Introduction

The banking industry is one that has over time stigmatized as being boring and old. However, recent globalization deregulation trends have opened new business channels for industry players. Technological advancements have for instance spurred banking to newer levels with internet banking and ATM services topping the list. Product diversification remains a top priority for every bank as the scramble for clients takes place. Unlike the days when bank clients were a reserved few and competition was minimal, modern-day banking is faced with stiff competition. This calls for a wide range of products to satisfy the ever-changing client needs within the baking industry. Bank of America offers a diverse range of products. A home loan is one such product.

Product Profile

Home loan is a product developed in response to the emerging need for homeownership by the American population. This is a secured form of loan offered on basis of a house/property security whose funding is drawn from a bank loan. This loan is issued by the bank to the borrower in order to purchase a property/house with the bank retaining conditional ownership of the property until such time that the whole amount borrowed has been retrieved. In case of a default by the borrower, the money is retrieved by the bank through the sale of the property. The Bank of America offers a number of home loan options including purchase loans, refinancing, and home equities (Bank of America Corporation, 2011). The product is available both in regular bank purchases and on its online resource facility. The bank prides itself on a team of professionals who assist clients in choosing in making decisions with regard to home loans.

Current Stock Price and P/E

The price to earnings ratio (PE Ratio) is a measure commonly used to gauge the price of shares relative to the net annual income earned by the entity for every share. It reflects the prevailing investor demand for the company’s shares. High PE ratios symbolize rising demand at the prospect of increased earnings in future dates. The Bank of America remains one of the outstanding marketing participants at the New York Stock Exchange with a share price of $14.18 with a 52 week low of $10.91 and a 52 week high of $19.86 (Bank of America Corporation, 2011). The current price earning ratio of the company is 12.3. A ten-year review of the same indicates a gradual decline in P/E ratio over the period (see figure below)

Company Profile

BAC is one of the largest financial institutions in the world. It serves a range of customers including individuals, small and middle-sized business entities, and large companies across the globe. It offers a whole range of banking services, investments options, asset financing, and management, as well as other products for the management of finance and risks. Its unmatched position in the US is evidenced by the large pool of over 59 consumers and small business entities it serves (Bank of America Corporation, 2011). The bank operates over 6100 retail banking offices and approximately 18700 ATM points (Bank of America Corporation, 2011). It also prides itself in whooping 29 million users of its online banking facilities. Its acquisition of Merrill Lynch in 2009 has seen emerge as one of the leading wealth management institutions globally in addition to being a global leader in corporate and investment banking. Its acquisition of The Bull further strengthened its retail brokerage network within its market niche. It trades across a wide asset ranging serving large corporations, government institutes, and individuals across the globe (Bank of America Corporation, 2011). It serves customers from across 40 countries and in addition to listing at the New York Stock Exchange; it is also a component of the Dow Jones Industrial Average (Bank of America Corporation, 2011).

Industry Profile

It remains no secret that the banking industry is one of the most challenging across the globe. Many banks operate billions of dollars and run a number of subsidiaries across the globe. In America, there are two predominant types of banks. These include regional banks and mega banks. Regional banks are smaller and predominantly focus on specific geographical areas within the country. They mainly provide lending and depository services. Megabanks on the other hand maintain both local branches and international banking. They primarily focus on financial centers e.g. New York. Both categories of banks provide stiff competition for the industry players. The changing market conditions have no doubt affected the banking industry. The recent economic recession affecting American institutions did not spare the banking industry. The cash crunch left most clients short of cash. Homeownership was not either spared with fewer people seeking loans to secure own places.

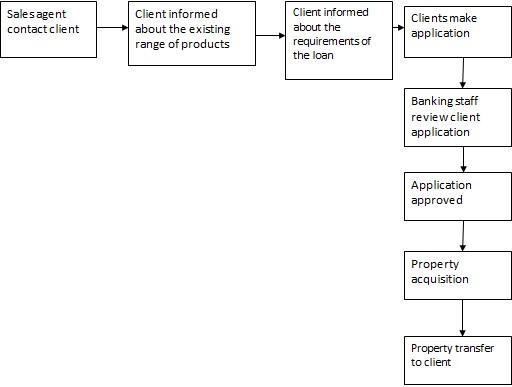

Full flow of the product:

Home products offered by the bank f America undergo a chain of processes before finally reaching their end-user. The process starts with the sales agents who make first contact with the clients either faced to face or via online facilities and ends with the borrower obtaining the property targeted. The process can be best summarized by the diagram below:

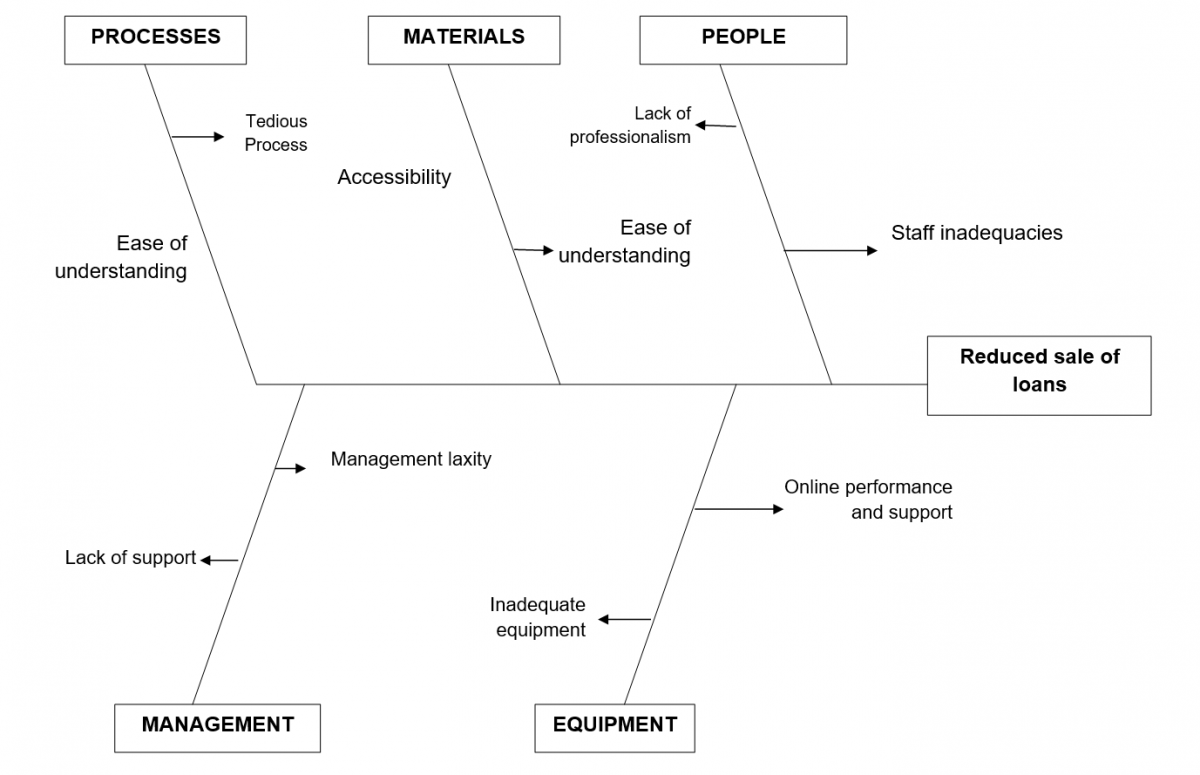

Banks often invest plenty of resources in identify loopholes that could dent its products image or its operations and hence affect its net income. To evaluate the flow, a fishbone diagram and a cause and effect diagram are used. The cause and effect diagram assists the management identify any loopholes which may result from specific processes associated with home loan issuance.

Evaluation using Pareto Charts

Pareto charts are useful in analysis f the possible sources of errors within a process flow. It is based on the principle that a large percentage of problems are often caused by few problems. It helps in identification of the few problems which the organization should put much focus on. It does this through categorization and stratification of errors, delays and customer dissatisfaction among others.

The Pareto diagram attached below shows the effect of some problems which interfere with the sale of home loans.

Pareto Data

As visible from the chart, 80% of the problem results from the first four issues.

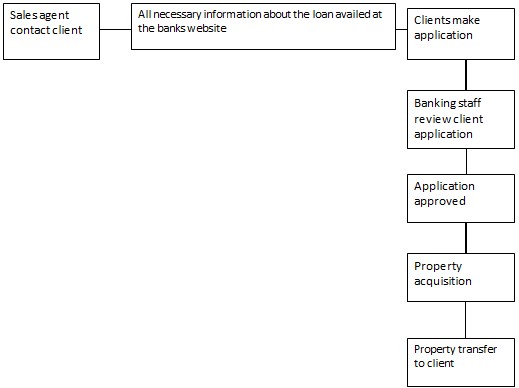

An improved flow process

To improve the process flow to the benefit of the bank, the errors considered to cause most problems within the flow processes are modified. Based on the analysis, the following process is developed

Recommendations

The changing technological landscape calls for the need to limit client and sales agent contact for purposes of gathering information. Availing such information on the website would limit the need by clients to talk directly to the sales agent over a loan. Additionally, it would guarantees that accurate information is availed to the clients for review and application. The bank should adopt increased use of technology in its sales and further avail qualified chat representative to answer further questions which may be raised by clients.

Conclusion

In conclusion, it must be acknowledged that the Bank of America has put much effort in ensuring that it reaches out to its clients. It should additionally liaise with other international banks to ensure it serves its global clients regardless of race and place of residence. A good example to follow is perhaps Moneybooker’s Ltd which has been able to avail withdrawal services to clients from across the globe. This would ensure that as the American housing loan market gradually diminishes, it explores newer markets across the globe. Like any other organization, the need to take advantage of the online resources to exploit the global market is inevitable to its success.

Reference

Bank of America Corporation. (2011). BAC Information. Web.