Introduction

In the recent past, a lot of changes have taken place in the New Zealand domestic airline market. There have been changes in the volume of travellers plying the domestic route, changes in the number of players in the market, and changes in sales volume among others.

It is estimated that in the year 2007, revenue from this sector amounted to about 1.6 billion New Zealand dollars. Industry experts are of the view that for a period of seven years from the year 2000, the domestic market was dominated by two key players. These were Air New Zealand and Qantas. It is only much later that new entrant in the market started challenging this dominance.

For example, the entry of Pacific Blue in the market in November 2007 brought with it a lot of changes to the market. Faced by this financially strong new competitor, Air New Zealand and Qantas had to change their strategies. This saw the reduction in air fares and increased flight frequency among others.

This development brings into fore the issue of strategic groups in this market (Leask & Parker 398). This is because the various players in this market make use of identical business models and strategies (Leask & Parker 398).

This is especially so in the case of the three major players; Air New Zealand, Qantas and pacific Blue. This essay is going to look at several issues surrounding this strategic group in New Zealand’s domestic airline market. The essay will include a strategic group map and analysis of the market using the Porter’s Five Forces Model.

Strategic Group Map for Air New Zealand, Pacific Blue and Qantas

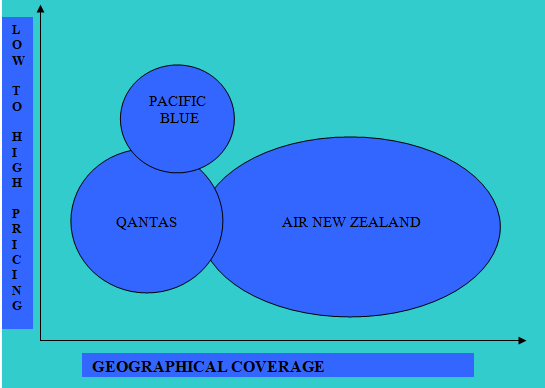

A strategic group map is the location of different strategic organisation’s or competitors in an industry within a two axis plane (Olusoga, Mokwa & Noble 155). The X and Y axis of the plane is made up of two variables within which the organisation’s compete. Pricing and geographical coverage will be the two variables for this map. The following is the strategic group map for the three strategic groups:

Figure 1: Strategic Group Map

Pricing and geographical coverage were the two variables selected for the map because they are main platforms on which the three operators compete on. It is notable that the three competitors have differently sized circles in the map. The size is determined by the position they occupy in the market and their share of the same (Scholes & Whittington 79).

Air New Zealand, according to this map, is the leader in the market. This is because it has the largest share in the market. For example, it is estimated that seventy percent of ticket sales between 2000 and 2007 was attributed to this company (Atkinson 22). The company has the largest geographical coverage with fourteen Boeing 737 air buses and fifty daily flights on the domestic routes (Atkinson 23).

In terms of geographical coverage, Qantas is second while Pacific Blue is third. Qantas has a fleet of four Boeing 737s and has thirteen daily flights. Pacific Blue has a fleet of two air buses and makes ten daily flights along the domestic route (Atkinson 22).

In terms of pricing, Pacific Blue appears to be uncompetitive to the two competitors, occupying the third position. This is especially so for those tickets booked within a short notice. Air New Zealand charges about $NZ 57 and $NZ 145 cheaper than Pacific Blue (Atkinson 25). Qantas is the cheapest, charging between $NZ 74 and $NZ 148.

Pacific Blue’s Strategic Group and Organisational Focus

As earlier indicated, Pacific Blue is one of the major strategic groups in New Zealand’s domestic airline market. A link is discernible between the group and its organisational focus.

To remain competitive, this group uses a two-pronged strategy which it has employed since its entry in November 2007. This is the combination of low costs with high quality and professional services to the customer. The crew is both friendly and professional, making the experience of the traveller more satisfying. The group has also focused on the main trunk routes. These are Wellington, Auckland and Christchurch.

As far as operating costs are concerned, Pacific Blue focuses on bringing them down to the minimum. It out-sources ground handling, engineering, crew support and infrastructure such as hangars.

However, the organisational focus of this company is challenged by some inherent limitations, endangering its competitive advantage. For example, while Air New Zealand has about fifty daily flights, Pacific Blue has a meagre ten. The domestic network can not be compared with that of Air New Zealand; it is far too modest.

Air New Zealand and Mobility Barriers in the Market

Khemani & Shapiro (19) gives a working definition of mobility barriers in a market. They conceptualise them as factors that hinder the movement of an organisation from one strategic segment of the market to the other (Khemani & Shapiro 19).

Geroski, Gilbert & Jacquemin (66) goes a step back and view mobility barriers as hurdles that makes it hard or impossible for an operator to enter or leave a market. This position is supported by Balogun & Hailey (108) and Ghosn (38).

Air New Zealand has mobility barriers that pose a threat to effective operations of Pacific Blue and Qantas in New Zealand’s domestic airline market. The barriers also hinder the movement of Pacific Blue and Qantas from one strategic group to the other (Pascale & Sternin 80).

For example, Air New Zealand has monopolised terminal facilities in the New Zealand market. Any new player must first get through air new Zealand to gain access to these facilities. A case in point is when Qantas built t its own terminal facilities in three chief airports before it started operations. This monopoly by Air New Zealand also hinders the expansion of Pacific Blue and Qantas.

Air New Zealand also monopolises the supply of services such as maintenance, spares and parts, ground handling and equipment. This is especially so given the geographical isolation of this country. For them to move from one strategic group to the other, Pacific Blue and Qantas must enter into commercial agreements with this monopoly.

Market supremacy of Air New Zealand is another mobility barrier to Pacific Blue and Qantas. The monopoly is able to control prices and other charges in most of the domestic airports.

The monopoly also enjoys nationalistic support from patriotic New Zealander’s, given that it is their local pride. All of these factors, coupled with an extensive coverage and high frequency, make it hard for the other two to progress in the industry.

Competitive Conditions for Pacific Blue in the Market: Porter’s Five Forces Model Analysis

According to Rainer & Turban (37), the Porter’s Five Forces model can be used to assess the level of competition in a market and in extension, the attractiveness of the same both to new comers and to incumbents. The following diagram represents a graphical view of the model that will be used to analyse the competitive conditions for Pacific Blue in New Zealand’s domestic airline industry:

Figure 2: Porter’s Five Forces for Pacific Blue

Source: Rainer & Turban (38)

Threat of New Entrants into the Market

Rainer & Turban are of the view that new investors have a high affinity for markets that are profitable (40). As such, a profitable market has the risk of being highly competitive due to the new entrants.

Pacific Blue faces a low level threat from competition from new entrants. This is given the fact that there are already barriers to entry into this market in existence. These barriers include the dominance of air New Zealand as earlier explained. The latter, given the iron control it has over the industry, deters new entrants. The industry is not very profitable.

Experts are of the view that the volume of travellers in the country can not support the existence of more than one operator profitably. Other operators in the past, for example Ansett New Zealand and Origin Pacific, have recorded heavy losses in the market. The former made losses of about $NZ 250 million before it exited. These factors make the industry less attractive to new entrants, posing a lower level of threat to Pacific Blue.

Threat of Substitute Products

The threat of substitute products is at a high level for Pacific Blue. This is given the number of operators in the market. Travellers can switch from the use of Pacific Blue services to that of Air New Zealand or Qantas at no extra cost. This is especially so given that some of the charges are identical.

But differentiation of the services offered by Pacific Blue reduces this threat, albeit with a small margin. The airline offers professional services that are also friendly, given the qualification of the staff.

Threat of Rivalry

This is the threat that Pacific Blue faces from the established players in the market such as Air New Zealand and Qantas. The competition from these players is stiff, given that all of them are competing for the relatively small number of travellers in New Zealand. Competitors such as Air New Zealand have also started online booking and aggressive marketing campaigns. This makes more visible and formidable competitors to Pacific Blue.

Bargaining Power of Travellers

The travellers, who are the consumers of the services offered by Pacific Blue, have a lot of bargaining power. The existence of Air New Zealand and other competitors have saturated the market, making the consumers to go to those airlines offering low costs. This has led to the reduction of air tickets as the competitors elbow for the small number of travellers. This has reduced Pacific Blue’s competitive advantage.

Bargaining Power of Suppliers

Supply of services and products to the airlines in this country is dominated by air New Zealand. This is given the geographical isolation of the country. As such, Air New Zealand, as the sole supplier of most products and services to Pacific Blue, has a lot of bargaining power. This makes it possible for the supplier to dictate the price, making the market less attractive.

Attractiveness of New Zealand’s Domestic Airline Market: An Analysis

The attractiveness of this market will be analysed on the basis of the five forces evaluated above.

The market can be described as unattractive both to new entrants and to incumbents. This is given that there are barriers to entry, given the monopoly of Air New Zealand. There are also mobility barriers, given that new entrants and incumbents are not able to move within the industry with ease. This is also attributable to the dominance of Air New Zealand.

There is stiff rivalry among the players in the industry. This is evidenced by the price wars that were especially stoked by the entry of Pacific Blue. This rivalry makes the industry less attractive. Ease of substitution, where consumers can move from one airline to the other, also makes the industry less attractive. This is given the high concentration of the operators as opposed to the low concentration of consumers.

The suppliers and the customers also wield a lot of bargaining power. This is attributed to the fact that air New Zealand monopolises most of the supplies, and the stiff competition between the operators works to the advantage of the bargaining power of the consumers.

The only thing that makes this market attractive is the low threat from new competition, given the existence of many entry barriers. However, this makes the market attractive only to incumbents, while acting as a turn off to new entrants. From this analysis, it can be concluded that New Zealand’s domestic airline market is less attractive.

Works Cited

Atkinson, Brown. Australian Airline Market since 2000: A Critical Analysis. Sidney: Sidney University Press, 2009.

Balogun, John, and Hailey, Hope V. Exploring Strategic Change. 2nd ed. Harlow, Essex: Financial Times Prentice Hall, 2004.

Geroski, Paul, Gilbert, Richard J., and Jacquemin, Alex. Barriers to Entry and Strategic Competition. Sidney: Harwood Academic Publishers, 2000.

Ghosn, Charles. “Saving the Business without Losing the Company”. Harvard Business Review, 80.1 (2002).

Khemani, Ray S., and Shapiro, David M. “Glossary of Industrial Organisation Economics and Competition Law.” Australian Journal of Fiscal and Enterprise Affairs, 35.8 (2002).

Leask, Graham, and Parker, David. “Strategic Group Theory: Review, Examination and Application in the UK Pharmaceutical Industry”. Journal of Management Development, 25.4 (2006).

Olusoga, Ade S., Mokwa, Michael P., and Noble, Charles H. “Strategic Groups, Mobility Barriers, and Competitive Advantage: An Empirical Investigation.” Journal of Business Research, 33.2 (2010).

Pascale, Richard T., and Sternin, John. “Your Company’s Secret Change Agents”. Harvard Business Review, 83.5 (2005).

Rainer, Turner, and Turban, Michael. Introduction to Information Systems. 2nd Ed. New York: Wiley & Sons, 2009.

Scholes, Johnson G., and Whittington, Richard. Fundamentals of Strategy. Harlow, Essex: Pearson Education Limited, 2009.