Executive Summary

Established in April 2009 by Greg Marples, High tech Burrito has popularly become immense, especially in food technology industry. Its full potential was realised when it shifted its focus from fast food joint to the introduction of customised menus that always brought out ‘healthier, fresher, tastier and better delicacies’. High tech Burrito unique delicacies of Mexican recipes and dining experience combined with good cultural atmosphere assured a one stop dining experience, service-oriented environment.

The relevant competitive models chosen for this assessment includes the Michael Porte’s five forces such as entry of competition, threats to substitutes, bargaining power, power of suppliers and rivalry, SWOT and Industrial analysis as well as macro analysis in order to assess High tech Burrito strategic capabilities and suggest future directions for the business. The case discusses the strategic available alternatives to Greg Marples as he attempts to secure HTB future growth and success (High Tech Burrito 2007, p.1).

Company Background

Founded in 1986, High Tech Burrito (HTB) was started as a food restaurant in April 2009 in Melbourne, Australia and now has 14 locations worldwide. Greg Marples owned and operated the business for more than 22 before venturing into other countries. HTB capitalised at the beginning as “fast-casual” food joint in the restaurant industry that captured the hearts of many. He remains a sole entrepreneur businessman as much of the capital was funded from his own savings and loans from banks (Bygrave & Zacharakis 2008; High Tech Burrito 2007, 1).

Business Environment

Industry Profitability

Industry profitability refers to company’s gross profit margin within a stipulated period. According to an online interview conducted on profitability of franchises and restaurants, Greg, the founder and owner of HTB reported high profitability within the first since month with profits ranging from $2500 to $3000 a day. On the other hand however, the figures can not be relied upon for future analysis since the owner overlooked the operation costs as profits were merely calculated on accumulated sales rather than looking at net profit margins.

Financial Business Model

Financial business model defines how business operates by providing an analysis on who owns assets, funding resources for implementing and ongoing processes (HealthConnect 2003, p.2). Financial business model is appropriate for strategic management courses when focusing on the entrepreneurship and innovation (Stevenson et al 2007). In this regard, Greg Marples injected his personal savings and applied loans from banks to start of the business (Greg 2010).

Industry Performance and Outlook

The following table presents Porter’s five forces (Porter 2010) as demonstrated by HTB analysis of the micro environment

Assessment

The industry analysis of HTB displays strong competition in the food technology and customer service. High Tech Burrito maintained its competitive edge by progressively innovating variety dishes and operational execution. Its product lines were also diversified as customised choices ranged from pork, beef, chicken, seafood, vegetarian choices.

With that selection, customers were also asked to select their favourite type of beans, rice, tortillas and salsas among other delicacies. In addition, the company has a numbers of loyal & the customer base that guarantees permanent growth. The company’s competitive strategy also included the implementation of programs such as fundraising activities boosted reseller sales and established direct conduct with its customers as an efficient way to demonstrate the advantage it has over its competitors (Gilinsky 2004, p.1).

For example, the recent fund raising strategy is an effective way of raising funds by requesting customers to invite their friends and family out for the surefire experience to generate money for schools and organisations and collect the percentage of the net proceeds. Also, the program that requires members to join their club and receive emails on future promotions and specials guarantees high quality, nutritious and delicious food (Gilinsky 2004, p.1).

HTB has been busy reintroducing different delicacies while failing to implement a plan that will develop customer wider base and build a fully customised menu in alliance with various culinary institutes in Australia. Greg’s strategy was to build a reputation of a luxury brand but the intensified competitive market pressure led him to consider which products would steal his customers heart’s away.

His fully integrated menu represented the ‘best bets’ for the future and assured brand equity that guaranteed sufficient returns on investment (Gilinsky 2004, p.1). On market research aspect, High Tech Burrito has always been striving to deliver delicacies in the State by conducting market research on customer needs. This information is aimed at gaining better understanding of customers needs, improve products and determine how best to provide better services for future sales.

Key External Drivers

Key external drivers basically concentrate on Macro analysis aspect. According to Robinson and his colleagues (1978), Macro analysis popularly known as PESTLE is an analysis of the external macro environment in which a business operates. PESTEL analysis includes factors such as political, economic, social, technological, legal and environmental issues (Robinson et al 1978).

Being an exemplar in its efficiency and customer service, HTB faces economic, social and political challenges simultaneously. Committed to fundraising activities, the triple bottom lines of economic, social and environmental objectives, HTB is slowly shifting from its traditional challenge of making positive long-term profits and concentrating on community sustainment projects.

On political aspect, HTB must balance many stakeholder interests to carry out its mission while the same time competing as a business. PESTLE is an ideal external driver for analysing the strategy behind the combination and projecting the results in terms of market positioning and financial performance which is important in determining when to expand customer base, expand geographically, or maintain the current strategy.

Summary of Internal Analysis

Internal Analysis also known as SWOT analysis determines company’s competitors and develops sales & marketing strategies for the company that allow it to achieve its marketing & strategic objectives. SWOT analysis for HTB position in the market is necessary for the development of marketing plan. On the strength aspect, HTB ability to provide customised menu ranked top in customer’s satisfaction survey and established loyal customer base.

On the weakness aspect, HTB international economic situation could damage the company’s market share position, demand and sales. In terms of opportunities, HTB the current performance in the uniqueness of foods offered has further strengthened its marketing position. Letting customers build their desired tastes or choose their own original gourmet burritos guaranteed ultimate burrito experience, one of the industries key success factors.

Gilinsky (2004) quoted Greg’s menu stating as “No lard, no fats, no MSG..just five star cooking with the best ingredients around, made your way” (p.1). Gilinsky (2004) adds that “Try an award winning High Tech Burrito-one bite and you’ll understand why High Tech Burrito really is..’ a better way to eat!’ since 1986” (p.1).

Financial Analysis

Key ratios

Financial ratios comprise of many different, but related ratios in explaining the relation between their concentration, institutional and efficiency. To determine their effectiveness, the analysis implies that firms require to effectively managing their resources as it determines how well they thrive in the competitive markets (Bruner 2009).

Historical Performance

Historical performance refers to company’s operating Performance at a certain period. This is measured by dividing operating profit by net sales to arrive and operating profit margin.

Operating performance is used in evaluating cash management performance, credit granting policies and receivable collections. In this regard, HTB cash management strategies have not been consistence as Marple, the company founder lamented in his interview that he has on many occasions used money from his pocket to pay for expenses (Urbancic 2003, p.5; Greg 2010).

Income Statement

Income statement refers to what drives revenue. In this regard, HT daily sales have been reported to range from $2500 t0 $3000 a day which is considerable a huge sum by the end of the month. HTB does not seem to be affected by seasonality as Greg responded in his interview by stating that there is always a long cue waiting for their delicacies each day. In expense category, HTB is reported to be currently paying annual rent at $56,602 per 1400 square feet (HealthConnect 2003, p.36).

Cash Flow Statement

Greg Maples has exhaustedly exploited his strategic options needed to grow his business in terms of market share concentration by seeking external investment through loans and housing mortgage securities. A fully integrated menu proved to be capital intensive, taking up all Greg’s available cash. On the other hand however, building brand equity and creating sufficient returns on investment by making an attractive menu for future sale will increase future cash flow for HTB (Gilinsky 2004, 1).

Table 1: High Tech Burrito Cash Flow STATEMENT for 2009.

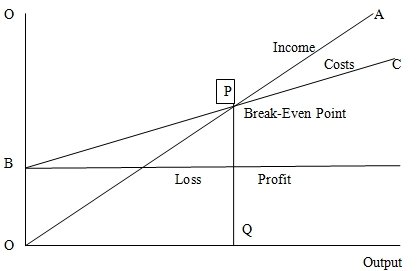

Break even Analysis

Pont OA represents the variation of cash flows at various levels of output while OB represents the total fixed costs (administrative expenses and depreciation). High Tech Burrito for this instance has higher output subsequently increasing total operational reflected negatively on company’s profits making slower reaching break even point.

Balance Sheet

Major liabilities on HTB balance sheet is the restaurants higher expenses.

Conclusion and Recommendations

Of primary importance is the challenge of ensuring HTB’s profitability and as company’s progressive growth guarantees investor’s financing. Revenues and costs should be separated, and profit maximization in the traditional sense should be the primary strategic objective since the company is still new it its operations. Despite carving out a strong niche in the Australia, HTB should employ a unified strategy in their enthusiasm for growth. The distribution channel raises challenges in terms of organic supplies.

In this regard, HTB should first strive to maintain the good relationship it has with its supplier from both Mexico and the US as depressed suppliers could lead to underutilisation of the distribution system that could compromise its competitive advantages. Secondly, HTB should re-focus to capture market share by investing heavily on advertisement to increase their product awareness. In Greg’s interview it was quite surprising that many of the attendants had not heard of the restaurant before.

This lack of strategy can cause serious implications for the business, including uncertainty and frustration among staff members, which could affect ongoing profitability. Operational excellence in terms of design of global supply chains for both local and international suppliers should be given highest priority. From Greg’s interview, it’s quite evident that HTB is facing several critical issues in the management, marketing and financial areas.

In this regard, HTB strategy and its supporting structure should be realigned with its primary objective and the new found mission to capture market share. The management team should explore several alternatives to improve the financial health of HTB. The central finding in the report was that the leadership of Greg Marple and operation strategy was poor and is threatening the growth and profitability of the company.

List of References

Bruner, R. F., 2009. Case studies in finance. 6th ed. Mc-Graw: Hill Higher Education.

Bygrave, B & Zacharakis A.,2008. Entrepreneurship, Hoboken, NJ: Wiley & Sons.

Gilinsky, Armand., Clark, D & Clark, T., 2004. High Tech Burrito. Sonoma State University: Randall Harris.

Greg, M. 2010. [Interview]. Web.

HealthConnect., 2003. HealthConnect Systems Architecture Project Phase 2-Systems architecture developmement. Financial Business Model, 2, 1-25.

High Tech Burrito., 2007. Web.

Porter, M. E., 2010. Competitive Strategy: Techniques for Analyzing Industries and Competitors. Internet Centre for Mnanagement and Business Administration, 1, pp.1.

Robinson, S., Hichens, R. and Wade, D., 1978. The directional policy matrix-tool for strategic planning. Long Range Planning Journal, 11, pp.8-15.

Stevenson, H.H. et al.,2007, New Business Ventures and the Entrepreneur. New York, NY: McGraw-Hill/Irwin.

Urbancic, F. R., 2003.The power of cash flow ratios. Department of Accounting, 1, pp. 1-6.