Introduction

The MCDM (medical device contract manufacturing) Inc was established in 1972. The firm is involved in “contract manufacturing and packaging services of the medical devices industry” (Jeffery and Norton 2).

The company has its headquarters in the United States, although it operates other 19 subsidiaries in 35 cities. The company “specializes in medical device contract and manufacturing and assembly, clean room medical injection molding, and design and fabrication of specialty assembly equipment for medical device manufactures” (Jeffery and Norton 2).

In the 1980s, the firm was among the largest corporations in the industry owing to its success in manufacturing medical devices and customer satisfaction. The company promised to offer more to its target market in comparison with its competitors. In 1974, MDCM held 42 percent of the U.S market share and by 1985, it had grown to over 54 percent (Jeffery and Norton 3).

The company’s success was boosted by small business acquisitions leading to consolidation and further expansion in the US market. Between 1989 and 1990, MDCM lost its major four out of ten consumers and as a result, the company witnessed a massive decline in profits and revenues. Profit margins began to fall as a result of buyers’ consolidation.

The firm’s pricing power was lost as it could no longer compete with other players in the industry on pricing strategy. The company’s market share and profits continued to decline up to 2000 when the management decided to make modifications to reduce internal costs, increase the flow of information, and increase its efficiency.

The adoption of information technology enables an organization to cut down its operational and internal costs. Consequently, opportunities are realized in three major ways which are business/organization portfolio, competitiveness, and internal costs. Briefly, competiveness means the extra advantage associated with the development of IT leading to a competitive advantage.

Internal costs imply the process of improving effectiveness and efficiency of a company thus cutting down costs. Lastly, business portfolio refers to the adoption of IT and its influence on the decision making process of potential investors.

Strategic objectives of MDCM

Based on the case study, the current strategic goals of MDCM are to cut down its operational costs, make information available to different departments in real-time, increase market share, be a market leader of the industry, and reduce internal costs (Jeffery and Norton 1-5).

At the moment, the primary strategic objective of MDCM Inc is to cut down the production costs incurred in the process of producing medical merchandise. The case study highlights that reduced costs could be achieved through internal costs as some of the problems noted result from internal environment. For example, the company lacks a proper network system which could be used to connect all the 19 subsidiaries in 35 countries.

This has resulted in increased operational costs (Jeffery and Norton 3). The firm’s operating system is outdated and it causes delays in relaying information to the MDCM employees. Lastly, the company lacks a standardized and proper email system that can be used to communicate with its employees. The legacy of the current system increases administration costs such as duty, financial, custom sales, and inspection systems.

The other noted strategic objective is to increase its market plan and go global through internationalization and globalization. It is important to note that at one point, the company was the largest market shareholder in the medical services industry (Jeffery and Norton 2), but this has since declined. The company once had a market share of 54 percent but due to a decline in its competitive advantage the share decreased (Jeffery and Norton 3).

Due to the aforementioned reasons, the company is planning to increase its market share and going global in order to realize market diversification. The company has the strategic objective of becoming a market leader in a market that it once dominated. The company is therefore on a mission to realize the benefits associated with investing in the IT sector in order to add value, increase profits, and expand its market share (Jeffery and Norton 8).

Competitive environment in which the firm operates (a competitive forces analysis)

MDCM operates in a competitive industry whereby the company is involved in contract manufacturing and packaging services of medical devices (Jeffery and Norton 2). However, in the past four quarters, the company has been reporting losses. In a competitive market like the medical devices industry, making such losses could be detrimental to a company in the long run.

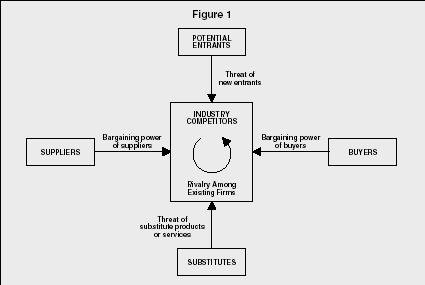

To better determine the competitive environment in which the DCM firm operates, Michael Porter’s 5 competitive forces of market analysis have been adopted. The five forces include presence of potential entrants, presence of perfect substitutes, traditional competitors, suppliers, and bargaining power of buyers/consumers (Porter 12). The forces are presented in the diagram below.

Figure 1: Porter’s 5-Forces Model

(Source: Porter 2008)

the medical service industry is a multi-million dollar industry with many competitors. Based on the case study, MDCM used to be the largest player in the industry with 42% market share in 1974. By 1985, the company’s market share had increased to 54% (Jeffery and Norton 3). However, since the 1990s, the company has witnessed a drastic decline in its market share and profitability, thanks in large part to new entrants in the industry. Based on the case study, the company was unable to compete with the prices set by new entrants and rivals.

Threat of potential substitute’s products/services: because of the decline in market share and increased cost of producing merchandise, MDCM is prone to potential threat from substitute products and services. The threat has the potential of reducing the company’s competitive advantage relative to its competitors.

Traditional rivals: MDCM operates in a competitive market made up of traditional rivals in the US market. These rivals are a real threat to the survival of the firm. Traditional rivals have the capacity of getting MDCM out of business if the company does not undertake a strategic response to counter their moves. It is important therefore for the organization to address this issue.

The three threats discussed above have the highest potential of affecting MDCM although the bargaining power of both buyers and suppliers have potential effects as well.

The strategic response(s) MDCM should employ to address the most critical strategic threats identified above

The three threats mentioned above (that is, traditional rivalry, threats from near entrants, and threats from potential products and services substitutes) need to be addressed if at all the organization wishes to achieve its organizational objectives. The strategic response for new entrants in the market could be addressed by raising the barriers to entry.

For example, MDCM could get copyrights and patents for most of its invention and discoveries, thereby prohibiting new entrants in the market. In addition, the firm needs to invest more on information technology to ensure information flows freely from marketers in the field to the production departments. This would ensure that new entrants are discouraged from entering the market as there are no loopholes to take advantage of.

The response to customers and suppliers bargaining power could be addressed by switching the costs for the consumer. Switching costs can be defined as the costs resulting from moving from one particular supplier to another supplier with quality services and at low costs. Through a value added IS the cost that would be used to identify a new supplier would be increased hence retaining the existing consumer and supplier.

This would suppress the suppliers’ and consumers’ bargaining power. On the other hand, by reducing the switching costs, the organization would be in a position to attract new suppliers.

The newly attracted supplier may have better supplier costs making them cost effective than the former suppliers. As a result, the low costs of suppliers would give the organization a competitive advantage in the market. Reduced costs and an increase in competitive advantage would enable the organization to start gaining strength and market share.

To prevent the presence of substitute products and services in the market, the organization should consider investing in research and development. For example, the adoption of the new IT would ensure that the company produces more competitive products thus gaining competitive advantage over its rivals and competitors. This will ensure that the organization is not threatened by the production of potential product substitutes from competitors.

Critical tactical objectives for MDCM

MDCM should also consider using tactical responses as they would assist the organization to achieve different strategic goals. At the moment, the major tactical objectives of MDCM are increase the switching costs for the consumer, reduce the switching cost of the consumer, produce innovative products, raise the entry barriers, and invest in IT, and R & D.

To start with, MDCM needs to work on its value chain and improve the value added chain. By adopting IT, the company will be able to improve on its supply chain management, and hence added value chain. In order for the company to achieve competitive advantage over its competitors, it needs to add value to its chain and this would entail better customer care, improved order procession and enquiry, and increased efficiency of these processes.

The switching costs can only be influenced through value addition to the company’s product by improving consumers’ and supplier links. The adoption of the anticipated IT would also enable the company to benefit from an increase in consumer switching cost and at the same time, reduce the firms’ supplier switching costs.

For instance, the adoption on new IT system would enhance communication greatly. As a result, the company will gain a competitive edge in the market relative to its rivals. Moreover, by enhancing the link between suppliers and consumers, this would enable the company to reduce expenses incurred and at the same time, lower the cost of production.

The five forces of Porter could be used to improve the competitive advantage. IT could be used contain the power of new entrants, substitution threat competition, power of supplier, and power of the buyer. The organization can also share data and information with the different subsidiaries and this would enable it to improve the services and products offered to consumers. To start with, this would make it easier to share and respond to inquiries.

In addition, the quality of products would also be improved. Furthermore, it would also be easier to share information across different subsidiaries thereby reducing the production cost. By producing innovative products, the firm would gain a competitive advantage. The company can be able to achieve this goal by embracing R & D as well as data technology. The innovative products would shield the organization from product substitution threats and decrease the level of rivalry from traditional competitors.

By adopting new technology, MDCM will be in a position to identify new suppliers in the market with lower supply costs. The company will also realize a decrease in its expenses such as production and internal costs and as a result, the firm could gain a competitive advantage over its rivals in the industry. By switching costs through reduction of the firms’ expenses, the firm would in effect increase its competitive advantage.

The organization can cooperate with its rivals though a shared IT system. This would encourage the company to gain price power over buyers thus reducing the buyers bargaining power and improve the price of selling its products. Through cooperation, the company will be able to enjoy high prices thus maximizing on its profits.

The adoption of a value added information technology by MDCM will lead to an increase in consumer switching costs. With high consumer switching costs, consumers will be prohibited from switching from one supplier to another thus cutting down the purchasing power of its suppliers thus gaining a competitive advantage. As seen in the case study, the major strategic objective of MDCM is to cut down its production costs to manageable levels.

Through the introduction of IT, the firm will be able to reduce its administration costs has the firm will not be required to hire more employees to carry out some of the tasks (Tetteh 984). Therefore, substitution of IT for labour will ensure that that production and labor costs are reduced to manageable levels. In addition, the work will be effectively performed and geared towards the realization of the organization strategic goals.

Conclusion

In conclusion, MDCM has been experiencing a decline in market share and profit margins, and this calls for the adoption of IT to cut down on its costs and increase production.

Some of the major strategic objectives identified in the case include reducing operational costs, becoming a market leader, going global, and reducing its internal costs. An alignment of the corporate strategies with the IT objectives would help in the realization of these strategic objectives. In addition, the adoption of IT could lead to value added value chain, thereby helping the organization gain a competitive advantage.

An analysis of Porter’s five forces reveals that MDCM is in a position to determine how to achieve a competitive advantage in the market. Some of the solutions identified include increasing and decreasing the supplier and consumer switching costs. Others include raising entry barriers, cooperating with rivals, producing product innovation, substituting labor for IT, and sharing information across the subsidiaries.

Works Cited

Jeffery, Mark and Joseph F. Norton. MDCM, Inc. (A): It Strategy Synchronization. Harvard Business, 2006, 1-9. Print.

Porter, Michael. The Five Competitive Forces That Shape Strategy. Harvard Business Review, 86.1(2008):78-93. Print.

Tetteh, Emmanuel. From Business Networks to Virtual Organisation: A Strategic Approach to Business Environment Transformation in Online Small and Medium sized Enterprises. 1999. Web.