Introduction

Telstra Corporation Limited is a service provider of telecommunications, information services, and network platform businesses and the ex state owned monopoly offers conventional telephone-service to homes and industries, adjacent and long-distance service, mobile telecommunications, and an inclusive range of data-services, comprising Internet and online-services.

This firm is Australia’s foremost ISP- the business also offers wholesale-services to other service-providers, builds and manages telephone directories, and offers pay television services instantly by its Foxtel.

According to Anon (2009), Telstra’s fixed telephone network expands from the main cities to the rural places and it has also created a number of delivery-platforms on which it supplies services, encompassing transaction and digital-data-networks, crossbreed fibre-coaxial cable broadband network, Internet-protocol-networks, and way in to global satellite infrastructure.

Background of the Company:

Telstra became a legal corporate name of an amalgamated entity in 1993- the national business name, Telecom Australia, altered into Telstra in 1995 to differentiate Telstra from other telecommunications businesses in highly hostile markets; however, the company had been trading as Telstra globally from 1993.

In 1990s, Telstra started to modify the competitive scenario of the overall Australian telecommunications market, and by 1991, it was open to rivalry in the national long distance and international telephone service markets. O’Leary (2003) suggests that the Commonwealth of Australia, in 1997, offered 1/3 of the company on ASX, NYSE, and NZSX; in 2000, to take the Sydney Olympic Games to above 400bn spectators, it built a communications network.

Outline and Purpose of the report:

The rationale of this report is to evaluate current and past performance strategic decisions of Telstra, to assess the competitive position, to consider the internal and external environments, and recommend based on strategic gap.

Scope and Limitations:

The main problems to complete this report were limited time to conduct research, the high price of few important journal articles, and academic reports on Telstra Corporation, and unavailability of relevant secondary resources. On the other hand, this study has scope to consider the organizational structure, past performance, and strategy of Telstra, which it uses to achieve its vision statement with skill of the management and workforce.

Environmental Analysis

External Environment Analysis or PEST Analysis:

Political:

Telstra operates under the governmental rules and many other legal barriers, which consists of tax policy, employment ordinance, environmental legislations, trade restrictions and tariffs, and political steadiness.

Tatnell (2009) argued that TELSTRA has been fined above 100,000 dollars by the Federal Government as it confessed about making unsolicited phone-calls to numbers on the ‘Do Not Call Register’; the Australian Communications and Media Authority (ACMA) also received several grievances on this matter.

Currently, the political atmosphere in Australia is quite stable; however, the telecommunications industry is greatly affected by repeated alterations of government and policy makers’ unwillingness or inability to execute or propose progress-oriented schemes.

Economic

The telecommunications industry can be altered by shifts in demand, rising inflation rates, irregular interest rates, variable exchange rates, growing taxation rates, and more recently, the global recession has assisted to lessen the development rate of the industry.

Telstra had significant adverse affects by the financial crisis; it faced a drive-up in broadband rollout costs while it had to raise the expected expenditures of its national broadband network; Somasundaram & Bathgate (2010) stated that Telstra is cutting 6,000 jobs, or 15% of its workforce in order to revitalize revenue.

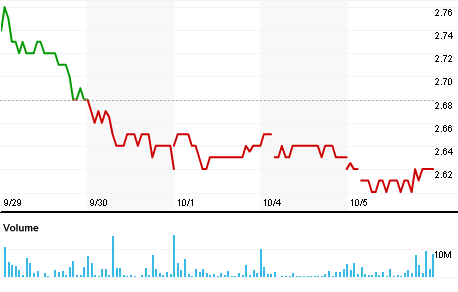

The company is failing to safeguard its funds for the growth of the economy; it might think about lowering some rate of its telecom and broadband networks as well; besides of that Singh (2010) suggests that the financial downturn persists in Australia as big brands like Telstra are failing to raise their stock price in normal standard. The following figure shows how the stock price of the company is falling in recent years (Reuters, 2010):

Social/Cultural:

Telstra keenly takes part in all neighbouring communities throughout Australia; the company is glad to afford a safe and friendly atmosphere where workers are appreciated and have a prospect to attain their complete aptitude, it is also committed to stop pollutions of the environment- it is in a well-built position to influence the environmental and social standards of its suppliers.

Technological:

Ferguson (2003) argued that in an industry that is constantly changing in terms of technology, Telstra is bringing Telstra Technology together with business-unit product development parts, network technologies, information technology systems and Telstra Research Laboratories; it is expecting to deliver the greatest technological support to customers by inspiring R&D, enhancing its relationship with technology-providers, and developing its IT platforms.

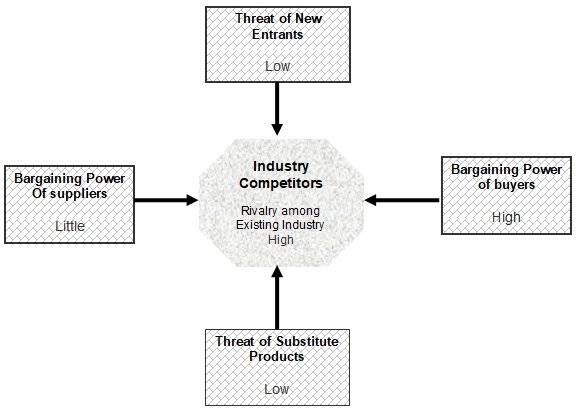

Porter’s Five-forces model for Telstra: –

Porter (2006, p.2) pointed out that if the forces are intense, almost no business organisation earns attractive returns on investment, as a result, it is important to assess current market competition.

Threats from new entrants: The threats of new entrants are moderately low for Telstra Corporation, as new companies would require large investment to penetrate telecommunication market but investors would show less interest to invest this sector to develop new brand image. On the other hand, it would be difficult to become successful competitor of Telstra Corporation, as the market condition has collapsed due to global financial crisis. However, the new entrants only become threat for Telstra if new multinational telecommunication companies enter in the market by using joint venture, franchise, or any other entry mode strategies.

Bargaining power of suppliers: According to the annual report 2010 of Telstra, it maintains full integration of Indigenous suppliers into its procurement practices. Telstra is continuously purchasing such network tools, IT and software from national suppliers and maintain a sound and mutual relationship with them and clear payment on time.

Bargaining power of buyers: the customers are continuously asking more and upgraded services from the intended servers, the bargaining power is comparatively higher in telecommunication industry.

Threats of substitute products: As Telstra is Australia’s dominant provider of fixed line services, Cell Phone and Internet services, the industry is not facing a higher competition from substitutes that indicates the threat of substitute products is low.

Rivalry among existing firms: All the business units of Telstra extremely competitive, so, rivalry relationship exists among the competitors of different sectors in the Australian market, for instance Telstra Internet Direct, Wholesale, BigPond, and mobile has different national and international competitors. Some major industry competitors of Telstra Corporation are SingTel Optus, Hutchison, and AAPT, whose are targeting and operating at the same market in terms of engaged themselves in stronger price, market share, and technology war.

Internal Analysis:

Culture, Vision, Mission Statement:

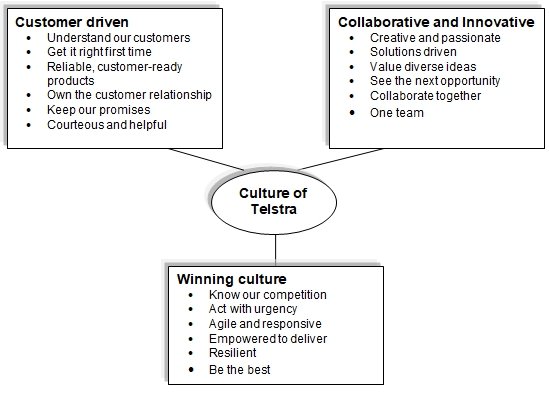

Culture:Products and services of Telstra are the most popular to the customers because its value is to understand customer demand, ensure reliability, maintain good relationship with subscriber, and keep promise. Telstra assesses the market competition to ensure best quality and it always try to work with urgency.

Vision: The Company is running upon the broader vision of keeping its leadership functional orientation over the Australia and its vision is to advance the way people live and work.

Mission: All activities of Telstra are directed by its mission and its mission is to build the best and easy “technology & content solutions”, as a result, its staff are always provide new creative ideas to face new challenges to reach its target. It strives to serve and understand its customers better than anyone else to satisfy its customers, which lead in their markets as a profitable and responsible corporation.

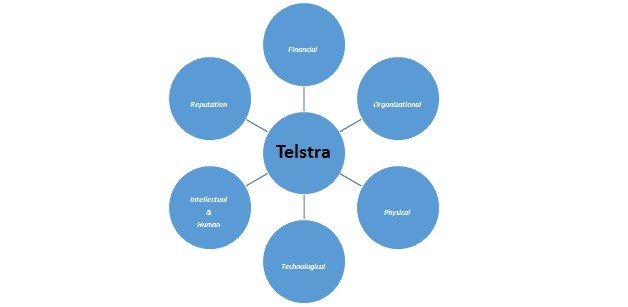

Competitive Advantage (Resources and Capabilities):

According to the annual report 2010, Telstra has more than 1.7 million broadband customers, about 2.1 million square kilometres GTM network, and 80,000 retail customers, who visit its store everyday. In addition, it has strong financial, organisational, and technological capabilities for further development though there are complain against that Telstra violated competitive neutrality concept by asking higher charges (Gans & King, 2005).

However, the following figure shows the resources and capabilities of the company and table compares financial variable for the fiscal year 2008, 2009, and 2010.

Table 1: Financial resources of Telstra

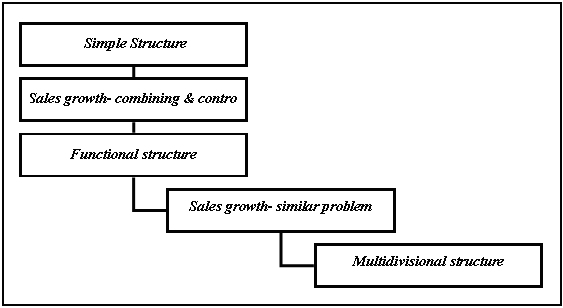

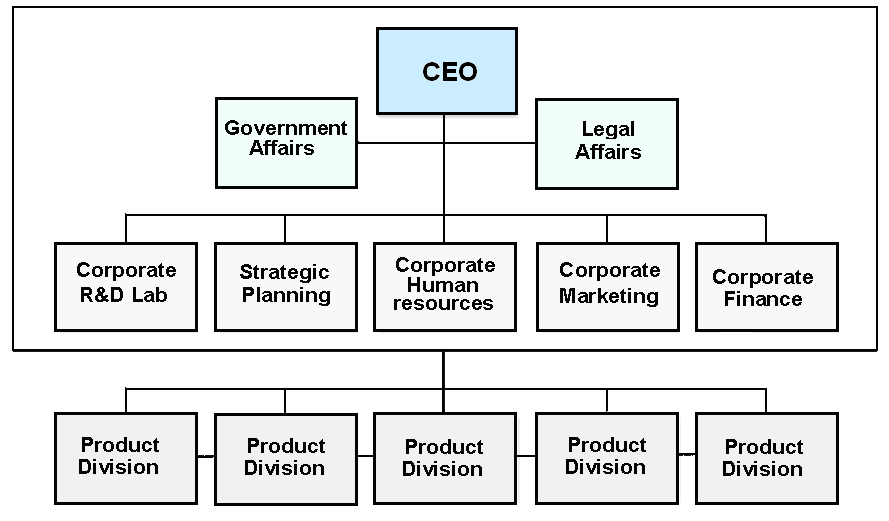

Organisational Structure:

The organisational chart of Telstra consists of financial, cost and pricing structure, Research and development structure configuration, process, corporate governance and control for implementing strategies as –

As the products and services of Telstra is entirely unrelated and less than 50% of the sales-revenue is generates from dominant-business, it uses the multi-divisional structure, where CEO control five subdivision. David Thodey the CEO of Telstra lie at the central power and control of the venture, Geoffrey A Cousins is the member of Nomination and Remuneration Committees, John V Stanhope is the CFO of the company, Liveingstone is the Chairman of Nomination Committee.

Performance

The performance of Telstra has been average in recent times. To motivate its workers, Telstra is expending $2,800 per worker, higher than $1,500 in 2006-2007; it is also performing well in lowering pollutant emissions as the amount of wastes recycled in 2009 (62%) is less than that of 2008’s (69%); it has also refurbished its call-centres and online customer services for ensuring customer satisfaction.

As per Telstra’s financial statements, its cash flow seemed to be quite strong (free cash flow was $6.2b up 42.6 percent in last year), ROA was 17.3 percent, and return on equity was 30.9 percent, whilst Telstra was highly determined to get a good return on shareholders’ funds.

Nevertheless, Corner (2010) suggested that Telstra’s dividend pay cut has been flat at 28 cents per share since 2007; consequently, shareholder wealth has smashed because profits has been mostly flat, rising by less than 4.7 percent each year; however, Telstra has compensated with a strong dividend yield (8.6% in 2010).

The Past 5 Years:

In last five years, Telstra’s performance has been steady along with small growth rate; sales revenue started at $23.7 bn in 2006 and now it is $24.8 bn with the maximum amount of $25.4 bn in 2009; Net Profit after Tax was on an incline from 2006, but it fell to $3.9 bn in 2010 from the previous year’s $4.1bn.

The sale of Kaz, an eight percent decline in Public Switched Telephone Network, low broadband growth, and the merger of CSL offset by six percent mobile growth; dividends per share have not changed until 2010, but TLS share price fell to below 2006 prices of $3.5 to $4 to a current $2.76 in 2010.

Today:

Today, there are the same flat figures and rather descending shift than ascending; sales are down from $1.4 bn to $24.8 bn, EBITDA down by 0.9 percent to $10.8 bn, and attributable NPAT down by 4.7 percent to $3.88 bn; however, Accrued Capital expenditure (Capex) brought some encouraging reports with a cut of 24.5% to $3.47 bn. The company included 175,000 new mobile-subscribers throughout this financial year.

Future Projection:

Telstra will target share growth by directing a high single digit EBITDA decline in 2011; Capex would be fourteen percent of sales, and free cash flow around $4 bn to $5 bn; 30% to 35% of incremental-cost growth will be unique and the suggested 2011 will be a transition year with growth arranged to return in 2012. In mean time, profits are estimated to rise to $25.3 bn in 2013.

Summary of Strategic Situation:

Telstra Corporation (2010, p.6) reported customers are the key asset of the company, so it works to advance customer satisfaction by upgrading its service and product range. It has strategy to invest for long-term growth, to sustain in the market as a market leader, and to differential products to increase market share.

During the global financial downturn, the company’s strategy was to cut 6,000 jobs for revitalizing revenue and lowering rate of its telecom and broadband networks as well; Telstra brought Telstra Technology together with business-unit product development parts, network technologies, IT systems and Telstra Research Laboratories.

Telstra is presently undertaking various strategies for recovering descending revenues, such as lowering outlays and hoping to utilise 2011 as a transition year. The company will expend $1 bn to raise market-share, shorten processes and develop customer-service under a program known as Project New, which includes 500 workers implementing 27 programs.

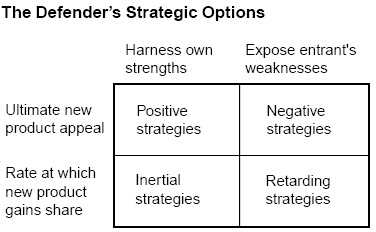

Roberts, Nelson & Morrison (2001) stated that Telstra takes preventive measure in order to face the threat of new entrants, for example, it adopted “defending the beachhead” theory to compete with Optus. However, the following figure shows strategic options –

Summary of External and Internal Environments:

During recession, Telstra cut 6,000 jobs and lowered rates of telecom and broadband-networks; it refurbished the technology-department to deliver greatest technological support to customers. It affords a friendly atmosphere at work; it is also committed to stop pollutions of the environment.

Gap Analysis:

Ting (2010, p.1) argued that Telstra should more concentrate on the advertisement in order to reduce accident for using mobile or IT devices at the time of journey. He also address that Telstra encourages pubic to use phone to enjoy traffic jam, which may increase risk, so it should develop corporate social responsibility to reduce misleading advertisement.

Stewart (2009) stated that the Fair Work Act 2009 ensured minimum standards by new legislative structure to uphold minimum safety net to the employees. Cooper, Ellem & Briggs (2009) also discussed about new legislative framework, therefore, Telstra should follow the provision of the Fair Work Act 2009.

Conclusion:

This company analysis of Telstra has used the tools of strategic analysis to weigh up the current strategic and competitive position. In addition, this report drew attention to discuss a number of aspects, such as environment, resource capabilities, organizational structures, recession, selection, and implementation of strategies and so on.

Recommendation:

- Telstra should more focus on its audit procedure to strengthen external and internal control of the company;

- The basic chart shows that its share price has decreased day-by-day. As a result, it should reduce its operating costs;

- It should more concentrate on the corporate governance, earning management, corporate social responsibly, and other issues;

- It should follow the recommendation of board of directors to hold its market leading position;

- In order to motivate the employees, Telstra should not cut the job of employees because this system will increase turnover rate and reduce efficiency of the employees;

- It should enter overseas market by following foreign entry mode strategy because it has enough financial and technological capacity to capture global market;

- In order to increase its market share and become more effective in operation, Telstra should concentrate on the monetary functions for having greater visibility as well as control on financing activities;

- Moreover, it should concentrate on mass customization, functions and co- branding with other companies;

- According to the annual report 2009 of Telstra, it spend $9m for advancement of R&D but it should increase the budget for research to develop IT management process, increase market demand and improve the effectiveness of employees;

- It should emphasis on the reporting systems and monitoring strategic risk management systems;

- To overcome from the adverse effect of financial crisis, it should strengthen remuneration policy, and determine dividend policy.

Reference List

Anon (2009). Telstra Corporation Limited – Company Profile, Information, Business Description, History, Background Information on Telstra Corporation Limited. Web.

Cooper, R., Ellem, B. & Briggs, C. (2009). Anti-unionism, Employer Strategy, and the Australian State, 1996–2005. Labor Studies Journal. Vol. 34, No. 3.

Corner, S. (2010). Telstra reports declining market shares, revenues and profits. Web.

Ferguson, I. (2003). Telstra creates R&D, tech, products supergroup. Web.

Gans, J. S. & King, S. P. (2005). Competitive Neutrality in Access Pricing. The Australian Economic Review, vol. 38, no. 2.

Kotler, P. & Keller, K. L. (2006) Marketing management. (12th ed.). New Jersey: Pearson Prentice Hall.

O’Leary, G. (2003). Telstra Sale: Background and Chronology. Web.

Porter, M. E. (2006). The Five Competitive Forces That Shape Strategy. Harvard Business Review. Web.

Reuters (2010). Telstra Corporation Limited (TLS.AX). Web.

Roberts, J. H., Nelson, C. J. & Morrison, P. D. (2001). Defending the Beachhead: Telstra versus Optus. Business Strategy Review, Vol.12, Issue. 1.

Singh, M. (2010). Telstra must have to find some way to get rid of financial crisis. Web.

Somasundaram, N. & Bathgate, A. (2010). Telstra to slash 6,000 jobs over 3 years- report. Web.

Stewart, A. (2009). Extending the Fair Work Act: The New National System. Federation Press. Web.

Tatnell, P. (2009). Telstra fined for phoning ‘do not call’ list. Web.

Telstra Corporation (2010). Annual report 2010 of Telstra Corporation. Web.

Telstra Corporation (2010). Culture, Vision, Mission Statement. Web.

Ting, J. Y. (2010). More responsibility needed in advertising related to encouraging mobile Internet device use while engaged in another activity. Australian and New Zealand Journal of Public Health. vol. 34 no. 4.