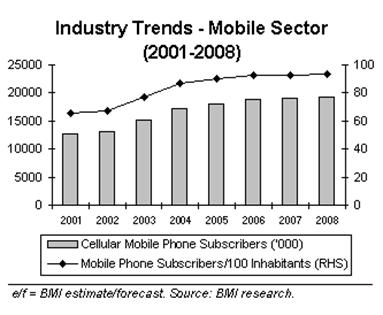

In the past few years, Australia’s mobile telecommunications industry has rapidly flourished and it has been predicted that there will be a further 6% increase in the services market this year. (Jones, 2009, 1265-1287) Their mobile penetration rate is almost 90.1% with approximately 18 million customers in Australia evidencing the fact that in Australia the mobile phone services are extremely competitive and developing very fast as their estimated growth rate last year was 54.4% (Jones, 2009, 1265-1287). Also, the mobile phone saturation rate in Australia had reached 100.76% last year (Jones, 2009, 1265-1287). This report has been written to analyze and properly understand the present situation of Telstra Australia. The first part of the report explains its history and then its internal and external environments are analyzed. Detailed customer analysis and competitive situation of Telstra is then explained.

Telstra is one of the foremost important media and Telecommunications companies of Australia. During the years of its establishment, it was controlled and operated by the Australian government. In this context, Telstra holds the largest market share in mobile communication holding about 45%. However, lately, it has been facing competition from Telstra Corporation and Optus. (Dowsett, 2009, 1-7)

Their GSM digital mobile network covers more than 94% of the Australian population and in 2000 they had even launched their Globalstar satellite service that provided almost 100% geographic coverage including an integrated GSM satellite handset. (Hausman, 2007, 365-383) Telstra also provides GPRS to its consumers while at the same time continually updates their network so that mobile Internet services can be provided by the company at data transmission speeds that is a lot faster than what their present GSM network services deliver. Telstra holds almost 46% of shares in the mobile market in Australia has over 12 million valuable customers. (Mullins, 2007, pp-709) Their phone products include postpaid and prepaid mobile services, 3G UMTS and GSM mobile networks, and mobile internet service. (Dowsett, 2009, 1-7)

/var/www/blog-sandbox.itp/wp-content/uploads/2021/10/201449_1.jpg 383×315 8bit N JFIF [OK] 23638 –> 21867 bytes (7.49%), optimized.

Telstra provides exceptional service to all in the mobile technology business and since their establishment, they have committed themselves to offer compelling and innovative services in data and telecommunication services to its consumers. Their mission statement is to design, develop and deliver better communications solutions for all of their customers. They are highly driven in bringing excellent services to the consumers to stay ahead in the competition since they aim at assisting those consumers who constantly seek to acquire flexibility and freedom in their everyday busy lives. (Rugman, 2006, pp-225) Their wireless communication services allow consumers to not only communicate with each other but also to search for entertainment, assistance, and information, at any place and anytime. Apart from providing mobile services Telstra also engages them in building relations with the various communities that they operate in. Due to their ongoing persistence in offering innovative mobile services, Telstra has become a vital part of their consumer’s lives and this also pushes them to be the vanguard of Australia’s mobile telecommunications industry. (Mullins, 2007, pp-709)

Within 16 years of its establishment as Telstra Corporation in 1993, it had become the largest mobile carrier company in Australia, but even then it never actually posted its overall profit. Although it continuously added newer subscribers, its market share has been declining over the past few years since the rate of growth of the mobile market has been a lot more than the company itself. While in 2001, Telstra Corporation held almost 56% of the shares in the Australian mobile market but during 2004 it had only 45% of the shares. (Hüsig, 2005, 17-35) However, since 2006 Telstra Corporation’s market share has been around 48% and it has been predicted that it will remain so even this year. Also, their average revenue per user or ARPU, which measures their overall success in the telecommunications industry, has been falling steeply with Aus $18 billion (2005) from Aus $21 billion (2004). (Rugman, 2006, pp-225) However, in 2008, the total revenue was Aus $24 billion.

Review of previous marketing mix strategies ─ The following are some of Telstra Corporation’s previous marketing mix strategies ─

Third Generation or 3G ─ 3G is a generic name used to indicate mobile technologies that utilize modern technological infrastructures allowing mobiles to provide users with data and voice services, video telephony, high-speed internet, and music services all at the same time. Since Telstra Corporation targets an audience between the ages of 18 to 39, 3G technology helps them to do so by providing high-speed data processing technologies. This has enhanced their customer productivity and experience and was launched in 2004. (Bonardi, 2005, 101-120)

- Vodafone live! ─ This is a customer-based service package targeting the younger generation of Australia. This service was launched in Australia in 2003.

When compiling the marketing strategies of Telstra Corporation’s products and services it is very important to study the external environment in which they have to compete and operate. Macro-level variables that need to be acknowledged for this understanding include political, legal, technological, socio-cultural, industrial, and competitive factors since any changes in these factors will also affect the environment where Telstra Corporation operates in.

- Legal and political factors

Telstra Corporation has to operate in a relatively rigorous legal and political framework. The Telecommunications Act of 1997 governs the Australian telecommunications industry and it is directed by the Department of Information Technology, Communications and Arts along with the Communications Minister. The Australian Communications Authority or ACA and the Australian Competition and Consumer Commission or ACCC act as the active regulators. While the ACA is responsible for maintaining the non-competitive aspects and technical regulations of the Australian telecommunications industry the ACCC supervises that the Trade Practices Act is applied so that consumer interests and fair competition is ensured. However, since Telstra Corporation is not owned by the government they are not subjected to a lot of restrictions that companies like Telstra were under in their early days under the government (Hausman, 2007, 365-383).

- Technological factors

Due to faster technological advancements and convergence between mobile and internet communication technologies, newer methods for delivering the quality and content of mobile telecommunication services have developed. Such continuous technological advances in telecommunications mainly in the mobile section has provided a lot of room for the providers and carriers to grow over the past few years even though at one time the Australian mobile market had appeared to be reaching its saturation point with almost 18 million subscribers in 2004 with 77% mobile penetration rate (Rugman, 2006, pp-225).

Although the mobile telecommunications industry in Australia is a high-yielding one, at the same time it is also a costly and severely competitive industry. Since 2004 investments made in the mobile industry for supporting modern technologies and networks have exceeded the $20 billion mark as per the ACA (Hausman, 2007, 365-383). This has created substantial barriers for entering into this industry and also threats created by the new entrants for the present major players like Telstra Corporation has been lowered owning to requirements like high operating costs and investments. Telstra Corporation, which mainly operated in the 2G network base after merging with Hutchison, has acquired a strong base in 3G too, thus building up a potential competitive advantage over other providers like Vodafone and SingTel Optus. In the last 5 years, the Australian mobile industry has developed by almost 48% as compared to the 30% development of the entire telecommunications industry taken together. Also, the mobile industry represents almost 28% of the revenue of the entire telecommunications industry (Rugman, 2006, pp-225).

Telstra Corporation targets the market comprising of the younger generation through their 3G mobile technology. However, their wireless and mobile technology services are aimed at people of all ages who are mobile aware. Demographically Telstra Corporation targets both the rural and urban areas in Australia. However, they are more successful in the highly populated urban areas and mainly in the capital cities. Although Telstra Corporation claims that they want to assist anyone wanting freedom and flexibility in their mobile usage services, their newer technologies target the more technologically aware people and thus their primary market target falls between the age groups of 18 and 39. But, it is also important that they target their secondary market audiences which comprise of friends and family of the purchasers and can belong to any age group (Dowsett, 2009, 1-7).

Although Telstra Corporation is ranked as the largest mobile service provider in the Australian telecommunications market, they already have 45% of the market share and also cover almost 94% of the Australian market (Hausman, 2007, 365-383). According to market researches, it has been found that most Vodafone services and products were purchased by people due to their convenience to be able to contact their friends and family members and need for freedom not only at home but also at work. The customers want proper reception, quality customer services so that they can conveniently contact other people but at the same time they want the products and services to be cost-efficient with the inclusion of as many features and services that are possible.

Telstra Corporation customers are the ones who wish to be a part of their wireless network and enjoy flexibility and freedom in their mobile phone services. Telstra Corporation normally aims at the demographics of 16 to 65-year-olds but their highest user demographic lies in the age group of 18 to 39-year-olds. But with their net connection and 3G, it becomes completely evident that the demographic Telstra Corporation intends to attract are completely technology savvy and mobile aware. According to normal trends, it has been seen that most youngsters when they reach the age of 18 are allowed to decide to buy their phone but the younger kids or those who are not financially independent will have to leave the decision-making process to someone older since they will have to obtain a mobile phone connection under their parent’s or guardian’s name. However, one should not underrate the influence which the young generation has in choosing their preferences when it comes to mobile connections (Rugman, 2006, pp-225).

Almost all of Telstra Corporation’s products and services, like prepaid, postpaid, 3G services, internet services, are brought by the customers depending on what plan suits the lifestyle of a particular user. The reason for the purchase of the customers is either for personal or official use and their purchase decisions are taken based on their economic positions, special promos and features offered by Telstra Corporation, and, to some extent, social pressures. Sometimes customers choose Telstra Corporation especially because they give a lot of free Talktime to their customers with the purchase of their services. Telstra Corporation offers its customers a wide range of services and the customers can choose from the various postpaid plan and prepaid plans or can even opt for Telstra Corporation’s exclusive No Plan service where the actual mobile plan is tailored according to the specific requirements of an individual customer. Customers who use their phones or internet services less frequently can opt for Telstra Corporation’s low-cost plans and those who want to pay after usage can opt for the postpaid plans (Jones, 2009, 1265-1287).

Although in the Australian telecommunications market Telstra Corporation is a relatively old player the reason millions of consumers choose them is because they have established themselves as an innovative and flexible mobile provider. With their internet connection and various sponsorship events, the younger generation of Australia has associated a cooler but stable image with Telstra Corporation. They provide 100% geographical coverage all over Australia due to which the customers can connect with anybody at any time using their wireless networks.

According to the Australia Competition and Consumer Commission, there are three nationwide mobile service providers in Australia presently, Telstra Corporation, SingTel Optus, and Vodafone. Earlier among the major competitors of Telstra Corporation was also Hutchison but after their merger this year Vodafone has only 2 primary competitors. There are some other mobile providers like Virgin Mobile, Orange, and AAPT, but they utilize either SingTel Optus’ or Telstra’s networks (Jones, 2009, 1265-1287).

As given above among the mobile haulers in the small yet extremely competitive telecommunications market of Australia the main competitors of Telstra Corporation earlier were Vodafone, SingTel Optus, and Hutchison but now Vodafone has merged with Hutchison leaving only 2 direct competitors. Smaller companies like Orange, Virgin Mobile, and AAPT are Telstra Corporation’s indirect customers since they are either dependent on Telstra, SingTel Optus, or Hutchison (Rugman, 2006, pp-225).

Since both Vodafone and SingTel Optus entered the Australian telecommunications market after Telstra Corporation, this relative advantage of theirs makes them very powerful allowing them to maintain their central position in the mobile industry of Australia by learning the market segment and preferences outlined by the feedbacks of Telstra Corporation. Comparing Telstra Corporation to these 2 giant rivals we understand that Telstra Corporation in Australia has a relatively high status. The main reason for this is that ever since Vodafone and SingTel Optus entered the Australian market they have had an extremely loyal and large customer base. At the turn of this century, Telstra Corporation had only half of SingTel Optus’ market share and almost 3 times more than that of Vodafone. But Telstra Corporation’s GSM services have been growing at a steady rate and they have thus overtaken their competition in this area in recent times achieving almost 20% of the retail market share in these few years since it had been launched in the Australian market. Telstra’s market shares have been constantly dropping in the past few years due to which a number of their customers have migrated to other companies. Also, although Orange is not a direct competitor of Telstra Corporation it is an extremely aggressive challenger. They are constantly contesting against Vodafone in an already saturated mobile telecommunications market. Both Vodafone and SingTel Optus provide their customers with bundling services which increases their competitive advantage (Dowsett, 2009, 1-7).

The products and services of Telstra and SingTel Optus are quite expensive when compared to that of Vodafone Australia. Telstra and Vodafone Australia both offer 3G and 2G services but SingTel Optus does not have any 3G services. Both the former offer very good reception quality and customer services, however, these are quite poor in the case of SingTel Optus. Telstra and SingTel Optus both launched their GSM network services in 1993 and have ever since been a dominant player in the Australian mobile market. Telstra which currently rules the market offers its customers discounts on their internet usages and fixed-line calls, unlike Vodafone Australia which offers lowered mobile processes. But even then Telstra has managed to stimulate demand among consumers in the mobile market. Just like Telstra, SingTel Optus also provides bundling services in the form of mobile and fixed services which not only cross-sells but also cross promotes their wide range of products and services. SingTel Optus has also offered several special promotions and pricing plans, like Vodafone Australia has done, to attract more customers and both have been extremely successful in doing so (Dowsett, 2009, 1-7).

In this paper, we have given the situation analysis of Telstra Corporation analyzing its every aspect. The first part has been dedicated to giving an overview of the company followed by its internal and external environments. Further, we have discussed the major competitors and customer bases of the company and have also given a comparison of the products and services offered by Vodafone with its primary competitors. Telstra Corporation has had to face both ups and downs while having to operate under the existing regime. Telstra Corporation currently shows very good signs in the market after having to gain access and commercially negotiating the possible pricing outcomes. Market researchers have predicted that Telstra Corporation will show rapid development in the Australian mobile market during the fiscal year 2009-2010 with better advertising facilities backed by revenue from international expansion especially in China and New Zealand.

References

- Bonardi, Jean. P. 2005, ‘Global and political strategies in deregulated industries: the asymmetric behaviors of former monopolies’, Strategic Management Journal, vol. 25, no. 2, pp. 101-120.

- Dowsett, M. 2009, ‘Vodafone’s Cell Phone Towers’, Managerial and Decision Economics, vol. 17, no. 1, pp. 1-7.

- Hausman, J. A. 2007, ‘Competition in long-distance and telecommunications equipment markets’, Managerial and Decision Economics, vol. 16, no. 4, pp. 365-383.

- Hüsig, S. 2005, Analysing disruptive potential: the case of wireless local area network and mobile communications network companies’, R&D Management, vol. 35, no. 1, pp. 17-35.

- Jones, N. 2009, ‘Competing after radical technological change: the significance of product line management strategy’, Strategic Management Journal, vol. 34, no. 13, pp. 1265-1287.

- Mullins, L. J. 2007, Management and organisational behaviour, Ed 8, New York, Financial Times Prentice Hall.

- Rugman, A. M. 2006, International business, Ed 4, New York, Prentice Hall/Financial Times.