Introduction

Primarily, this written report is intended to cover two main areas: a brief academic description of the role and value of a performance assessment statement/ratio analysis in an internationally sustainable context, as well as a voluminous study of an essential aspect of the financial performance of EDF Energy. Firstly, the author highlights the importance of the specific approach as one of the methods of assessing the enterprise and its capabilities in the future. Consequently, it is known that “a statement/ratio analysis” is carried out to identify optimal ways to achieve the goals of an organization, such as increasing business activity – asset turnover, ensuring liquidity and financial stability, and increasing a firm’s profitability. Accordingly, these aspects are essential and should be taken into account based on strategic planning, identification of resources, and directions of subsequent development of EDF Energy, finding its strengths and weaknesses.

Secondly, the report’s author conducts a comprehensive investigation of EDF Energy as a British energy-generating company wholly owned by the French state-owned firm EDF. In this section, the student focuses on the study of the critical financial component of EDF Energy in the conditions of modern realities. In other words, the student considers the results of the company’s economic activity, expressed through financial indicators, such as profit, loss, and profitability. This procedure can serve as a kind of indicator of the importance of this enterprise in the national economy. In particular, emphasis is placed on explaining the company’s economy in terms of external and internal factors over the past five years. Furthermore, these processes justify the predicted consequences of their usefulness and efficiency on the student’s actions, decisions, and activities in the role of a manager.

The Role and Value of The Performance Assessment Approach (A Statement/Ratio Analysis)

On the one hand, financial statement/ratio analysis, as the performance assessment approach, plays one of the most critical and significant roles in obtaining information to objectively assess an enterprise’s financial condition. Such an analysis provides knowledge about a firm’s financial results, changes in the structure of assets and liabilities, as well as settlements with debtors and creditors. In general terms, this approach is fundamental when making meaningful management decisions related not only to a company’s economic situation but also to several prospects for an organization’s future development in a sustainable international context. Conducting this investigation will allow one to determine the advantages and disadvantages of the financial policy in an organization, adjust it, and improve its activities. One should emphasize that although economic indicators help assess a company’s growth potential and risks, they cannot be used individually to directly evaluate an organization, its securities, or its creditworthiness. It is necessary to study all the enterprise’s activities and the external economic and industry conditions in which it operates. This will allow managers to interpret the values of financial coefficients correctly.

In addition to owners of an enterprise, these details are essential for creditors of a business, who, based on the data received, will make judgments on granting a loan and lending conditions. A company’s investors, based on the financial analysis data, can judge a firm’s financial situation. This will allow them to decide whether to invest their funds in this enterprise, what income they will be able to get from investing, and what is the degree of risk of non-return of the invested funds.

On the other hand, the value and significance of the approach within the framework of international phenomena lie in the subsequent increase in the profitability of an enterprise, increasing its business activity and ensuring stable activity. It allows a financial analyst to evaluate past results, assess the current financial position of a company, as well as form an opinion on the forecast of future results. At the same time, analysts must carefully consider the list of indicators used for strategic planning.

It is important to remember that financial statements and ratio analyses themselves are not “answers” but are indicators of some aspect of a company’s activities. Thus, it is possible to form an opinion about the economic relations within a corporation, with the help of which analysts can predict a firm’s profit and free cash flow. Moreover, it becomes possible to take into account the financial flexibility of an organization or its ability to receive the funds necessary for the growth and fulfillment of obligations, even in the event of unforeseen adverse circumstances. Furthermore, the approach makes it possible to assess the abilities of a company’s management and changes in a firm and the industry over time, as well as comparability with similar companies or the corresponding sector. Consequently, the value of a statement/ratio analysis for making informed decisions lies not so much in calculating indicators as in interpreting the results and drawing correct conclusions.

EDF Energy Research

A Significant Aspect of The Recent Financial Performance

One of the most significant aspects of EDF Energy’s financial performance is accounting (financial) reporting regarding income statements/ratio analysis. Such an informative and reliable subsystem in the organization’s activities acts as a source of calculation support for managing factors affecting the financial outcomes and conducting a comprehensive examination of the organization’s activities. Profit belongs to one of the most challenging economic categories; without studying it, a scientific approach to solving issues such as improving production efficiency, strengthening the material interest, and responsibility of labor collectives in achieving final results at the lowest cost is impossible. It is important to note that the completeness and transparency of data on the economic consequences should be considered necessary conditions for making decisions of a tactical and strategic nature. In this case, it is advisable to appeal to relevant and reliable sources of information about the “monetary” components of EDF Energy for their subsequent analysis and interpretation of the results obtained.

In general, the analysis of recent reports gives a clear and precise picture of the relatively unstable balance of income and expenses of EDF Energy due to several operations. It is vital to remember that the company’s financing in Britain is entirely managed by EDF (Fitch downgrades, 2022, p. 6). Indeed, there have been a lot of discussions and discussions about EDF’s work in the privatized UK energy market regarding this phenomenon (Blackburn and Smith, 2022, para. 8). The fact remains that EDF Energy is one of the best energy companies and the largest producer of low-carbon electricity in the UK (Ingrams, 2022, para. 1-2). Hence, the information presented below mainly relates to the financial position of EDF and its impact on EDF Energy, respectively.

For instance, one of the documents for 2021 demonstrates the most promising dynamics of revenue growth and increased profitability of the business. As a rule, this is due to strong EBITDA growth, as well as achieving all financial goals and plans for disposal and cost savings (EDF, 2022, p. 1). It is noteworthy that EDF and EDF Energy, in particular, presented relatively good results to a great extent last year despite such a global problem as COVID-19. Thus, EBITDA in 2020 increased compared to the figures for 2019 and amounted to about £700 million at the macro level (EDF group results 2020, 2021, para. 3). However, due to some external and internal factors, EDF Energy, unfortunately, has undergone many drastic changes not for the better within the framework of the economy and financial indicators.

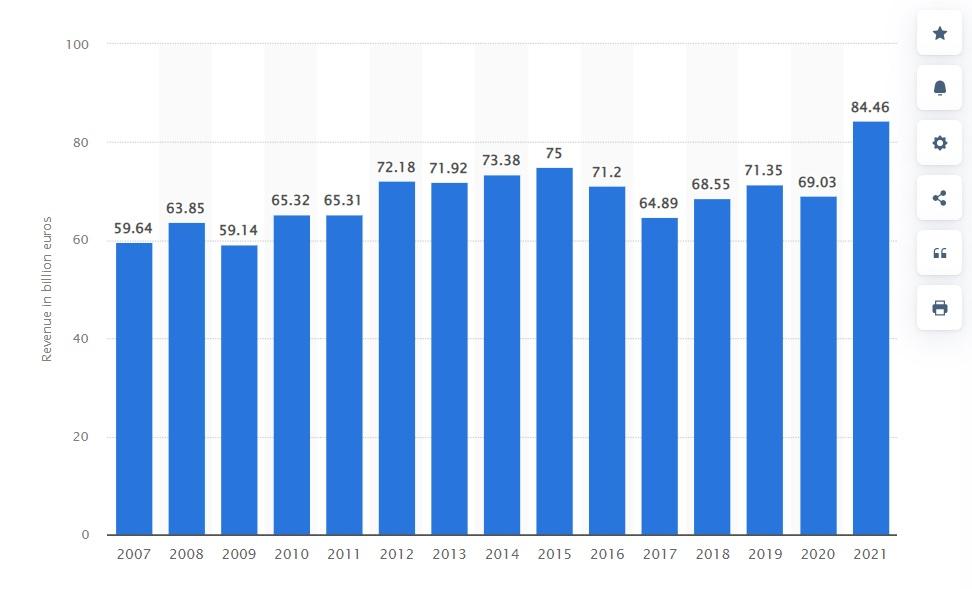

In this situation, it is enough to look at the news and events about the firm in the spectrum of such concepts as revenue, expenses, EBITDA, profitability, cash flow, net profit, break-even point, the number of accounts receivable, and many others in recent months. In general terms, 2020 has become one of the most problematic years for businesses, both small and large enterprises, like EDF Energy. In EDF, revenue fell by more than 3%, net income excluding non-recurring items decreased by almost 50%, and net income Group share decreased by more than 87% (2020 annual financial results, 2021, para. 2). Such disappointing circumstances occurred throughout the organization, including the “branch” in Britain. Consequently, the company rethought its “failures,” striving to eradicate such unfavorable assumptions in every possible way. By the way, to some extent, the organization has fulfilled the initially designated goals and promises; it has already “catch up” in 2021, at least concerning revenue (Alves, 2020, para. 1). The effectiveness of measures to increase profits can be found in the following figure.

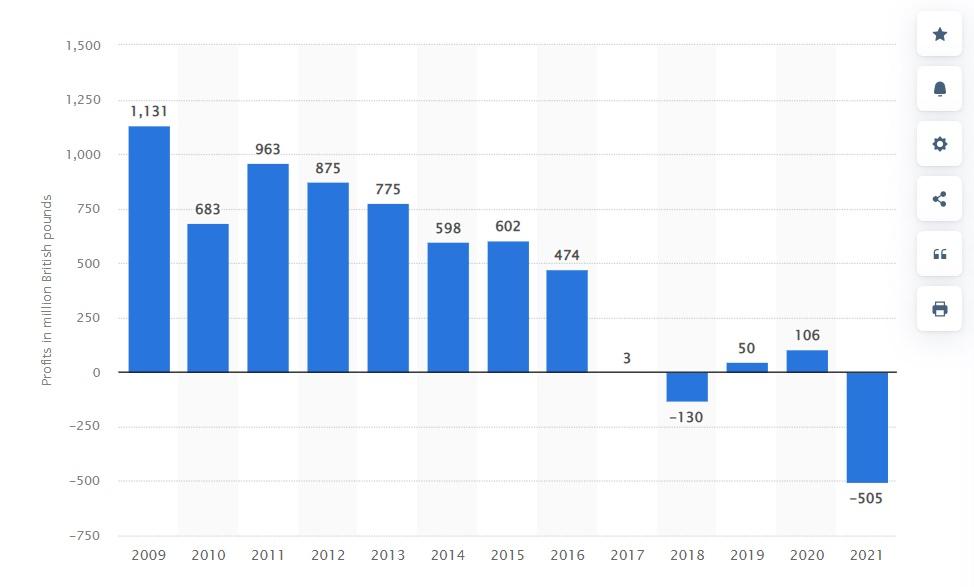

Appealing to the data regarding EDF Energy, and not only EDF as a global organization, one can see some “shortcomings.” For example, the profits from energy generation from 2017 to 2021, in particular, decreased compared to previous periods, and the firm is now incurring significant losses (Sönnichsen, 2022, para. 1). EDF Energy reported a loss of £154m in 2020, warning that it could not fully meet its goals and plans for financial performance (Blackburn and Smith, 2022, para. 8). Moreover, in relation to this indicator, 2021 was one of the worst years for EDF Energy (Sönnichsen, 2022, para. 1). This information can be found on the following graph from the Statista website.

Over the past few months, the picture of the situation has turned differently, and the indicators of financial activity do not appear in such pleasing patterns. De Beaupuy (2022, para. 4) reports high losses for the company for 2022 of 1.31 billion euros due to the state’s readiness for nationalization. In addition, EDF Energy currently has debt obligations of more than 4.5 billion euros, which will most likely not be repaid soon (Fitch Downgrades, 2022, p. 6). Indeed, the paper’s author should assume that these circumstances cannot but disappoint since a year earlier, EDF Energy had net revenue of 3.74 billion euros (De Beaupuy, 2022, para. 4). Lévy (2022, p. 2) reports that the EBITDA of EDF Group has decreased by more than 70%, but it is imperative to take into account that it includes EDF trading and better generation due to the new nuclear fleet in the United Kingdom. However, today EDF Energy is likely in danger of being exposed to specific risks that entail an increase in various costs.

It is not a secret that extreme tension in the electricity market can be observed today in Europe and the United Kingdom. Accordingly, this moment cannot but affect the financial activities of EDF Energy. The consequences of COVID-19 and the ongoing war in Ukraine caused the energy crisis are among the few factors of the company’s losses. Wholesale gas prices in the UK have reached a record, and EDF Energy is forced to appeal to the government to take action. Notably, given the complex situation in the British energy market, most British energy suppliers have gone bankrupt because their business models did not view the scenario of a significant and rapid price jump.

In a sense, this is a national crisis, and the rise in prices to an unprecedented level in recent months creates an extremely difficult operating environment for the industry in which the company operates. In broad terms, it is known that the reduction in electricity production decreased the firm’s revenue by about 24 billion euros in 2022 (Mallet and Aloisi, 2020, para. 3). Thus, today’s policy forces EDF Energy in the UK to buy electricity at record-high prices and sell it cheaply to competitors. Assuming current trends, the organization is undoubtedly not on the verge of collapse and ruin. Still, there are many prerequisites for this in the case of the lack of management initiative in both EDF Energy in Britain and EDF in France.

The Likely Consequences

One should recognize that the effectiveness of the previously identified aspect of the results of EDF Energy’s activities on the student’s future actions as a manager is challenging to characterize in an objective and reliable form. It is evident that it becomes more difficult for leaders to adapt to the situation and reach the previous profit indicators in such crises. Regardless, it is necessary to make some assumptions, synthesizing and generalizing the knowledge obtained earlier as follows.

It is becoming quite apparent that in the current conditions, EDF Energy is experiencing severe financial difficulties due to the threat of an energy crisis due to rising gas prices. EDF Energy is more likely to face an even more significant “critical situation,” and the company is unlikely to cope with the problem alone. In this case, a huge responsibility falls on the shoulders of stakeholders. By showing foresight and compassion, EDF Energy has every chance to overcome the existing difficulties successfully and, at the same time, get the maximum benefit (Ruane, 2022, para. 2). Instead of panicking, a leader needs to have a clear plan of action in terms of defining the mission and core values of the company, caring for employees, organization, focusing on solutions, solving one problem at a time, and several other equally important aspects (Expert Panel, Young Entrepreneur Council, 2020, para. 2). A manager should implement a competent and correct strategy to mitigate the problems identified earlier.

A company like EDF Energy, which operates in market conditions, tends to be exposed to various risks. A crisis is a profound negative deviation that may threaten the organization’s existence. In this case, a manager should draw clear conclusions about the company’s financial condition, comparing the pre-bankruptcy stage data and the case in which the firm is in bankruptcy proceedings. When evaluating accounting statements, one should not forget that, for example, discounting the value of accounts receivable should be obvious to the head of EDF Energy when the state of the corporation’s liabilities and assets is assessed. In other words, it should not be clear retrospectively but should be apparent already at the time of the obligation. Similarly, a manager may use the real, rather than the book value of assets in calculations and evaluate the liquidity of certain assets. However, it should be understood that determining the market value of investments can be “tricky” since it must be determined not only at the current moment but also at the time of deciding the insufficiency of property or objective bankruptcy in the past.

Any crisis is a litmus reaction, a means of testing a company’s corporate governance system, regardless of its legal field, ownership structure, or industry. In a critical situation, the weaknesses of the company as a whole are more pronounced, and those companies that have prepared poorly for the crisis receive more severe punishment. Therefore, it is not a secret that financial difficulties force many organizations to strive for sustainable development, and it is this circumstance that a manager should appeal to when performing their official duties, future actions, and making important decisions.

Thus, it is necessary at least to determine the right strategy with the appropriate risk appetite of the company (the level of risk that the company will be able to accept). The implementation and operation of risk management systems should be supervised. Moreover, it is recommended to focus on studying external conditions and understanding the driving forces of business to help identify and recognize the features of the impending crisis. In particular, it is important to show leadership in thinking about and proposing the best solutions, preventing panic, eliminating some causes of internal problems, and giving external stakeholders, investors, and employees confidence in the company’s future.

In general, if a manager finds a balance between the core and new opportunities, it will help the company become more stable and protect itself from crises in the future. Now many companies do not build far-reaching plans at all – they often create short documents describing their principles of work, directions of movement, and goals, but without detailing specific steps. Nevertheless, a modern organization must be flexible and understand where it is going and how to transform if market conditions change.

Conclusion

Summing up, it should be stated that in the process of writing this report, the student acquired essential knowledge, skills, and abilities to conduct a full-fledged analysis of the company, keeping in mind specific concepts. The set goals and objectives were completed, and the work was provided for each of the points indicated in the instructions for the task. Based on this, it is necessary to identify several key points from which the student has identified new knowledge.

Firstly, it was revealed that “a statement/ratio analysis” is an approach that allows you to link several indicators of a company’s financial performance. Analysts can see a complete picture of the results of their activities in the statistics and dynamics over several years and compare the company’s performance indicators with industry averages. The results of a qualitative analysis should be a well-founded, calculated conclusion about the organization’s financial situation, which will become the basis for decision-making by management, investors, and other interested parties. Secondly, one must recognize that EDF Energy’s operations are undergoing some of the worst times in terms of key financial indicators such as profitability and profitability of the company. The war in Ukraine, the resulting energy crisis, and the consequences of COVID-19 are one of the few factors so unfavorable outcomes for the firm. Nevertheless, considering the company’s data analysis, the approach allows a manager to approach relevant issues competently and correctly, weigh all the pros and cons, and make the right decision.

The report synthesizes theoretical and empirical research on EDF Energy’s financial condition, potential, and capabilities. This brief analysis gives a general idea of the picture of the situation, from which it is possible to draw certain conclusions and make appropriate decisions for the position. In addition, the author does not exclude errors, shortcomings, and weaknesses in interpreting the data obtained due to the insufficient amount of relevant and objective information about the company. Nevertheless, the facts explained earlier are enough to comprehend the organization’s state in the local market and industry.

Reference List

2020 annual financial results. (2021) Web.

Alves, B. (2022) EDF Group’s revenue 2007-2021. Web.

Blackburn, T. and Smith, S. (2022) How much profit UK energy firms British Gas, EDF, SSE make during cost of living crisis. Web.

De Beaupuy, F. (2022) EDF posts $1.3 billion loss as state readies nationalization. Web.

Expert Panel, Young Entrepreneur Council. (2020) Nine strategic ways to handle a company crisis calmly and competently. Web.

EDF. (2022) 2021 annual results. Paris, France: EDF. Web.

EDF group results 2020 – highlights for EDF Energy Ltd. (2021) Web.

Fitch downgrades 2 EDF UK subsidiaries; puts 2 on RWN. (2022) Web.

Ingrams, S. (2022) EDF energy. Web.

Lévy, J. (2022) 2022 half-year results. Paris, France: EDF. Web.

Mallet, B. and Aloisi, S. (2022) EDF issues fourth profit warning as nuclear output drops. Web.

Ruane, J. (2022) The complete guide to business crisis management. Web.