Introduction

Sports Direct International PLC is a UK-based leisure and sports apparel company. The company retails sports equipment, footwear, clothing, and accessories. The company operates under Premium Lifestyle, Brands, International Sports Retail, and UK Sports Retail. In addition, the company is involved in sales and distribution of sports equipment and clothing through other licensed brands. The main products under its various brands are Slazenger, Lonsdale, Cartlon, Dunlop, Muddyfox, Lillywhites, Sondico, Silver Fox, and Antigua. Sports Direct International PLC has been in the market for more than three decades. The company’s online portal, SPORTSDIRECT.com, is the main sales point for different sporting apparel, equipment, and footwear. Sports Direct International PLC has 757 retail stores, spread across the UK market, accounting for a total of 468 branches. At present, the company has developed strategies aimed at improving efficiency, introducing more products, and entering partnerships with other global brands. For instance, in 2017 alone, Sports Direct International PLC merged or acquired the Flannels Group Ltd, GAME Digital PLC, and French Connection Group PLC as part of their expansionary strategy (Sports Direct International PLC 2017).

A subsidiary of the Pentland Group PLC, JD Sports Fashion PLC is a UK-based company within the apparel industry that has been in operation for more than 30 years. The company retails branded sportswear, outdoor apparel, and sports equipment. The company functions through the Outdoor and Sports Fashion segments. The notable products of the company fall within leisure, general sports, rugby clothing, footwear, and accessories. These products are sold under brands such as Chausport, Size, Cloggs, Perry, Tiso, Millets, Gyms, Footpatrol, Deakins, and Go Outdoors. JD Sports Fashion PLC has a well-developed online business platform where products are displayed and customers can make orders. The company has been very aggressive in its expansionary strategies and product differentiation.

For instance, in 2017, JD Sports Fashion PLC acquired or merged with other competitor brands, including 2Squared Agency Limited, Sprinter Holdings 2010 SL, and Hot-T. Specifically, JD Sports Fashion PLC signed a joint venture deal with the Shoemaker Incorporation, which is an active multi branded venture under Hot-T. As part of the agreement, JD Sports Fashion PLC acquired 15% of the Hot-T brand. In addition, the joint venture agreement allowed JD Sports Fashion PLC to acquire a further 35% of the brand at the end of the 2016/2017 financial year. At present, the company is finalizing its plans to re-enter the London Stock Market (LSM) to carry out an IPO for one of its premium store brands called the Footasylum. This brand is valued at €150 million. JD Sports Fashion PLC has more than 1,300 stores globally, with active presence in Sweden, the UK, Canada, the US, Hong Kong, and Dubai (JD Sports Fashion PLC 2017). This paper seeks to carry out a comparison of financial performance between Sports Direct International PLC and JD Sports Fashion PLC.

Analysis of Sales and Profitability

Profitability focuses on the earning capability of a company. That is, how revenues are converted into profits. It also provides information with regard to pricing strategies and how costs are managed by an entity (Horner 2013). Sales and profitability of the two companies will be analyzed by reviewing the statement of comprehensive income. The revenues for Sports Direct International PLC grew from £2,832.5 million in 2015 to £2,904.3 million in 2016. It further increased to £3,245.3 million in 2017. The total growth rate over this three year period was 12.58%. The gross profit also had a similar trend. The values rose from £1,240.8 million in 2015 to £1,284.6 million in 2016. In 2017, the values were higher, at £1,330.6 million.

The operating profit decreased during the same three year period. The values dropped from £295.6 million in 2015 to £223.2 million in 2016. This drop can be attributed to a significant increase in exceptional items from £8.3 million in 2015 to £11.1 million in 2016. In 2017, the operating profit reduced further to £160.1 million. This can be explained by the large increase in selling, distribution, and administrative expenses. Despite the decline in operating profit, the overall profit for the period increased from £241.4 million in 2015 to £279 million in 2016. The value later dropped to £231.7 million in 2017. It can be observed that the annual year profit was greater than the operating profit in both 2016 and 2017 (Sports Direct International PLC 2017). This can be explained by the large investment income that was earned by the company. The income statement further reveals that the cost of sales grew proportionately to sales. In addition, selling, distribution, and administrative costs accounted for the largest proportion of operating expenses.

In the case of JD Sports Fashion PLC, the revenues generated had an upward trend. The values rose from £1,522.3 million in 2015 to £1,821.7 million in 2016. The value increased further to £2,378.7 million in 2017. The total growth rate for the entire period was 56.26%. The gross profit margin also increased from £739.6 million in 2015 to £884.2 million in 2016 and further to £1,163.6 million in 2017. The operating profit also followed an upward trend. The values rose from £90.5 million in 2015 to £131.6 million in 2016 and further to £239.8 million in 2017. The exceptional items for the company increased drastically from £9.5 million in 2015 to £25.5 million in 2016. It later dropped in 2017 to £6.4 million. The profit for the year had an upward trend. The values rose from £69.8 million in 2015 to £100.6 million in 2016. In 2017, the value increased further to £184.6 million (JD Sports Fashion PLC 2017). The company also generated some revenue from finance income. The growth in sales and profit for the company can be attributed to the opening of new stores and acquisitions that were made between 2015 and 2017.

Gross profit margin and return on capital employed (ROCE) will be used to evaluate the profitability. The calculation of all the ratios is presented in Appendix A. The gross profit margin for Sports Direct International PLC fluctuated. The values of the ratio increased from 43.8% in 2015 to 44.2% in 2016. The ratio dropped to 41% in 2017 (Table 1). These changes can be explained by the volatile costs of sales. The return on capital employed (ROCE) had a declining trend. The values dropped from 22.53% in 2015 to 19.89% in 2016. The ratio further dropped to 16.49%. The decrease was caused by growth in capital employed. In the case of JD Sports Fashion PLC, the gross profit margin dropped from 48.6% in 2015 to 48.5% in 2016. The ratio increased slightly to 48.9% in 2017. The values were fairly constant because the company tried to maintain a constant ratio between sales and cost of sales. The ROCE for the company had an upward trend. The ratios increased from 25.5% in 2015 to 29.7% in 2016 and further to 37.3% in 2017. The upward trend was mainly caused by growth in profit for the year.

A comparison of sales and profitability of the two companies shows that Sports Direct International PLC had a higher level of sales and profit for the year than those of JD Sports Fashion PLC. However, the gross profit margin and ROCE reveal that JD Sports Fashion PLC had a higher level of profitability than Sports Direct International PLC. The company is better at managing prices and costs. In addition, it is more efficient at generating revenues and profits from the available resources than Sports Direct International PLC.

Analysis of Cash Flow Performance and Liquidity Position

Managing cash flow is vital because it ensures that there is adequate cash available to sustain the daily activities of the business. Thus, liquidity ratios give information on the ability of an entity to settle its immediate obligations using either current or liquid assets (Horner 2013). Quick ratio will be used to analyze the liquidity of the two companies. The quick ratio of Sports Direct International PLC increased from 0.94 in 2015 to 1.13 in 2016 due to increase in current assets. The value dropped to 0.87 in 2017 as a result of the increase in current liabilities. Quick ratio is a conservative measure of liquidity and it evaluates the ability of a company to settle current liabilities using quick assets. The increase that was reported in 2016 signifies an improved liquidity position. Further, in 2017 and 2015, the company was unable to pay current liabilities using quick assets. This can be a sign of an underlying financial problem.

In the case of JD Sports Fashion PLC, the values of quick ratio were less than 1. The ratios increased from 0.54 in 2015 to 0.78 in 2016. This was largely caused by a drop in current liabilities. They later dropped to 0.68 in 2017 due to an increase in current portion of the debt. It can be observed that all the values were less than one. It implies that the company was unable to meet current obligations using quick assets. A comparison of the two companies reveals that Sports Direct International PLC has a better liquidity position than that of JD Sports Fashion PLC. Further, it can be noted that the trend of the quick ratios of the two companies was the same. Thus, the trend of the ratios can be as a result of industry and not internal factors.

A review of the cash flow statement shows that the net change in cash flows for Sports Direct International PLC was £67.8 million in 2015. The value rose to £77.5 million in 2016. It later dropped to £98.5 million in 2017. This shows that the company paid more than it generated in 2015 and 2017. This can be explained by the amounts that were spent on the expansion program. In the case of JD Sports Fashion PLC, the net change in cash rose from £93 million in 2015 to £99 million in 2016. This can be explained by the cash earned from investments. The value dropped to £22.7 million in 2017 (JD Sports Fashion PLC 2017). It is evident that the cash that was generated by the company was able to cover all the payments. Thus, JD Sports Fashion PLC is better at managing cash flow than Sports Direct International PLC.

Analysis of Efficiency

Efficiency ratios give information on how well an entity makes use of available resources to generate sales and income. Therefore, they analyze the efficiency of a company in making sales, collecting cash, paying creditors, and replenishing inventory among others. It is worth mentioning that the efficiency has a direct impact on the revenues, profits, working capital, and liquidity (Horner 2013).

The inventory turnover gives information on the rate at which an entity replenishes stock. A high value of inventory turnover implies that the company is efficient in managing inventory. This ratio is often analyzed together with days inventory outstanding (DIO). The DIO for Sports Direct International PLC rose from 119 days in 2015 to 158 days in 2016. This change was caused by a significant increase in inventory balance. It signifies a decline in efficiency because the company took longer before replenishing stock. The value dropped to 120 days in 2017 due to a decrease in both credit purchases and inventory balance. This implies that there was an improved efficiency in the speed at which the company replenished stock. On the other hand, the DIO of JD Sports Fashion PLC reduced from 106 days in 2015 to 93 days in 2016. This signifies an improvement in inventory management. The increase was caused by a significant growth in credit purchases during the year. In 2017, the ratio increased to 105 days. It shows that stock in the company lasted for a longer period than in 2016. It signifies a drop in efficiency. This can be explained by the rapid growth in inventory balance. A comparison of performance of the two companies shows that JD Sports Fashion PLC had lower DIO ratios than Sports Direct International PLC. This implies that it is more efficient in managing inventory.

Receivables turnover gives information on the speed at which a company collects the amount due from debtors. This ratio highly depends on the credit policy of a company and industry trends. The days sales outstanding (DSO) for Sports Direct International PLC had an upward trend. The values rose from 20 days in 2015 to 34 days in 2016. It further increased to 41 days in 2017. The growth in the ratio is caused mainly by increases in both accounts receivable and credit sales. Further, the upward trend implies that the efficiency in collecting accounts receivables deteriorated because the company took a longer period to collect the amount due. In the case of JD Sports Fashion PLC, the values increased from 4 days in 2015 to 5 days in 2016. The values further rose to 11 days in 2017. Also, it can be observed that both accounts receivable and credit sales increased. This explains the trend. The efficiency in collection of account receivables for the company dropped. Thus, a review of results for both companies shows that the efficiency in managing accounts receivable deteriorated. However, JD Sports Fashion PLC was more efficient than Sports Direct International PLC in collecting accounts receivable.

The payables turnover gives information on the efficiency of an entity in paying trade creditors. A shorter number of days signify efficiency in paying accounts payable. The days payables outstanding (DPO) for Sports Direct International PLC rose from 39 days in 2015 to 49 days in 2016. The increase was caused by growth in both credit purchases and accounts payable. It shows a reduction in efficiency because the company takes a longer duration to pay creditors. In 2017, the ratio dropped to 26 days. This was caused by a drop in account payables and a corresponding increase in credit purchases. The drop signifies an improvement in efficiency. In the case of JD Sports Fashion PLC, the DPO reduced from 58 days in 2015 to 48 days in 2016. This can be explained by a decrease in accounts payable and a corresponding increase in credit purchases. It shows that the efficiency in handling accounts payable improved. The ratio increased to 50 days in 2017. This shows a decrease in efficiency caused by an increase in both accounts payable and credit purchases. A comparison of the ratios for the two companies shows that Sports Direct International PLC was more efficient in managing payables than JD Sports Fashion PLC.

Cash conversation cycle (CCC) measures the period of time it takes a company to convert purchases to cash. Most importantly, the ratio reveals how efficient a company is at managing working capital. The CCC for Sports Direct International PLC increased from 100 days in 2015 to 143 days in 2016. It implies that efficiency dropped in 2016. This can be explained by an increase in both DIO and DSO. In 2017, the CCC dropped to 135 days due to a significant decrease in DIO. The CCC for JD Sports Fashion PLC improved from 52 days in 2015 to 50 days in 2016. This was caused by a significant decrease in DIO. In 2017, the ratio increased to 66 days due to increases in both DIO and DSO. The CCC for JD Sports Fashion PLC was lower than those of Sports Direct International PLC. This implies that the company is efficient in generating cash flow and managing working capital.

Consideration of the Funding Structure

The capital structure of a company focuses on the use of debt and equity capital to finance the operations of a business. An entity needs to maintain an optimal balance between the two sources of funding. The debt to equity ratio for Sports Direct International PLC had an upward trend. The values rose from 12% in 2015 to 24% in 2016. The ratio further increased to 31% in 2017. The growth implies that the proportion of debt that is used by the company increased. This can be attributed to the £700 million loan refinancing that the company entered into and £915 million that was borrowed for expansion. In the case of JD Sports Fashion PLC, the value dropped from 13% in 2015 to 2% in 2016. This was caused by an increase in both debt and equity. The ratio increased to 6% in 2017. A comparison of the two companies shows that Sports Direct International PLC has a higher leverage level than that of JD Sports Fashion PLC. This can also explain why JD Sports Fashion PLC has a higher profitability than Sports Direct International PLC because finance costs reduce the net earnings. The two companies still have a potential to borrow and expand their operations because the debt to equity ratios are low (Marshall, McManus & Viele 2016).

Analysis of the Share Price Movements

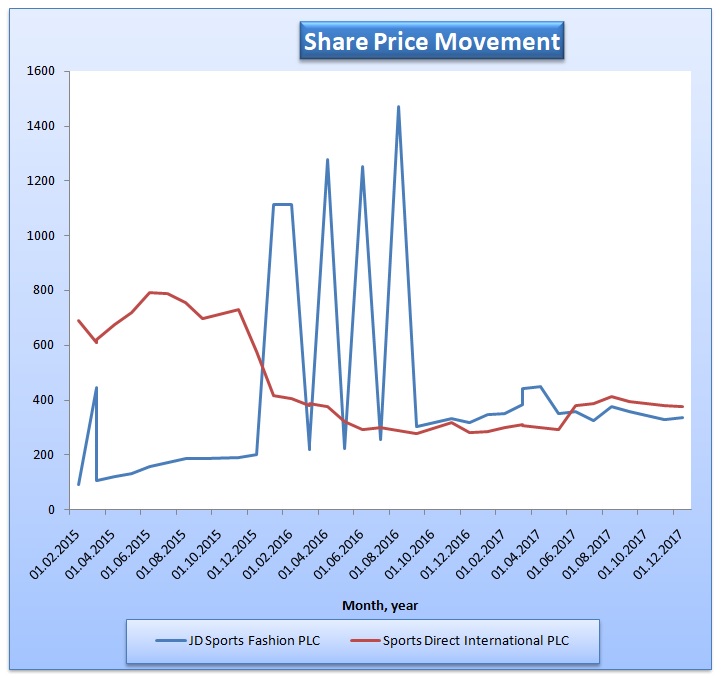

The movement of share prices for Sports Direct International PLC and JD Sports Fashion PLC will be drawn using monthly data for the period between January, 2015 and December, 2017 (Yahoo Finance 2017a; Yahoo Finance 2017b). The monthly share prices are presented in Appendix B (Table 2).

The share prices for JD Sports Fashion PLC were erratic, with a very sharp increase at the end of 2015 (Figure 1). Apart from the outliers, there was a general increase in the prices. This trend was caused by the growth in profit and sales. In the case of Sports Direct International PLC, the share prices dropped. This trend was largely caused by heavy borrowing and high operating costs.

The earnings per share (EPS) for Sports Direct International PLC rose from 40.6 pence in 2015 to 46.8 pence. This can be explained by the increase in profit for the year. In 2017, the ratio dropped to 39.4 pence due to decline in profit. The EPS for JD Sports Fashion PLC rose from 35.17 pence in 2015 to 50.15 pence in 2016. This was caused by an increase in profit. The EPS later dropped to 18.38 pence in 2017 due to increases in the weighted average number of shares. A comparison of EPS for the two companies reveals that Sports Direct International PLC had higher values than those of JD Sports Fashion PLC.

Conclusion

The analysis above focused on the financial performance of Sports Direct International PLC and JD Sports Fashion PLC. The data was used to evaluate and compare the profitability, liquidity, efficiency, leverage, and market prospect ratios of both companies. The results of this analysis confirmed that Sports Direct International PLC had a higher level of sales and profit for the year than those of JD Sports Fashion PLC. However, the two ratios reveal that JD Sports Fashion PLC had a higher level of profitability than Sports Direct International PLC. Further, based on the quick ratio, it is evident that Sports Direct International PLC has a better liquidity position than JD Sports Fashion PLC. In terms of the activity ratios, JD Sports Fashion PLC is more efficient in managing working capital and cash flow than Sports Direct International PLC. Further analysis revealed that Sports Direct International PLC uses more debt as a source of capital as compared to JD Sports Fashion PLC.

The share prices for Sports Direct International PLC seem to portray a downward trend while the prices for JD Sports Fashion PLC were increasing. The swings in financial performance for Sports Direct International PLC were mainly caused by the increased costs that are associated with venturing into the up market and opening new stores. This led to the reported growth in sales and a decline in margins due to high costs. In addition, the increase in the use of debt to finance the expansion plans led to a decline in share prices. JD Sports Fashion PLC continued to expand into foreign markets, such as South Korea, through mergers, joint ventures, and acquisitions. The company also expanded operations by opening up new stores. This led to the growth of sales and profits. The growth in profits over the years, and the successful expansion programs, caused the share prices to rise sharply. From an investor’s point of view, it is recommended to buy the shares of JD Sports Fashion PLC and hold those of Sports Direct International PLC.

References

Horner, D 2013, Accounting for non-accountants, Kogan Page Limited, Philadelphia, PA.

JD Sports Fashion PLC 2017, Investor relations – reports. Web.

Marshall, H, McManus, W & Viele, F 2016, Loose leaf for accounting: what the numbers mean, McGraw-Hill/Irwin, New York, NY.

Sports Direct International PLC 2017, Reports and presentations. Web.

Yahoo Finance 2017a, JD sports fashion plc (JD.L). Web.

Yahoo Finance 2017b, Sports direct international plc (SPD.L). Web.