Abstract

There have been a lot of changes in the economic status of each and every country in the world over the last century. This is attributed to a number of factors. One of the major causes of this is the industrialization and civilization of countries.

In the last century, many countries have shifted from agriculture and other primary sources of income to industrialization. New Zealand is one of these countries. This paper will discuss the current economic status of New Zealand and its prospect of a more stable economy in the coming one or two years. In order to achieve this, the paper will mainly focus on the Gross Domestic Product (GDP).

Since factors affecting the GDP also have a significance effect on the macroeconomic stability of a country, they will also be discussed in detail. Some of this factors are the level of consumption of the country’s population, the level of savings and investment and the government’s fiscal and monetary policies. Primarily, this paper seeks to clarify the point that New Zealand’s economy is slightly resilient and will probably become even more stable in one or two years’ time.

The Economic History Of New Zealand

In order to determine the growth rate and progress of the economy of New Zealand, it is necessary to look at its past economy. Until the second half of the twentieth century, New Zealand was a traditionally agricultural country. Agricultural goods formed the bulk of the country’s exports. This was long after the deposits of gold in New Zealand had been exhaustively mined. Some of these goods were dairy products such milk and cheese, wool, fruits, vegetables, meat and forest products.

The entire agricultural system was efficient hence a lot of revenue was collected from the sector. The rich agricultural harvest were influenced by fertile soil and abundant rainfall received throughout the year. New Zealand’s economy wasn’t resilient by then due to the fact that the country imported almost twice as much as it exported. The income earned from exports was barely sufficient to pay for the importation of other significant goods that lacked in the country.

Until 1973 when it joined the European Economic Community, the United Kingdom was the main trading partner of New Zealand. After this year, New Zealand suffered a tremendous slump due to reduced export of its products to the United Kingdom. Such circumstances have prompted New Zealand to diversify its sources of revenue. If this was to be achieved, the country would no longer have to depend on agriculture as the main source of revenue.

It also won’t be affected much if the market for agricultural goods or their price tumbles down. This decision has seen New Zealand regain its earlier trading partners and even attract other foreign markets. Currently, its main trading partners include the United States of America, Japan, the United Kingdom, China, Australia and the Republic of Korea. With such powerful and relatively financial stable trading partners, New Zealand’s economy will probably get better in the following years.

Current Economic Activities In New Zealand

The transition of New Zealand from an agricultural economy to a market economy has led to the tremendous growth in its economy. Currently, the country has a lot of manufacturing and service industries. These industries are appropriately planned and managed for the economic empowerment of the citizens and the country at large.

The industries are also manned by efficiently skilled and highly trained and qualified personnel that have the interests of the country’s economy at heart. Apart from the locally available labor, New Zealand also hires the services of professional experts from neighboring countries such as Australia.

Apart from abundant and quality labor supply, New Zealand boasts of a highly technological and computerized production process. The country has implemented and also imported the latest technology in the world that not only speeds up the production process but also ensures high quality output (Taylor and Henisz, 1994, page 156).

The machines have greatly helped to cut on the production costs. The overall effect is that goods and services produced are offered at affordable prices to both the local and international market. This is the exact reason why New Zealand is making it big in the international market.

The Role Of International Trade In New Zealand’s Economy

New Zealand’s economy is greatly dependent on International Trade. In fact, most critics say that the economy of New Zealand owes its growth to Foreign Direct Investment (FDI). According to Arthur (2000, page 38), exports form a large percentage of the country’s revenue.

An estimated value of US $ 83 billion of New Zealand companies is owned by foreign parties, including whole governments, organizations, or at times rich individuals. It is common to come across clusters of businesses in New Zealand that are owned by foreign investors. International trade has been fostered by a number of factors:

Political Peace And Stability

New Zealand maintains a smooth relationship with almost all the countries in the world. In the recent past, New Zealand has not been involved in any war or conflict. As a matter of fact, it is ranked among the most peaceful nations in the world. Political peace and stability are what have boosted international trade in New Zealand to greater heights.

A lot of businesses have been established in New Zealand by foreign countries due to this peace and stability. The investors are assured of security and benefit because of the conducive business environment provided by a sound political system.

Most of the investments in New Zealand are owned or controlled by foreign countries. It is estimated that the USA alone has injected a total of U.S $ 2.3 billion into the economic system of New Zealand. In fact, business ties between the United States of America and New Zealand have always been there. Some US-based companies also have branches in New Zealand. This is because they can rely on the prolonged bilateral ties that have existed between New Zealand and the United States of America (Shooks and Lewis, 1981, page 34).

The establishment of the American Chamber of Commerce in Auckland, New Zealand points to the fact that foreign companies feel secure with their investments in this country. Furthermore, in a survey dubbed ‘Doing Business 2008’ by the World Bank, New Zealand was ranked the second most business friendly country in the world. This contributed to an increase in the number of investors streaming into the country every year.

Lack Of Unnecessary Bureaucracy

Investors prefer doing business in a country where there are little or no unnecessary procedures. A country with such officialdom scares away investors. When it comes to starting a business, New Zealand has easy procedural steps for an investor to start a firm in the country (Potter and Spires, 2002, page 78).

While other countries insist on tireless paperwork that can take months to be completed, New Zealand has put in place an efficient system that enables a foreign investor to start business in the country within twelve days only. This is one of the reasons why the country was ranked at 99.9% in matters relating to “Business Freedom” and 85% when it comes to “Economic Freedom.” Government control, conditions of the labor market and property and ownership rights are also favorable to foreign investors.

Free Trade Agreements

New Zealand has engaged in a free trade agreement with Australia. The two are in a partnership called Closer Economic Relations (CER). Under this partnership, goods and services are traded freely between member countries. Both the two countries have mutually benefited from this scheme.

Goods and services from New Zealand have been open to a market of about twenty five million prospective customers in Australia. In the same manner, New Zealand has served as a major market for the goods and services from Australia. A major achievement on the side of New Zealand as a result of this agreement is that a total of 19% of its exports are imported by Australia

New Zealand has also signed free trade agreements with other countries. These are Singapore, Chile and Brunei. The trade agreement, known as the P4 agreement, has been of substantial importance to the member countries. Of most significance is that these member countries will never lack a market for their goods.

They are also least affected by the instability of commodity prices in the international market. Furthermore, each of the member countries utilizes its comparative advantage to produce only goods that it can produce easily and efficiently. It can then easily acquire the other goods which are best produced by other member countries.

From the above discussion, it can be inferred that international trade has been of much significance to the economy of New Zealand. If this smooth international relations are anything to go by, then the economy of New Zealand is set to experience a major boost in the next one or two years.

Current Economic Situation Of New Zealand

New Zealand is currently recovering from the global financial crisis which began in 2007. Prior to this financial crisis, New Zealand was again struggling to gain ground after the Asian financial crisis of 1997 to 1998. Although the New Zealand economy is generally struggling to be stable, there is a prospect of much stability in the years to come.

This is because there is a general economic slump throughout the world and New Zealand is no exception (Bannock and Peacock, 1989, Page 27). This section will look at today’s economic situation of New Zealand basing on its GDP figures.

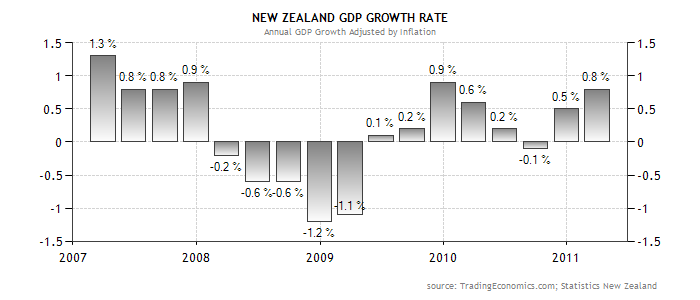

The Gross Domestic Product of New Zealand has been experiencing gradual growth. Over the years, New Zealand’s GDP growth had a quarterly growth of 0.56. However, the growth has been encountering a series of highs and lows. During the times when the economy was doing well, the GDP growth was growing at an impressive percentage.

A good example of this is in 1999 when it hit an impressive mark of 2.7. On the other hand, the GDP growth rate was low at times when the economy was doing poorly. A good example of this is the year 1991 when the GDP growth rate hit the lowest mark in New Zealand history, which was -2.60. The figure below is a representation of the trend in the growth of the Gross Domestic Product of New Zealand in the last four years.

Source: TradingEconomics.com; Statistics New Zealand

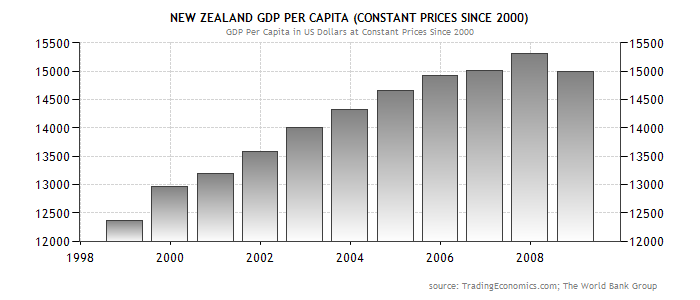

The Gross Domestic Product Per Capita of New Zealand has also increased significantly over the years. This has been as a result of increased production due to increased efficiency and reduced costs of production. Currently, the GDP Per Capita of New Zealand stands at 14995 US dollars. The value of the GDP Per Capita was at its record highest in 2007; 15308 US dollars.

This was probably before the serious consequences of the 2007 global financial crisis set in. Although New Zealand has a low GDP Per Capita compared to other Western economies, the rate at which it is growing is promising. It is with no doubt that with such a trend, New Zealand’s economy is going to become more stable than ever in the coming one or two years.

The figure below shows the value of the GDP Per Capita of New Zealand from the year 1998 to 2008.

Source: TradingEconomics.com; The World Bank Group

As seen from the above diagram, the GDP Per Capita has been growing steadily from 1998 to 2008. This is a positive trend about the economy of New Zealand because it portrays the high probability of a better economy of the country in the coming years.

Challenges Facing The Economy Of New Zealand

Although New Zealand is on its way to a more stable economy, there are various hindrances that stand in its way to this achievement. Some of these hindrances are internal while others come from external forces. The internal barriers can be overcome, as it will be seen later.

The external forces such as a global financial crisis cannot be averted by any country. However, it is possible to plan for the future in such a way that the negative effects of these forces do not have a devastating impact on the economy. Below are some of these hindrances and how New Zealand has stepped in to provide viable solutions to some of them.

Dependency On Trade

New Zealand’s economy is majorly centered on trade. The dominant type of trade is international trade. Although a bit of the economy is diversified, trade remains the main source of government revenue and personal income to local investors. Its policy of a free market economy is faced with many uncertainties. For instance, the prices of most international goods are unpredictable.

This puts the economy of the country at stake because prices can suddenly drop to unimaginable levels without warning. As much as there is a prospect of a better and more stable economy in the coming years, it is also possible that one day New Zealand can wake up to a crushed economy. In order to avoid such a circumstance, New Zealand is trying to stem up its foundation in trade by diversifying more of its economy to include other sectors such as tourism.

Strong Currency

The New Zealand dollar is strong compared to most developing countries, which can be prospective trading partners. It is therefore expensive for such countries to import products from New Zealand. This limits the market of goods from New Zealand to a handful of developed nations such as Australia, Japan, China, the USA and the Republic of Korea. Some of these nations produce identical goods to those produced in New Zealand.

Therefore, New Zealand can never be assured of a constant outflow of exports to its trading partners. There may be instances where it may have to lower the price of its goods to outshine competitors. To avoid such instances, New Zealand has engaged in trade agreements that stipulate clearly the terms and conditions of the agreement. With such an agreement, the country is assured of a steady market and no cases of breach of contract.

Although New Zealand has one of the lowest unemployment rates in the world, the effects of unemployment, no matter how miniature, still count. Unemployment slows down the rate of economic growth of a country. The effect of unemployment on the economy of New Zealand was at its worst during the period when the country had a social security system that provided benefits for the unemployed.

Those were the days when the rate of unemployment was close to zero (Fynes and Ennis, 1997, page 97). With the current unemployment rate of 6.5%, such a move would be suicidal to the economy of the country. Unemployed people drain the economy by raising the level of dependency. The working class is forced to spend some of their revenue on those who don’t have a source of income.

The overall effect is that a vicious cycle develops. Increased expenditure on the unemployed reduces the amount of funds that are available for saving and thus investment. Lange (1990, page 178) states that lack of savings and hence little or no investment leads to a retarded economy that strives to produce only that which is sufficient for consumption. Luckily for New Zealand, a lot of jobs are created on a daily basis. For instance, approximately one thousand jobs were created in the June 2011 quarter alone.

Current Account Deficit

New Zealand has a persistent current account deficit. The current account deficit stands at a value that is 8-9% of the Gross Domestic Product. This is a trend that has been going on for years. The main cause of this deficit is an imbalance or inequality between the value of exports and imports. New Zealand mainly exports agricultural products. It also earns some foreign exchange from tourism activities. On the other hand, it imports valuable goods such as machinery and computerized devices.

The cost of the imports far exceeds the total revenue acquired from the exports. Another cause is the relatively weaker New Zealand dollar compared to other developed countries. This makes it less expensive for foreign countries to import goods from New Zealand. On the contrary, it is expensive to import goods into New Zealand. New Zealand is trying to work on this discrepancy by broadening the base of its exports.

Disadvantages Of A Floating Exchange Rate System

New Zealand has adopted the Floating Exchange Rate System which is full of uncertainties. The uncertainties scare away potential investors. This is because they are not sure of how much they will make from the economy. It cannot be predicted whether the investor will make a loss or a profit (Franklin, 1978, page 56). This system also has a negative effect on importers. They are not certain of how much they will pay for their imports or worse still, the exact price at which they will sell their products.

Efforts Of The Government And Monetary Authorities To Stabilize The Economy

The government and Monetary Authorities have played a big role in a bid to stabilize the economy of New Zealand. They have put in place various mechanisms and policies to counter inflation and cut down on foreign debts. The following are some of the ways in which the government and the Monetary Authorities have helped to keep the economy of New Zealand:

Monetary And Fiscal Policies

The government of New Zealand has the authority to make necessary adjustments on the availability and value of money for the betterment of the economy. The government can regulate the amount of money in circulation through government expenditure and taxation. The coordination of the two steps also controls the level of aggregate demand hence checking on inflation (Northdurft, 1992, page 124).

Increase in expenditure by the government of New Zealand increases money circulation hence raising the level of aggregate demand. On the other hand, decrease in government expenditure reduces money circulation hence reducing aggregate demand. In the same way, increase in taxation by the government of New Zealand reduces money circulation and aggregate demand. Decrease in taxation increases money circulation and aggregate demand.

The money authorities of New Zealand can also control the amount of money in the economy through monetary policies. These money authorities include the Reserve Bank and the Central Bank. The main concept behind the monetary policies is the control of the interest rates. This control is achieved by the regulation of the amount of money in circulation.

The Central Bank can take expansionary measures to increase money circulation. These measures include buying of government securities, lowering the reserve requirements and lowering the interest rate on loans to banks where it has to act as the lender of last resort (Hatch, 2001, page 201).

The overall effect will be that bank loans will have lower interest rates, more people will go for the loans and there will be an increase in money circulation. In the same way, measures can be taken by the Central Bank to contract money circulation. These include sale of government securities and raising reserve requirements.

The bank can also raise its lending rates so that the banks have to raise their interest rates in turn. The overall effect is the reduction in money circulation. With such mechanisms, the economy of New Zealand won’t get out of hand and will definitely stabilize within a short time.

Conclusion

From the foregoing, it is evident that even though New Zealand’s economy is currently slightly stable, it is bound to become more stable in the coming one or two years. It is also clear that New Zealand has undergone many transformations from an agricultural economy to a free market economy.

Furthermore, there are a number of challenges that face the economy of New Zealand, but policy makers from New Zealand have come up with appropriate remedies for almost all of them. Finally, the government and the Monetary Authorities have played a significant role in the stabilization of New Zealand’s economy. In conclusion, New Zealand’s economy is set to become more stable in the coming years.

Reference List

Arthur D. L. (2000). Sector partnership report, promotion and development of export trade: Best practice in organization and partnership. Trade Partners UK, London: Trade Partners UK.

Bannock, G. and Peacock, A. (1989). Government and small business. London: Paul Chapman.

Franklin, S. H. (1978). Trade, growth and anxiety: New Zealand beyond the welfare state. Methuen: Wellington

Fynes, B. and Ennis, S. (1997). Competing from the Periphery. London: Dryden Press.

Hatch, C. (2001). Strategic linkages and competitive advantage; Microenterprise best practices. Bethesda: MD

Lange, D. (1990). Nuclear free: The New Zealand way. New Zealand: Penguin Books.

Northdurft, W. (1992). Going global: How Europe helps small firms export. Washington DC: Brookings Institution

Potter, J. B. and Spires, R. (2002). The wider effects of inward foreign direct investment

in manufacturing. Journal of Economic Geography, 2, 279-310.

Shooks, W. and Lewis, K. (1981). New Zealand – Australia free trade agreement. Melbourne: Industries Assistance Commission Library.

Taylor C. R. and Henisz W. J. (1994). US Manufacturers in the global marketplace. New York, NY: Conference Board.