Article Summary

James Glynn’s article, ‘Interest rates on hold, signals RBA governor Glenn Stevens’ was posted on 26 August, 2011. It reports the decision by the Reserve Bank of Australia to suspend interest rates even as the economy is faced with inflation and a concern over the chaotic world markets.

Introduction

In recent months, the Australian economy has been faced with turmoil on the world markets, creating a high degree of uncertainty. Even in the face of a mining boom, unemployment rate is still high in Australia. Some companies are on the verge of laying off employees and even threatens to move businesses elsewhere, citing a strong exchange rate between the Australian dollar and the US greenback. Despite speculations that the Reserve Bank of Australia would cut interest rates by year end, nonetheless, such an idea is still on hold.

Even with a booming mining industry, cutting interest rates by the end of the year may be inevitable. At the moment, Australia has one of the highest base rates at 4.75 per cent, compared with international standards. Nonetheless, the Australian government envisages a return to surplus by 2012, even as other major economies are still faced with mounting debts.

The banking network in the country is robust, and natural resources are still in high demand, especially from China. This, coupled with a strong sovereign balance sheet might have informed the decision by the RBA governor to put the idea of rising interest rates on hold. The research paper endeavours to assess the impact of keeping interest rates on hold. The paper shall also endeavour to examine the relationship between interest rates and currency exchange rates.

Analysis

Impact of keeping interest rates on hold

Having the interest rates on hold which is at high rate compared to other economies for long time has puts pressure on budgets of families as they are deemed to spend more than expected. If the interest rates are lowered the economy would be saved from the global downturn.

However, lowering the interest rates increases the rate of unemployment. Holding interest rates also leads to unemployment as witnessed in Australia where a company was planning to lay 1000 workers. Holding on the interest rates has the capacity of increasing inflation which is not good to the economy.

This is because it has the capacity of harming the manufacturing and agriculture industry which depend mostly on exports. This would affect the aggregate demand as exports will be less compared to imports. The boom from the mining industry has no capacity of sustaining the economy for long.

Therefore the only solution is increasing the interest rates so as to lower the inflation that is bound to hit the country. However, based on the neoclassical theory, increase in the interest rates is much likely to lower investments because it raises the capital cost.

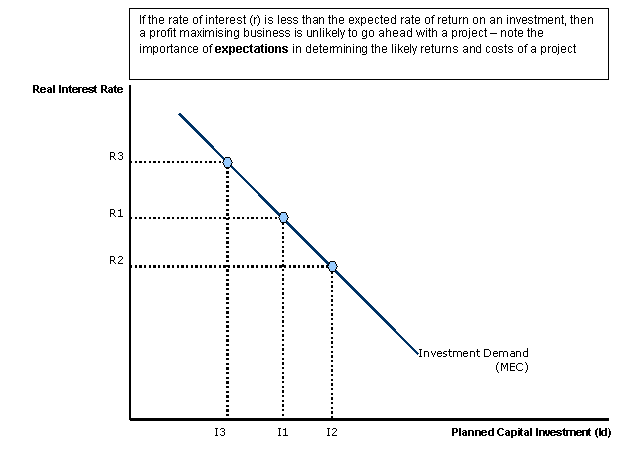

From the above graph, viable investment occurs where the interest rate is low such that it can allow business and firms to invest because they are able to borrow funds. At level R2 where interest rate is low it would lead to much more planned investment at level I2. At R2 the cost of borrowing funds to finance a business investment is low and so is the opportunity cost of making use of the profits retained. When the interest rates fall with other factors held constant, it leads to “an expansion along the investment demand curve”. Increase in interest rates (R3) leads to less investment (I3) or the projects that were underway would not be carried because of financial constraints.

So as to ensure that investments go up, the Australian bank reserve should lower the interest rates to encourage borrowing leading to more investment. Manufacturing companies, tourism, and agriculture are under threat because of the high interest rates. This is because tourists will not be willing to visit Australia because of the high currency exchange rate. On the other hand, the manufacturing and the agriculture industries will not be in a position to make exports as most of the people and firms will be importing. With strong currency the foreign market will not be willing to purchase Australian goods in the outside market because of their high currency value.

Increase in the interest rates leads to an increase on inflation which affects the rate of employment. Putting interest rates on hold at level R1 means that the rate of investment I1 remains at the same level as few investors are willing to invest in an economy that is not moving. This reduces the borrowing rates as the interest rates charged are higher compared to other nations. The other implication is that lenders are willing to lend out so as to gain the high interests rates. However, the customers are unwilling to borrow since the interest rates are high and no speculation on the stabilization of the market. This means that the rate of spending is high than the rate of investment in the economy which is a negative effect on economy. With no investments in the economy, it then implies that the rate of unemployment would be high and so would be inflation.

Supposing that the Reserve Bank of Australia increases the interest rates from R1 to R3, the rate of investment would decline from I1to I3. Increase in interest rates increase the cost of borrowing which would affect the Australian construction industry and other sectors. The investment and consumption expenditures would be reduced by the increased interests’ costs affecting the aggregate demand. This increases the cost of borrowing and availability of capital leading to the reduction in industrial investment which affects the upcoming investments. This reduces the rate of economic growth because the economic cycle would have reached its peak. On the other hand, banks and other lending institutions will be hit by high interest rates that would have a lower credit growth. This will discourage foreign investors from investing in Australian economy. Employment which is depended on the rate of investment would be the lowered as the rate of investment declines. This effect resulting from increase in interest rates affects the aggregate demand (GDP) by depressing it much further downwards.

Increases in interest rates also affect the consumers’ purchasing power as well as the spending habits of the consumers. This is because disposable income reduces as the interest rates increases. With tight lending rates the consumers will be forced to reduce their spending. With reduced spending, businesses would be affected and would be forced to reduce it employees thus increasing the rate of unemployment.

Relationship between interest rates and currency exchange rates

The high Australian currency exchange rate has been “holding close to 30-year highs against the US green back”. The Australian dollar has being stronger thus undermining its competiveness in the international financial market. Inflation which is depended of interest rates determines the exchange rate of a currency. A rise in a country’s inflation rate leads to decrease in the demand for the country’s currency.

This increases the price of its currency in the foreign markets leading to decline in the exports because of the high currency prices. However, consumers and business increase the rate of importing goods and services. This leads to imbalance in the balance of trade as imports outweigh exports. The forces put pressure on the high inflation caused currency, as the pressure continues, the currency rates are adjusted back to their normal position.

Effects of high interest rates on inflation

Inflation is the general percentage rise in the prices of goods and services of a particular time in a given economy. Reserve Bank of Australia minutes of August indicates that the board considers “lifting rates to try to curb inflation”. Increase in interest rates is believed to reduce inflation.

Inflation is impacted by the amount of money supplied in an economy. Therefore the increase in the rate of interests’ rate has effect on the money supply in the economy. They influence the consumers spending patterns as well as shifting business and consumers from borrowing money to saving what they already have.

Increasing in the interests’ rates raises the cost of borrowing much higher. This leads to fall in the consumer prices which have the possibility of reducing the economy’s rate of inflation. The reason why the prices of goods and services fall is because consumers’ likelihood of using credit to make purchases is definitely low.

On contrary, if the consumers decide to use their credit to buy their goods and services, percentage of the assets they own would be used to pay the interests which would lower the consumers’ purchasing power (CPI). This ensures a flow of funds to the economy steering it back to the original position then stabilizing it in the long run. However, when the inflation has gone down because of increased interest rate, the rate of unemployment rises up because of low investment rates.

Conclusion

In conclusion, the rate of interest rate, inflation and currency exchange are related to one another. Holding on the interest rates has the capacity of retaining the economy for a short while. However, it comes with its price like increased rate of unemployment among the people and closure of young industries and companies.

When the rate of interest rate is increased, the cost of borrowing increases and the consumers’ price index is reduced. The lending institution get high interests as consumers are discouraged from borrowing and purchasing goods and services through credit. Contrary, those who purchase using credits are highly charged on their assets that bring in financial inflows lowering inflation.

On the other hand, high interest rates discourage foreign investors as the currency is high this leads to unemployment as no companies are formed. In other instances, high interest rates reduces the rate of economic growth as the financial lending institutions are hit by high interest rates that lead to low credit growth.

Bibliography

Chetty, Raj. “Interest Rates, Irreversibility, and Backward-Bending Investment”. Review of Economic Studies :74, (2007) 67–91.

Eton Goeff. ‘Capital Investment & Spending’. Web.

Glynn, James. “Interest rates on hold, signals RBA governor Glenn Stevens.” The Wall Street Journal, 2011.

Hall, Robert, E. Inflation causes and effects. Chicago, University of Chicago, 1982.

Henderson, Callum. Currency strategy: the practitioner’s guide to currency investing, hedging and forecasting. Chichester, Wiley, 2006.

International Monetary Fund. Housing and the business cycle. Washington, DC: International Monetary Fund, 2008.

Jackson, Bruce. “Rates on hold as mortgage-belt spared”. Web.

McMahon, Satephen. “Rates put jobs at risk says union”. Herald Sun, 2011.

Madura, Jeff. International financial management. Australia: South-Western Cengage Learning, 2010. Rao, Sheshagiri. ‘Will high interest rates kill investment growth?’. Web.