Four time precise factors came into action in 2004. They include the Bush Administration of American Dream’ 3 zero advance proposals, Housing Enterprise Oversight, Base II accord of the international regulation and SE agreement to allow Investment Banks to manage their risks using their calculations through consolidated supervised entities program (Cooper & John 2005). The combination of the four changes in 2004 intended to speed up off-balance sheet mortgage securitization as the main avenue to drive the revenue together with the share price of banks. There was no objection at the Reserve bank conference on low interest rates. Associated policies like the American Dream were neither a factor nor a higher advantage on investment banks together with multi-layered rules in the US. In this case, Freddie and Fannie controls were just but an assumption. This made the companies create their own controls by the name of Fannie and Freddie lookalikes SIV and CDOS (Roubini & Mihm 2010).

When OFHEO forced greater capital conditions on Fannie and Freddie, the banks, which were selling mortgage to them, incurred revenue gaps and disruption to their earnings. They took the initiative of making their own Fannie and Freddie lookalikes (SIVs) structured investment vehicles and (CDOS) colloterized debt obligation. This influenced the controls of Federal Mortgage Pools. The corresponding response from the private RMBS was later picked by Freddie regulator much later to take effective action.

Development of Basel I and II

There was a greater dispute with respect to the idea of transition between Base I and base II. The co-sponsor added pressure to originate mortgage and issue RMBS. This warranted some response since it had an effect on the regulatory, which confronts policy makers (Kindleberger & Aliber 2005). This issue affected the business model and co-operate tradition that always pushes risk taking far resulting in periodic crisis (Kahn 2008). The changed business model enabled banking to begin mixing traditional credit culture and equity culture. The previous model was based on balance sheets and traditional spreads on loans which could not allow banks gain growth in their stocks. Therefore, the banks deployed strategies that were based on trading fees and income through securitization. This enabled banks to increase their earnings and at the same time economizing capital through gaming the Basel system. Securitization and originate-to-distribute does not encompass risk spreading. Its main objective is to share higher prices, drive revenue together with the return on capital. It is about increasing risk taking and up-front revenue identification. The introduction of another option, banking started mixing traditional credit culture and an equity culture.

For all executives and sales to capture the benefits of the business model, compensation had to evolve. Bonuses based on up-front revenue rose relative to salary; substantial option together with employee share participation-schemes became the custom. This was seen as being in the shareholder’s interest, which was a common philosophy, that “if you pay peanuts you get monkey.” An IB easily executed the securitization model, which was integral to the securitization process and capital market sales. Deutsche and UBS banks in Europe already had this advantage. This point was made by the US lobbyists with respect to the Glass-Steagall act; the rules for IB’s which were considered restrictive compared to Europe and competitive. It was unfair for the FDICA act of 1991, which required all banks to adhere to an advantage ratio. For that reason, the IB and US strongly lobbied and supported the US authorities to do away with Glass-Steagall in 1999 and move to the new SEC rules in the year 2004. It proposed that they move to the new Basel II the soonest. Basel II could make mortgagees attractive and give low capital weights while helped to raise returns on capital.

Implementation of New Basel

During the publishing of Basel II in 2004, all banks were informed that weight capital given to mortgages could fall from 50 percent to 35 percent and later to 15 percent. This could be possible under the modified Basel II, depending on how the banks could use the sophisticated internal rating-based (IRB) version. A reduced capital weight increases the return on a given mortgage (Cooper 2003). The corollary is that concentration on low-capital-weight mortgage improves the banks’ overall return.

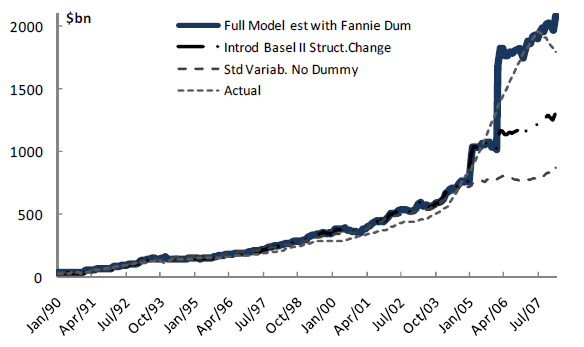

One of the assumptions of basic capital control under Basel system is the “portfolio invariance.” It is the riskiness of an asset like mortgage, which is independent of how much the asset is added to the portfolio. Banks believed this since they responded to the arbitrage opportunity, which rose in the transition of Basel I to Basel II. If a mortgage securitization could be pushed and accelerated into off-balance sheet vehicles, banks could have raised the return right away before the incoming of the new regime. This would be rational to do to the extend where the proportion of on-balance sheet mortgage with 50 percent capital weight and off-balance sheet mortgage with zero capital weight are equated higher returns. This could emerge in the case of Basel II regardless of the assets being off or on the balance sheet.

Northern Rock an Example

Northern Rock is a bank in the UK, which is an example of banks that grew mortgage with Basel II anticipation in mind. They faced liquidity problems afterwards during their operation. Mortgage products had been made attract by IRB adherence to the Base II. IRB mainatained that Basel mortgages products could accrue quick incentives than could be funded through deposits. Northern Rock grew mortgages for more than 25percent per year in few years before its concurrent collapse.

The Bank borrowed heavily in the wholesale market while concentrating on investing in mortgage products for about 75 percent, which could have reduced its capital requirement when the Basel II application came into function (Krugman 2008). When credit culture and equity culture were mixed, the attraction for management intended to expanded businesses with profitable mortgage products that could drive their expansion of share prices. Alternatively, they could return excess capital to their shareholders with equal beneficial effect on the share price. According to the CEO of Northern Rock, they completed implementing Basel II for two and a half years. Northern Rock was leveraged during this period. A financial crisis broke out in the bank in June 2007. Just as the problem was to break and liquidity was to dry up. Northern Rock had a total of assets of GBP113billion and shareholders’ equity of 2.2billion. Their RWA through the Basel II was as low as 19 billion, which is 16.7 percent of the total assets (Kothari 2010). Through Basel II they had Tier 1 capital of a healthy 11.3 percent of the RWA although this is two percent of the total assets. It is during this period of crisis that the liquidity dried up making them to suffer for the first run on a British bank since 1866. Their authoritarian capital was less than ten percent of the GBP of 23 billion, which the authorities used in supporting it.

References

Cooper R & John A 2005, ‘Coordinating coordination failures in Keynesian models;’ Quarterly Journal of Economics, vol.103 no. 3, pp. 441–63.

Cooper R 2003, Coordination Games, Cambridge University Press, Cambridge

Kahn S 2008, A systemic crisis demands systemic solutions’, Melbourne University Press, Carlton.

Kindleberger C & Aliber R 2005, Manias, Panics, and Crashes: A History of Financial Crises, Wiley & Sons, New York.

Kothari V 2010, Executive Greed: Examining Business Failures that Contributed to the Economic Crisis, Palgrave Macmillan, New York.

Krugman P 2008, ‘A model of balance-of-payments crises’. Journal of Money, Credit, and Banking, vol.11 no. 3, pp. 311–25.

Roubini N & Mihm S 2010, Crisis Economics: A Crash Course in the Future of Finance, Melbourne University Press, Carlton.