alarm.

For others, the trend is an economic blessing to the country. According to one view on this debate, immigrants are today an important impediment to the government’s objectives of its goals. As this view holds, since the majority of the immigrants are illegal the fact is that majority of them are not paying taxes.

As Geigenberger (171) identifies, with this quality, the government lags behind in many of its objectives. This is because the collection of the taxes thus revenue does not reflect the anticipated collections. According to Geigenberger (171), because of this inability to get taxes from the majority of the immigrants, the government is always strained in the achievement of objectives.

This is because of many reasons. On the first ground, though these people are not paying taxes; they are consuming the social resources. They are for example, using hospitals and thus the medicines which are covered by the government using the tax collections. Besides the hospitals, such people are also using other resources such as electricity, water and such which are subsidized by the government using the resources from the taxes.

The overall impacts of these are two fold. First is that the government is forced to increase taxes for the category who pay the taxes. Over the last ten years, the government has indeed increased taxes for almost all classes (Geigenberger 171). This is attributed to the increasing population fueled by the increasing migration into the country.

As Geigenberger (172) states, this is economically clear. This is because the government generally has set standards to achieve for the population. These objectives are achieved through funding to programs. The funding is usually informed by the figures which exist of the population who are the consumers.

Considering that the immigrants are an addition to the already known population, fact is that this category contributes to making the government unable to meet the objectives with the funding targets which had been previously done. The government is thus forced to increase funding to each of the projects because it is only through this way that the population which now includes the immigrants can have access to the resources.

This case is analyzed through state data. In the academic year 2003-3004 for example, the state of Minnesota spent around 118.14 million dollars on the education of the children of undocumented immigrants. In this academic year, New Mexico spent 67 million dollars for the same category (Geigenberger 174). Overall, all this presents an increase on the education budgets for the state governments. According to these estimates, the immigrants (illegal) are taking up more than 1.3 billion dollars of healthcare spending by the country.

The above view, though clear, does not present convincing information. According to estimates, on average, an immigrant contributes an increase of 0.1 percent to the average income of a U.S natural citizen (Ottaviano & Peri 2). This increase in average income to the locals is identified to be coming from either the labor that the immigrants provide or their participation in buying of goods and services.

According to this line of thinking, the immigrants are setting up new business and thus creating employment opportunities. As estimates puts it, the current trend in immigration contributes averagely to a 10 percent increase in the overall employment level in the country, both from the new businesses and from the capital provided by the immigrants when they buy (Ottaviano & Peri 27).

Historically, the idea has been that immigrants contribute to unemployment because they create scramble for jobs. This view has been variously discounted. According to Geigenberger (10), the immigrants into the country are not in any case vying for the same jobs with the locals.

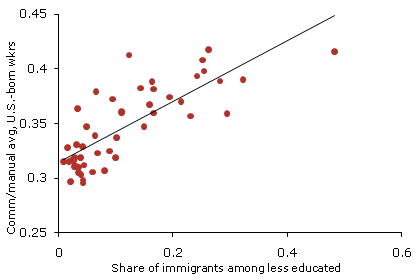

This as Geigenberger (10) identifies is because in most cases, the educational achievement of the immigrants is usually lower compared to the locals. The meaning of this is that as the locals take up the jobs at the higher levels, the immigrants ensure e that there is no vacuum at the lower level jobs as they take them up as befitting their educational qualification. The fitting a line to a scatter plot presentation below which was done by Ottaviano & Peri, highlights the lower jobs taken up by immigrants compared to the locals.

Source: Economist’s view (15).

According to Geigenberger (10), indeed many of the low-level jobs such as restaurant services, care giving, construction (low level) and farm work would excessively be deficient of workers if the immigrants were blocked from coming into the country. According to Geigenberger (10), these jobs are 87 percent taken by the immigrants not only because of their lower qualifications but also because the locals are not ready to take them up.

As Geigenberger (10) summarizes, the meaning of this is that the important sectors of the economy including agriculture, construction, hospitality and commerce greatly needs the immigrants as a labor. The table below highlights the central place of immigrants to the economy.

Distribution among important sectors.

In the discussion of the disadvantages of immigrants, issues has been that because majority of them are undocumented (illegal) thus making them only a liability to the economy. Some have discounted this too. According to Burman (124), by 2006, the country was estimated to have around 8.3 in the illegal immigrants. It is estimated that this portion of the population in the country was contributing or taking up 5.4 percent of the needed labor force in the country.

As Burman (124) identifies, this category of the undocumented immigrants are not a disadvantage in relation to taxes as it is also believed. Instead, as Burman (137) identifies data continues to show that close to 80 percent of the immigrants who are undocumented still pay their state, local and federal taxes. As the data shows each year, the category of the undocumented immigrants contribute more than 70 billion dollars to the social security fund.

Generally, the contribution of the immigrants to the taxes usually remains under the unaccounted for payments. Because these workers do not want their identity to be identified, they pay their taxes but hold their identity. By the year 2005, more than 8.8 reports on the tax submissions by workers to the Social Security Trust was by workers whose identified had been withheld. These taxes amounted to 57.8 in billion dollars (Burman 137).

According to matching which ensued, these funds were majority coming from illegal immigrants. As data shows, the trend has been the same for a long period. In the year 2003, the figure contributed by this category was 75 billion dollars. At this time, there was an estimated 255 million illegal immigrants presenting their taxes but remaining obscure in their identity (Burman 147).

Conclusion

In the recent times, the U.S has responded to the migration issue through actions aimed at shutting the border points to limit migration. Construction of fences has been a commonality in the recent actions by governments. The American borders have been the target for many years. As these borders and border security continue to shut the immigrants, many things are bound to happen.

Among them is that the country is bound to lose he cheap labor which has been effective for the industrial booms throughout the history. America, from the days of slaves to the abolition of slavery and now immigration, has proved to depend more on such a category of low salaries person to make possible economic gains especially during hard times when payment of good salaries is impossibility.

This could cause collapse of some sectors such as agriculture which heavily depend on these people. Besides, with such measure so f shutting the borders, the country is bound to lose of the social benefits that these people bring especially the family value system they instill on the American culture.

Works Cited

Burman, Stephen. The state of the American Empire: How the U.S. A Shapes the World. Berkeley: University of California Press, 2007. Web.

Geigenberger, Julia. The Lasting Value of Legal Immigration for the United States of America. München: GRIN Verlag, 2008. Web.

Ottaviano, Gianmarco, Peri, Giavanni. Rethinking the gains from Immigration: theory and evidence from the U.S.Washington, DC: National Bureau of economic research, 2005. Web.

Economist’s view. FRBSF Economic letter: The effects of immigrants on U.S. Employment and Productivity. 2010.Web.