Aviation and air travel are some of the fastest developing industries in the contemporary world. It seems unbelievable that the industry managed to reach the modern, advanced stage over less than one hundred years after being established at the beginning of the 20th century (Gildner et al. n.d.). Today, aviation is one of the most popular modes of transportation, an industry that penetrates multiple aspects of everyday life of the contemporary society, and serves as the driving force for some of the largest businesses in the world – tourism and travel.

Being an oligopoly, the industry is extremely competitive as the airline businesses have to adjust their prices to all types of internal and external changes in the market economy. Additionally, the businesses within this industry are facing a variety of global, sociocultural, and legal challenges such as the environmental concerns and policies, the growing risk of terrorist attacks targeting airplanes, and the ongoing debates over the rights of the passengers and safety procedures. Emirates Airlines is one of the largest competitors in the industry and is known for very high standards, excellent performance, and never-ending drive for innovation and improvement (Campbell n.d.). Nonetheless, it is also a subject to political uncertainties that negatively influence travel demand (Article 3).

The aim of this paper is to explore Emirates Airlines and how it functions within the airline industry. The paper will explicate the company’s operational processes in the framework of several economic models and concepts. It will also assess global challenges faced by the airline and provide recommendations on how it can gain a competitive edge in the industry.

Demand and Supply

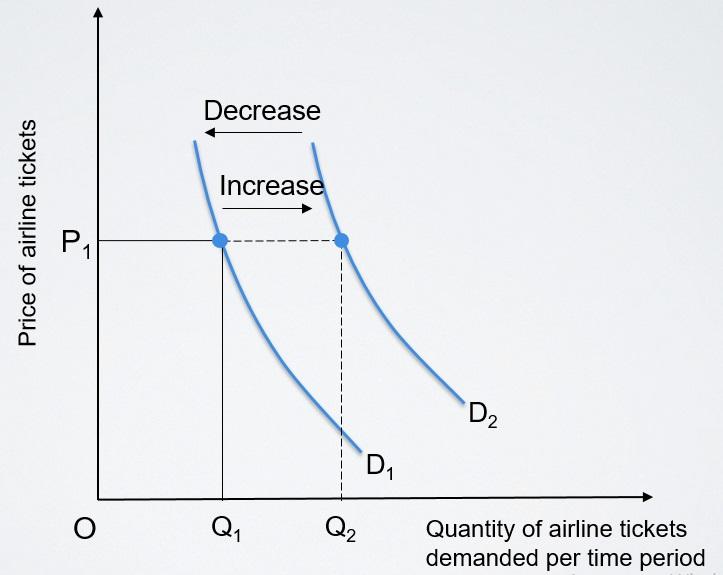

Demand in the airline industry can be considered “a function of the number of non-stop routes that an airline industry serves out of the origin airport” (Ciliberto, Murry, & Tamer, 2015, p. 26). Moreover, such variable as a distance between departure and destination airports is recognized to influence demand (Ciliberto, Murry, & Tamer, 2015). Figure 1 shows shift in a demand curve for the company’s services.

The demand for Emirates Airline is driven by almost 5 billion people that live within a seven-hour flying radius to the UAE (Squalli 2013). Tourism to other countries of the Middle East also contributes to the demand. Given that the company is owned by the Dubai government, it is not bound by restrictions imposed on other carriers. Therefore, it explores a significant portion of air passenger traffic in the region.

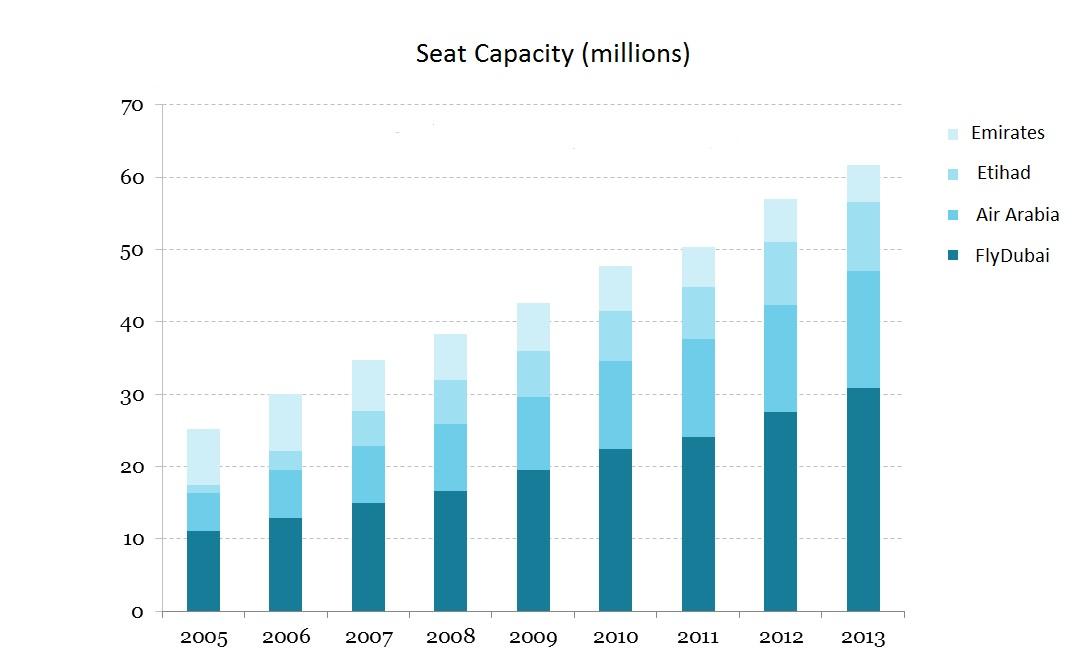

The supply in the industry is presented by the following companies Emirates Airline, Air Arabia, Etihad, Ras Al Khaimah Airways, and FlyDubai (Squalli 2013). Emirates Airline has the largest fleet in the industry consisting of 197 aircraft and provides its services to 39 million passengers per year (Squalli 2013). The company expects that it will experience a demand that will surpass 75 million passengers in three years (Squalli 2013).

Market Structure

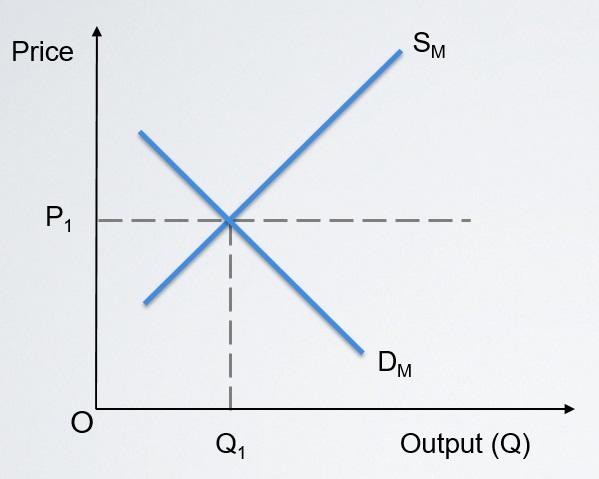

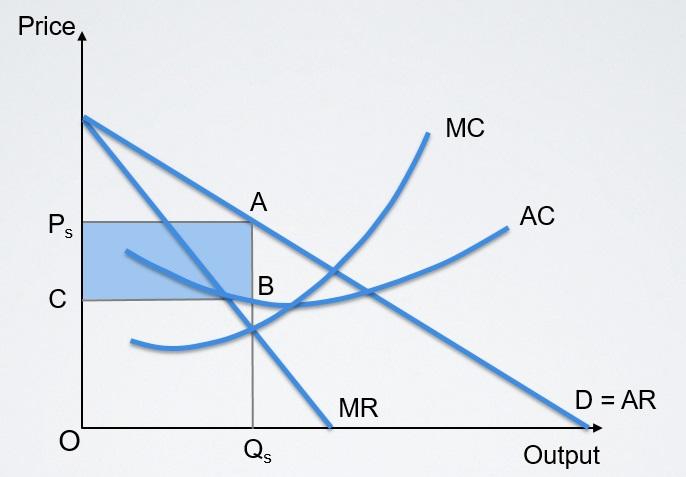

The market in the airline industry can be described as “a unidirectional trip between two airports, irrespective of intermediate transfer points” (Ciliberto, Murry, & Tamer, 2015, p. 25). The market in the UAE is composed of the five carriers mentioned in the previous sub-section of the paper. However, Air Arabia, Emirates Airline, and Ethihad share the majority of air traffic in the region (Squalli 2013). Figure 2 shows how the market would look under perfect competition.

Emirates Airline has the largest carrying seat capacity that reaches 62.6 million seats per km (Squalli 2013). Figure 3 shows the growth of the four major carriers in the UAE in relation to seat capacity. It is clear that Emirates Airline’s seat capacity is only matched by that of Etihad (Capstats 2017).

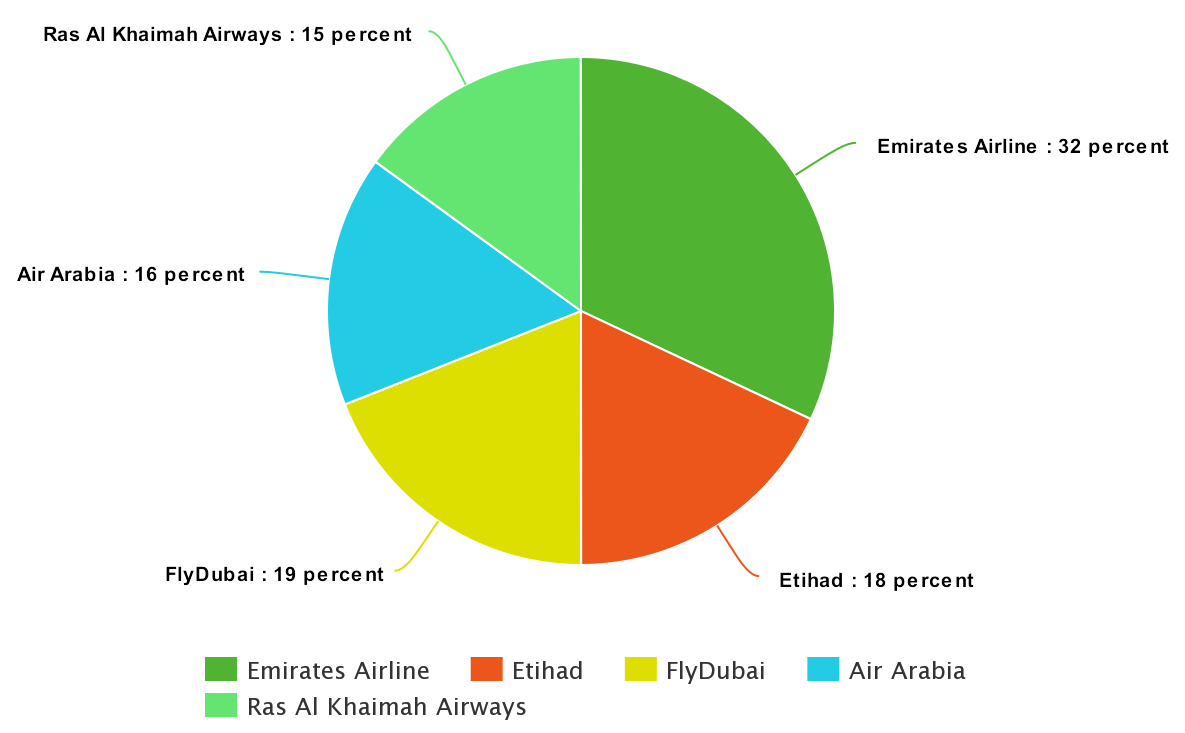

The chances of new players entering the market are low due to the fact that the country’s government imposes severe restrictions on the industry, thereby creating barriers to entry. Taking into consideration the fact that the airline market in the UAE is controlled by only five carriers, the industry can be considered an oligopoly. Figure 4 depicts the industry’s market share.

Figure 5 shows the market under monopolistic competition.

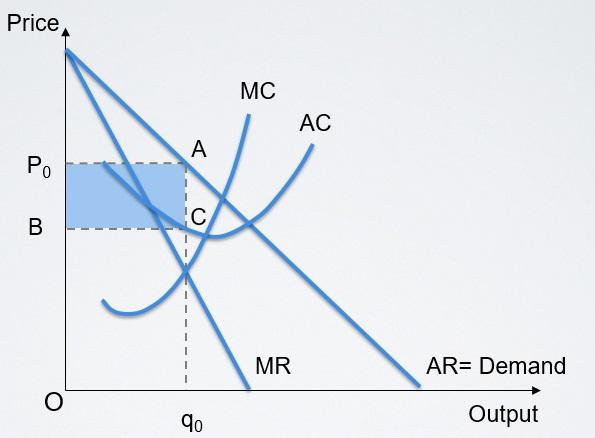

Figure 6 shows monopolistic market

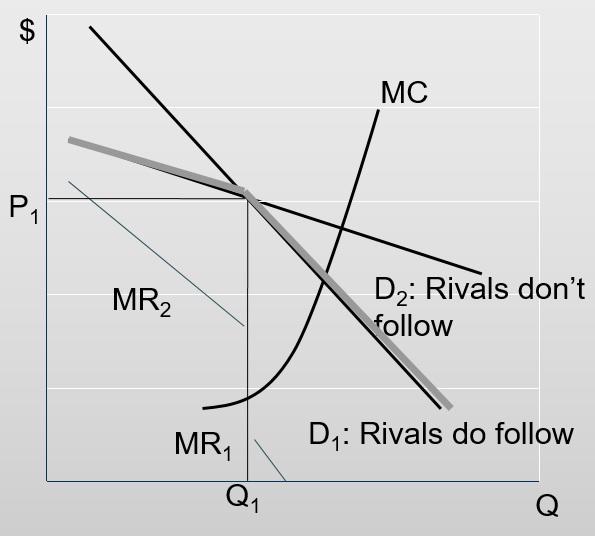

Figure 7 depicts non-collusive oligopolistic market.

Price Discrimination

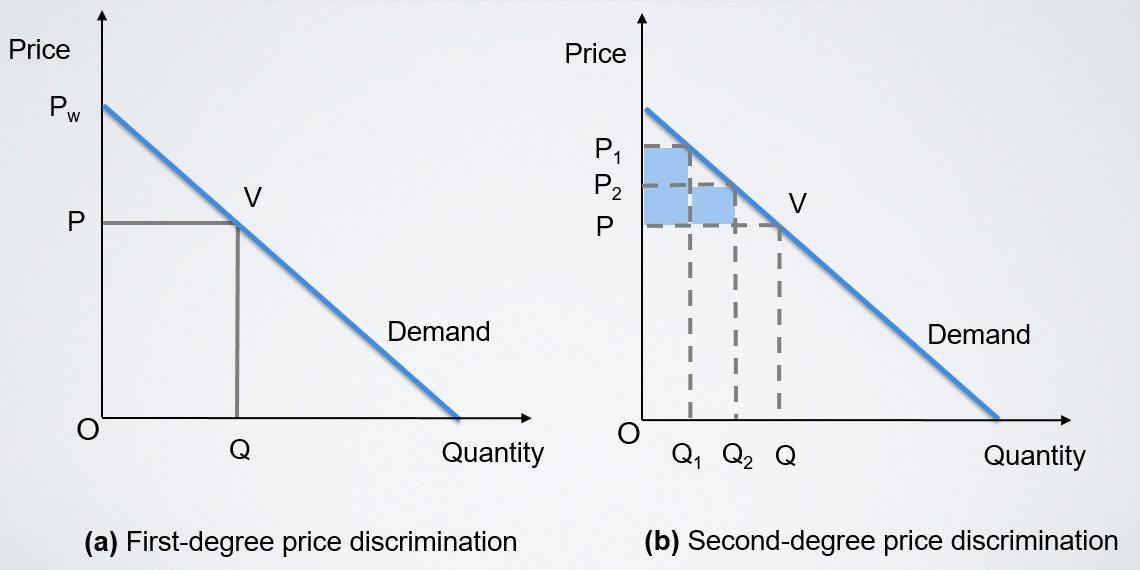

In terms of price discrimination, the UAE airline industry is not different from airline industries in other countries. Time of ticket purchase is the main use of demand elasticities in the market. Ticket prices are changing with time, thereby allowing Emirates Airline, as well as other companies, to explore inelastic demand. In this way, the company captures maximum consumer surplus (Pettinger 2014). Price-sensitive customers are attracted to purchase tickets with early-bird discounts. The carrier also explores other price discrimination strategies that include, but are not limited to cheaper unsocial hours and different classes. Figure 8 shows two degrees of price discrimination.

Global Challenges

According to Campbell (n.d.), the most significant threat for Emirates Airline “may lie in the US, the world’s most lucrative travel market” (p. 36). It has to do with the fact that aggressive expansion moves in some of the most important American destinations such as Orlando, Dallas, and Seattle among others, have led to the initiation of a lobbying campaign against the carrier that is being pushed by American airline companies (Campbell n.d.).

The campaign is not limited to Emirates Airline but also includes other Gulf carriers. Air transport liberalization is another global challenge faced by the company. It can lead to more competition that will inevitably diminish the carrier’s market share. Taking into consideration the fact that the company has invested millions of dollars in the expansion of its carrying capacity, it is at risk of downsizing its fleet if emerging markets in the Global South show the decrease in demand (Campbell n.d.; Squalli 2013).

Conclusion and Recommendations

Emirates Airline is a successful carrier that operates in one of the fastest growing markets in the world. In order to develop and sustain a competitive edge in the industry, the company has to consider expanding its market to include more destinations in Canada and Latin America. By doing so, it will be able to explore Canadian market, which has not been substantially influenced by the economic recession, and to capitalize on growth opportunities offered by the emerging markets of Latin America. The company should also expand its cargo business.

Reference List

Campbell (n.d.)

Capstats 2017, Data content. Web.

Ciliberto, F, Murry, C & Tamer, E 2015, Market structure and competition in airline markets, DIW. Web.

Gildner, A, Babusca, R, Eisenhart, A & Zlata, M (n.d). ‘The status of the airline industries in the United States’.

Pettinger, T 2014, Airline price discrimination. Web.

Squalli, J 2013, ‘Airline passenger traffic openness and the performance of Emirates Airline’, The Quarterly Review of Economics and Finance, vol. 24, no. 1, pp. 11-19.