Identification

JetBlue airline was founded in 2000. The airline was established with the goal of being the principal economical commuter airline in the US aviation industry. The firm founders believed that the goal could be attained through presenting high excellent client services delivery and differentiated products.

The company vision stresses on treating the clients in an exclusive manner. On that note, the airline developed a mission to be recognized as the best regional carrier through the provision of economical, pleasurable as well as secure air travel services to its clients.

Further, the airline’s undertaking is to be acknowledged as the top cost-effective traveler airline offering superior client service to undeserved markets. The firm identifies clients’ need for the most excellent worth in their journeys. As a result, the firm has the latest most superior planes that are reliable, secure, fuel conserving and using the most advanced expertise.

JetBlue has also developed a viewpoint of maintaining distinctive services as well as offering the unsurpassed price worth for its’ customers’ tickets. In order to provide high quality services to its passengers, the airline engages highly trained and inspired personnel to enhance their proficiency.

Analysis and Evaluation

JetBlue have focused its growth in the next ten years and to realize this growth, the airline-planned strategies will be evaluated in terms of financial performance and internal business processes.

Financial performance

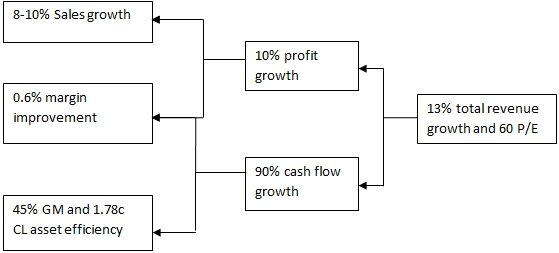

The firm’s financial performance from 2003 to 2006 indicates reduced prospective future growth. The trend in the profit margins as indicated by the gross profit margins and net profit margins indicate that the firm’s profits have reduced due to challenges the firm has faced during that period (see appendix 1). However, the firm has recorded growth in sales volume and earnings per share indicating future prospect for the firm. Against this backdrop, the firm has established ten-year financial plan. The plan targets a growth of 13% in revenue.

Internal business processes

SLEPT Analysis

The airline has to evaluate and scrutinize its operations to enable the realization of its goals. Therefore, Jet Blue has to assess the existing social prospects, legal and environmental issues. In addition, the political and technological aspects are equally essential.

Social factors

The social factors that the firm is exposed to offer both external prospects and risks to the firm. For instance, the firm is faced with the prospect of increasing number of passengers over the years. Conversely, the firm is likely to be faced with increased costs contributed by corpulent travelers who increase the consumption of fuel.

Legal factors

On the legal aspects, the airline has to adhere to the rules governing the operations of flight including take off as well as the requirements concerning the unions of employees. Further, the airline must undertake to operate under the stipulated regulations by the relevant authorities.

Environmental factors

On the environmental front, the airline has to find a way of dealing with the current policies of climate change and global emissions. The airline has to adhere to the global rules controlling emissions. Adhering to the obligations is significant in ensuring that the airline take advantage that comes with the environmental conservations.

Technological factors

The utilization of technology has enabled the airline gain competitive advantage over its competitors. Technological applications including internet ticket purchasing has enabled the airline to operate at reduced costs besides increasing efficiency in its operations. In addition, the website applications have increased the customer knowledge and have enhanced using appropriate marketing mix.

SWOT Analysis

In order to compete effectively in the market, the airline has to evaluate itself in terms of its strengths, weaknesses, the available opportunities it as well as the potential threats in the market.

Strengths

The airline has been able to beat its competitors through enhanced customer satisfaction by providing in-flight excellent services. In addition, the airline position in the short-haul airline services is additional strength to the firm. The customer knowledge of JetBlue as the only airline that offer quality services at low-cost increases the competitive advantage.

Weaknesses

The current financial position is the major weakness the firm is facing. JetBlue’s financial positions have deteriorated since 2003 enabling the firm to reduce its expansion strategies and marketing expenses. The poor financial performances have affected the firm’s growth and exploitation of its capabilities.

Opportunities

Embracing new technologies enable the firm exploit new opportunities. For instance, the use of internet in ticketing as well as internet advertising of the company’s services has enable the airline exploit the available global opportunities.

Threats

Major threat facing the airline faces is strong competitors from other firms offering short haul services. The competition is in terms of pricing as well as quality services. Therefore, the company has to differentiate its products in order to remain competitive.

Alternatives

The firm has to come up with various alternative strategies to remain competitive as well as ensure growth in customers. The alternative strategies should be aimed at increasing the airline market share as well as enhancing its competitive advantage. The alternatives include horizontal integration, expanding marketing channels and increasing number of planes in its fleet.

Alternative 1: Buying united airlines

The first alternative is to absorb small competing firms or integrate with similar airlines. In this strategy, the airline should aim at acquiring the United Airlines. In acquiring the United Airline, JetBlue will secure market leadership as well as increased market share. Besides, the airline acquisition will augment sales, which in turn increases the airline revenue.

Alternative 2: Expanding marketing channels

In the second alternative, the airline should consider developing new marketing strategies as well as expand its marketing channels. Increased marketing channels will not only ensure increased airline brand reputation but also enable its expansion into new markets outside the United States. In other words, the airline should consider exploiting international market opportunities.

Alternative 3: Increasing planes in the fleet

In the last alternative, the airline should buy new planes in its fleet in anticipation of the increased flights demand as well as expansion into new markets. The planes should be cost effective in terms of fuel consumption as well as general airline services. In other words, the new fleet planes should be appropriate for its short haul services and should be in line with the needs of the market niche.

Recommendation and Implementation

Depending on the manner in which the strategies of the airline have been created, the airline should continue increasing its landing destination within the domestic markets. Once the domestic markets have been established, the airline should expand in the international markets. The international markets should include European hubs, emerging market destinations such as china and the Far East as well as destinations in developing economies including Africa where the industry has not fully developed.

In addition, JetBlue should utilize both the new and old media to advertise its services to the larger world market. In other words, the airline should increase the marketing mix to position its products and services in addition to increasing the reputation and popularity of its brand.

The airline should also build partnerships with related airlines as well as travel firms within the targeted markets. Partnerships should also be established with the travel websites particularly with the destinations airports, hotels and resorts, touring companies as well as other hot spots. The users of such websites will have opportunity to book their flights with airline for the destinations.

The implementation of the recommendations

The recommendations should be implemented in three phases. In the introductory phase, the airline-marketing department should apply the marketing mix particularly the promotional campaigns through any media to increase the brand awareness within the targeted markets. The airline should also increase at least seven new planes in the fleet to cater for the increased customers. The first phase should take one year at approximate cost of $600 million

In the second phase, the airline should develop new website to help in attracting more customers as well as increase access to its services. The new websites should also aim at building the brand reputation as well as enhancing the marketing strategy. The second phase should be implemented by the IT department and should be within the third year of the development plan. The phase should cost the airline approximately $400,000.

The final phase should ensure the airline start its international flights. The operations department at an approximate cost of $1 billion should implement the phase. In the long-term, the airline should look for mergers and takeover or any other form of horizontal integration to increase its market share and accessibility into the competitive markets.

Appendices

Appendix 1: Profit margins

Appendix 2: Ten-year financial plan

Appendix 3: Competitive Product Matrix (CPM)

Appendix 4: Quantitative Strategic Planning Matrix