Introduction

Introduction and Justification of the Study

The news, social media sites and many people of late speak about online companies investing a lot of cash in the market. Indian Online Purchase is growing at a scorching speed over the last decade and expected to become the largest online consumer market by 2025. India’s population is about 1.2 billion, which could be a reason why online companies are struggling to make an appearance in the country. The use of the internet and mobile phones are widely spreading within the state. Media buyers, ad networks, and publishers interested in investing in the Indian market should consider the limitations and significance before flooding the market; however, it is very evident that attention ought to be paid to four main reasons. These reasons are mobile dominance, the transformation of online payments, demands from millennials and the extensive growth of the e-commerce community. Snapdeal, Flipkart, and Amazon are among the big online companies spending cash into India’s e-commerce market (Kumar & Gupta 2017).

The significance of The Study

There are three major categories of people that may benefit from this research. The first group is online investors who wish to invest in Indian e-commerce, they may learn the advantages and disadvantages of indulging in the market, and they may weigh the options before making the decision. The second group is the online companies in competition, Amazon, for instance, and they may gain insight on the reasons why other companies investing in Indian e-commerce are far much ahead of them, and in turn, they will compete favorably. Finally, the educators can use this study for learning purposes and may consider incorporating it in the syllabus since the rise of Indian e-commerce due to technological growth and India’s vast population is doubtlessly a significant example of business history.

Study Objectives

- To determine India’s growth rate in E-commerce are reasons why other businesses should focus on India regarding online buying.

- To identify the frequently used online company in India and deduce the best ways they can improve their service delivery to increase the number of online buyers.

The scope of the Study

This Research was restricted to the discernment of young professionals who have decent income and can make purchases. For the study, describing and identifying a young professional depends on the view of the interviewer. The study was mainly carried out in urban areas since there is a slow rate of internet and smartphone penetration in India’s rural places and suburbs. Data for this study were collected between the years 2013 and 2018, the period when the internet and technology are a part of an average man’s everyday life.

Literature Review

Critical Overview of Conceptual Literature

Ofir (2018) a global Sales Manager at TUNE who has labored expansively with evolving mobile-first markets of India gives four main reasons why people should be keen on India’s Online market Growth. According to Forbes, for a total of 206 million Indian internet users in 2013, 50% of them access the internet by mobile only, this number is still growing. From 2013 to 2017 smartphone users are increasing at 26% compound annual growth rate (Kaur & Kaur 2015). Smartphone users in India take a vital position in the e-commerce development of their country due to the introduction of cheaper 2G enabled smartphones that are accessible to many. This growth rate can be higher with time since the use of mobile-only users in rural and smaller urban centers is gaining internet access; hence they become potential online buyers (Franco & Regi 2016).

Despite India having many mobile users, their mode of payment is still conservative and slow. Majority of its people still use cash on delivery to make payments. Since more online companies are investing in India, mobile wallets and credit cards will be used widely, increasing online store globally (Hande & Ghosh 2015). Paytm Company has significantly contributed to the growth of online payment. Paytm has more than 1000 million operators in India and they run over 75 million transactions monthly (Paul et al. 2018).

Almost two-thirds of the total Indians population consists of people younger than 35 and statistics show that 63 percent of smartphone users are under 25 years of age (Leong et al. 2016). This young population obsessed with internet dictate the rate at which the government adjusts its infrastructure and policies to promote e-commerce shops, delivery systems, and faster internet access. Therefore, India is a high priority marketing strategy for e-commerce investments due to its demography (Negi & Birla 2017).

There are limited large e-commerce corporations in India, which include Amazon, Flipkart, Alibaba, and Snapdeal among others. Amazon announced the addition of 2 billion US dollars investment in the Indian economy, and their reason was that they see great potential in the Indian economy regarding e-commerce. Alibaba invested 500 million US dollars in the Indian economy (Khare 2016). Founder and CEO of Amazon say India is the fastest country ever whose growth rate and current scale is at a billion dollars gross sales, and they have never witnessed such a thing before (Thamizhvanan & Xavier 2015).

Critical Overview of Empirical Literature

These online companies are now collectively pushing to upgrade a loaning environment to boost and expand small corporations and business startups. The higher the number of people shopping online, the higher the prospects for sales for advertisers and publishers (Bagchi 2015). India is the primary e-commerce growth market due to improved income level and high internet penetration rate. The most significant e-commerce player in India is Flipkart currently. Morgan Stanley expects more than 50% of India’s online users to buy products online come 2026 from 14% which was in 2016. Between the years 2016 and 2017 Flipkart’s shares in the Indian e-commerce market rose from 31.5% to 35.7%, according to Bloomberg Intelligence and Euromonitor Passport, Amazon’s shares grew from 24.5% to 27.7% during the same period. Citi research approximated amazon’s India sales to be worth $16 billion in 2018 (Kalia, Kaur & Singh 2018).

E-commerce is renowned for providing timely and reliable delivery of goods and services. Its ready accessibility makes it be termed as one of the best in delivering quality customer solutions, because of its provision of high-quality solutions, especially to the most challenging business requirements (Gupta & Rajesh 2018). The current world requires a more excellent knowledge in telecommunication, and if India as a country has gone online especially in the sector of business. Therefore, it is presumed that India has climbed to greater heights as far as modern technology is concerned, and the growth of telecommunications industry is predicted to grow higher than that especially in 2020 (Thakur & Srivastava 2015).

The government and private sectors are putting necessary measures to ensure schools have information technology programs due to the high knowledge and better skills in computer literacy. The above meant to ease the future capability to get into the job field, hence 850 operational universities as at 2018. For this reason, most youths come out as highly innovative; thus they can create self-employment (Sivakumar & Gunasekaran 2017). India is rated the second best worldwide regarding internet subscribers. The e-commerce has taken the lead as the wireless segment takes the point, and people use mobile applications among other sources to market and sell their products (Kanchan, Kumar & Gupta 2015).

Conceptual Framework

One of the most relevant themes investors are focusing on is e-commerce war and growth rate in India. A cumulative capital of over $10 billion has been gathered by three competing online companies, Amazon, Flipkart, and Snapdeal for the sake of investing in India’s e-commerce, this means that the stakes are high (Srinivasan 2015). The winning online company in this war will be the one with the most substantial number of service users and with positive review comments on their services (Goswami & Khan 2015). There are three reasons why these large online companies are scrambling to invest in India’s e-commerce, these reasons are represented diagrammatically as shown below.

The sole reason why customers complain about online services is poor delivery. Online companies are investing more in improving efficiency in the delivery of goods and services, improved service quality and faster services, and this will up the game for boosting e-commerce in India (Paul et al. 2018). Convenience is the key to enhanced e-commerce, discounting products and regulating product price also contributes to the enlargement of e-commerce. Improved government policy in India regarding the digital economy and information communication technology has helped transform the country’s e-commerce growth rate (Vakeel et al. 2017).

Methodology

Sample Selection and Data Collection

The target population for the study was all India residents in the rural and urban areas of different ages ranging from 18 years to over 65 years. The general sample was comprised of 123 respondents, 73 male, and 50 female. Minimum age of participants was 14 years. SD range of 1.55. Participants were divided concerning age groups.

Online users and smartphone owners together with those who do not own mobile phones were also included in the estimates through data imputation provided by Citi Research and Pre-IPO research. To create a sampling frame, extracts of records for all online users located in India since 2013 and 2015 was recorded. Stratified sampling which is a probability sampling technique was used to reach the participants. Layered sampling technique was used within each online company to gather information on the number of online users and their age bracket. People from different ethnic groups also took part in the study as long as they reside and operate in India (Hande & Ghosh 2015).

Data Source

Questionnaires developed by a group of researchers were used to collect data for this study. The surveys were sectioned into three parts. Part one consisted of questions concerning whether the respondents use smartphones and for which purpose do they use the internet. They were also asked to specify their age brackets. In the second part of the questionnaires, the respondents were asked whether they purchase goods online and at which frequency do they use online markets. They were also to indicate their reasons for preferring online buying. The last section they were to specify their favorite online company and specify the reasons why they prefer it to others (Sivakumar & Gunasekaran 2017).

Comprehensive interviews were also conducted with the CEOs and managers of online companies investing in India. These interviews provided first-hand information on the perspective of the online company management, and it also gave reasons why they invest in India other than other countries (Gandhi 2016).

Strategic Data Analysis Methods and Instruments

Statistical Package for Social Sciences (SPSS) and Tableau was sourced to assess the rate at which residents of India use online shops within the past six years. Simple statistical techniques were used to record and tabulate the outcomes of the research. Primary data were evaluated by determining a percentage of the responses. To calculate the rate of response to each selection was divided by the overall number of participants who answered the question. The Outcomes of part two and three of the questionnaire were tabulated (Shewale et al. 2016).

Descriptive statistical data analyses were conducted on selected samples to obtain a clear comprehension of the total population. Visualization of the data was examined by calculating measures of central position, frequencies, and means of dispersion. The data was then represented for modeling by carrying out a hypothesis test, regressions, correlations, probabilities, and time-series analysis (Ramkumar, Jin & Chou 2015).

Data Analysis and Findings

This study was designed to determine the reasons why people should be keen on India’s E-commerce. 123 questionnaires were circulated randomly to residents in both rural and urban India setting, and the response rate was 78.3%.

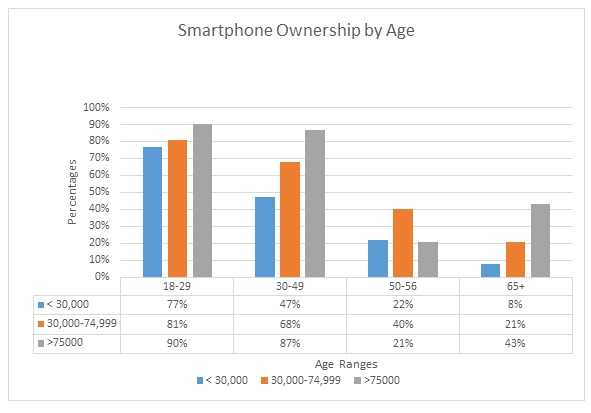

Visualization Data Analysis Demographic Profile

The findings will be presented in three sections, the percentage of investments of the largest online companies investing in online buying and selling of goods and services in India, demographic profile, the rate of smartphone users and the enlargement pace of e-commerce in India. The randomly sampled smartphone users were told to indicate their age bracket in the questionnaires, all age arrays were denoted in the outcome as shown in Figure 2. The breakdown comprised of a mean of 0.83 of the total Indian population who are online users are aged 18-29, 0.67 range 29-49 years, 0.28 are 50-56 years, and finally, only a mean of 0.24 of the population who use and own smartphones are 65 years and over. The modal class is 18-29 years, this is the young age bracket who are engrossed and immersed in the internet, and they are the targeted age group aimed at enlarging e-commerce in India. 3-49 years is the median of the dataset (Vakeel et al. 2017).

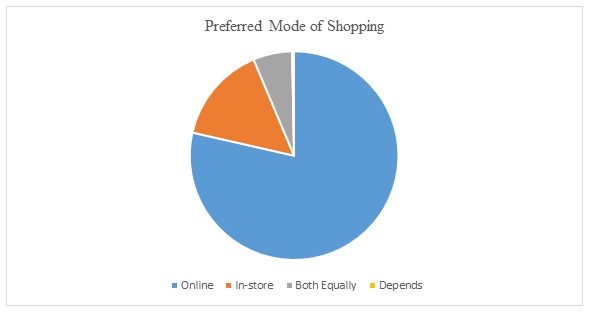

Preferred Mode of Making Payment

Surveys carried out by Pre-IPO Research surveyed changing attitude among young Indian professionals towards e-commerce. Young professionals gave out their views on their best way of shopping, whether they preferred online, in-store, both equally or whether it depends. Below is a graph showing the results deduced from the research, 78% preferred online shopping, 15 percent chose in-store, 6 percent of the professionals preferred using both online and instore whereas 1 % said it would depend on what they buy (Findyr Blog 2018).

Depending on the frequency of purchasing online, 85% of young professionals in India buy goods and services from the internet on a monthly basis more recurrently. Their reasons for buying online are divided by value, convenience, variety, and expense. 63 percent of the people plan to shop more and more online whereas 32 percent are contented with the rate at which they purchase goods online (Franco & Regi 2016).

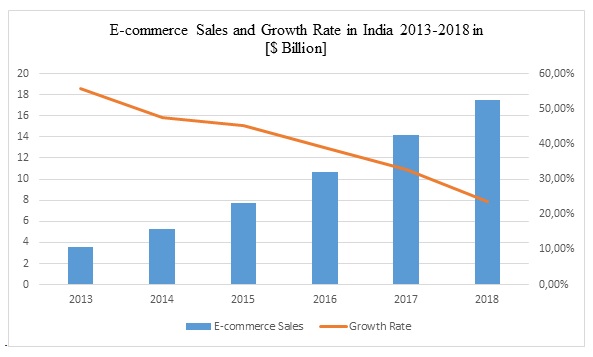

E-commerce growth Rate in India

The online and retail sector depends solely on the internet, as a huge number of people in India are getting online, the industry also grows. Despite the rate at which internet is penetrating in India is among the most inferior around the globe, the number of those linked up to the internet is intensifying swiftly (Zhao et al. 2016). Use of smartphone is also penetrating India art a higher rate hence more people are getting connected on their handheld devices; therefore e-commerce growth rate goes high. Indian e-commerce looks more promising and bright (Ramkumar, Jin & Chou 2015).

Figure 4 compares the entire retail sales and retail commerce sales in India over a phase of 6 years, from 2013 to 2018, it is evident that overall retail sales in India increased from 17.73 billion level to 1,243.58 billion. The average retail sales registers double-digit growth figure each year, which is quite impressive. E-marketers predict a 15% consistent rate of growth each year from 2018 onwards. Retail e-commerce looks more promising, from 3.599 billion in 2013 it grew to 17.51 billion in 2018 with a consistent growth rate of 47.6%. The retail e-commerce proceeds to record an unprecedented increase along with growth by leaps and bounds (Emarketer 2018).

Preliminary Results

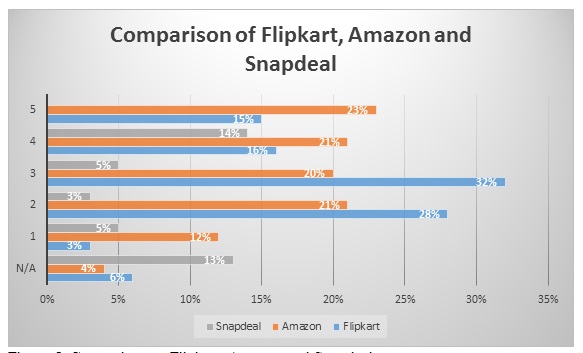

A vast majority of respondents have used the three e-commerce retailers for online shopping. There is a higher probability that Flipkart provides marginally better end to end user experience. The recurring survey helped to come up with more conclusive final results. The current state and future trend of these online companies were deduced (Chiu et al. 2014).

Flipkart was rated good and very good by 66% of users, while Amazon and Snapdeal were ranked by 62,5% in the same category. Under post buying checkout experience, Flipkart was rated good or very good 72% by buyers, whereas Amazon and Snapdeal have respectively 65% and 51%. According to product choice, Amazon and Snapdeal were ranked the highest at 63%, and Snapdeal had 57%. Snapdeal and Flipkart were rated 67% concerning affordable pricing, and Amazon had 64%. Flipkart appears to be the largest online company in India. However, the e-commerce field is quite changing. Investors will be required to analyze the market to understand where the market is headed before adding more investments (Sadachar & Fiore 2018).

Conclusion

India has a substantial opportunity. It is anticipated to perceive an improved and robust e-commerce development with the rising standards of living, increased internet access, and the vast young population. There will also be an elevation in the number of advertisers and publishers targeting these online consumers. This significantly contributes to more profitable opportunities for ad networks to aim at a market that most likely shall expand with time and become more productive.

Recommendation

The following recommendations are made considering the findings, analysis, and conclusion made from the study:

- E-commerce is set to perform a very vital function in India’s economy, any opportunities that appear should be made accessible to both large and small online companies.

- India is destined to grow in geographic reach and revenue. More research should be conducted on the best ways online companies can improve their services to attain more sales.

- Online Publishers, advertisers and other companies working in the same field should take advantage of the growing Indian e-commerce to boost their businesses.

- Entrepreneurs should come up with new business ideas due to a large number of internet users in India.

References

Bagchi, S 2015. Urban India’s Smartphone Population Ages – eMarketer. Web.

Chiu, CM, Wang, ET, Fang, YH & Huang, HY, 2014, ‘ Understanding customers’ repeat purchase intentions in B2C e‐commerce: the roles of utilitarian value, hedonic value, and perceived risk’, Information Systems Journal, vol. 24 no. 1, pp. 85-114.

Emarketer 2018. Urban India’s Smartphone Population Ages – eMarketer. Web.

Findyr Blog 2018. Pre-IPO Research – India’s e-Commerce Wars – Findyr Blog. Web.

Franco, CE & Regi, BS 2016, ‘Advantages and challenges of E-commerce customers and businesses: An Indian perspective’, Int. J. Res.-Granthaalayah, vol. 4, no. 7, pp. 1-12.

Gandhi, SK 2016, ‘India’s jumbo jump from e-commerce to mobile enabled services (MES): A Review’, Productivity, vol. 56, no. 4, pp. 1-10.

Goswami, S & Khan, S 2015, ‘Impact of consumer decision-making styles on online apparel consumption in India’, Vision, vol. 19, no. 4, pp. 303-311.

Gupta, VC & Rajesh, PS 2018, ‘Digital India with E-Commerce revolution in rural India: transform India digitally and economically’, Journal of Commerce Journal of Commerce, vol. 53, no.1 pp. 50-64.

Hande, PV & Ghosh, D 2015, ‘A comparative study on factors shaping buying behavior on B2B and B2C E-commerce platforms in India’, EXCEL International Journal of Multidisciplinary Management Studies, vol.5, no. 3 pp. 1-10.

Kalia, P, Kaur, N, & Singh, T 2018, E-Commerce in India: evolution and revolution of online retail, IGI Global, Panjab, India.

Kanchan, U, Kumar, N & Gupta, A 2015, ‘A study of online purchase behavior of customers in India’, Intact Journal on Management Studies, vol. 1, no.3, pp. 1-4.

Kaur, EH, & Kaur, MD 2015, ‘E-Commerce in India–Challenges and Prospects’, International Journal of Engineering and Techniques, vol. 1, no. 2, pp. 36-40.

Khare, A 2016, ‘Consumer shopping styles and online shopping: An empirical study of Indian consumers’, Journal of Global Marketing, vol. 29, no. 1 pp.40-53.

Kumar, N. & Gupta, U 2017, ‘Factors Influencing Online Purchase Behaviour of Customers in Tier III Cities of India-A Factor Analysis Approach’, International Journal of Marketing & Business Communication, vol. 6, no. 1, pp. 1-4.

Leong, CML, Pan, SL, Newell, S & Cui, L, 2016, ‘The emergence of self-organizing e-commerce ecosystems in remote villages of china: A tale of digital empowerment for rural development’. Mis Quarterly, vol. 40, no. 2, pp. 475-484.

Negi, D, & Birla, MD 2017, ‘Future of Insurance Business and E-Commerce in India’, International Journal of Scientific Research and Management, vol. 5, no. 9, pp. 7119-7123.

Ofir, B 2018, 4 Reasons You Should Pay Attention to India’s E-Commerce Growth. Web.

Paul, P, Bhuimali, A, Aithal, PS, & Bhowmick, S 2018, ‘Business Information Sciences emphasizing Digital Marketing as an emerging field of Business & IT: A Study of Indian Private Universities’, IRA International Journal of Management & Social Sciences, vol. 10, no. 2, pp. 63-73.

Smartphone ownership by income/ age grouping 2018. Web.

Ramkumar, B, Jin, B, & Chou, WHC 2015, ‘Factors Influencing Consumers’ Intention to Engage in International Online Out-shopping: A Comparison of the US and Indian Consumers’ Out-shopping Intention at Chinese e-retailers.’ in Conference: International Textile and Apparel Association (ITAA) Annual, Santa Fe, NM, pp. 1-2.

Sadachar, A & Fiore, AM 2018, ‘The path to mall patronage intentions is paved with 4E-based experiential value for Indian consumers’, International Journal of Retail & Distribution Management, vol. 46, no. 5, pp. 442-465.

Shewale, AH, Gattani, DR, Bhatia, N, Mahajan, R, & Saravanan, SP 2016, ‘Prevalence of Periodontal Disease in the General Population of India-A Systematic Review’, Journal of Clinical and Diagnostic Research: JCDR, vol. 10, no. 6, pp. ZE04.

Sivakumar, A, & Gunasekaran, A 2017, ‘An empirical study on the factors affecting the online shopping behavior of millennial consumers’, Journal of Internet Commerce, vol. 16, no. 3, pp. 219-230.

Srinivasan, R 2015, ‘Exploring the impact of social norms and online shopping anxiety in the adoption of online apparel shopping by Indian consumers’, Journal of Internet Commerce, vol. 14, no. 2, pp. 177-199.

Thakur, R & Srivastava, M 2015, ‘A study on the impact of consumer risk perception and innovativeness on online shopping in India’, International Journal of Retail & Distribution Management, vol. 43 no. 2, pp. 148-166.

Thamizhvanan, A, & Xavier, MJ 2015, ‘Determinants of customers’ online purchase intention: an empirical study in India’, Journal of Indian Business Research, vol. 5 no. 1, pp. 17-32.

Vakeel, KA, Das, S, Udo, GJ, & Bagchi, K 2017, ‘Do security and privacy policies in B2B and B2C e-commerce differ? A comparative study using content analysis’, Behaviour & Information Technology, vol. 36, no. 4, pp. 390-403.

Zhao, WX, Li, S, He, Y, Chang, EY, Wen, JR & Li, X 2016. ‘Connecting social media to e-commerce: Cold-start product recommendation using microblogging information’, IEEE Transactions on Knowledge and Data Engineering, vol. 28, no. 5, pp. 1147-1159.