Abstract

Price mechanism is used to allocate scarce resources in a free market economy. The decisions made consumers and suppliers determine the equilibrium price in the market. This is done through price signals whereby when demand is high, prices are raised by suppliers so as to increase their potential profit leading to an increase in the quantity supplied.

On a daily basis, the price mechanism is an extremely influential mechanism for determining how scarce resources are distributed amongst competing ends. the main reason why the government chooses to intervene in the market is to ensure that scarce resources are distributed optimally among all the parties and to improve the social and economic status.

All governments of all political affiliation get involved in the economy to manipulate the allocation of limited resources among all the users. The main reasons for policy interventions are: to correct market failures, to achieve a more equitable distribution of income and wealth, and to improve the performance of the macro-economy domestically and internationally.

The government can intervene in the market through many ways, for instance, it can impose a competition policy, employment laws, price controls, indirect taxes, subsidies, and tax relief. Most of the commonly used technique is indirect taxes and subsidies. An indirect tax increases the price of a commodity and reduces the quantity consumed whereas a subsidy reduces the price and increases the quantity consumed.

However, both methods are influenced by the price elasticity of the demand curve. The purpose of this paper is to discuss the role of price mechanism in allocation of scarce resource in a free market economy and in a mixed economy where the government takes control. It gives the role and importance of government intervention in the allocation of scarce resources through the use of indirect taxes and subsidies.

Price mechanism is an imperative phrase used in economics to depict how decisions from customers and business interrelate in the distribution of resources which are limited. Price mechanism plays three crucial roles in the market; signaling, transmission of preference, and rationing function.

Through the signaling function, prices adjust in determining where scarce resources should be allocated. For instance, when the price of a product falls, the demand of the substitute product is affected and the government has to come in to adjust the allocation of resources so some people do not suffer at the expense of others.

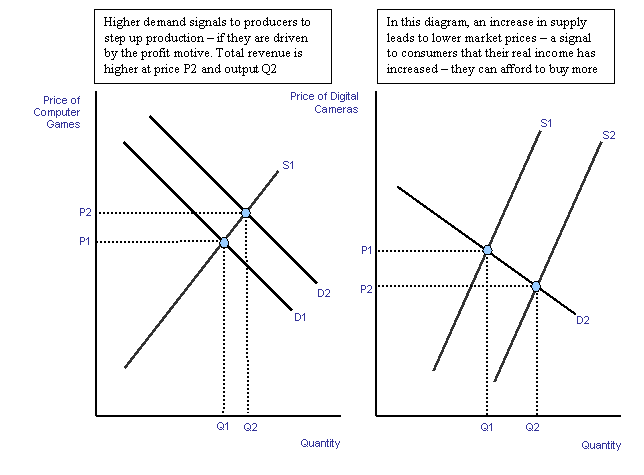

A price decrease or an increase is a signal that there are shortages or excesses in production. An increase in market prices as a consequence of improved demand is an indication to producers or suppliers to enlarge their production so as to satisfy the increased demand (Mankiw, 2009). On the other hand, a fall in market prices as a result of an increase in supply is a signal that consumers can buy more products with their real income.

The figure below demonstrates how changes in demand and supply have an effect on the price and quantity demanded. When demand for computer games increases, suppliers are gestured to increase their production and sell at an elevated price so as to raise their profit margin. When the supply of digital cameras increases, price falls signaling that consumers can purchase more at their real income.

Through communication of preferences, consumers convey essential information to suppliers or producers about their adjustment in requirements and wants. A high demand leads to an increase in the market prices which acts as an incentive to suppliers to produce more in order to make more profits.

On the other hand, a weak demand leads to a contraction in market supply meaning that producers have to produce less in order to meet the market demand. One advantage of a free market economy is that the forces of demand and supply determine the prices and no single person is responsible for deciding the quantity to be produced and at what price. Through the rationing function, prices determine the allocation of scarce resources especially when demand exceeds supply.

When the supply of a commodity decreases the relative price increases and only consumers who are willing and able to pay get the product. This means that prices are good rationing device for equating supply with demand. On the other hand, if the supply of a product increases, the prices fall and more consumers are able and willing to purchase the product resulting in an equilibrium situation (Riley, 2006).

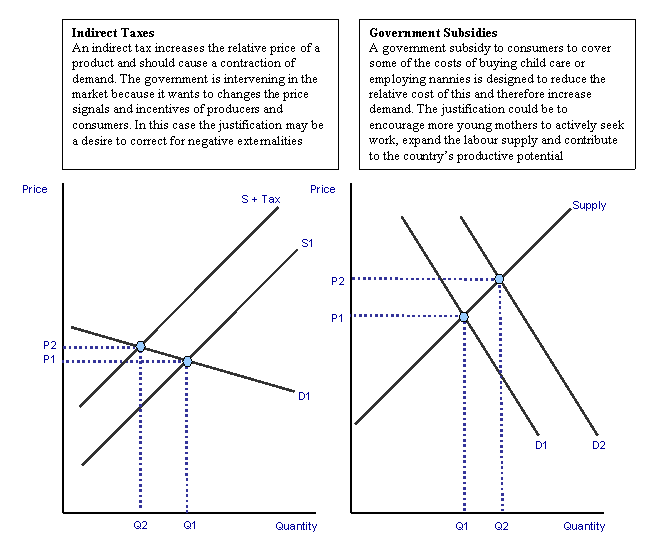

The price mechanism acts as an allocative mechanism for allocating scarce resources in a free market. However, most economies are not free and are composed of two sectors: the market and non-market sector. The non-market sector (government) intervenes in the allocation of scarce resources through the planning mechanism. It uses subsidies and taxes to determine the relative price to be charged in the market. When the government charges an indirect tax, the relative price of a commodity rises resulting in a reduction in its demand.

The government intervenes in the market so as to correct negative externalities and to ensure that neither the producers nor the consumers are exploited. The use of a government subsidy to consumers results in a reduction of relative prices thereby increasing the demand (Mankiw, 2009). The following diagram show how the government uses indirect tax and subsidies to control the relative price of a commodity.

In a market-oriented economy, prices serve as the main mechanism guiding the allocation of resources (determining what goods and services are produced, how they are produced, and how they are distributed among owners of factors of production). When the price structure reflects the underlying economic scarcities of outputs and inputs, the allocation of resources resulting from individual producer’s and consumers’ behavior is expected to be consistent with maximum and sustainable economic growth (Lazear, 2000).

For non-tradable goods, such as land which is immobile, labor because of restrictions in international migration, or commodities which are highly perishable or with relatively high transport cost, scarcity value is determined by domestic supply and demand factors.

For internationally traded commodities in which a country is a price taker in the world market, scarcity value or opportunity cost is represented by the border price of these commodities (Krugman & Robin, 2006). This is the world market price at the country’s border. While a liberally operating market would create that price arrangement, government involvements are essential to search out the right prices in instances when the market is not functioning properly.

And the market will fail to allocate resources efficiently in the provision of public goods, presence of externalities, and in cases of extreme instabilities in production or prices. When a country is a large exporter or importer of a commodity in the world market so that the world price is affected by its level of exports or imports, there is also a case for intervention through an optimal export or import tax (Ng, 1992).

The government’s price strategy, for that reason, should be designed to ensure an enticement structure that reveals the true costs of outputs and inputs.

In practice, governments in market economies intervene directly in the production of output and input prices through a variety of commodity-specific policies mostly in other objectives, for instance, to raise government revenues, or protect domestic producers from foreigners. An indirect tax augments the costs of production for producers leading to a shift in the supply curve. The distance between the supply curve before tax and the supply curve after tax is imposed reflects the tax charged per unit of production.

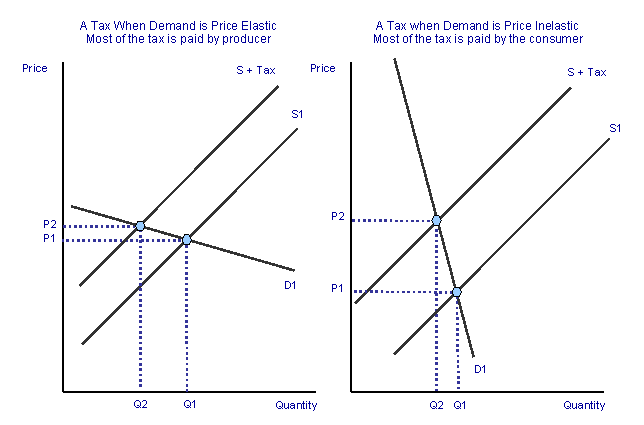

However, with an indirect tax, producers do not meet the entire tax burden since they may be able to transfer some or all of it to consumers by increasing the price of commodities. Price elasticity of demand and supply determines the extent to which businesses are able to pass on the tax burden to consumers (Krugman & Robin, 2006). The diagram below shows how price elasticity affects the usefulness of an indirect tax.

When demand is price elastic, the burden of an indirect tax is paid by the consumer whereas when the demand is price inelastic, the burden is paid by the producer. The government prefers to impose indirect taxes on products which have inelastic demand curves as opposed to those with elastic one because consumers do not suffer much and only a small portion of the total consumption is affected and the government earns more from tax revenues.

A government subsidy can be defined as a financial support given by the government to producers as a way of encouraging them to produce more output. The effect of a subsidy is to increase supply and reduce the relative price (Lundvall, 2010). Governments give subsidies in order to control the rate of inflation, promote production and consumption of merit goods (those that have increased social benefits), increase revenues for producers, and to protect consumers from exploitation by producers.

A subsidy causes the supply curve to shift to the right. The government can also offer a direct subsidy to consumers to boost demand in a market. Just like an indirect tax, the effects of a price subsidy are determined by the elasticity of demand and supply. If the demand curve is inelastic consumers become better off with a subsidy than in an elastic demand curve (Riley, 2006).

It is demonstrated that government intervention in markets can in many instances greatly worsen the allocation of resources. It is also true that governments can play important and constructive roles in addressing market failures and those shortcomings in government performance may consequently stem from failure to intervene as well as sins of commission. Even in free market economies, governments play a central role in setting out the context in which markets operate.

Most of the time, market malfunctions results from lack of information on the side of consumers about the advantages and disadvantages of the products that are offered in the market. The role of Government intervention in such a case is to improve information given to consumers as a way of helping them to way the costs and benefits of a product or service before making a decision of whether to go for it (Roy, 1980).

For instance, if consumers are provided with enough nutritional information about the types of foods that can be used to reduce the risks of obesity, they will be better placed in making decisions on what to consume and what to avoid. Such programs are intended to alter the supposed costs and benefits of spending for the consumer. Although, they do not affect the market prices, they are aimed at influencing demand and as a result they affect the output and spending patterns.

In any market economy, the way in which governments provide institutional settings increase the environment against which market incentives operate. In providing this environment, governments can fulfill several crucial functions, though the degree to which they actually do so varies enormously. They may provide public goods, regulate private activities to counteract other market failures, and act to prevent or limit rent-seeking activities and the abuse of market power.

In some instances, government involvement fails to work in the anticipated way because of the unplanned costs that frequently comes about. However, most government interventions have been found to be effective in improving the market failures. There are instances when the forces of demand and supply can not be relied on fully because they may result in disequilibrium conditions.

This calls for the government intervention to rectify such situations. When producers charge high prices to consumers, the government may intervene through the use of subsidies to the producers. The purpose of a subsidy to a producer is to reduce the cost of production thereby reducing the cost charged to consumers. On the other hand, the government may choose to give subsidies to consumers to enable them purchase commodities which are being offered at a high price.

An indirect tax is aimed at increasing the cost of production which results in a decrease in the quantity produced and an increase in the price of the commodity to consumers. There are other methods that the government can use to regulate the market which includes price controls, total bans, import quotas, and many others. The aim of government intervention is to make sure that neither the producer nor the consumer is exploited in the production and consumption of goods and services.

Reference List

Krugman, P., & Robin, W. 2006. Economics. New York, Worth Publishers.

Lazear, E.P. 2000. “Economic Imperialism,” Quarterly Journal Economics, 115(1)|, pp. 99–146.

Lundvall, B. 2010. National Systems of Innovation: Toward A Theory of Innovation and Interactive Learning. New York, Anthem Press.

Mankiw, G.N. 2009. Brief Principles of Macroeconomics. South-Western, Cengage Learning. pp. 10–12.

Ng, Y. 1992. “Business Confidence and Depression Prevention: A Mesoeconomic Perspective,” American Economic Review 82(2), pp. 365–371.

Riley, G. 2006. As Markets & Market Systems: Price Mechanism. Web.

Roy, C. E. 1980. “The Austrian Theory of Efficiency and the Role of Government”. The Journal of Libertarian Studies 4 (4): 393–403.