Opportunity Cost

Opportunity cost is a term that is applied in the microeconomic theory where a decision has to be made between two or more choices. An opportunity cost refers to the choice that is forgone when another choice is made. For a choice to qualify as an opportunity cost, the alternatives should be mutually exclusive with reference to the available resources.

When individuals in business make a choice that can be considered the best at that point in time, other alternatives that the individuals forgo comprise the opportunity cost. In economics, decision-making mainly entails deciding between several mutually exclusive choices. Therefore, managers in businesses lose some of benefits of the choices they forgo.

The concept of opportunity cost demonstrates the relationship between choice and scarcity that characterise this field. Chance outlay may be in the form of economic and pecuniary expenses, occasion, gratification, effectiveness, or any advantage that the vanished choice may have brought to the business environment.

An example of application of opportunity cost in economics is where an individual has to decide between an investment in the stocks of a company and another investment such as a government bond. If the individual chooses to invest in the stocks of the company, the utilised money cannot be used in the purchase of the government bond.

Supposing the stocks generate a return of 2%, and that the equivalent value in investment will generate 6% returns over the same period, the investor has an opportunity cost of 4%. This figure is obtained by subtracting the value obtained in the investment in stocks from that which would have been obtained from the government bond (6%-4%).

Product Differentiation

Product differentiation is another concept of marketing and economics. Organisations use it to differentiate their products from those of their competitors. Organisations in the business environment often have a special target group for their products, with success in the industry being dependent on how well the organisation is able to market itself to this target group.

Product differentiation makes product more attractive to an organisation’s target group. An organisation may also produce several products. The concept of product differentiation in this case enables the organisation to provide a choice for consumers by differentiating between the various products.

Product differentiation as a concept in economics arose from the theory of monopolistic competition proposed by one of the renowned economic scholars. Edward Chamberlain proposed the concept in the publication of this theory in the early 30s.

An example of product differentiation is the multinational organisation Coca-Cola that produces several types of refreshment products. The company produces some brands that have dominated the market for several years, including the famous Coca-Cola brand.

Because of the rise of several global competitors such as Pepsi Cola, Coca-Cola has had to apply intense marketing with product differentiation to stay at the top of competition. The application of product differentiation has allowed this company to develop a large consumer base.

Coca-Cola also produces several brands of soft drinks aside from its trademark brand, with this move also recording significant success on the global market. Therefore, product differentiation is applied in the organisation to ensure that the trademark brand still manages to sell, despite the high demand for the other products. This example proves that product differentiation is an integral part of marketing and economics.

Natural Monopoly

The provision of goods and services by an organisation depends on the existence of competition. In the absence of competition, an organisation can control a market and enjoy the benefits that come with this situation. A monopoly may be defined as an organisation that is involved in the production and sale of a particular product or service in a market where it is the sole producer of such type of a product or service.

The concept of natural monopoly in economics depends on the existence of monopoly in an industry. This concept defines a monopoly where a single firm efficiently runs the industry, as engagement of multiple firms may introduce technicalities and reduced efficiencies. In the natural monopoly, capital costs are often too high for the entry of other companies, with the first supplier retaining the market monopoly.

This cost advantage inhibits the entry of other competitors. The existing organisation operates based on the economies of scale. This concept applies mainly to public utilities, especially in the provision of vital services such as electricity.

An example of a natural monopoly is where an organisation is contracted to provide electricity in a small nation such as New Zealand. The organisation transmits electricity as a monopoly in the nation, connecting the population to reliable sources of electricity. The industry has large fixed costs and a relatively small sized market.

Hence, the existence of a natural monopoly serves as the best alternative in the provision and transmission of electricity. The absence of competitors is also regulated, in most instances, by regulations of the country in which the natural monopoly is existent, with the aim being to protect the end users. Some of the shortcomings of a natural monopoly include poor pricing and service delivery.

Oligopoly

The other economic concept that is an opposite of a monopoly is an oligopoly. In an oligopoly, a relatively small number of producers or organisations characterise the industry or market. This form of market results mainly in the collusion of the few organisations, with consumers having to pay higher prices for the services or goods produced by these companies.

Reduced competition also provides an opportunity for the organisations to fix higher prices while still maintaining high sales and profits. An oligopoly is also characterised by awareness of what each of the competitors is doing, with the result being similar decisions in relation to the market trend.

The decisions that each of the organisations makes influence those of their counterparts in the industry, and hence the reduced competition and price changes.

Examples of oligopolies can be found in different industries all over the world, including both the industrialised and developing nations. For example, the United States has oligopolies in industries such as the film industry, television industry, wireless network industry, and insurance.

The bulk of revenue from the film industry in the country is shared between six companies while the four main wireless providers serve over 89% of the market population. In the internet and television industries, the United States has a market that is controlled mainly by seven companies.

Few companies that benefit from the large population with a high spending capacity serve the insurance industry in the field of healthcare. Therefore, these industries in the United States are good examples of oligopolies. While oligopolies may be beneficial in a market as compared to monopolies, there is a need for regulation in some markets.

Free-rider Problem

The concept of free rider problem arises from the existence of free riders in economics. A free rider is anybody who thriftily takes advantage of any commodities or services without necessarily having to recompense for them. The provision of public goods and services was the first area that this concept was applied. Initially, it described the benefit from services that the individual did not pay for.

This concept is not limited to economics. It has application in other areas such as antitrust law, political science, and other relevant fields. A free rider problem develops where individuals who free ride inhibit the provision of goods or services, leading in most cases to the overuse of a resource.

The provision of public services is the area that was initially dogged by the problem of free riders. However, this situation has also been described in other areas.

One example of free rider problem is where employees depend on a union for the representation of their economic and other needs. Most unions require that their members pay a certain amount of money to allow the running of the union. This fee is important in the running of the unions and effective representation of members.

Some members may resist the payment of representation fees while at the same time benefiting from the efforts of the union such as improved working conditions. If many members of the union do not pay their union fees, the union may not provide effective representation.

It may eventually disintegrate. The result is a failed provision of the services that were initially provided by the union. The presence of free riders in a group may also discourage other group members from participation, thus leading to the collapse of the group.

Figure showing the contribution and benefits of a party in an engagement t=constituting free riding.

Externalities

The economic concepts that have been discussed above relate directly to the industry in which the organisations operate. However, the effects of an industry may affect other industries and consumers who are not directly related to the involved industry.

The term ‘externality’ refers to overheads or advantages that any individual encounters obliquely from an industry without making the selection of deserving these advantage or expenses. Industries cannot exist in exclusion. Their effects are felt within the industry as well as other areas that are not related to the industry.

Externalities exist because of the universal nature of industries and the existence of integration, interdependence, and mutual reliance between different industries. Therefore, other individuals and parties that do not have a say on these effects can feel the effects of the industry.

An example of externalities is the environmental cost incurred by an individual, a country, or a party because of an industry such as the automobile and transport industries. Vehicle manufacturers make their profits from the sale of complete products or parts of their products. Consumers of these products benefit from them too, meaning that both parties have mutual benefits.

Some of the other parties that benefit from the industry include the petroleum industry where the organisations provide vehicle owners with the necessary fuel for their vehicles. Although environmental pollution is not an intended effect from the industry, there is significant pollution, which affects all individuals whether involved in the industry or not.

In this case, pollution is an externality for the above industry. Individuals who are involved in the industry often target to reduce these externalities, as they may have legal implications and obligations for the industry.

Monopolistic Competition

Monopolistic competition is a term in economics that is a combination of two terms, namely monopoly and competition. These terms are common in economic theories, with some being discussed in this paper. Monopolistic competition is a form of competition that fits in the category of imperfect competition.

In this form of rivalry, many competitors in a bazaar contend by producing commodities that do not have resemblance, and are thus not perfect alternatives of each other. Monopolistic competition entails the production of different products and services in the same industry, with the difference being mainly in the area of quality and brand.

This form of competition allows competitors to ignore the prices charged by their counterparts, especially the effects that these prices have on the industry and competitors. Monopolistic competition stems from the theory of monopolistic competition.

Markets with this form of competition have multiple producers and consumers, limited price differences, and barriers. The organisations have a significant control over the prices of their products.

An example of an industry where monopolistic competition is common is the toiletries industry, especially in the manufacture of tissue papers and toothpastes. In this industry, different manufacturers produce products that are essentially different in terms of composition or have different packaging materials. The use of product differentiation allows the marketing of these products as different entities within the same industry.

Different manufacturers provide different prices for their products. The change of contents and packaging in these products is in line with product differentiation, a concept that is described above. Therefore, competition is not direct since the organisations claim to offer different products for their clients and customers.

Perfect Competition

Perfect competition is another form of competition in economics that characterises the business environment. In perfect competition, an industry or market has no single dominant organisation. Hence, none of the organisations has the capability to fix prices for a product that is produced by the organisations.

There are few markets, if any, with perfect competition, with this situation being contributed by the presence of strict conditions that the market must fulfil to qualify as having a strictly perfect competition.

However, few examples of perfect competition are evident world over, with the best examples of this form of competition existing in some markets that auction their products. The key players in these markets may attempt to approximate this form of competition. However, few have achieved this form of competition.

Limited examples of perfect competition are available, with the best being the stock exchange markets of different countries. These markets are the closest in resemblance to perfect competition, with the only limiting factor being that some large companies and investors may influence the price of shares and their purchase.

The flaw that is available in stock exchange markets allows the scanty application of perfect competition as a concept. However, most of the institutions and organisations that deal with a normal supply business bazaar have no capability to control the value of share or supply.

Hence, this industry is one of the few that have resemblance to perfect competition in economics. The existence of perfect competition in any economy through the regulation of stock exchange may influence the economy in a number of ways, thus leading to the positive performance of various sectors within the economy.

Industry Concentration

Industry concentration constitutes one of the other concepts of economics that apply in several industries and countries. The concept relates to the structural characteristic of a market, or the proportion by which an economy is concentrated in terms of firms and organisations.

This concept is currently considered one of the indicators of economic performance, as opposed to the traditional view where it pointed to the failure of a market or economy. The traditional view of this concept led to the formation of many regulations in different economies, with some of the controls still existing in some of these economies.

However, the modern-day view has contributed to the theory that industrial concentration is a positive thing. Different units have been used in the measurement of industrial concentration, including the concentration ratio, with the other measure being the Herfindahl-Hirschman Index (HHI).

Industrial concentration for any economy may be estimated from the available statistics in the economy, with the most important of these indicators being the number of organisations in any industry and their market share. An example is the estimation of industrial concentration in the Unites States economy. The United States authorities consider an industry concentrated if the HHI exceeds a fixed figure (1,800).

Some of the industries with HHI that exceed the figure set by the authorities include the glass industry, motor vehicle industry, and some other industries such as those that are involved in the manufacture of breakfast cereals.

The availability of this value allows the government, policymakers, and investors to make decisions on the best policies and decisions in investment. Therefore, industry concentration is an important concept to estimate in any economy.

Free Riding

Free riding as a concept in economics is related to the conception of free riding problem that has been discussed above. In economics, fee riding means that an individual or company gets the advantage of a product or services without having to pay for the cost of this product or service.

If many individuals and organisations participate in this move, the economy and industry within which they operate may suffer significantly. However, the term may apply in the stock markets, as opposed to the free rider problem that applies widely within economics and business. While applied in this sense, free riding means the purchasing of securities and shares without the necessary finance to carry out this transaction.

Some individuals may purchase these shares at a given price without having to actually pay for them. They have a plan to sell them to other individuals before they can settle stock transactions, which usually take three days. The concept of free rider is used by individuals who look to make fast cash by buying shares at one price and sell them at a price that guarantees profit without having to spend the equivalent amount of money.

Free riding is a violation that may attract penalties and suspension from trading for a given period. The concept is favoured, especially in the United States where stocks can only be settled within three days.

This concept of buying shares and having to pay for them within three days of purchase is commonly referred to as the trade day +3 (T+3). Authorities in this country are responsible for the control of these transactions, with the FRB (Federal Reserve Board) being responsible for any inconveniences.

Collusion

As stated earlier, competition is a key factor in economics. Many organisations spend millions of dollars to ensure that they have the competitive advantage over their competitors. Some of these organisations often engage in secretive agreements with other organisations or parties to influence the market or gain some form of advantage over their competitors.

Collusion is a concept in economics where two or more parties agree, either legally or illegally, to engage in the limitation of open competition through practices that may undermine, mislead, negatively affect other parties, or achieve some goals in the market that are not allowed by oversight authorities.

These organisations may decide to curve up the market, inhibit the production of the necessary goods and services, or lead to the limitation of opportunities in the industry and economy. Some of the previous collusions in history have even led to wage fixing.

Collusion in economics can simply be defined as the practice of rival companies partnering for mutual benefit in the industry or economy at the expense of other markets and industry players. An example of collusion in the United States is when some of the basketball teams in the major league tried to limit the earnings of team members within the confederation in the 80s.

Owners of these teams wanted to limit the increase in the amount that was paid to players to bring down the operational costs for the teams to ensure continued profitability. Key industry players opposed the move.

The direction led to the existing laws and regulations on the same. The 60s were characterised by collusion between major electrical manufacturers in the US. The plan saw the dawn of price-fixing and division of the electrical market.

Predatory Pricing

Modern-day businesses and organisations depend on competition. Organisations that compete better survive longer in relation to those that are less competitive. One common concept that is applied in economics that relates to competition between organisations is the predator pricing.

Predatory pricing is the provision of goods or services at a significantly low price with the intention of driving out competitors or preventing the entry of new competitors in a specific industry.

When competitors are unable to provide their goods and services at a low price, they are forced to exit the market, thus allowing companies that practice predatory pricing to exist in the industry for longer while controlling the pricing of these commodities.

By the provision of predatory pricing, an organisation may succeed in the establishment of a monopoly, which may be favourable to its overall success. This concept is mainly practiced by large organisations that can sustain small margins of profit.

An example of predatory pricing may be found in retail outlets that offer their customers low prices for goods. An example of predatory pricing in this area is amazon.com that provided delivery of its merchandise to the French bazaar at no cost in contravention of the French rulings that related to this concept.

The organisation continued to provide free shipping of its products to its customers in this country, despite incurring a daily fine. The provision of free-shipped products to the French market led to the development of a large market for the organisation, which unsettled other competitors within this market.

Some of the companies that could not withstand the new pressure and competition had to exit the market, with some of the others looking for legal reasons to suspend free shipping by amazon.com.

Cartel

The term ‘cartel’ is commonly used in economics. As opposed to collusion that is an illegal agreement between parties that are often a disadvantage of other parties and organisations, a cartel is formal. Competing parties engage in formal agreements that lead to price fixation and control of other areas of market and industry such as the production of goods and services and their marketing.

Cartels are mainly in industries and economies that have few key players. Hence, they exist in oligopolies with limited numbers of producers and distributors. The most common form of agreement in cartels is price fixation, which leads to mutual benefit for these partners.

The entry of market competitors into cartel agreements leads to favourable operating environment for the parties, with the result being an increase in the amount of profits that each of the players is expected to get. Collusions are difficult to dismantle. Competition laws are some of the tools that are used, although ineffectively, to achieve this goal.

Examples of cartels can be found in the mining industry where companies form them (cartels) to control the profits that they attain. The petroleum mining industry is one of these industries, with some of the oil producing countries making cartels that set the global oil prices to ensure they attain the best prices for this commodity.

Profits that are available to these organisations are also multiplied through engagement in these cartels. The Organisation of the Petroleum Producing Countries (OPEC) is one of the organisations that are involved in the fixation of prices in the global oil market. This organisation allows member countries to achieve the best prices for their oil.

Quantitative Easing

Quantitative easing is another widely applied economic concept. This concept refers to a form of policy that is applied by central banks of nations that are unable to stimulate economic performance through the application of conventional monetary policies. The central bank in these countries buys assets from other companies such as bank to ensure that the asset value is raised with a concurrent raise in their yield.

The action by the central banks also results in an increased monetary base for the organisations. As opposed to the conventional purchase of short-term bonds and securities, the application of qualitative easing by the central banks allows them to purchase these assets for a longer period, hence influencing the performance of an economy by stimulating economic growth.

The United States is one of the nations that have applied quantitative easing as a major part of its monetary policy. The country used quantitative easing in the purchase of mortgages after the global economic crisis, which led to improvement in the country’s economy whilst resulting in growth in the same area.

The Federal Reserve also continued to buy these assets even after the global economic crisis to stimulate satisfactory growth in the economy. The purchase of mortgages in the economy was perceived as one of the main effective ways in the stimulation of the federal economy.

This take had positive effects, including the resolution of the crisis. The other area that the Federal Reserve invested in is the reduction of unemployment that was a constant threat to the economy of this country. The result of the quantitative easing led to improvement in the economy of the nation, with the interest rates and inflation being controlled effectively.

GNP (Gross National Product)

The GNP (Gross National Product) of an economy is another important concept that is widely used in the description of economies world over. The total value of all products and services that a country produces in a given year constitutes the GNP of that country.

The main difference between this value and that of the GDP is the tag on which production is made on. In the GNP, manufacturing is addressed with respect to the possession of these services and commodities while the GDP describes it with reference to a single ecological region. The GNP of a nation may be described as the total earnings that the nations and its people make per annum.

The total manufacturing of a state may be measured in the form of worth of all services and supplies that it is able to generate, including the revenue received by its populace from overseas. A superior GNP means that a country is performing well.

On the other hand, poor performing countries report a GNP that is significantly lower than that of other nations. On the contrary, GDP defines the cost of productivity that is made within a nation’s perimeter, whether alien businesses add to this worth or not. The difference between these values is also important in assessing the performance of an economy.

An example of GNP is that of the US that was reported at $14.27 trillion in 2009. The difference between the GNP and the GDP may be demonstrated by the values that were obtained in this country in the same year, which stood at $14.12 trillion. Both of these values are important measures of economic performance. However, the GDP is more significant as a gauge of financial status.

Comparative Advantage

Comparative advantage is another concept in economics that is related to competition within an industry. Comparative advantage essentially means the capacity of an organisation or business to offer its merchandise at a reduced price (both marginal and chance overheads) compared to that of other similar organisations.

Comparative advantage is mainly used to describe the production opportunities for different countries by comparing the costs of production within these countries.

The comparative advantage between countries defines the possibility of trade between countries and the products that they can trade in. A nation with a relative gain in one commodity may provide it to other states that do not enjoy the benefit.

Comparative advantage may be applied in the countries that are unable to produce certain products. Trade between countries allows the deal of products that are efficiently produced in other countries. Therefore, this concept does not act as a limiting factor for trade between nations, and hence the reason for the existence of trade between them.

An example of the application of comparative advantage is where a country produces more vehicles than coffee because of automation. The other country may produce more coffee with few or no vehicles being produced. The first country enjoys a comparative advantage in the production of motor vehicles as opposed to the second country that has a comparative advantage in the production of coffee.

However, these countries can make up for their deficiencies through trading in these commodities. This strategy is one of the ways that international trade occurs. Trading in these commodities allows countries to acquire products that they do not have.

Monetary Policy

Monetary policy is another widely used economic term. Governments world over and other financial authorities are involved in the protection of their countries’ economies using special policies that are aimed at controlling the availability of money in the economy.

A monetary authority in a nation may use monetary policy as a means to stimulate, control, and sustain economic growth and stability in the nation. Some of the measures that guide monetary policies include unemployment rate within the economy, inflation, and interest rate.

Traditionally, governments have had to carry out the functions of special monetary authorities. Special branches of the authorities have been created to ensure that the monetary policy is respected.

The chief authorities that are responsible for the maintenance of stable economic environments in countries are also responsible for the monetary policies in these economies and nations. The other function of monetary policy in a nation is to provide the assurance that the economy is performing as it should, hence attracting the foreign and local investors who further strengthen the economy.

An example of a monetary policy is the target to reduce inflation within an economy where monetary authorities that intend to affect the consumer price index control the interest rates. The institution of monetary policy to lower inflation is a common practice in many nations.

It was widely practiced in the period following the global economic crisis. Effects of the policies that were instituted in the period included the resolution of the crisis and the normalisation of the global economy. Central banks of respective countries are involved in the formulation of monetary policies.

GDP (Gross Domestic Product)

The Gross Domestic Product (GDP) of a nation is used as an indicator of economic performance. This economic measure is used as a standard while comparing the performance of many nations. It denotes a shift from the GNP that was initially used before the use of the GDP. The GDP of a nation can be described as the cost of all commodities that a nation makes per annum.

This value is used as a means of comparing the performance of economies, with the GDP per capita providing the benchmark of living in the nation of interest. The Gross Domestic Product of a country may also be described as the production within a given geographical zone.

Traditionally, nations used the GNP as a measure of economic performance and a comparison between economies. However, this measure takes into consideration the investments of citizens in other countries while the GDP restricts the value of goods and services to the same geographical area. While the GNP and the GDP are related, these values are essentially different.

They depict different aspects of an economy. Methods that are used in the calculation of GDP ensure that countries whose GDP is calculated can be accessed on the global scale in terms of their economic performance. An example of Gross Development Product is that of the United sates economy where the country recorded a GDP of $14.199 trillion in 2009.

The country recorded one of the best GDP in the same year. Other nations that have better GDPs include Singapore and China. A comparison of these GDPs provides a trend in performance of a country over the year

Absolute Advantage

Absolute advantage is another concept in economics that relates to how well a party is able to compete. This term is used to define the ability of a party to offer higher quantities of a product as compared to what is offered by their competitors. However, for the term to apply, both parties have to use similar resources to attain the outputs that are compared in absolute advantage.

International trade is the main area that the principle of absolute advantage is applied, with comparison taking place between companies and countries.

The concept of absolute advantage can be contrasted to that of comparative advantage in that comparative advantage involves a comparison of the opportunity cost. Absolute advantage consists of a comparison of production capacities for organisations, including the labour that is put into production of certain products.

An example of absolute advantage is where a party can produce five goods using four employees while another company can produce ten of the same goods using the same number of employees in an hour. If the employees receive the same compensation for their services in the organisation, the second company has an absolute competitive advantage over the first organisation.

The reason why the second company enjoys this competitive advantage is that it can produce twice as many products as the first company, although with the same number of employees working for the same period.

The determination of absolute advantage in organisations allows the companies to determine the trading partners and the right policies for the organisation. The concept is also widely applied in economics in the determination of organisational and economic performance.

New Trade Theory

The new trade theory is another concept that is applied widely in economics, especially in international trade. New trade theory consists of a combination of models that are applied in the international trade. Some of the main models that are available in the New Trade Theory include economies of scale and the assessment of network effects in a variety of industries.

The above models may be significant to influence comparative advantage as a concept that was traditionally held in economics. The determination of opportunity cost in the international trade may lead to poor results, as some countries have no differences in some of their respective industries.

The result of the comparison in opportunity cost for different countries, which can lead to equal opportunities for different countries, may need the application of the New Trade Theory.

An example of the application of the new trade theory is in the estimation of the performance of some industries in the developing nations in comparison with that of the developed nations. The application of the theory demonstrates that developing nations may have significant efforts to put to catch up with similar industries in the developed nations.

Developed nations enjoy economies of scale as opposed to developing nations that are dependent on the few resources that are at their disposal. Most of the developing nations have economies that are not as competitive as the developed nations’ economies.

The result is that smaller economies do not perform well in relation to the different economies. The theory has also been used over the past to compare the performance of several economies globally.

Fiscal Policy

Fiscal policy is another form of policy that is applied in economics in addition to monetary policy. Fiscal policy is employed by administrations in different countries to influence their economic performance through the manipulation of revenue collection and government spending. Fiscal policy is one of the main ways that governments influence their economic performance.

Any government can influence its economy thorough taxation measures where the amount of taxation and the component of the taxes are adjusted to make changes to the economy. Increasing or reducing taxation has a direct effect on the national economy, and so does changing the areas of spending and the amount of spending that an economy carries out.

Fiscal policy is one of the major macroeconomic variables. It affects other variables such as resource allocation and income distribution in an economy. Fiscal policy has been the main tool of different economies in their attempted control of different sectors of the economy. Financial position and performance may be altered through the modification of levy and administration expenditure.

Unlike the monetary policy that is under the control of monetary authorities such as central banks of the respective countries, fiscal policy is under the control of legislature and government executives within a country.

An example of fiscal policy was applied in Greece when the economy was underperforming in the wake of the global economic crisis. The country had to institute a number of fiscal policies to rescue the economic situation, with the results being the stabilisation of the economy. The fiscal policy that was instituted in Greece led to the economic recovery that is still being experienced today.

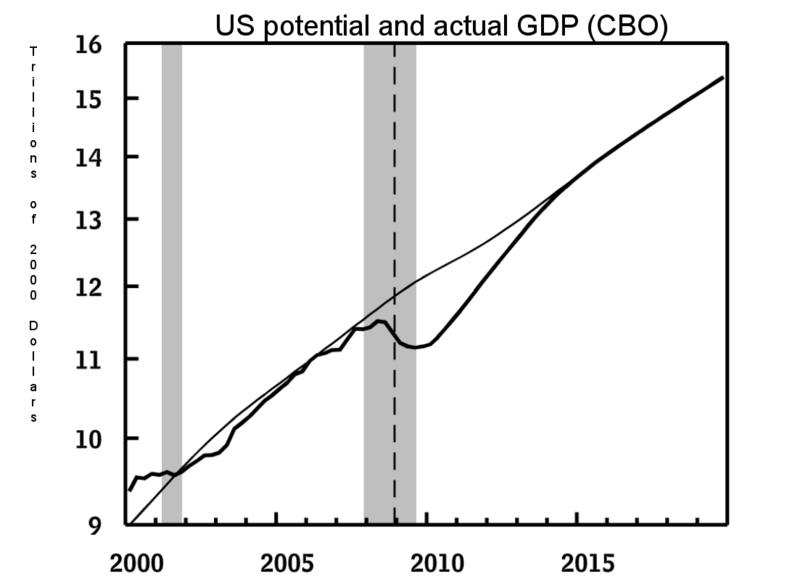

Output Gap

The output gap is another economic concept that has significance in the determination of economic success and performance. For the calculation of this gap, one has to have the actual and potential GDPs for the country of interest. If the difference between the actual and potential GDP is a positive value, this output gap is often referred to as the inflationary gap, which often indicates growth in demand against supply.

A negative gap is referred to as the recessionary gap, which indicates that the economy is going through deflation as opposed to inflation. The obtained value may then be used in the calculation of other economic variables, which are important in the estimation of economic performance and strength.

The calculation of output gap in the economy may be important in the development of policies to assist in the development of an economy. An example of the use of this output gap to make policy decisions is in the US where the output gap ensures the development of several Acts to cater for the economic performance.

The two main Acts that resulted from the US attempt to normalise the output gap include the American Jobs Act and the Jobs through Growth Act.

These Acts were meant to stimulate the economy of this nation into performance in the process ensuring that the output gap closes. The calculation of the output gap also contributes to the calculation of other economic variables that are important in the overall economic performance.

Graph showing the Potential GDP against actual GDP for the United States over the last few years.

Porter’s Diamond of Competitive Advantages

Porter’s diamond of competitive advantage is a common concept in economics that is applied in international trade as well as economic analysis. Comparative advantage as proposed in classical theories is dependent on the nature of a country in the form of the available resources such as minerals, fertile land, labour, and a large population.

However, Porter asserted that an economy could create an advantage for itself through new formation of new economic advantages such as the provision of skilled labour use of the latest technology and the provision of support from the existing institutions.

The factors were captured in a diamond-fashioned illustration that Porter used to exemplify the concept of country’s benefit. Countries may use the factors in this diamond to influence their industrial and economic performance.

Porter’s diamond consists of four main factors that are under the influence of other factors. In factor conditions, the country and local authorities determine some of the factors of economic performance. As indicated in the diagram, demand conditions obey the law of supply and demand. An example is when a nation with a challenging confined bazaar develops a countrywide benefit.

Related and supporting industries in the economy can affect the economy positively if they are strong enough. Firm strategy, structure, and rivalry also affect the competitiveness of a country on the global front and their comparative advantage.

The four characteristics and elements that are found in Porter’s illustrations affect the competitive benefit of a nation and in the end the fiscal performance. These elements are represented in the figure below that was proposed by Porter.

Figure showing Porters diamond of competitive advantage.

Unemployment

Unemployment is a macroeconomic factor that is commonly used to gauge the economic performance of a country. Unemployment is the state of joblessness in a country. A large group of qualified workers is looking for employment. When economies are going through recession, the unemployment rate is usually high in relation to the low rate that is observed in the presence of good economic performance.

The unemployment rate can be used as a comparison value for the performance of various economies throughout the world. Countries with a high unemployment rate can be considered performing poorly compared to those with relatively low unemployment rate.

The global unemployment rate is also an important value in economics, with the value standing at 6% in 2012. A comparison of unemployment rate during different periods in the history of a given country may be used to estimate the changes that have taken place over time.

An example of unemployment rate is in the comparison between the economy of the UAE and that of China. Dubai has one of the lowest unemployment rates in the world. This rate is an indicator of good economic performance. The average rate is at less than 4% with that of China being at 11% over the same period.

The comparison shows that the UAE has a relatively better performing economy compared to that of China. However, as facts demonstrate, there is a need to use other values to evaluate the economic performance and/or compare between nations and economies.

Figure showing the relationship between unemployment and economic performance