Abstract

- Objective: The study aimed to establish the existence of hindsight bias in elections by analyzing pre and post-election responses from students regarding the 2016 election.

- Methods: A total of 288 students took part in the exercise, where 208 of them participated before the elections while the remaining 80 were involved afterward. The study was carried out in the form of a survey. The between-groups design was used to collect data. The three major parties, namely, Liberal, ALP, and Greens, were included in the survey. Subjects responded to questions that required them to estimate how likely a certain party would win or would have won the election. A scale of 1-5 was used to rate the responses. Next, two moderator variables (importance and investment) were included to guide the outcomes at the analysis stage.

- Results: Post-election responses indicated higher ratings compared to the pre-election responses, suggesting the presence of hindsight bias. Additionally, significant differences occurred between estimates from high and low-investment subjects.

- Discussion: Subjects with high investment are more likely to readjust their responses to match the election outcome compared to subjects with low investment. Therefore, knowledge outcome is not the only determinant of hindsight bias. Regarding limitations, the study failed to accommodate other possible variables such as age, sex, and occupation.

Methods

Participants

The study involved a total of 288 students, including male, female, and others. The first 208 students were engaged before the election (pre-election). The group consisted of 56% women and 42.30% males. Others constituted 1.40%. The subsequent survey included 80 students, where 67.50% were female, while 28.70% were male. The remaining 3.80% represented others. The average age of subjects was 23.95 for the pre-election and 22.60 for the post-election surveys.

Materials and Procedure

A between-groups design was used to collect survey data. Subjects were engaged in pre and post-election. The first group of students was supposed to respond to the question, ‘How likely did you think that your preferred political party would win the election?’ The second group was asked to respond to the question, “Before the election, how likely did you think that your preferred political party would win the election?” The two questions were designed to establish whether hindsight bias existed regarding election results. The questions focused on three main parties, namely, Liberal, ALP, and Greens. A 5-point scale was used to rate the responses where 1 denoted ‘not at all likely’ and 5 ‘extremely likely’.

Participants from both samples were asked to state how much importance they attached to politics and the election, upcoming or recent, depending on the time of the survey. This variable was titled “importance” for the purpose of the study. Subsequently, subjects were required to state the importance they attached to their preferred party winning in the upcoming or recent election. The variable was named “investment” for purposes of this study. A 5-point rating scale was adopted to categorize the responses obtained. The scale ranged from 1 (not at all important) to 5(extremely important).

Moderator variables were used to “split” data at the analysis stage. The purpose of the splitting was to achieve high or low importance/investment groups. For the importance of politics, a mean ranking of 4.14 was adopted to categorize the ratings as either low or high importance. A rating of between 1 and 4 fell under “low importance,” while that of 5 was treated as “high importance.” For investment, the mean rating of 3.91 was adopted. Ratings of 1-3 were treated as “low investment,” while 4-5 constituted “high importance.” To ensure that only significant data was used for the study, respondents who preferred minor parties were eliminated from the survey.

Results

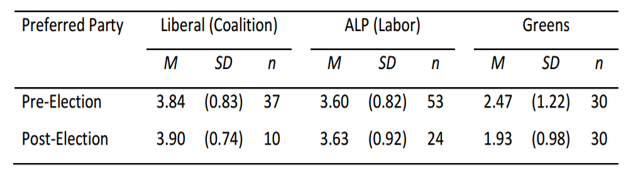

Subjects’ responses to the pre and post-survey were entered into tables. Hindsight bias was determined by comparing post-election responses to those obtained in the pre-election survey. Figure 1 below represents responses obtained from subjects regarding their opinion that their preferred party would emerge the winner in the election. Figure 2 represents the mean obtained for the post-election survey based on the investment levels of participants.

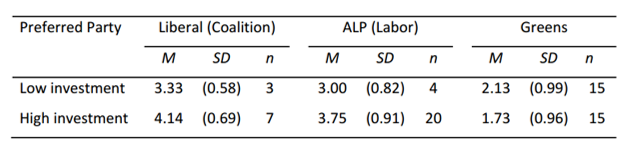

The Table 1 below is a representation of the mean differences across the three categories for both low and high investments obtained from the subjects’ responses.

Table 1: Differences in Means for High/Low Investment

For Liberal Party, the mean difference between low and high investment stood at 081. For ALP, the same difference was 0.75 while it was -0.4 for Greens. The mean ratings for responses from subjects who reported high investment were higher for Liberal and ALP compared to subjects who reported a low investment. However, for Greens, the mean rating for subjects who reported a low investment was higher relative to subjects who reported a high investment.

Table 2 is a further illustration of the influence that investment has on post-election responses. Post-election ratings from Figure 1 are used as the control for this part. Participants with low investment gave ratings that were below the post-election responses obtained in Figure 1 (control), for Liberal (3.33), and ALP (3.00). This pattern is not repeated concerning Greens party, where the low-investment ratings exceeded the control result by 0.2. Similarly, mean ratings from subjects with high investment exceeded the post-election responses obtained from Figure 1 with the exception of the Greens party.

Table 2: Influence of Investment on Responses

Discussion

At the beginning of the study, it had been assumed that prediction ratings would be higher after the election compared to the situation before elections for parties whose preferred party won the election. It was also assumed that hindsight bias would be stronger among subjects with high investment whose preferred party won the election relative to the case among subjects with low investment whose party won the election. The results of this study are consistent with previous literature regarding similar studies. Subjects’ responses to a post-election survey are often more reflective of the actual election results compared to the pre-election approximations (Leary, 1982). The ratings for the post-election survey were higher relative to those obtained from the pre-election survey regarding the Liberal and ALP parties. For the Greens Party, post-election ratings fell below the pre-election score, suggesting that subjects whose party had not won would be less inclined to readjust its estimates to match the outcome. Therefore, hindsight bias is stronger for subjects whose party won the election.

Responses from subjects who reported a high investment differed largely compared to those who claimed that they had limited investment in the party that won the election. Results from this study agree with the alternative hypothesis regarding the influence of investment on post-election responses. For the Liberal party, estimates for subjects who reported a high investment were 4.14, being a 0.81 difference from the same category for low investment subjects. Similarly, a mean difference of 0.75 was obtained from between the low and high-investment splits of the ALP category. These findings support the long-held belief that investment is a likely influence of hindsight bias. A subject who had a high interest in the election is likely to provide a closer estimate to the actual result relative to one who professes little interest as to whether the party in question wins the election. Therefore, investment serves to moderate hindsight bias. To support this assertion, Blank, Fischer, and Erdfelder (2003) have observed that factors other than knowledge outcome [being aware of the outcome] may elevate hindsight bias.

It can be argued that subjects with a high investment are more likely to associate themselves with the actual outcome compared to low-investment subjects for several reasons. First, high-investment subjects have ‘invested’ emotionally and perhaps financially, in the outcome. As a result, they are less willing to admit that their estimates are more inaccurate. This aspect is what Leary (1982) terms as ‘ego involvement’ where responses from subjects who claim to know more about an event are likely to contain hindsight bias. The second reason relates to knowledge updating. Roese and Vohs (2012) describe knowledge updating as the mechanism by which the human memory takes in new information and integrates it with older existing memory. At the same time, inconsistent information is not affected by the new information. Thus, knowledge updating may explain why subjects with high investment gave higher ratings relative to their low-investment counterparts. Hence, the existing knowledge that the given party stood a high chance of winning becomes augmented with the knowledge that the said party had actually won.

This study was conducted through a survey carried out in two phases. The first phase was aimed at collecting data that would be used to estimate hindsight bias by comparing with estimates obtained after the election. A survey was appropriate for this kind of study. However, the use of between groups design was not appropriate for this survey since it made it difficult to associate responses obtained from the before and after surveys. For this reason, it is not possible to estimate correctly the level of bias that existed between the pre and post-estimates. A known disadvantage of the between groups design is the impossibility of maintaining homogeneity. Differences between individuals often result in skewed data, which cannot be reliable in some studies (Charness, Gneezy, & Kuhn, 2012). A repeated measures design would have been more appropriate. The latter design would guarantee consistency of data given that the same participants would take part in both surveys. However, the repeated measures design has various limitations, which include boredom of participants due to repetitive activities and “practice effects” where participants become better at a task with time. Additionally, some participants may opt out of the study before the second part is completed, thus leading to a “too small” sample.

As observed, using the between groups design affected the internal consistency of data obtained. Nevertheless, the study bears an external validity since it is generalizable to other situations. Therefore, the findings of this study are important in psychology. It may be adopted to expand the existing body of knowledge that relates to hindsight bias. Researchers have maintained the operationalization of concepts in the study. This situation is ensured by the use of moderator variables to connect factors that have an influence on hindsight bias. The study appreciates that the knowledge of outcome is not the only factor in play regarding hindsight bias. In the case of politics, whether an individual views politics as important or inconsequential to them will likely affect the level of hindsight bias expressed. Therefore, hindsight bias regarding an event will primarily depend on the importance that people attach to the particular occasion. Investment is another factor that shapes hindsight bias. Parties are likely to show high levels of hindsight bias regarding events they had a particular interest in (Schuett & Wagner, 2011). Additionally, ego involvement is expected to play a role in influencing hindsight bias if the subject has invested in some way or another in the outcome of the event.

Overall, the study is subject to various limitations that relate to the sample. While the sample is adequate for a survey, diversity was not ensured in terms of sex, age, and occupation. Women exceeded men by 14% in the first survey and by 38% in the subsequent survey. A study involving an equal or nearly equal number of men and women would have resulted in different outcomes. Age also plays a role in deterring the strength of hindsight bias. Groß and Bayen (2015) observe that hindsight bias is stronger in older adults compared to younger ones. Coolin, Bernstein, Thornton, and Thornton (2014) attributed higher incidence of hindsight bias in older adults to memory inhibition. As people grow older, their ability to remember irrelevant information declines. Therefore, because the current study involved young adults only, it is arguable that different results would have occurred if a diverse age base had been included in the study. Finally, by involving students only, the study blocked out the possibility of occupation as a determining factor of the strength of hindsight bias.

Reference List

Blank, H., Fischer, V., & Erdfelder, E. (2003).Hindsight Bias in Political Elections. Memory, 11(4-5), 491-504.

Charness, G., Gneezy, U., & Kuhn, M. A. (2012). Experimental methods: Between-subject and within-subject design. Journal of Economic Behavior & Organization, 81(1), 1-8.

Coolin, A., Bernstein, D. M., Thornton, A. E., & Thornton, W. L. (2014). Age differences in hindsight bias: The role of episodic memory and inhibition. Experimental aging research, 40(3), 357-374.

Groß, J., & Bayen, U. J. (2015). Hindsight bias in younger and older adults: The role of access control. Aging, Neuropsychology, and Cognition, 22(2), 183-200.

Leary, M. (1982). Hindsight Distortion and the 1980 Presidential Election. Personality and Social Psychology Bulletin, 8(2), 257-263.

Roese, N., & Vohs, K. (2012). Hindsight Bias. Perspectives on Psychological Science, 7(5), 411-426.

Schuett, F., & Wagner, A. (2011). Hindsight-Biased Evaluation of Political Decision Makers. Journal of Public Economics, 95(11-12), 1621-1634.