Introduction

Macroeconomics deals with analysis of major factors contributing to stability of an outward looking economy. These elements are referred to as economic variables and they include: consumption expenditure, investment expenditure, savings, exports and imports. These are the macroeconomic variables describing an economy operating at an equilibrium position.

Any extraneous variable injected into the national equilibrium equation would affect the stability of a nation. This research paper will begin by discussing the current economic crisis in the United States of America. It will entail a detail examination of major issues that have contributed to recession as an economic crisis in United States of America.

Easy credit facilities, collapse of major financial institution, war in the Arab countries, economic suctions on potential trading partners, skyrocketing inflation rates, and the decline in value of a dollar against other hard currencies are factors contributing to crisis in the economy.

To counter these factors contributing to financial crisis, this paper will deliberated on policy instrument employed by President Barrack Obama. It will involve a thorough appraisal of fiscal instrument for the economic year 2009- 2010. So as to offer an explicit view of fiscal policy, it is important to focus much attention first on the description of both contractionary and expansionary fiscal policy.

This research paper will further offer a comparison of the two as employed by the current president of United States of America then describe a statement of polices adopted by the White House. Before a conclusion is drawn, we will put across recommendations which are relevant for the current economic situation.

Economic crisis in United States of America

The current economic stalemate in various countries is as a result of misplaced priorities. This means that man is the source of all the troubles pulling down the prospects on an economy. Economic crisis has been marked by low employment of factors of production because of low spending.

This minimum spending may be as a result of fewer saving. Macroeconomic equation offers an illustrious example of how savings, investment, consumption and the balance of payment deficit affect the running of an economy thus leading to economic crisis (Richard, 2010). As part of the factors contributing to economic crisis the paper present the following ideas as the leads to economic crisis.

Collapse of major financial institution

The beginning of the crisis was a very simple pointer n the financial market. It was triggered by a housing plan whereby credit was given to people to buy houses whereas they could not afford. Since they didn’t have enough savings, the only option was to go for mortgage from financial institution.

The long run effect was a failure in paying back their debts and a subsequent collapse of major banking institutions. Statistics shows that there was an estimate of 6 trillion US dollars mortgage debt in 1999 which translated to 12 trillion US dollars in 2007 and a further higher level in later years.

If these figures are compared with annual value of gross domestic product of approximately 11.5 trillion US dollars with a debt of 9 trillion US dollars then it was not possible pay the losses. This acted as the beginning of the present predicament of never ending debt crisis. Although stimulus package has been recommended by US administration, minimum results have been registered.

Easy credit conditions

In the year 2000 the government reserve reduced its rates by 5.5 % for three years. This was necessitated by terrorist attack in 2001 and a predicted deflation. An increased downward pressure on interest rates was caused by increased trade deficits in the year 2006 and summed up by the housing problem (Lahart, 2010). Following the deficits, United States had to borrow so as to finance them. The act had an effect on the price of marketable securities and the interest rates since the two are inversely proportional to each other.

Invasion of Arab country of Iraq

As a security measure, United States of America invaded Iraq with presumption of destroying dangerous chemical weapons in possession of Iraqi government.

This meant redirecting development resources to this otherwise non income activity. The net effect of this action is a deficit in capital and recurrent expenditure budget. Monetary and non-monetary resources could have been used for development and to supplement other arms of the federal government. Economic assumptions shows that resources are better utilized within a country.

Sanctions placed on growing economies

Economic suctions placed on other countries destroy environment meant for business. A good illustration of this factor is economic suctions imposed by the united nation on the already crippled economy of Zimbabwe.

This was a bold step following a widespread crime against humanity committed by the sitting government. The net effect of the trade sanctions is a minimized ease of flow of economic goods through trade channels. Another factor chipping in is the progressive growth in economies of Japan and Europe which is unfavorable for the economy of United States (Paul, 2010).

Other nations have diverted their trading partners from USA to these fast growing economies. This therefore means that the output for locally manufactured products cannot find market thus yielding less national income. Appreciation of the dollar against other hard currencies has affected exports of sectors where it has a comparative advantage.

The surplus produced are suppose to be exported to earn foreign exchange and support domestic investment. A long run effect of low exports and increased imports is the creation of unfavorable balance of payment deficit where the United States economy cannot find foreign market for its products while on the other hand it has to import.

Inflation

Increase in price of oil per barrel and other consumer goods has an effect on consumption spending. In the beginning of the year 2007 prices of oil was 49 US dollars but one year later the prices was nearly a triple of the value (Joseph, 2010). Economist based the argument of the view that people would want to save more and spend less because of the fast increase in prices of goods and services. Since the prices are high, purchasing power of the consumer reduces.

This translates to a situation where producer goods cannot find market thus forcing producers to cut down their production. Inflation also affects negatively market securities like bonds. Public tend to shy away from the unattractive bonds which then calls for a new offer. In this regard money is held for speculative purposes.

Decline in value of dollar

For any investment to be done, investors are more concerned with the rates of exchange so that they can get a value for their money. If the exchange rates are high, investors would get a less value for their investment because it would not find market. The United States recorded a high decline in the value of its currency by 45% between the years 1985 to the end of 1987.

This mainly affected the bonds and other securities in the stock market owned by foreigners who had invested in the U.S. economy. It therefore meant that the public and private projects cannot be financed by foreign direct investment as a source of capital.

Fiscal polices employed by President Barrack Obama

The current president of United States was fast in formulating policies to deal with economic crisis. Among the package was the use of fiscal policy to jumpstart a thriving economy.

This captures the tax collection as a source of revenue and how they can be spent wisely. If the percentage of taxes and their internal composition are adjusted then their cumulative effect will be on: aggregate demand and employment in the economy, the ways of allocating resources while taking care of income distribution. Every government must consider drawing an all inclusive budget for the citizens.

The major source of finance for the budget is revenue collection in form of taxes from all administrative levels. Another principal source of funding is printing money. More money will go into circulation and can lead to hyperinflation if production in all sectors of the economy is not enhanced.

The government can also borrow from the public by issuing securities like bonds and other stocks. This has an effect of reducing money in circulation and therefore using such funds for developing sectors of the economy. Reserves and selling fixed assets can also be used as a source of funds for federal government’s intentions.

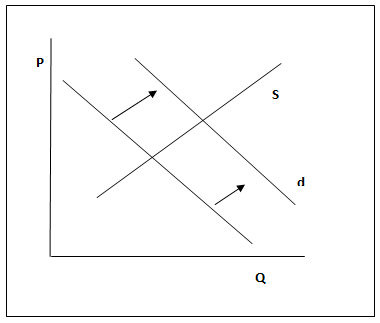

So as to be explicit on fiscal policy instrument, graphical representation can be drawn to demonstrate effect of taxes on the demand curve.

A reduction in taxes has an effect on effective demand since the demand curve shifts to the right as shown by the arrow in the graphical diagram.

Expansionary fiscal policy

This involves a progressive increase in government spending compared to taxes as a source of revenue. Since the expenses in the budget are more then the budget will face a deficit of finances.

The 2009 saw a deficit 1.8 trillion US dollars and the current projection for president Obama will realize a deficit of 7.1 trillion US dollars by the year 2019. Health plan by the president will see more funds being allocated to it. Following an increase in terrorist treat and continued stay of military in Iraq will demand more funds be allocated in form of military spending.

While attempting to build on employment level, Obama’s government has to create opportunities for its youth. This is in form of enhancing the capacities of both service and manufacturing sectors. The motive of the president’s budget proposal was ultimately for socioeconomic equity. As an expansionary measure, US president proposed a tax relief for those earning less incomes and families with minimum source of income.

This would subject them to more disposable income. Since tax levels are low, consumers would shy away from spending hence an overall increase in consumption expenditure and aggregate demand. An equal and opposite force of increasing taxes for income groups of persons earning above 25,000 dollars is meant to reimburse accounts of the federal government and thus gourd them from loss after a tax subsidy for the poor population.

The act empowering the less fortunate in the system will bridge the gab between the poor and the reach thus achieving a bigger percentage of social equality. Considering the fact that more taxes have been imposed for the elite in the system then spending on expensive consumer goods is reduced but a tax relief would motivate them to spend (Krugman, 2010).

By cutting down on taxes charged for small and medium enterprises, the administration would reduce unemployment while expanding on job creation. The action of raising taxes on capital gains is a non-motivating factor to investors as it would reduce the amount spent on investment. These taxes on capital gains supplements governments budget and thus enable it developing less developed areas of the United States of America.

To analyze on the issue of divided taxes is that the kill the will power of an investor whose earnings has to be taxed further regardless of the levels of earnings. It must be considered that the current economic crisis was partly caused by a reduction in efficiency of stock market leading to investors moving out of the market. Financial institutions with its aspects of circulating deposits could not function well.

To illustrate this point, persons would borrow funds but were not able to payback their debts. This meant that the financial institution failed to generate incomes from the process of lending and reinvesting deposits. The president wish to streamline these financial sectors by injecting in funds from the central bank by reducing banks lending rates. If the rates are reduced, banks would go for funds from lender of last resort. Therefore these banks would be able to support their activities.

This expansionary fiscal policy is meant for redistribution of economic resource and a more progressive definition of taxes. This means that those who earn more will have to pay more in form of taxes.

Contractionary Fiscal Policy

This kind of fiscal measure has a high revenue level as a result of high taxation rates. Contractionary measure is possible by reducing government spending or increasing the taxes levels. The end factor is a less deficit in budget or rather the surpluses are more contrary to anticipation. By default, a budget is supposed to show an equilibrium position between spending and incomes (Lahart, 2007).

In his administration president Obama planned on increasing taxes on high income groups so as to balance on income distribution and bridge the gab between the poor and the rich. However much of the contractionary policy is not used by Obamas administration simply because of the policy framework.

Statement on the policies adopted

Policy instrument adopted by president Obama is an expansionary fiscal policy with an aim reducing the gab between the poor and the rich through fiscal policy instrument adopted. A more progressive taxation system recognizes the need to tax more people at a higher income category and redistribute it the low income group.

The policy also favors the poor population in the health care plan by reducing the pay roll tax contrary to previous reduction on income tax. Pay roll taxes majorly finance the social security and medical care of the population. This major cut was to stimulate growth in various sectors of the economy by building on the motivation power of the people (Richard, 2010).

Recommendations

Financial sectors form the basis of any economy. There is a need therefore to make them more responsive to the needs of the population by letting the interest rates fluctuate with demand in the market.

This is possible if the federal government do not temper with the lending rates of banking sectors. In the light of this statement, a positive measure can be taken in form of encouraging masses to borrow and reinvest.

Interest rates can be reduced for those who want to invest in specific sectors of the economy an example being housing. Foreign direct investment is another approach that can be employed by the government to stimulate growth. This is possible if taxes imposed on foreign investors are reduced.

It can be in form of tax cut on corporate body. All factors considered, an American economy cannot survive on its own without employment of monetary policy. As illustrated in statement mentioned above, monetary policy is the use of interest rates to regulate on money circulation in the system.

If the government wants to encourage borrowing from financial institution then it reduces the lending rates. People would then go for monies in the bank to reinvest in a potential business environment. If an overinvestment is registered then the government can increase the lending rates which would prompt people to hold monies for speculative purposes.

Conclusion

The beginning of this paper is a discussion covering on the economic crisis in the United States of America which is broadly seen as recession.

Contributing factors analyzed include: collapse of major financial institution, progressive increase in the prices of consumer goods, misplacement of priorities, trade sanctions on other nations, and the perpetual increase in debt burden. As a measure to deal with financial crisis president Obama employed the use of fiscal policy as a macroeconomic stimulus package. The research paper is explicit on both expansionary and contractionary fiscal policy.

It is evident that the president employed more an expansionary measure by focusing on reducing on taxes imposed on low income group. After an analysis of the policy instrument, the paper offers a statement on fiscal policy. Final it is imperative to make recommendation which will add value on to the research in the field.

References

Krugman, P. (2010). The Return of Depression Economics and the Crisis of 2008. New York: Norton Company Limited.

Lahart, J. (2010). Egg Cracks Differ In housing, Finance Shells. Wall Street Journal, 23, 1317- 1623.

Joseph, E. (2010). Freefall: America, Free Markets, and the Sinking of the World Economy. New York.:Norton & Company.

Richard, B. (2010).The Global (Financial). Economic Crisis.

Paul, W. (2010). Financial Stress – Should We Blame the Failing Economy? Economic policies.