Objectives of the Research Paper

The objective of this research is to demonstrate how Mashreq Bank has benefited from the adoption and implementation of Microsoft windows based platform in its core banking operations. The windows platform is becoming increasingly attractive to large banks. It is used to support their primary banking services that include ATM, Internet banking in addition to branch and call center operations.

Overview and background for Mashreq Bank

Mashreq bank is the largest private sector bank operating in the United Arab Emirates (UAE). The company has approximately USD $14 billion worth of assets. The bank offers financial services through its 60 branches in UAE and Qatar. Mashreq is regarded as a pioneer in banking in the UAE fully dedicated to offering full financial services both to its commercial and retail banking customers.

It was the pioneer bank in the region to issue credit, and debit cards, implement a call center, 24-7 access to automated teller machine, and link its branches to a centralized online database. Before shifting to the windows based platform the company had significant performance challenges in meeting service levels on the Unisys (NCR) mainframe processor.

Batch processing consumed up to six hours on a daily basis and up to nine hours at the end of the month. Furthermore, the central processing unit usage was approximately 90% that resulted in backlogs in processing and reduced the companys ability to meet new product and processing demands.

Mashreq Bank Vision and Mission

The banks vision of single minded devotion and leadership differentiates it from the competition. The mission include; delivery of superior service, becoming customers primary bank, being the preferred employer and establishing good relationship with all the stakeholders. These are meant to ensure that the company delivers optimal value to its stakeholders.

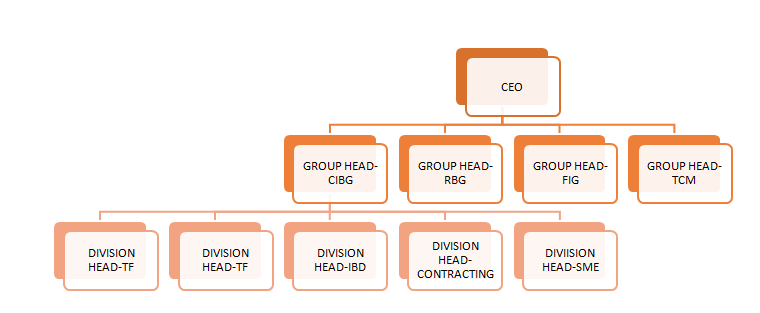

Mashreq service units and product Divisions

The bank has four major divisions that include; financial institutions, corporate, personal and SME banking.

Financial Institutions

These division deals with the provision of tailored financial solutions to the banks institutional clients. Products and services offered under this category include trade and account services, virtual branch, funds transfer, cash letter services and online banking services (Mashreg 1).

Corporate Division

The corporate division handles issuance of checkbooks, maintenance of accounts, cash management products and payments, in ward and outward remittances, updating of trade license and the provision of letters of credit, documentary collections, discounting and guarantees (Mashreg 2)

Personal Banking Division

This division offers deposit and deposit growth services, borrowing services that include; loans, credit cards and overdraft facilities. Customers are also provided with mobile and inline banking platforms for them to manage their finances (Mashreg 1).

SME Banking Division

The financial solutions offered under the SME division are similar to those of personal banking category except that they are offered to small and medium enterprises.

Role of Information Systems in Mashreq’s Strategy and Business Model. Mashreqs Strategy

The bank pursues a strategy of operating prudently and profitably. In the banks strategic plan over the period 2011-2013, the bank intends to maintain its leading position as a financial solutions provider not only in the UAE but also in the wider Arab region.

In its lending operations, the bank has been very cautious in avoiding instances of bad debts and non-performing loans. In terms of technology, following the Banks adoption of Microsoft platform, the bank has strengthened its online banking system by upgrading to a new online banking system that has enhanced security features.

The new Microsoft platform has provided Mashreq customers with added banking services, increased the customers security level and widened the scope of financial transactions. The banks adoption of online banking is part of Mashreqs broader strategy geared toward the delivery of convenience and security in online banking transactions.

Because of its leadership in technological innovation, Mashreq opted to upgrade its mainframe infrastructure. The bank wanted a system that could well apply in its development cycles, a system that could easily connect core banking applications and other banking systems. The companys management were interested in a system that could support its continued expansion and high volumes of transactions arising from the growth.

As at 2005, the daily peak average for the bank stood at 1.5 million transactions and a result the new system had to handle such a large load and even more. After consultation with the Dubai Microsoft office, the company opted for a solution based on Microsoft technology (Microsoft 2). The new Microsoft platform was subjected to a series of tests before the bank adopted it.

The results from the test indicated that the volume of online transaction processing increased by 60 percent compared to the Unisys mainframe environment. Similarly batch processing results indicated that the new platform was 300 percent faster than the mainframe. Because of the positive results, Mashreq bank fully migrated to SQL server 2000 and windows server 2003 64-bit technology.

Role of Information Systems at Mashreq Bank

Through the new system, the bank has achieved more stable operations. In the first six months following the adoption of windows platform, the bank brought down the number of critical incidences involving its SQL server based banking platform.

The positive outcome was a result of the good architecture provided by the windows based information system and optimization from the Dedicated Support Engineers (DSEs). Given that it was a new system, Microsoft gave the company a team of experts to help the company address ant incidences and know how to avoid similar problems in the future (Horton 6).

The number of reactive incidents also declined. Other than improving the availability of the banks core banking servers, the IT team at Mashreq in collaboration with Dedicated Support Engineers (DSEs) worked together to improve and optimize Mashreqs internet information systems (IIS) which is the engine for its online banking services for both retail and business customers.

The bank undertook a thorough check to ascertain if the new system was properly configured. Once this was confirmed, it embarked on the application of best practices. Because of these initiatives, Mashreq has managed to significantly reduce the volume of imprudent occurrences in the bank. From adoption, only one reactive occurrence has been reported at the bank in a period of five months.

In general, the new banking platform has increased the level of service delivery and enhanced the banks ability to address emergencies. For example suppose there is an interruption in the main banking system, the bank has a reserve backup that immediately fills the gap and service should continue without interruption.

Similarly, the bank has achieved significant cost reductions following the adoption of the new information system. The moved from a reactive approach to critical incidences and embraced a more proactive approach. Similarly, the bank has engaged in server consolidation and virtualization. These developments have brought significant flexibility to the bank, and significantly reduced on its operating expenses.

The duration of query at the bank reduced from half an hour to only 3 seconds. To date, the performance of Mashreq banks performance on the new SQL server has exceeded expectations. The bank significantly boosted its speed in processing operations especially for large volumes of time series data covering several years.

In one instance, the bank managed to process 100 million records in only three seconds. This is quite remarkable considering that under the old platform it would have taken up to half an hour. The results are impressive considering that the SQL server is being run in a production environment and as a result able to deliver actual results.

Using the new server, the bank has widened its presence. The SQL server is always on and provides high usability of the banks Customer Relationship Management (CRM) system and other key banking systems (Injazz and Popovich 5).

The bank fully provides round the clock services throughout the year. Whenever there is a software or server failure, it switches its database to a secondary backup server ensuring that there is no service interruption (non-stop banking systems).

Increased productivity of information technology is another role which the new platform has provided. In addition to boosting its presence within UAE, the bank found that the SQL server is much easier to set up, and it is quite intuitive. With the new Microsoft based platform, a manager does not need high levels of special skills in order to successfully execute and manage consistent application operation.

Similarly, when compared to other banking databases, performance tuning of the SQL server does not consume much effort. With just a few internal systems, the server makes it possible for Mashreq bank to handle a number of activities for example operations, development and management all at a time.

The bank has had the SQL server for a few years yet the level of performance improvement in the short duration is quite high. The banks workload volume running in the new system has significantly increased.

Using the databases created the banks divisions were consolidated into a single system by the banks IT team. The consolidation has delivered even more efficiency and automation by creating a system that is ever on instead of doing it on a batch basis.

Improved customer service delivery, one of the merits of the SQL server is that it offers accurate and up to date business intelligence. Through the system, Mashreq is able to deliver up-to-date business information across all its branches so that the branch managers can make informed decisions on a daily basis.

With its expansion strategy in UAE and beyond, the company understands that if it is to be successful, then it must give full access to customer data to its local offices. Similarly, the financial requests from the local branches must be addressed with speed. In retail banking, it is important that a bank has instant access to data when serving the customers.

Mashreq offers an operating environment where customer data and other useful information gathered are disseminated to all branch networks. The bank boasts of close contact with its customers, and with its branches fully equipped with customer data, they are able to provide quality services that exceed the customers expectations. All this has been made possible because of the upgrade to SQL server.

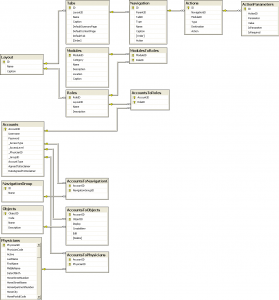

The Components of Information Systems

The Microsoft SQL server comprises of four major components of which three are sporting acronyms. The list below is used in determining the components of SQL server. Database Engine: This section of the SQL server deals with coming up with interrelated databases, SQL Server Analysis: it is the element of data analysis of SQL server.

It produces online analytical cubes that are programming objects responsible for classifying data inside an interlinked database and getting relevant data out of the database, SQS Server Reporting system: This element is responsible for providing reports irrespective of the operating system of the database SQL Server integration services: is a component of SQL server that performs the function of transforming, extracting and loading the process that converts raw data into information that is ready for use.

Enterprise manager: He is responsible for providing a general overview of installation on the network. The administrative roles played are of high level that has an effect on one or more servers. He is also responsible for planning maintenance duties and transform organization of personal data bases. Query Analyzer provides fast criteria for delivering queries against the database for SQL server.

It helps in analyzing information out of the database in reply to the request of the user before putting it into practice in other applications, coming up with stored procedures and performs administrative duties. SQL profiler; it helps one to check various types of events and scrutinize the performance of the database at a specific time.

SQL server enables one to repeat the path of the system that has various tasks. It is a significant tool responsible for detecting specific problems and determining performance related issues with the database. Service manager is responsible for controlling the SQL service agent processes, Microsoft distributed transaction coordinator, and the main SQL server process.

It has an image of the system that is found in the tray of the machine that helps the SQL to run. The service manager helps in starting, pausing or stopping any of these services. Data transformation systems: It offers a method for exporting and importing data between the SQL installation and a group of other formats.

The most common application of data transformation system is export and import data wizard found in the SQL server program group Books online is offered with SQL server that includes answers to various development, administrative, and installation issues. It is an important resource to consult in case of a technical support or before starting the internet.

SQL server administrative characteristics-the major function of the SQL server is to reduce the required knowledge when coming up with database applications, its interface enables majority of the information technology staff to combine their efforts in development.

The SQL server helps many companies in developing database applications at a low cost. The latest system used with SQL server brings some developments in the database administration hence making it cheaper over long term. The major characteristics include:

- Administration through DMF that make use of policy based management for effective governance of the database.

- Centralized management through a single and steady administration interface.

- Mechanized operations to carry out database maintenance duties and react to the system issues.

- Close supervision across the enterprise through the performance studio, offering simple mechanisms for reporting.

Type of Information System and Technology Used

For the managerial duties, Mashreq bank utilizes Executive Support Systems (ESS) in most of its branches within UAE. The system is especially ideal for board directors in formulating policies that help in the running of the company. The system uses various data analysis and modeling techniques to analyze the information gathered from various branch databases.

The databases provide details on transactions carried out on daily basis. The branch information is then organized in the transaction processing system and translated into a form that the mangers can understand and use. The ESS system organizes information in a report format. The information indicates relevant patterns of profitability and demand useful in decision making and policy formulation.

In addition, the ESS reports summarize the important details in a manner that can be easily understood by the companys board of directors who are in most cases busy. They give the directors an overview of how the company is operating.

The system offers guidelines to managers on how they can formulate strategies which are later implemented by the branch managers through employees. The resulting strategies and objective are disseminated to the branches and the branch managers in turn pass them to the supervisors and employees at the branch level (Hunt 8).

Mashreq departmental managers for example sales manager and public relations manager make use of Decision Support Systems (DSS) in addition to Management Information Systems (MIS) in making departmental decisions.

A marketing manager at Mashreq can use the management system and decision support system to come up with methods for increasing sales through marketing the branch at the grass root level. Through these systems, Mashreq has positioned itself ahead of the competitors.

Mashreq bank equally uses Transaction Processing Systems (TPS). This system indicates the details of all the transactions undertaken at the branch level. The system is the foundation of all the other systems in the bank because it gives a significant amount of information on Mashreqs operations.

The information gathered is utilized in executive support and management information systems to design services that meet the needs of the consumers. The sales division largely relies on the system in ascertaining the services and products that are most needed and as a result be in a position to formulate the best promotional strategies. Majority of the information posted on the companys website is also sourced from the TPS.

The last system in use is the Knowledge Management System (KMS). Through this system, the bank develops a central location in which a wide range of information is posted. The information posted in the central location comes from a number of sources that include research, transaction processing systems and employees.

Employees are encouraged to share the ideas and opinions which can help the company improve performance and working conditions. The information collected is shared on the company intranet.

Through this system, the bank has established productive relationship between management and employees because in the process of decision making, the management takes into consideration the views of the employees resulting in increased employee commitment and loyalty (Menon 4).

Usability of Mashreqs Website

Internet usage has enabled Mashreq bank to expand on the wide range of activities it provides. The bank has developed its own website to enable it perform these services better. The website information is readly accessible to the customers from wherever they are. For example, customers are able to access offshore and e commerce banking through its website.

E-banking service has enabled the bank to serve its global customers. This banking service is provided to both nationals and internationals at a lower tax rate. This service is vital for foreign investors. The main objective of Mashreq bank coming up with this type of banking service was to provide banking services to people abroad.

The bank has been able to win the trust and loyalty of its customers through maintaining a long-term good relationship with them. E-commerce and E-banking has enabled people to move from one country to another without moving with their finances. These customers can also possess debit cards that can enable them to own and access finances online.

Internet services allow people who practice offshore banking to access information internationally as long as they are connected. The bank uses the transaction processing system to provide information to its customers because it has information about the daily activities of the firm.

The Mashreq bank uses this information to prepare bank statements and develop databases for its customers. Customers are able to access their bank accounts from where they are by logging in the website of the bank.

Customers who are access to the internet can access their accounts at any time as long as they have access to the website of the bank. This enables customers to transfer money from and to their accounts at any time. It has also made it possible to access new electronic accounts.

The website has also enabled customers to apply for loans and pay their bills from their homes. The bank also uses the knowledge information system to get information relating to the customers and the banks. The use of internet and online banking has derived satisfaction to its customers.

Comparison between the Current and the Previous Systems

Previously, the bank was using the manual system before the introduction of online banking. For example customer who had an intention of opening an account in another country was expected to obtain a statement from the current account of Mashreq bank and present it to where he wished to open an account.

The use of internet banking has changed this because a customer can open an account online. The bank also used UI system to perform its operations. Although there is introduction of the internet banking, some manual systems are still in operation.

Disadvantages of Not Embracing the New Microsoft Technology Platform

With the old Unisys mainframe, the bank suffered high maintenance costs and poor support from the vendors. In fact, with their NCR Unisys system coming to the end of its useful life, NCR would no longer offer support for the mainframe computer and it was already getting difficult to find spare parts. Such a system could significant affect the banks performance because of failure to address issues quickly.

Similarly, its growth prospects were limited by the functionality and capability of the old Unisys NCR system because of inability to initiate and implement new products in a timely manner. The old system was equally unable to deliver customer centricity which meant that the competitors were having an upper hand, and the company could not achieve the efficiencies associated with real-time straight through processing.

Benefits of the Microsoft Platform to Mashreq Bank

The bank enjoys more technological possibilities

Following the adoption of Microsoft platform, Mashreq has a wider variety of technologies to choose from given that the technology is a viable option even under critical situations. The bank is working in collaboration with a team of experts from Microsoft and because of this the bank has fully taken advantage of new technologies as they become available.

Its engagement with Microsoft has opened the bank to a wealth of possibilities. With a wide range of technology available at its disposal, Mashreq has embraced new technologies that address its needs and those of its customers.

Savings in Deployment Effort and Time

Just months following the negotiations between Microsoft and Mashreq bank, the bank had the SQL server 2000 solution up and running in its production process. Taking into consideration the size and scope of the new information system, its deployment was relatively faster compare to other information technology projects that the bank had undertaken.

The Microsoft Technology Center (MTC) in Dubai offered training to Mashreq IT employees. The knowledge and skills that they gained through the training was very instrumental when the bank was migrating its core banking applications. The performance achieved in the production environment was even much better than the one registered in the test environment.

Readily Available Expertise

Even though Mashreq bank has capable internal human capital, its engagement with MTC further provided the bank with the necessary expertise in helping the bank understand particular technologies and the best ways to achieve technical and business needs.

The architecture provided by MTC highlights the importance of efficient use of technology. Currently, Mashreq bank is in a position to validate its proposed information system solutions and achieve high levels of performance.

How information systems help the Mashreq deal with its problems and compete in the industry

Currently, 70-75 percent of the banks initiatives are technology driven. To the bank, technology has moved from being an enabler to a critical growth driver. With its innovative technology, the bank is in a position to deliver creative product offerings to its corporate and retail clients.

The bank was the pioneer in introducing chip card in the United Arabs Emirates (UAE) and the bank is striving to maintain its leading position in the market. Initially, the bank was facing a problem of obsolete technology which resulted in significant inefficiency in service delivery. To address this problem, the bank undertook organization-wide technology overhaul.

Through this initiative, it replaced all legacy systems in its product processors, core banking, and front office systems. The change was not limited to software applications; the bank upgraded the hardware and the network as well. The bank upgraded into fault tolerant superdome servers and introduced new ATMs. In terms of processing, the bank introduced imaging and workflow.

Initially, the bank focused on the adoption of homemade systems, however to address the associated inefficiencies, it the bank has now embraced the best of breed practices and solutions which have given it optimal gains in the competitive banking industry.

By using the various information system technologies, Mashreq has managed to sufficiently its retail and corporate customers in the UAE. The banks management at various levels have managed serve millions of customers in the UAE market. In addition, a significant number of the management team uses the information systems in making decisions.

The bank equally makes use of its internet to coordinate the activities of its branches. The information system has equally helped the bank to establish a number of systems that include business to customer (B2C), Business to Business (B2B), Customer to Business (C2B). Through these platforms, the bank has offered its various products to its customers.

As a bank, Mashreq has successfully utilized a number of information systems in its operations. The systems have been utilized not only for functions within the company but also those outside the company. At the internal level, the systems have been instrumental by management all levels in decision making.

In addition, the systems have facilitated the organization and dissemination of information to interested parties. The bank has also utilized the systems as a tool for marketing because it uses the system to update its customers of any improvement or the introduction of a new product or service. Other stakeholders have equally been able to access the banks information from its knowledge management system.

Works Cited

Cogmap. “Mashreq organizational chart.” 2012. Web.

Horton, D. “Bank in Dubai maximizes its core banking system through support engineer offering.” Mashreq. 2009. Web.

Hunt, R. “Microsoft and core system vendors position windows for large banks: if you build it, will they come?” Tower Group. 2008. Web.

Injazz, C. and Popovich, K. Understanding customer relationship management (CRM): People, process and technology. Business Process Management Journal 9. 5 (2003): 672-688.

Mashreg. “Financial insititutions.” Mashreq. 2012. Web.

Menon, S. Technology led innovation regime. Inside Talk 1.2 (2009): 1-3.

Microsoft. “Mashreq employs virtualization benefits with VMware.” Customer Success Story. 2011. Web.