Introduction

This financial research report is about a potential investment opportunity for a client interested in any publicly traded company in the US. The company preferred for the client is General Motors Company (GM). Established more than 100 years, GM designs manufactures, markets, distributes vehicles, and vehicle parts, and sells financial services across the globe (General Motors para. 1). With more than 215,000 employees, the company has been able to deliver 10 distinctive automotive brands under the General Motors corporate umbrella: Chevrolet, Buick, GMC, Cadillac, Opel, Vauxhall, Holden, Baojun, Wuling, and Jiefang (General Motors para. 1).

A Rationale for Choosing the Company for Which to Invest

GM is the oldest car manufacturer, which is viewed as a great company, given consumers’ interest for its a wide range of vehicles, from electric cars to heavy-duty full-size trucks sold globally. The company’s electric cars, specifically Chevrolet Volt, have won green initiative awards.

Economic Significant

GM is a company that has brought about significant economic changes in the global automobile industry. With the established sales channels across the world and innovative technologies, including an electric car, GM has critical implications for both the energy and transport sectors. In other words, GM is a company with innovative products and technologies with huge potential to change significant fractions of the economy and improve the US economic growth for many decades.

As GM is considered for this investment option, one must not forget that for decades, the company had acquired a bad reputation, leading to its bankruptcy in 2008 and a subsequent bailout by the public (Rosevear para. 14). Today, however, GM has changed tremendously with huge profits, growing dividends, shareholders’ support, and leading cars in the auto industry.

The company is positioned for growth, as the new management has demonstrated. The strength of this firm makes it important for the economy in specific areas related to employment and inflation and, therefore, of interest to any investors. GM has continued to improve its manufacturing processes to cut costs and return profits. In addition, it has significantly embraced new technologies to reduce the overall headcount in the factory – a strategy that has controlled growth in wages. Of course, in the US auto industry, issues associated with increasing labor costs are among the most complex ones. Nevertheless, the company continues to work with the United Automobile Workers Union (UAW), which represents autoworkers at three large automakers in the US to improve compensation and benefits (Cutcher-Gershenfeld, Brooks, and Mulloy 3).

Additionally, the big three automakers in the US are now seen as major players in the US auto industry after decades of turmoil. GM is now caught between technology and innovation to deliver new cars to customers. The firm has a relatively small production number of electric cars relative to gasoline-fuelled cars. GM’s production capacity for electric cars is poised to increase each year as demands for such cars increase. That is to say, the electric car market is growing faster, steadily, and rapidly than earlier thought. Analysts and investors have noted that the number of electric cars on the road in the US will reach 25% (up from the current 5%) by the year 2025 (Goldman Sachs para. 2). This emerging trend will ultimately change oil consumption in the US and other countries and create new oil demand patterns. Perhaps, the reduction in demands will be associated with many electric vehicles on the road, which would probably drive low oil prices. Therefore, GM and other electric car manufacturers will transform the economy in a significant way.

Financial Significant

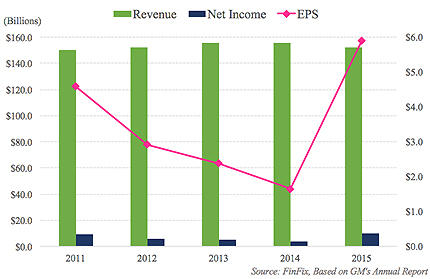

Current financial reports indicate that GM is back to profitability, and it is likely to continue with this trend. Moreover, the firm has continued to realize increased revenues (except for the fiscal year 2015) because of year-over-year growing demands and sales across the globe.

For current and potential investors, GM resumed dividend payments in 2014, and it paid $1.2 and $1.38 for the fiscal years 2014 and 2015, respectively. Still, the company focuses on enhanced investment in different divisions to improve its technologies, particularly on more affordable electric cars.

The continued investment and dividend pay demonstrates that GM executives have confidence in the future performance of the company. To this end, the financial significance of the GM to the US economy or global economy and individual investors is significant and continues to reshape the US auto industry after decades of uncertainties. GM has massive financial, marketing, manufacturing, and technical resources, which it can leverage to facilitate the production, sales, and promotions of new cars globally. Its bailout following the financial crisis indicates how GM is important to the US general economy.

While the company pays dividends, GM stock would be suitable for the patient, long-term investors with the buy-and-hold approach. According to analysts, GM stock offers an important opportunity for investors who are focused on long-term rewards and patient enough to sell in the future (Rosevear para. 4).

As GM’s share price continues to rise, long-term investors have better buying opportunities at the company. To date, the so-called bailout stocks of auto and financial industries remain unattractive to most investors. Thus, this offers the best buying opportunities.

Other Factors of Consideration for the Selected Stock

Investors should consider GM as an automaker of the future. As stated above, electric cars are gaining traction, and GM is among the major players. This approach represents a strategic positioning for the company, which gives it competitive edge competitors.

Tesla is now strategically positioned in the middle of two emerging industries, electric, self-driving cars, and clean energy, which will move the company forward.

Further, the current leadership is also focused on the long-term success of the firm. The CEO, Mary Barra, has GM in the right direction for the future growth. Specifically, the GM is now shaping and leading in the trends that are expected to reshape the auto industry (Rosevear para. 1). In this case, the company will not go wrong with such approaches because it has embraced technologies lead other companies in the auto industry. GM stock price will continue to rise as revenues increase. Thus, it is a good bet for investors.

Primary Reasons Why the Selected Stock is a Suitable Investment for the Client

GM is currently considered as a yield stock and growth-oriented. A potential investor must evaluate the company’s stock to understand why it is a good buy right now. There are three important reasons. First, the valuation is important. The firm’s shares now trade at less than four times the last 12-month earnings. For a century-old firm, that stock is terribly cheap. Thus, it should not be less than 10 times the earnings. The company now pays stead quarterly dividends that are about 38 cents for every share. This implies that an investor can receive about 4.78% in yield from dividends if they purchase GM stocks now. However, the major challenge is the 4.8 P/E, implying that the company would take relatively shorter time to earn that investment because of the faster growth rate.

Second, low prices imply that GM can now yield about 4.8% in dividends. Of course, the industry is known for cyclical behaviors and, therefore, an increased dividend may not be sustained because the company may reduce dividends during downturns. Historically, GM and its major competitors, such as Ford, have often recorded losses during economic difficulties. Notably, the US car market is now getting to its peak and GM stock is relatively cheap. However, GM has managed to change, specifically by lowering its costs down to allow it survive and remain profitable in another recession. While a recession may cause a decline in profits, the company currently has about $20 billion in cash to fund research, product development, and other investment obligations, if at all a downturn will occur. Further, GM also claims that paying dividends will remain among the major obligations unless the recession is severe. However, investing in GM now should not be about dividend payment and then reinvesting later.

Finally, the third reason for purchasing this stock is the growth trajectory presented by the CEO about two years ago. The CEO presented a thorough plan to revamp the company’s pre-tax profit margin to about 10% and sustained in the next decade. While the plan is intricate, the simple observation is that the plan has allowed GM to earn more profits and will continue to do so in even in difficult periods. Since the CEO presented the plan in October 2014, the company’s margin was 6.1% but today it is about 8.3%. Investors must always acknowledge that it could be difficult to get high-yielding, sustainable dividends, high-value price, a strong management team, and a remarkable profit-growth-oriented company (Rosevear para. 7).

A Description of the Client’s Profile

The investor is a growth-oriented and yield focused one. The investor will strive to leverage the long-term potential of GM profitability through buy-and-hold approach. GM share price is characterized by price fluctuations, but it is currently rising. The investor generally has a long-term investment vision.

The investor is a rich and whose main goal is wealth creation. Current income generation or the yield offered is not the primary goal of the investment decision. Hence, it will be important for the long-term growth oriented investor to hold off on GM’s stock until the company sustains its profitability margin beyond 10%, perhaps in the next decade.

The investor must be patient. Besides, they must be a supporter of GM in the recovery and reshaping of the US auto market, and believes in long, growing future of the company and the comprehensive plan of the CEO. The investor understands that the loss-making trend will soon end, and Tesla will start paying dividends.

The investor is a long-term value-oriented one. Long-term value-oriented investors find General Motors stock or Ford’s stock extremely attractive. Thus, they should buy, get dividend yields, and hold for a long time as share price rises. GM currently has positive operating margins and operating cash and, therefore, the company presents limited investment risks, which are not critical investment challenges. GM stock is, therefore, perfect for such an investor.

Analysis of Financial Ratios

Liquidity

Current ratio is important for assessing an overview of GM’s ability to repay its short-term debts using its short-term assets. Current ratio for the last three fiscal years is as follows.

Table 1. GM’s current ratio. Source: GuruFocus.com, LLC.

The ratio has been declining, but GM is still efficient in its operations and, therefore, issues may not occur. The acceptable ratio ranges between 1 and 3. Although the ratio is declining, it does not necessarily imply that GM will face bankruptcy again.

Quick ratio shows whether GM will be able to meet its short-term obligations based on its liquid assets but not inventories.

Table 2. GM quick ratio. Source: GuruFocus.com, LLC.

For the last three fiscal years, GM has noted a declining quick ratio, which demonstrates that the company is highly leveraged and struggling to grow and sustain sales. Thus, the diminishing trend is not good, and GM may struggle to cover its financial obligations.

Earnings per share ratio reflects the value of earnings per outstanding share of Tesla’s stock. The dividend preferred has been subtracted to eliminate common manipulation through non-recurring items, depreciation, or amortization rate. This presents better performance of the company.

Table 3. GM’s earnings per share ratio. Source: GuruFocus.com, LLC.

The earnings per share is an important indicator of the current GM share price performance, and it is necessary for investors who want to evaluate the general profitability of GM. In this case, GM is profitable.

The current price-earnings ratio is 5.75, implying that the company is making profits. That is, GM has positive earnings and posts profits albeit, fluctuating year-over-year.

Table 4. GM’s price-earnings ratio. Source: GuruFocus.com, LLC.

Gross margin shows that GM is now profitable, and generating adequate revenues to cover all costs related to production.

Table 5. GM’s gross margin. Source: GuruFocus.com, LLC.

While this ratio is positive show that GM is doing relatively well, it is not consistent. The low ratio (below 20%) also shows that GM has not created sustainable competitive advantage in the auto industry. Consistency of gross margin is important for competitive edge.

The Risk Level of the Stock from the Investor’s Point of View

GM is not a high-risk stock, but the company has a bad reputation associated with the bailout. Consequently, many investors have shunned the company shares, but the conventional wisdom states that investors should concentrate on stocks out of favor and then hold until they become favorable. GM is not alone in this predicament. Citigroup Inc., American International Group Inc., and JPMorgan Chase & Co. continue to trade below their book values because investors were not pleased with the bailout idea.

Vehicle recall is major issue facing the auto industry and eventually affects stock performance. The company has to repair and compensate affected customers. Earnings were also not stable in the fiscal year 2015. A failure to reach expected target negatively affects yield and investment decisions. Moreover, sales may also decline in the core market, especially in North America. GM also faces branding issues. In this case, customers argue that the company is among the ‘old school’ auto manufacturers. Notably, the company has transformed its technologies to introduce new brands of cars, including electric cars. Overall, recalls, unstable earnings, and branding continue to challenge the company’s stock. Nevertheless, market share and profits continue to grow.

Key Strategies to Use to Minimize These Perceived Risks

While GM is equally attractive, the investor should also consider other investment options perhaps in different industries. For example, the long-term investor may also opt for corporate bonds because of comparatively low risks compared to GM stock investment because such fixed-income instruments can help the investor to counter possible losses at GM. Additionally, the investor should continuously improve the portfolios to mitigate risks in stocks. This implies that the investor will maintain a fixed risk-return ratio in the portfolio to account for the long-term growth-oriented and fluctuating yields from GM. Notably, other long-term value-oriented stocks offered by Ford or Tesla should be considered in the same industry. Overall, low-risk investment option is a strategy to mitigate adverse effects of GM shares.

The investor should also evaluate GM’s quarterly performance and assess its global market performance to predict possible challenges. The announcement that Chevrolet Volt EV will be a long distance car, for instance, has put GM as the industry leader competing against Tesla. Thus, such developments should influence future decisions to buy more, hold, or sell immediately.

Recommendations of This Stock as an Investment Opportunity

Following the analysis, it is recommended that the long-term growth-oriented and yield-driven investor should invest in GM stock. Notably, GM stock has huge potential to appreciate and generate massive returns because the company is currently trading below its book value. The decision to buy and hold is supported with the following facts.

GM Growth

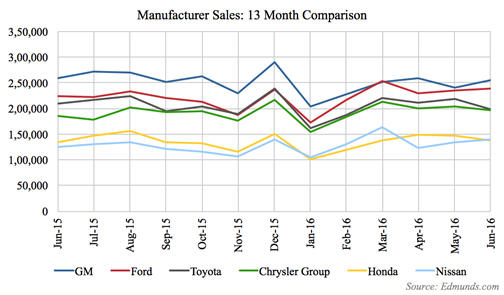

GM has been acquiring market share while positioning itself to realized over 10% in pre-tax profits and sustain that rate in the next decade. In fact, latest data indicate that GM now leads Ford, Toyota, Chrysler, Nissan, and Honda in acquisition of retail segment market shares (Bajpai para. 2).

Dividend Yields and Repurchase

Investors have continued to earn dividends from the company. Besides, the company has expressed its capabilities to pay dividends even during hard economic periods.

Efficiency

GM is now focusing on efficiency by eliminating needless costs. GM strives to make every division and business segment the ‘industry best’. The company’s efficiencies are meant to save more than $2.5 billion by 2018. Moreover, the comprehensive plan will also assist the company to realize these goals.

Overall, GM share prices have dropped and short-term value-oriented investors may regret their investment decisions. However, for long-term value-driven and yield-oriented investors, GM presents massive investment opportunities. In fact, the company depicts growing strength in several aspects, but the same improvements have not been shown on the current share price. The company is gaining its financial strength, has sustained dividend payments, focused on technologies, vehicle innovation, diversification in financial services, and a leader in the industry. The company now concentrates on changing transportation. It is a recommended stock for patient investors who can buy and hold while earning dividends.

Works Cited

Bajpai, Prableen. 5 Reasons to Buy General Motors (GM) Stock. 2016, Web.

Cutcher-Gershenfeld, Joel, Dan Brooks, and Martin Mulloy. The Decline and Resurgence of the U.S. Auto Industry. Economic Policy Institute, 2015.

General Motors. About General Motors. 2016, Web.

Goldman Sachs. Cars 2025. 2016, Web.

GuruFocus.com. General Motors Co. (NYSE:GM) Gross Margin. 2016, Web.

Rosevear, John. The 3 Best Auto Stocks for Your Portfolio. Motley Fool. 2016, Web.