Introduction

Brand health tracking (BHT) is a relatively important marketing target that is repeatedly overlooked by a majority of companies. In a perfect world, there would be a number of important aspects that should be tracked in order to help a brand prosper. Usage measurements, for instance, allow marketers to comprehend and assess customer conduct and market share. Another key aspect that can be evaluated by means of research is brand attitude (insight).

Overall, the crucial importance of brand health tracking should not be ignored by companies that are looking for ways to achieve their business goals. This report dwells on the health of the Vodafone brand and compares it to Telstra. Marketing and research objectives are outlined and comprehensively explained. The investigation is conducted to assess Vodafone’s brand health and spot the brand’s upsides and downsides. In conclusion, the researcher reaches an extensive verdict concerning the company’s overall brand health.

Marketing and Research Objectives

By gathering quantitative data from customers, marketers can not only keep a finger on their brand’s pulse but will be able to adjust their approach to compensate for areas that do not perform effectively. The most important marketing objective is to find ways to improve Vodafone’s brand health. This objective is important because it helps the researcher define the extent to which the brand is recognised and remembered by the customers.

Additionally, this objective is critical since it might help in evaluating potential Vodafone customers who might become loyal clients. The probability that a client will buy their products or decide to transfer their business to an opponent is the key research objective of the investigation. It might be reasonable to compare the purchase intent shown by Vodafone customers before and after a marketing campaign. The investigator believes that Vodafone’s success is contingent on the company’s policies regarding corporate responsibility.

Research Design

The current research project will take into consideration brand awareness and brand image in tracking Vodafone’s brand health. To achieve the objectives of the study, the researcher will compare Vodafone to Telstra in terms of brand health. The methodology utilised is a classic brand funnel that includes six levels of customer perception (Mirzaei, Gray & Baumann 2011). The researcher expects to interview a sample of 100 random people to obtain data that would help in assessing the current state of Vodafone’s brand health and compare it to their rival’s (Telstra) brand health.

The sample would be split into three groups, where 35 individuals are Vodafone’s potential customers, 35 individuals are Telstra’s potential customers, and the remaining 30 individuals are not connected to either of these two operators (e.g., use another mobile operator or do not use one at all – if that is applicable). The research will be conducted in the form of an interview with the intention of tracking the participants’ opinions in an informal manner (Srivastava 2011). The researcher believes that the data would be slightly affected by customer bias, but in the context of the current research, this should be seen as a kind of advantage. The results of the interview are expected to split the participants into six groups, as mentioned above.

The interview would include questions that relate to the companies’ quality of services, brand image and overall contentment. The researcher expects to obtain data that would help to evaluate to what extent the customers are acquainted with Vodafone and Telstra. The users of the two mobile operators will be interviewed separately, and the results of each interview will not be disclosed to any participant prior to the evaluation of the output (Gaus et al. 2015). The interviewer would ask the participants 20 identical questions so as to evaluate their past experience with the companies, as well as future expectations (if there are any) on a scale from 1 to 6 (where 1 – not satisfied and 6 – completely satisfied). The unorthodox 6-point scale is used to show an association between the lowest (awareness) and highest (loyalty) levels of brand health and six levels of customer attachment.

The researcher is interested in identifying customer patterns for both brands and evaluating the level of attachment on the basis of this interview (Romaniuk 2013). The methodology of this research aims at utilising a personalised approach to the customers of mobile operators with the purpose of pointing out the competitive advantages of Vodafone and evaluating its satisfaction scores in compliance with the brand health funnel (Leeflang et al. 2014). The main challenge that the researcher is projected to face is the customers’ bias (e.g., Vodafone’s loyal customers would show disrespect for Telstra’s accomplishments and advantages, and vice versa). This issue can be mitigated by firm questions that would not provide any room for false judgement. It is evident that some level of bias is inevitable, but the researcher should carefully approach the survey creation process so as to minimise the adverse effects of customer bias (Charles & Zavala 2015).

The research closely compares Vodafone to Telstra in terms of vital brand characteristics and the services that these two companies provide to their customers. If the research design is correct and adequately followed, the company will be able to increase its income level and gain a larger customer base (Milichovský & Šimberová 2015). The researcher believes that the final verdict concerning Vodafone’s brand health should be formulated after the results of the interview are processed and methodically evaluated. When framing the interview questions, the researcher will rely on the psychosocial characteristics of the current/potential client base. The investigator is primarily interested in the behavioural patterns inherent in Vodafone’s customers and expects to find a functional dependence between certain customer characteristics and conversion rates. This functional dependence is in compliance with the key marketing objective of the given research and should be assessed in a recurring manner (Chernatony 2011).

The results of this assessment are intended to show the level of customer satisfaction and brand funnels completion percentage (the percentage of Vodafone’s customers who are eliminated at each next funnel). The researcher should monitor the outcomes of the study in order to formulate several transitional research objectives. This would help Vodafone keep the pace and not lose the thread of the company’s development in accordance with the key marketing objective. Vodafone is expected to strengthen its position in the market of mobile operators and provide its customers (both real and potential) with innovative services. This might eventually assist the company in enticing Telstra’s customers, or at least provoke a sense of doubt in the potential customers who do not know which of the existing mobile operators to choose (Lehmann & Srinivasan 2013).

The researcher believes that the major customer target is to reach the potential clients of the company. This assumption is based on the brand funnel approach and features an assessment of Vodafone’s target market. Nonetheless, the researcher does not want to disregard the clients who are not aware of their services. Instead, the current research is intended to analyse Vodafone’s customer base and identify their common interests and characteristics (Karbasi & Rad 2014). It is also crucial to compare Vodafone’s customers to Telstra’s customers and see how Vodafone could benefit from Telstra’s customer experience and marketing approach.

Before analysing Vodafone’s opponent, the researcher intends to evaluate the current features that Vodafone offers and highlight the areas that lack credibility or are not acclaimed by general (or even loyal) customers. In order to sort the targeted customers, the investigator proposes to split them into several groups. The participants would be divided according to their age (six particular age groups dividing the sample into target segments), gender, income level (very low, low, average, high, very high) and location (urban/ rural). The municipality name is required to generate a map that would feature the research participants’ current location. After the interview, this fragmentation would explicitly display the needs and requirements of Vodafone’s customers.

Output

Brand Funnels

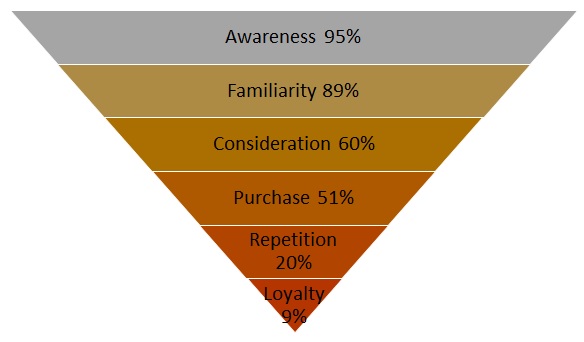

The conducted research proved the investigator’s expectations. First, the researcher reviewed the funnel of awareness. The interview results showed that the sample of 100 random customers was more acquainted with Vodafone than Telstra (Figure 1). The results for the non-customers basically mirrored the results obtained for those individuals who are Vodafone’s and Telstra’s customers, as the Vodafone brand is more recognised by the customers.

The next brand funnel is familiarity. The results of the research showed that the customers were more familiar with Vodafone (Figure 2). The interview displayed that Telstra did not provide their current and potential customers with an acceptable amount of information concerning their current and future tariff plans, rewards, and bonuses. The majority of the sample considered the aspect under consideration one of the key pillars of a successful mobile carrier company and complained about it. The reason for this is probably Vodafone’s extensive marketing campaign that helped the company obtain the most of its loyal customers.

As one may notice, the indicators started critically going down with each subsequent funnel. The next brand funnel is a consideration. This time, Telstra showed better results and the sample generally stated that when it comes to choosing a mobile carrier, they are more willing leaning towards the features proposed by Telstra (Figure 3). Vodafone’s customers discussed the possibility of switching to the key company’s opponent and most of these believed that there is no significant difference between the two carriers at this point (consideration). The majority of the sample also mentioned the ability to upgrade their phone as proposed by Telstra and the absence of a loyalty reward scheme in Vodafone. The customers also complained that Vodafone does not have their Voice over Wi-Fi feature implemented.

The purchase funnel showed a decent deviation in the numbers and proved that the majority of customers and non-customers lean towards Vodafone as their primary option (Figure 4).

The most prevalent explanation was backed by the fact that Vodafone is an international company with arguably more experience in the field. The majority of the non-customers also testified that they would go with Vodafone merely because of the brand and not because of exceptional features or any rewards. This fact also proves that Vodafone is a respected company and a trusted brand.

The next funnel is based on repetition. This is where the statistics for both companies fell dramatically and turned out to be almost identical (Figure 5). The interview showed that almost all of the sample decided that they would not buy the product again if they had the opportunity. In this case, it means that Vodafone’s unsatisfied customers might turn to Telstra and vice versa. The current situation opens up several prospects for the researcher that might be beneficial to the key marketing objective of the research.

The last funnel explores the loyalty of the customers. The researcher also managed to estimate the probable loyalty level of non-customers (Figure 6). The sample exceeded expectations, and Telstra slightly outdid Vodafone. The attained outcome showed that Vodafone should implement new strategies and utilise novel approaches in order to conquer the market and entice new customers who would become loyal customers in the near future (Jung 2015).

The final output, which combines all the funnels, can be seen in Figure 7. The chart exposes the issues that Vodafone has. It is evident that Vodafone wins the race when it comes to the basic funnels such as awareness and familiarity. Nonetheless, as we narrow the criteria, Vodafone struggles to provide consistent performance. Telstra shows a stable performance while not being as popular among the customers. As it goes down to the percentage of loyal customers, Vodafone wins the battle, but the price of this success is rather high as the marketing strategy of the company is not optimised.

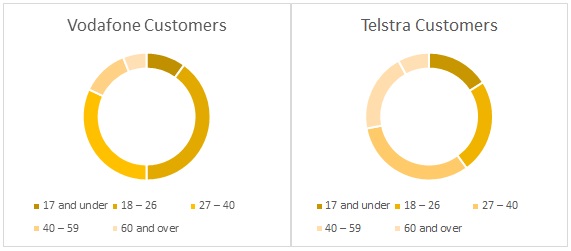

The results also present a great differentiation when it comes to targeting by age criteria (Figure 8). Vodafone is widely targeting the younger and middle-aged segment, while Telstra is targeting all of the age groups for all practical purposes. This also has a significant effect on the overall success of the company and its ability to convert their potential clients into loyal ones.

The fact that Vodafone still wins over Telstra illustrates the importance of brand image in business, but there are several potential improvements (Romaniuk, Bogomolova & Riley 2012).

Potential Improvements

First, Vodafone should pay attention to the services that they provide to their customers. The majority of the sample mentioned that the absence of a rewards scheme is a crucial disadvantage. In addition, Vodafone might consider implementing adult content filter protection as they are targeting the younger segment of the population. Finally, Vodafone does not provide its customers with an opportunity to upgrade their phones after a certain period of time spent with the mobile carrier. Needless to say, all these functions are already implemented by Vodafone’s rivals, and this aspect should be addressed by the company’s administration.

Second, Vodafone should take into account issues related to customer targeting. The findings of the current research show that Telstra manages to target all age groups, while Vodafone mainly focuses on a younger segment of the population. One possible way to mitigate the adverse effect of this strategy would be to reward other age groups with particular benefits that are seen neither in Telstra nor any remaining rival mobile carriers.

On the other hand, Vodafone might put more effort into its mobile and Internet marketing strategy and conquer the online segment. This move will evidently be supported by the younger part of Vodafone’s customer base as millennials have proved to enjoy interacting with famous brands online. This approach would be visibly beneficial in terms of operating various contests and reporting on new, attractive promotions available for Vodafone’s customers and followers.

Conclusion

The current research has been conducted using a quantitative design. The findings of this study and the approach used are vital for the researcher because they offer extensive evidence concerning the investigated topic. At the same time, this research can be characterised by a rather low level of bias and in-depth analysis of Vodafone’s brand health. The evaluation of the company’s brand health is a crucial marketing aspect and should be approached with robust scepticism. Nonetheless, the current quantitative research on Vodafone’s brand health shows that it is possible to reach the marketing objective and set intermediate objectives. The brand funnel pyramid presents necessary evidence. The researcher managed to avoid much of the ambiguity and reach reasonable decisions intended to solve Vodafone’s marketing issues. The methodology utilised to obtain the data and evaluate it proved to be efficient, generating an extensive amount of evidence that could be exploited in practice.

References

Charles, V, & Zavala, J 2015 ‘A satisficing DEA model to measure the customer-based brand equity’, Journal of Brand Management, vol. 4, no. 1, pp. 132-135.

Chernatony, L 2011 ‘From brand vision to brand evaluation: A strategic process for building integrated brands’, Brand Vision and Brand Evaluation Journal, vol. 43, no. 12, pp. 81-110.

Gaus, H, Jahn, S, Kiessling, T, & Drengner, J 2015 ‘Developing a scale to measure brand values’, Developments in Marketing Science, vol. 3, no. 15, pp. 33-36.

Jung, S 2015 ‘Can brand equity explain excess behavioural loyalty?’, Asia Marketing Journal, vol. 17, no. 1, pp. 55-57.

Karbasi, B, & Rad, A 2014 ‘The effect of sales promotions characteristics on brand equity’, Management Science Letters, vol. 4, no. 9, pp. 2107-2116.

Leeflang, P, Verhoef, P, Dahlström, P, & Freundt, T 2014 ‘Challenges and solutions for marketing in a digital era’, European Management Journal, vol. 32, no. 1, pp. 1-12.

Lehmann, D, & Srinivasan, S 2013 ‘Assessing brand equity through add-on sales’, Customer Needs and Solutions, vol. 1, no. 1, pp. 68-76.

Milichovský, F, & Šimberová, I 2015 ‘Marketing effectiveness: Metrics for effective strategic marketing’, Engineering Economics, vol. 26, no. 2, pp. 34-40.

Mirzaei, A, Gray, D, & Baumann, C 2011 ‘Developing a new model for tracking brand equity as a measure of marketing effectiveness’, The Marketing Review, vol. 11, no. 4, pp. 323-336.

Romaniuk, J 2013 ‘How healthy is your brand-health tracker?’, Journal of Advertising Research, vol. 53, no. 1, pp. 11-13.

Romaniuk, J, Bogomolova, S, & Riley, F 2012 ‘Brand image and brand usage’, Journal of Advertising Research, vol. 52, no. 2, pp. 243-251.

Srivastava, R 2011 ‘Measuring brand strategy: Can brand equity and brand score be a tool to measure the effectiveness of strategy?’, Journal of Strategic Marketing, vol. 17, no. 6, pp. 487-497.