Introduction

Overview of the Global Financial Credit Crisis

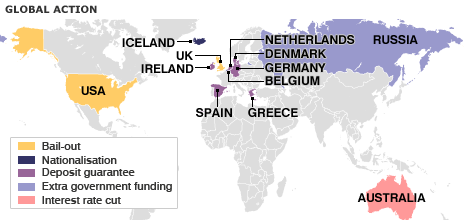

The recent global financial crisis that occurred two years ago caused a lot of controversy and uncertainties in the business world. The credit crunch referred to a severe shortage of money or credit though at the time this was like a new term to many people. The crisis affected the global industrial leaders in different ways. GE Corporation is a good example of the negative influence caused by the global economic recession on the development of any business. (BBC news, pp. 1)

Financial Crisis: How It Happened

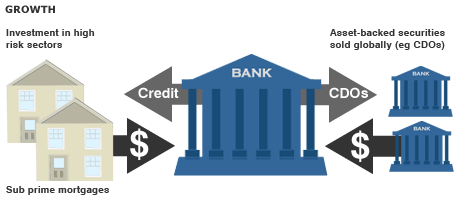

The credit crisis was linked to the sub-prime mortgage business. The United State banks gave high risk loans to individuals having poor credit histories which together with other loans and assets were bundled into Collateralised Debt Obligations (CDOs). These were then sold to investors globally as portfolios.

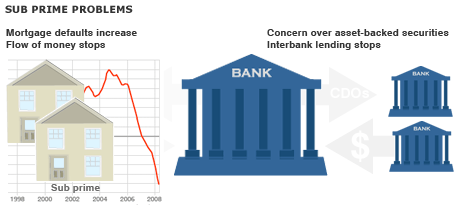

Increased interest rates and falling house prices rendered many people unable to repay their mortgages. Due to the losses made, the investors became reluctant to take on more CDOs thus the freezing of markets as most banks became reluctant to lend each other. This happened as the lender bank could not be sure how many bad loans could be in the books of the opponent.

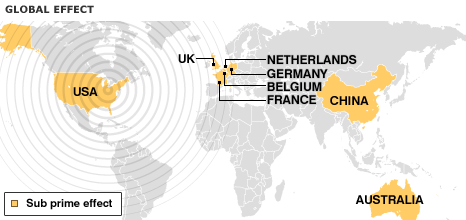

The impact of the sub-prime mortgage was not confined in the United Sates only as the implications could be felt far and beyond like investment banks in Australia which experienced the losses. Due to the market conditions large firms cancelled the sale of bonds worth billions of dollars just to play safe and avoid more losses.

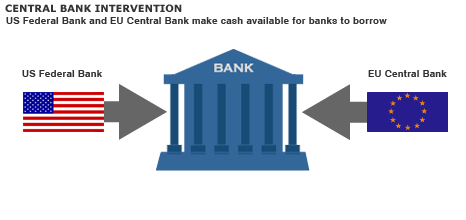

With the situation getting worse, the US Federal Bank and the European Central Bank intervened and provided funds for the banks to borrow at favorable rates so as to boost the money markets. So as to encourage lending, the interest rates were also lowered credibly.

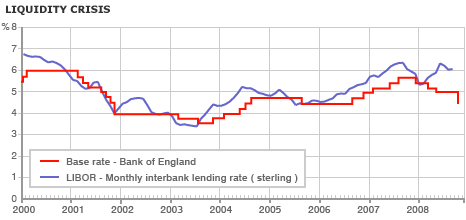

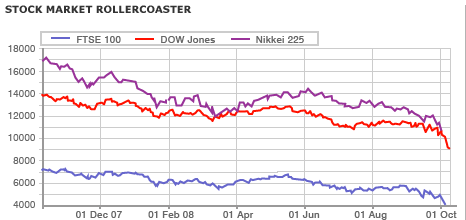

As from the above graph, it is clear that the short term help is not a solution to the liquidity crisis since banks still hold the fear of lending to other banks. As an effect of lack of credit to individuals, companies and banks, then comes in the threat of recession leading to repossessions, bankruptcies, job losses and high costs of leaving.

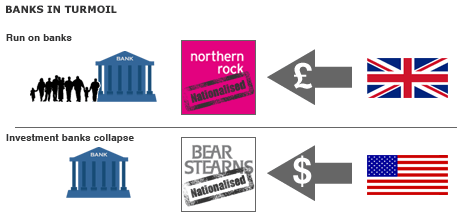

Withdrawal of £2bn by worried customers takes place as a result of the UK bank Northern Rock, looks for an emergency loan so as to stay afloat and it is later nationalized. Confidence in the financial sector was greatly interfered with for example where large businesses had been threatened. A good example of this is the Bear Stems which caused tension when it was almost failing.

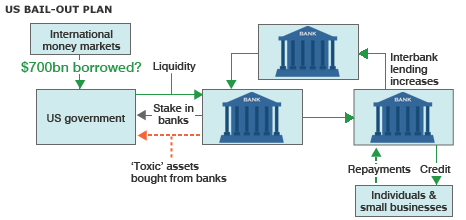

The US government intervened in areas where financial giants were at a threat of collapse so as to bail them out for a return of stake in such companies. This occurred for example between the US Government and Wall Street. The money was expected to be borrowed from world financial markets and the US government hopes to sell the distressed assets back with the stabilization of the housing market.

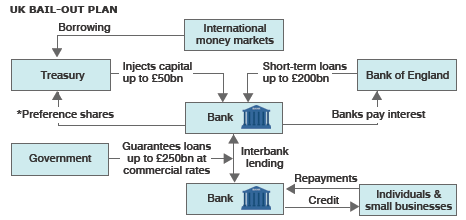

During this period of recession bank and other business in the UK were experiencing serious shortage of cash, causing the intervention by the government in such conditions. A good example is when the UK bailed eight of its major banks with an aim of attaining preference shares in return (BBC news, pp. 1). The UK government expects to get a stake in the banks in return to its investment though the value is not clarified.

The credit crunch affected economies all over the world making the urge of governments to nationalize banks in different localities. In the US, reports show that Canada and parts of Europe, Central banks coordinated half-point percent reduction in interest rates as an effort to ease the financial crisis (BBC news, pp. 1).

As an effect of the crisis, the rise and fall of shares have been influenced by news of failures, bail-outs and takeovers and therefore reflects the level of investors’ confidence in the banking system. Retailers have been hit as an effect of fall in consumer confidence due to job insecurity and falling house prices just the same way that bank shares have been affected by bad debts.

Impact on Credit

The global recession had a very negative effect on credit and in-fact led to what is known as credit crunch which can be defined as an excessive shortage in cash. This came as a result of failure of the market as described above which meant that most business were operating at a risk of decline as the liquid cash was affected terribly and banks could not give out loans at the moment.

This can be supported by cases such as the Northern Rock which had just been grated an emergency financial support from the Bank of England. The bank relied heavily on the markets, rather than savers’ deposits, to fund its mortgage lending which came to a standstill on the onset of the global recession. Depositors withdrew money from the bank until the government stepped in to guarantee their savings (BBC news, pp. 1).

General Electric (GE)

Vision / Mission

At General Electric (GE) the corporate vision is ‘We bring good things to life’. From all over the world GE people are dedicated into turning imaginative ideas into good products and services that they believe has great potential of changing people’s lives worldwide.

By count, GE has survived nine recessions and one depression in the 130 years of operation and growth. The driving force through the various cycles of operation results in their ability to perform, change and diversify so as to attain a solid competitive advantage over the long term (GE annual report, 2008).

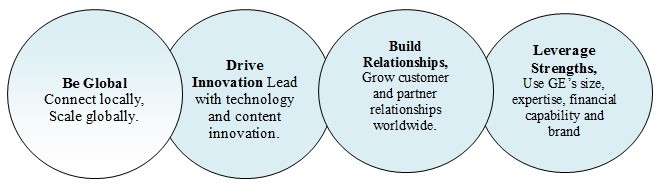

The main strategies at GE borrow from their past strengths and make them applicable and relevant to the current global business requirements and regulations as shown below:

An increase in revenues outside the US is expected in 2009 with an average annual growth rate of 13% in the previous year. This shows a good trend and is achieved through an approach called “connected and scalable localization” which entails acceleration of growth through the expansion of their local product lines, serving new customers, and creation of firm partnerships with local champions in the market (GE annual report, 2008).

Drive Innovation

GE’s continuous funding of innovation through the downturn will help keep up with the pace in its growth plans and strategies. Good examples of this are the proposed $10 billion to be invested in technology and content in 2009, and the launch of economical “value products” in 2009 such as the 2.6-megawatt wind turbine, which has high efficiency, more capacity, and lower cost (GE annual report, 2008).

Build Relationships

The global operation of GE keeps it in a safer position due to the numerous ventures and partnerships which help in growth and risk diversification on a worldwide basis. Due to the multi-business structure, many governments prefer GE as an important partner to work with just as it is with large investors with a good example in the Beijing 2008 Olympic Games where $2 billion of revenues was realized

Leverage Strengths

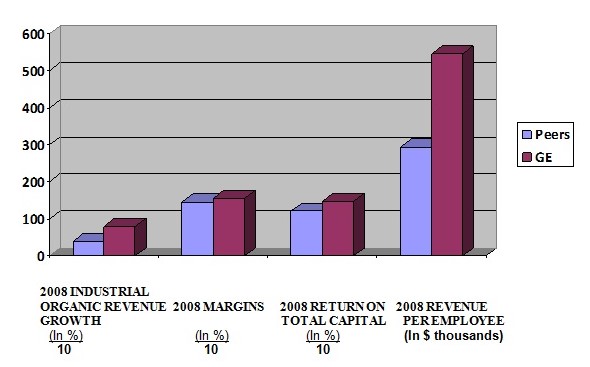

GE has core processes which are centered on organic growth, operating excellence, and development of leadership globally (GE annual report, 2008). This processes aim at spreading good practices across the company and a comparison with a composite world-class of peers can be shown from the chart below:

General Electric Background and History

General Electric is a US-based company with over 125 years of history in over 140 countries and an employee numbers of 323,000 worldwide. Founded in 1892 by Thomas Edison, General Electric is now one of the world market leaders, which however has experienced considerable financial problems in 2008 – 2009. GE started as an Electric company but few decades later, diversification comes in and thereafter has established solidly in different fields such as energy, research, manufacturing, healthcare and others (Answers.com, 2009).

Middle East Operation

Background and History

General Electric has been working with companies and countries in the Middle East since the 1930s. From this time onwards there has been great diversification of GE in the market with large project set ups and the operation with different business so as to achieve its great mission in the region. Some of the problems GE has been concerned with range from construction of world class hotels such as in Dubai, roads and infrastructure and the attention to water issues. In 2008 alone, GE businesses in the Middle East alone realized high revenue of US$6.6 billion and this is as a result of numerous businesses established by GE. Some of the major business establishments in the region are energy, water, healthcare, aviation, oil & gas and in the industrial sectors (General Electric, 2009).

Organizational Structure and Management Model

The Organizational structure of General Electric is horizontal and includes the CEO, the Senior Leadership Group, Staff Officers, the Board of Directors, and over 1,700 personnel across the Middle East with more than 10 of these being on the ground facilities and more still under development increasing the hope for future growth on their current investment. The major locations of operation in the Middle East include the following countries; Bahrain, Jordan, Kuwait, Lebanon, Oman, Qatar, Saudi Arabia and United Arab Emirates (General Electric, 2009).

GE’s commitment to the community

GE’s employees in the Middle East organize and participate in volunteer activities and charitable initiatives through GE Volunteers, involving the local community. This is done through sharing skills with the underprivileged and those with special needs, mentoring students and brightening up the community as a whole therefore providing a beneficial interdependence. In order to nature women professionally and avoid gender segregation, GE through the Women’s Network has encouraged gender diversification which has increased the number of women in its top management globally (General Electric, 2009).

Benefits attached with GE’s presence in the Middle East

Generally, there has been a very great improvement in the Middle East putting in mind that only 30 years ago the place was a major desert with minor developments. At the moment, the region is under heavy construction with Dubai alone having 24% of the world’s cranes (General Electric, 2009). These regions are being converted into tourist centers with new housing developments, business districts, manmade islands, heavy infrastructure and many more. This significantly increases the demand for more water, energy and entertainment therefore making GE be the best solution and partner.

Financials

Liquidity Ratios

The liquidity ratios are used to analyze the potential capability of a company to pay its short-term debts in cases of an emergency. A higher value of the ratio means that the company has a larger margin of safety to cover short-term debts. In this analysis of GE Company we are going to discuss the common liquidity ratios which include the current ratio, the quick ratio and the operating cash flow ratio (Investopedia.com, 2009).

When calculating the liquidity it is important to consider assets that cash generate cash quickly in case where a company is running out of operating cash. Therefore, it is wise to know that in cases of an emergency, short term assets will make a quick source of cash to use for paying of the business’ debts. The liquidity ratios are very important as are used to determine if a company will be able to continue as a going concern or otherwise (Investopedia.com, 2009). In cases where creditors are seeking payment, the important part which is the ability of the company to turn short term assets into cash to cover the exposed debts now comes in.

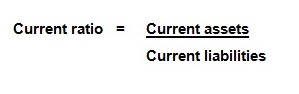

Current ratio: This current ratio is used to measure a business’s working capital position which involves checking the proportion of the total current assets for a business to the total current liabilities. This helps ascertain weather a company’s short term assets are readily available to pay off its short-term liabilities (Investopedia.com, 2009). The formula below is used to calculate the ratio:

The higher the current ration the better the company’s financial position.

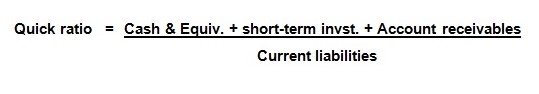

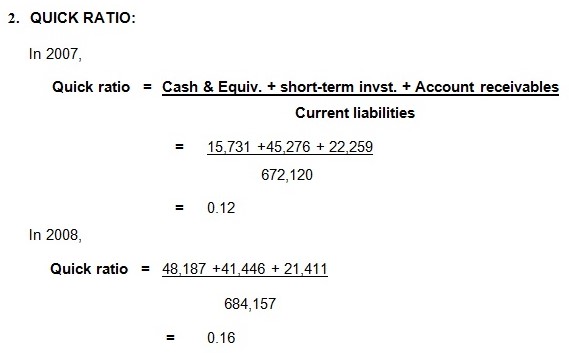

Quick ratio: This ratio is also referred to as acid-test ratio and is used refine the current ratio by measuring the amount of the most liquid current assets there are to cover current liabilities. This excludes inventory and other current assets that are not easy to turn to cash and in this case a higher ratio means a more liquid current position. The formula below is used to calculate the ratio:

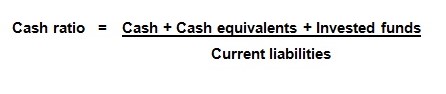

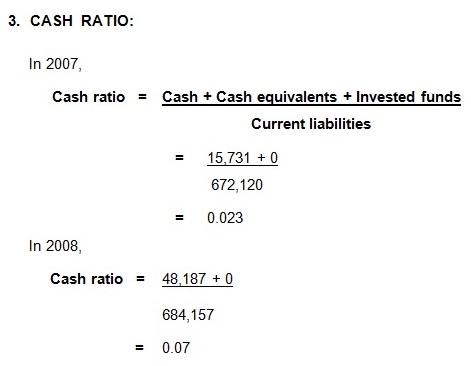

This ratio is an indicator of a company’s liquidity and refines both the current and the quick ratios by measuring the amount of available cash, cash equivalents or invested funds that are in current assets to cover current the liabilities. The ratio is calculated using the formula below:

Cash conversion cycle: This cycle expresses the length of time in days that a company uses to sell inventory, collect receivables and pay its accounts payable. The shorter the cycle the more liquid the company’s working capital position is and is calculated usin the formula below:

Cash conversion cycle = DIO + DSO – DPO

Where:

- DIO = Days Inventory Outstanding

- DSO = Days Sale Outstanding

- DPO = Days Payables Outstanding

The following are statements of accounts of the GE Company

Statement of Financial Position

General Electric Company and consolidated affiliates:

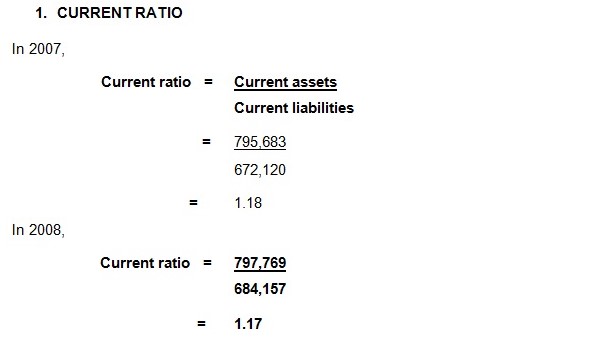

From the statement of financial position above, the current ratios in the respective years are calculated as follows:

Since the current ratio of the company in 2007 was higher, this means that it was in better financial position as compared to the following year-2008. This explains that the financial position of GE in the recession period was weakening or declining.

In 2008 there GE had a more liquid current position which is indicated by a higher quick ratio as compared to 2007 which has a lower ratio by a 0.04 margin.

A higher ratio in 2008 explains the same effect in the financial position of the company, showing a more liquid position.

GE: Credit Crisis Issues

The credit crisis phenomenon is referenced to 9th August 2007 from the unwelcome news from the French bank BNP Paribas which triggered a sharp rise in the cost of credit, making the financial market realize the seriousness of the situation (BBC news, pp. 1). Even financial giants like GE could not escape the credit crunch as we are about to see.

How did it happen?

As the credit crisis issue hit the US, one would expect any shocking news as even the financial giants were shaken. Due to this crisis, General Electric reported a lower than expected first-quarter profit in April thus lowered its outlook for fiscal 2008 as a slowing US economy sapped its financial-services business. This was not a good show especially to the management and especially the Director and CEO of the company, Jeff Immelt. The net income of the company at the moment had already fallen 6% low, to $4.3 billion, or 43¢ per share, from $4.57 billion, or 44¢ per share, the previous year (BusinessWeek, April 11 2008).

As the global recession was eating into companies some companies had to do anything so as to survive only to get into more trouble. The main example of this is the General Electric Company which was sued by secretary for false accounting.

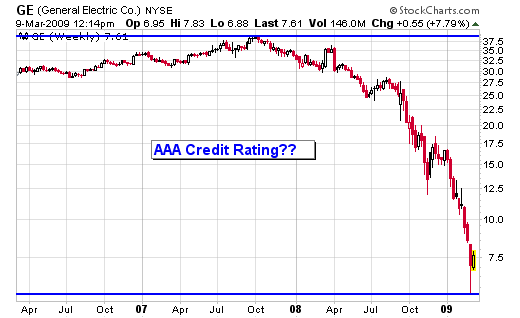

General Electric Company’s common stock dropped 79 percent in the previous year as the recession and credit crisis eroded profit at GE Capital and undermined the value of real estate on its books (StockCharts.com). The graph below shows the operation of GE during the period of the global recession.

Stock Chart

Time in Years

What exactly happened, and what division / businesses were affected?

Before the global recession, GE was considered an almost recession proof company and this can be associated with the former CEO (Jack Welch) who had helped make the company very stable through various management strategies. Therefore after acquisition of the CEO post by Immelt, GE has been in a constant decline making many overpriced acquisitions and at the same time relying too heavily on its GE Capital finance arm, among other things (NEW YORK POST, 2009). The position of the economy at the moment was so bad that almost nothing could be done to save the mess- a statement by a former executive.

Though the credit crisis could not be avoided, proper strategic management would have saved the situation a great deal something which Jeff Immelt did not do well. Sources tell that the CEO was responsible for loading up the unit with depth during the go-go years and the unit became so big that he could not possibly reconstitute it at the moment. This shows that despite the effect of global recession, management factors also had an influence in GE Crisis. As a way to solve the problem he would have started running down GE Capital like two or three years earlier.

The graph below shows the trend of the market decline during the period of global recession:

With credit crisis, GE had to liquidate some of its assets so as to ensure they maintain operation and as a way to play safe. This is seen in the acquisition of GE plastics by Saudi Basic Industries Corporation (SABIC). On 21st May 2007 SABIC announced that they had reached an agreement for SABIC to acquire GE Plastics at a cost of $11.6 billion (Sabic, 2007). This acquisition was supported by Jeff Immelt both in terms of higher cash offer and due to the company’s premier position as one the world’s fastest growing, and innovative companies with a strong reputation as an efficient operator of large chemical plant & technology.

SABIC is a Middle Eastern Company but with its roots in the American market, and is recognized as among the world’s largest petrochemicals manufacturing company. The company is among the world’s market leaders in the production of polyethylene, polypropylene, glycols, methanol and fertilizers as well as the fourth largest polymer producer (Sabic, 2007). Since SABIC has operated in the America for 20 years, it has experience of operation in the US as a top chemical Company and will therefore form a good match for global operation with GE Plastics operating under it. The acquisition of GE Plastics by SABIC is expected to raise the employment numbers from roughly 700 employees in the US to a high of 30,000 people. This will be beneficial to the US residents and globally as well.

What are the Solutions?

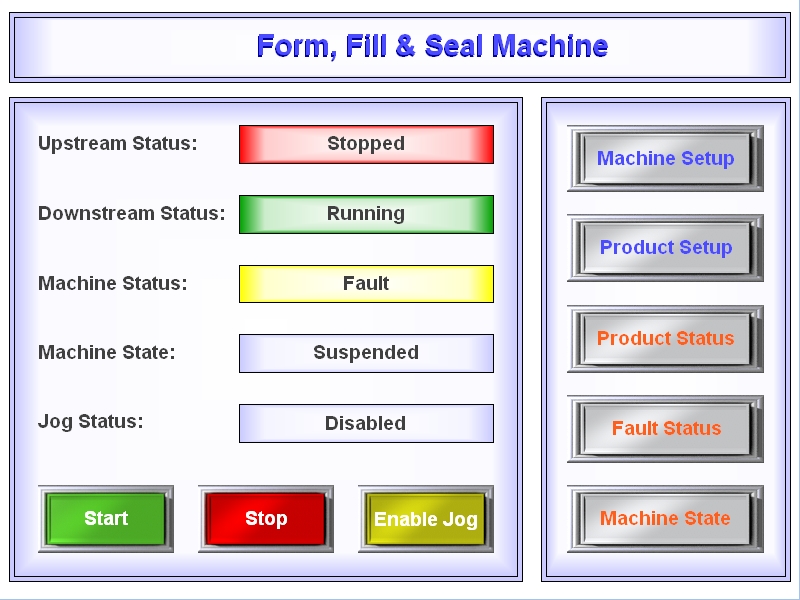

OEM Solutions Pack for Proficy® iFIX 5.0 Released by GE Fanuc Intelligent Platforms Accelerates Development, Reduces C and Streamlines Operations (GE Fanuc, 2009).

GE Fanuc Intelligent Platforms is a joint venture between General Electric Company and FANUC LTD of Japan and is an experienced high-performance technology company that has helped come up with the OEM Solutions Pack (GE Fanuc, 2009). Due to the situation of the economy there is the need to find a solution to improve the situation and be safe.

In 4th August 2009 GE Fanuc Intelligent Platforms released its new OEM Solutions Pack for Proficy 5.0 which was award winning software that makes easy duplication across many devices and machines for ease of integration, consistency of operation and the implementations of data standards like OMAC (GE Fanuc, 2009).The OEM is expected to save a lot of dollars for GE and therefore is a perfect solution at the current situation of the ongoing global recession. This software will help a great deal in reducing their development goals through the adequate capability to provide maximum utility and hence saving.

The OEM has a great advantage as we can see it includes a variety of machines performance screen templates and dynamos fixed in such way as to provide easy use. This will always quickly provide machine level monitoring at a total low cost to the end customer and at the same time it can streamline project schedules and enable very easy maintenance.

Proper management and strategic planning will however play an advantageous role in making sure no losses are made through poor management issues. Strategic planning will always ensure proper execution plans are made before undertaking a risk that can negatively affect the business in case it fails to work.

Analysis

US Stimulus Package

Due to the global economic recession, a temporary solution has been reached through the Obama government which involves the issue of the stimulus package. Since the congress has reached an agreement on an economic stimulus package, the report says that taxpayer will receive checks ranging from $300 – $1,000 per household, whereas businesses will get tax breaks as well. Businesses are also to receive $70 billion in tax breaks so as to invest in plant and equipment and small businesses making losses now will be allowed to reclaim the previously paid taxes (cheap outings, 09).

The stimulus package is a good idea as it puts money in peoples pocket but most likely is not a long-term solution. This is so because it is going to add about $150 billion dollars or even more to the current deficit which may possibly make the situation even worse in the shot-term future, as the value of the dollar drops. This process however is aimed at providing for economic stimulus in the form of money for infrastructure projects to inject cash back into local economies and stimulate job creation (Suite 101.com).

This may be a risky step to the individual as it may easily lead to bankruptcy. So as to trigger the market from the fear of investment, the US government has planned to do this by giving out the money to citizens and businesses which are expected to have an effect of boosting investors’ morale. As this happens, the government will then recollect a large portion of the money that has been released in the form of taxes. Through the paying for infrastructure projects, the idea behind that is that of a loan, this is so because all the money is taxed at different levels (Suite 101.com).

With this idea in mind, it means that it is possible for the stimulus package of the US government to assist in the economic recovery just solely. The ability is tied to the possible activation of the stock market which in turn boosts the morale of investors currently thinking weather to take a risk in such an economic position.

Along the lines of technology hope is also on a high note as this will always form a strong backbone to economic recovery. Therefore it is not certain that the stimulus package plan will make recovery of the market without any external influence. There might be a need to involve participation of other factors.

Works Cited

Answers.com: The Worlds Leading Q & A site. 2009. Web.

BBC NEWS / Business / Timeline: Credit Crunch to downtown.2009. Web.

Business Week: Credit Crisis Crimps GE. 2000-2009. Web.

Ge: Imagination at work. 2009. Web.

GE Fanuc: Intelligent Platforms. 2009. Web.

INVESTOPEDIA: A Forbes Digital Company. 2009. Web.

NEW YORK POST: GE IMMELT-DOWN. 2009. Web.

Sabic: News & Media Relations. 2008. Web.

Suite 101.Com: The Genuine Article. Literally. 2009. Web.