The Great Recession of the late 2000s is one of the most catastrophic financial hardships that the world has ever experienced. The crisis begun in 2008 and took shape in 2008 due to a number of reasons. It begun with the US economy and has now affected nearly all states in the world. Even though economic recession ended in 2009 in the US, the majority is still feeling its effects.

In Los Angeles., for instance, continual sky-scraping unemployment remains, together with low consumer assurance, the ongoing decline in domestic values and increase in foreclosures and individual liquidation, a growing federal debt calamity, inflation, and increasing gas and food costs (Gullapalli and Anand 16). In reality, a 2011 survey established that more than half of the entire Americans believe the U.S. is still in depression or even melancholy, although executive information shows a historically self-effacing resurgence.

All of the above features combine to pile pressure on citizens of Los Angeles, which complicate their lives more. Others are forced to flee away from their families while others commit suicide due to loss of capital and hard economic life. The city of Los Angeles is one of the places that are worst hit by the catastrophe.

This paper evaluates the causes of the 2008 economic crisis as well as its effects to the people of Los Angeles. The paper focuses specifically to the problem of public health. Through assessment, the paper identifies that people are affected mentally due to loss of income or business. The crisis rendered so many people jobless, bringing more despair to the citizens of Los Angeles (Wingfield 21).

Richardson observed that the 2008 economic crisis could have been caused by the existing societal structure that is dominated by the few. The writer does not believe that banks are solely to blame for the mess. In fact, a close analysis by Los Angeles financial analysts confirms Richardson’s arguments. The widening gap between the rich and the poor makes it hard for the society to develop uniformly. The financial devices used in measuring the economy do not capture the plight of the poor.

Another cause of the turmoil as explained by Richardson is inadequate safety net that leads to unsuitable stimulus in hard times (9). Los Angeles economic experts blame the state government for coming up with decisive policies that can easily hurt the economy. The state had subsidized many services, especially loans where citizens could pay low interests.

Another factor that caused recession in the US, which affected Los Angeles severely, is development in other parts of the world (Richardson 11). The US no longer enjoys hegemonic powers as it used to do. Its exports have reduced because other states have taken over markets previously held by the US. This forces citizens to overspend their cash as nothing is gained in return. There are no longer manufacturing jobs for citizens as such jobs have been overtaken by events.

People focus more on technology and as a result, Los Angeles administration should focus more on education. The state should fund the education sector in order to encourage technological development. Moreover, the state should provide basic needs to individuals until they are age 20. The market should be allowed to operate according to its own logic although individuals must be protected from industrial exploitation.

Los Angeles researchers continue to argue that the state should rectify the current employment situation by intervening in the market (Whitney 14). Even earlier scholars recommended that the state should always intervene in the market to bring normalcy. The state should not allow capitalists to control the economy because the majority will suffer. In cases of economic turmoil, the state suffers more because unemployment leads to violation of law (Whitney 16).

People become violent and intolerant to each other’s behavior. Some individuals develop anti-social behaviors and turn out to be criminals. This affects the state’s economy since no investor is willing to invest in an insecure environment. Many individuals tend to evade payment of taxes since their incomes are constricted to basic needs only. These are some of the effects of recession to the Los Angeles economy.

Since the 2007 economic crisis, the international monetary fund columnists- Mai Chi and Loungani Prakash approximate that 210 million people are jobless worldwide. Local data from Los Angeles economic department confirms that indeed many people have been rendered jobless.

The worst hit regions are Europe and the US. The report summarizes that the situation is worse in the US and more particularly in Los Angeles because it was the first to encounter the crisis. Joblessness has led to reduced income among the Los Angeles households, low life expectancy and low educational attainment for school goers (Aversa 7).

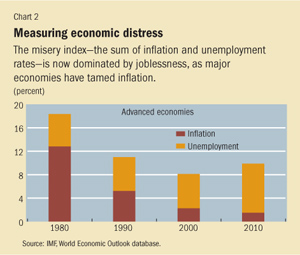

The situation is predicted to worsen in Los Angeles because companies are not willing to reinstate retrenched employees. Profits have fallen drastically among companies within Los Angeles meaning that they cannot sustain a big work force. The diagram below shows how the country has been affected by previous recessions and the current meltdown trend.

From the diagram, it can be concluded that inflation goes hand in hand with unemployment. In the previous years, the US government had sufficient policies that contained the influence of inflation (Mai and Prakash 2). In recent years, that is, 2000-2010 the government has filed to take affirmative action to avert the situation. Instead, it has left people to languish in poverty and misery.

In the US economy, the government was forced to bail out companies in order to retain employees. Such employees would work less hours meaning that their incomes were reviewed. This also meant that there could be no future employment.

Government support is not always permanent because the state is not supposed to interfere with the market logics (Wessel 5). Once the state interferes with the market, investors tend to shy off. Investors hold that the market is self-correcting and that such difficulties are temporary. Such scholars believe that the market regains its glory once corrective measures are erected.

Unemployment leads to stress, frustration and change of attitude. The market operations change completely especially when people are fired (Hern 47). The purchasing power is reduced implying that small-scale traders are affected too. Some are even challenged mentally and end up being locked in mental hospitals. An individual cannot imagine spending life without money yet he/she was used to decent life. Some families are forced to adjust their budgets to meet the market demands.

Prices of commodities skyrocket to an extent where common citizens cannot afford. The state does not control prices of all commodities because some are universal that is, determined by global trends. When it reaches this point, individuals are disturbed mentally because they are unsure of the future. Companies in Los Angeles continue to record losses, which make employees doubt the security of their jobs (Alford 3).

Los Angeles public health has been affected physically because parents dump their children due to inability to provide food. Such children and the elderly end up suffering physically because they cannot get food. Their health is compromised completely. Many elderly persons and children have died in Los Angeles because of lacking necessities.

Government’s help is not always guaranteed, therefore, food security is a problem to the victims of recession (Gross 12). Recession causes many disasters such as deaths, retrenchments, sacking and lack of income generated from private enterprises. The worst effect is mental problems, which is usually hard to handle.

Works Cited

Alford, Peter. “Japan headed for longest, deepest post-war recession”. The Austrailian, 2009.

Aversa, Jeannine. “Bernanke: Recession could end in ’09”. The Washington Times, 2009.

Gross, Daniel. The Recession Is… Over? Newsweek, 2009.

Gullapalli, Diya and Anand, Shefali. “Bailout of Money Funds Seems to Stanch Outflow”, The Wall Street Journal, 2008.

Hern, Matt. Common Ground in a Liquid City: Essays in Defense of an Urban Future. Vancouver: AK Press, 2010.

Mai, Chi and Prakash, Loungani. “Finance and Development: The Tragedy of Unemployment”. International Monetary Fund, 2010. Web.

Richardson, John. “The real causes of the crash of 2008”. Hearst Communications, 2011. Web.

Wessel, David. “Did ‘Great Recession’ Live Up to the Name?” The Wall Street Journal, 2010.

Whitney, Mike. “Stock Market Meltdown”. Global Research, 2007.

Wingfield, Brian. “The End of the Great Recession? Hardly”. Forbes, 2010.