Background and analysis

Empirical studies have shown that the automobile industry has boosted its outlook by providing numerous car spa services (Stach 73). This has led to sustainable growth and development in the automobile industry. On a lighter note, Colonişteanu (116) elucidates that in the recent past, the selling price and variable costs for car spa services have become extremely high. This has been attributed to the emergence of new car spa technology into the market and which is a few years old. It is important to note that auto wash technology is not just efficient but also environmentally friendly. Bodeker and Cohen (12) expound that this technology helps to facilitate the cleaning and removal of dirt through the use of bio-degradable products.

According to a study conducted by Bodeker and Cohen (44), Car Spa has been regarded to be the most recent innovative technology for supplying car care products and services. The technology has grown out of the desire to provide clean and sustainable car services. A car spa facilitates the provision of exceptional services and reduces problems caused by high-pressure impellers and rough scrubbing (Bodeker and Cohen 47). Stach (16) points out that Car Spa requires professional monitoring to ensure that the cleaning process brings optimum results.

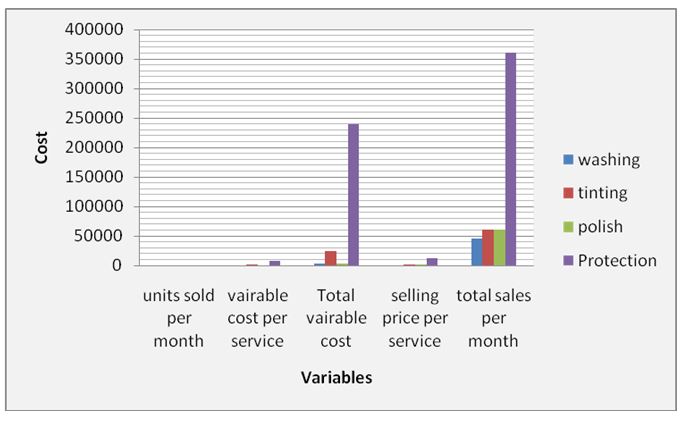

Upon careful analysis of literature, it is possible to discern that customers have demonstrated more interest in auto wash vehicle services. It is important to note that there are more returns from the cumulative number of units sold per month. These units include services such as washing, tinting, polishing, and protection.

Analytically, it is evident that units for washing are relatively lower than those of other services. Nevertheless, two spaces are strictly reserved for a car wash. Each space is in use for 12 hours. Moreover, due to increased turn up for car wash customers, each vehicle is allocated 25 minutes only. Therefore, service providers are expected to be through with washing within the allocated time. This has created room for maximum capacity where over 60 cars can be washed in a day. At some point, customers have been required to book the services for a maximum of one day in advance. It is imperative to note that the variable cost for washing services is slightly lower than those of other services. However, since less time is allocated for each car, there is a huge turn up for cars and this justifies the need to have two washing spaces reserved for this service.

From experience, tinting usually takes approximately 6 hours (Bodeker and Cohen 45). It is important to note that only one space is allocated for this service. Nevertheless, there are multi-use spaces that can be utilized in case there are two cars to be serviced at the same time. Since the tinting space is utilized for 12 hours a day, this allows a maximum of 4 cars to be tinted in a day. This also translates to servicing 120 cars every month. This is far higher than the maximum capacity of 25% which is 30 cars per month. It is imperative to note that the longer the time taken for each service, the higher the charges.

Besides this, car polish services are conducted on a full-time basis. There is only one space allocated for such services and is being utilized for 12 hours. It is important to note that a multi-use space is available to accommodate an extra car that may require polishing at the same time. Just like tinting, polishing takes approximately 6 hours. Therefore, only two cars can be polished a day and thus a total of 60 cars per month. In some instances, the Car Spar may score 50% of its maximum capacity when only one car is polished per month. It is important to mention that polishing services are not as competitive as washing. This is because; most car owners polish their cars once a year

The car protection service is offered on a full-time basis. Since this service has high demand, there are at least two spaces allocated for this service. However, there is an additional space for multi-use purposes. This can be used in case three cars need protection at the same time. This results in the maximum capacity of a car spa for protection services. Statistically, if such trend remains constant, there are 3 cars per day and 90 per month for protection services. However, at times, the Car Spa may have 33.3% of its maximum capacity.

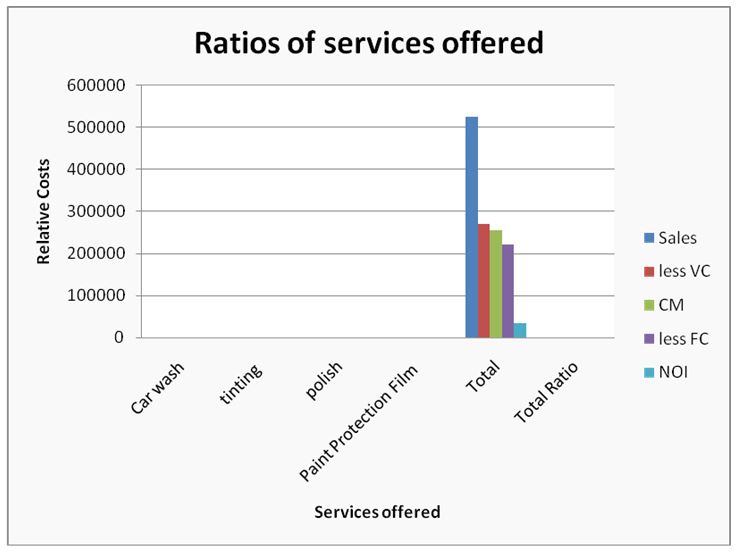

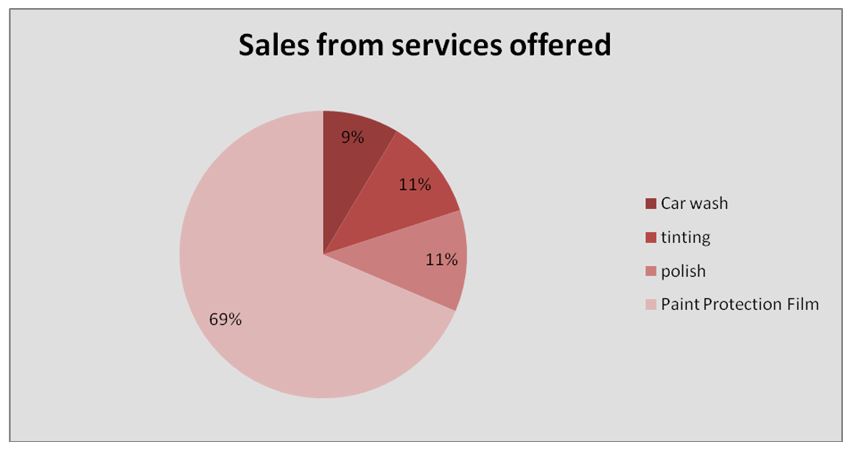

From a statistical perspective, it can be observed that protection services are the most expensive since the price per unit is approximately 8,000 compared to washing, tinting, and polishing relatively cheaper services. Moreover, protection service is in high demand since it amounts to 68.8% of the total sales made.

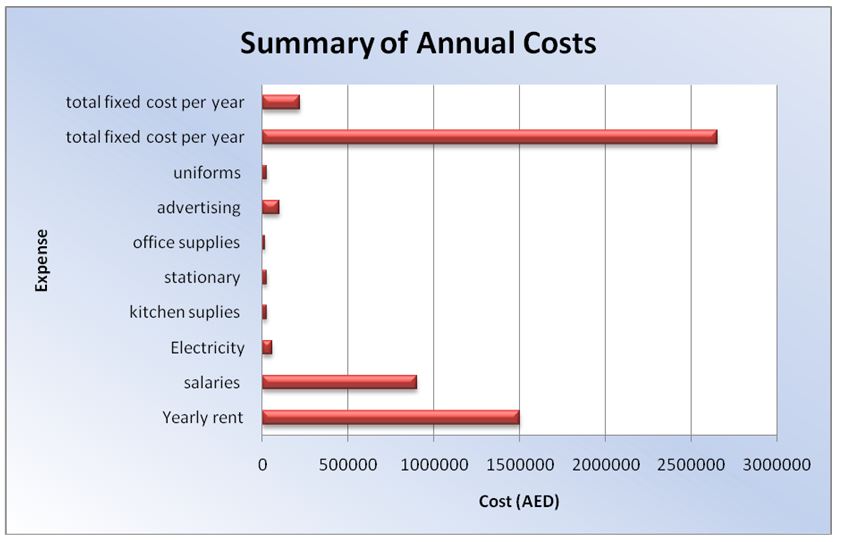

A Car Spa is an investment that has both returns and expenditures. At some point, the management is required to supply human personnel with uniforms, income among other personal effects. Moreover, much of the income earned is spent on paying bills such as rent, power, stationery, advertisements, and other relevant equipment.

Figure 4: Summary of Sales

BEP sales=FC/CM ratio = 454389 AED

Accounts receivables

No matter the size of the company, the future of selling at Car SPA is easy and convenient for customers. Installment sales, credit cards, and revenue from the bank are various ways to sell on credit. The Accounts Receivable is an essential management control to the financial life of any company. Assets Receivable arising from credit sales are one of the biggest assets of a business (Stinespring 15). Hence, Car SPA can easily run into thousands of losses if accounts receivables are not monitored and rectified properly. Thus with the Accounts Receivable Control, the management team at Car SPA can:

- Avoid delay and default payments from the customers.

- Have the exact amount of the receivables of the company, making it possible to seek advanced loans from financial institutions.

- Generate information for the cash flow. The latter is a crucial accounting aspect in the operations of the Car SPA business.

It is a good practice to send a little reminder to customers via email, for example, a billet winning anything today or the next day. Car SPA is providing a service and should of course avoid possible oblivion. If the management can generate graphs displaying the Accounts Receivable statement, it will be a good tool to support the Finance Director of the company.

Accounts payables

Sound financial management should provide a better margin for profitability, balance spending, and evaluate the current balance of accounts payable and receivable.

This is how it should work at Car SPA. Effective financial control will be able a firm to evaluate how its capital swirled in the past and what is happening at the present. In such a way, the finance department at Car SPA can identify potential failures and unnecessary expenses, profit from alternative applications and relocation of services, and offers advanced to customers.

Hence, for efficient financial management in a company like Car SPA, it is necessary to implement certain management controls, provide a generator system of information that enables effective planning of activities and control of outcomes.

Control of Accounts Payable provides information for making decisions on all a company’s commitment and disbursement of funds.

Accounts payable are commitments made by the company, represented by the purchase of goods, production inputs, machinery, services, wages, taxes, rent, loans, contributions, among others. The control of accounts payable should be a routine task of the company as it usually involves large amounts of money as observed in the financial records of Car SPA.

The control of accounts payable is crucial because:

- all liabilities payable can be swiftly identified;

- It prioritizes payments in the event of financial difficulty;

- It verifies the contracted obligations and unpaid bills;

- No loss of time to get discounts;

- Payment of penalties and interest can be avoided;

- Provides information for the preparation of cash flow;

- Reconciliation with the account balances can be done easily and professionally.

Through the Car SPA report, all the company’s commitments are controlled by providing the administrator the ability to scan all its commitments by vendor, type of payment, notes payable, and paid titles, as well as late duplicates at any given time.

Implementing the control of accounts receivable exists in the market paper models (plug), and also software (some even free).

It is common in small businesses for owners to pay more attention to the daily purchase operations/production and sales at the expense of the administrative organization. The management at Car SPA should have the company’s control at hand for it to run well and achieve better results.

Cash flow

Cash flow is a financial management tool for designing future periods of all inputs and outputs of financial resources of a company. It indicates cash balance for a given projected period. If Car SPA has rigorous financial control, it can be pretty easy to prepare. It should be used to control finances and act as an instrument in decision-making.

A cash flow should be regarded as a flexible structure, in which the entrepreneur must enter the information of inputs and outputs as the business needs. With cash flow information, a business owner can prepare the management structure results, sensitivity analysis, and calculate profitability. The balancing point and the return term

Investment can also be computed by the finance management team at Car SPA. The aim is to check the financial health of the business based on analysis and get a clear answer about the chances of success of the investment and the current stage of the company. To carry out a financial analysis, it is necessary to project the cash flow for one year and then sum up the amount using spreadsheets.

Budget

A budget should be understood as a plan for entering all the income and expenses for a particular period. It is a tool that should be accompanied by subsequent order controlling expenses and optimizing revenues, and thus enables the creation of savings. Responsible and careful budget management allows the allocation of a portion of the proceeds from the savings. This implies that spending should not be more than the obtained and/or expected revenue. These savings allow controlling current expenditure and preparation of important financial decisions such as business expansion and diversification of business portfolio (Awasthi, Chipalkatti, and Souza 105).

A budget has major advantages at various levels including:

- Control: it allows the control of expenses, helping a firm decide expenses to be incurred;

- Organization: even the simplest budget allows systematic division of resources by category of expenditure, income, and savings;

- Communication: By allowing more people to be involved in its preparation, a budget enables discussion of priorities in an organization;

- Knowledge: lets a company understand the state of finances with some rigor, working as a self-education tool that shows how funds are spent;

- Take advantage of opportunities: It makes it possible to determine the savings at any time and that the value is obtained accurately. It also allows the exploitation of opportunities that arise unexpectedly;

- Optimization of time: the largest organizational expenditure resulting from a budgeting process usually allows effective management of time;

- Monetary gains: further streamlining of expenditure results from the preparation of a budget and allows additional savings that may be applied to generate extra income.

For a budget schedule to bear positive results, an organization should always bear in mind a core set of rules that include:

- Clear definition of the priority objectives of savings, taking into account the immediate and urgent needs;

- Know exactly where you will apply your recipes, for what purpose and where to buy;

- Plan for fixed, current, and incidental expenses;

- Check the extracts from all accounts of an organization;

- Organize the spending document functional form;

- Avoid waste.

The application of these rules is essential in the proper management of organizational finances. Conversely, when expenses are higher than income and deficit situations occur when running an organization like Car SPA, the finance department must craft alternatives for boosting income or revenue. Such a situation may demand an alternative financing requirement such as expanding a business entity or diversification of products being offered to the targeted market.

Return On Investment (ROI)

ROI refers to related operating income from the investment of a company. The return on investment shows the rate of return obtained by a company to its lenders, which may either be equity or debt capital. The higher the ROI the better the payoff.

To obtain the ratio of Return on Investment, the Operating Income is usually divided by the available investment. The operating profit refers to the profit made by a firm before remunerating its funders. There is some controversy about what should be considered to be an operating profit. All income arising from the investment made in an organization should be part of the operating profit. This includes interest on income and proceeds of investments in other companies, but not the financial costs. The latter should be excluded. Investment may also be referred to as net assets. This regards asset value less non-interest-bearing liabilities (operating liabilities), which include suppliers, salaries, social charges, and tax liabilities.

The data is obtained from the balance sheet and statement of operations of every department of an organization. For some situations, notes are also important when a company does not disclose, in a segregated manner, the costs of financial income.

Measurement unit – By splitting a monetary value by other monetary values, the result does not have a specific measure. However, to multiply by a hundred makes these measures a percentage. Thus, one can compare the return on investment of a company with other returns that are riskless. But it is important to remember that when using the operating income of a quarter, for example, the payoff will be the quarter of the returns (Alderson and Betker 96).

Measurement range – Since the operating profit can vary between a negative number and a positive number, the expected range of measurement ranges from minus 100% to infinity. Usually, the result should be positive.

In the case of a Spa business analyzed above, it is crucial to mention that both demand and supply tend to vary with time. Local and global factors may significantly affect such a business entity either positively or negatively.

References

Alderson, Michael., and Brian Betker.”Additional Evidence on the Corporate Cost of Capital and the Return to Corporate Investment.” Journal of Applied Finance 19.1 (2009): 91-102.Print.

Awasthi, Vidya, Niranjan Chipalkatti, and Carlos De Mello Souza. “Connecting Free Cash Flow Metrics to what Matters for Investors: Accuracy, Bias, and Ability to Predict Value.” Journal of Applied Finance 23.2 (2013): 104-119. Print.

Bodeker, Gerald, and Marc Cohen. Understanding the Global Spa Industry. New York: Routledge, 2010. Print.

Colonişteanu, Cristina Rodica. “Managing a SPA Business in Economic Downturn.” Marketing From Information to Decision 2 (2009): 115-126. Print.

Stach, Dariusz. “Debt Collection Prevention Management of Receivables/Debts in a Company.” e-Finanse 10.2 (2014): 71-82.Print.

Stinespring, John Robert. “Fixed Versus Sunk Costs: Creating A Consistent And Simplified Cost Framework.” Journal of Economics and Economic Education Research 12.1 (2011): 11- 26.Print.