Abstract

Housing is critical for every country because it allows the representatives of the general public to obtain appropriate dwellings. Unfortunately, housing prices in London tend to increase so that people can hardly afford them. Even those who want to purchase a house do not have such an opportunity because of the lack of supply. Considering the mentioned issues that exist in the UK housing market, this paper will analyze the topic trying to define the reasons house prices increased. The discussion will be based on authoritative literature sources so that relevant information will be used to identify possible market failures and how they can be overcome.

Introduction

The housing market attracts much attention from the representatives of the general public because it deals with the greatest form of household wealth and people can easily observe any issues related to it. In the majority of cases, they say that house prices are too high for the ordinary population to afford them, which has an enormous influence on clients and the economy, leading to the increased rates of homelessness. It seems that there are too many people who need dwellings in the UK, but only a few houses are available. In addition to that, people discuss this problem in connection with the financial crisis and new money that was created before it. Thus, it is not surprising that there is a considerable public debate on this issue. The population of the UK question the affordability of house prices and discuss the possibility of instability in the market. Mainly, attention is paid to London, as this city is the capital of the country that attracts a lot of English people and foreigners increasing competitiveness and making it more difficult to find a residence.

According to the London Housing Market Report (2015), London’s economy grows regularly. As a result, the unemployment rate leveled out even though it remained at more than 6%, which means that a lot of people are still not able to afford appropriate dwellings. What is more critical, house prices grew up by 7% in 2015, making it more difficult to save enough money to buy them. In this way, the fact that the number of new housing orders decreases seems to be expected.

Economic Functioning

London is a place known to the majority of the world’s population as an outstanding place full of magnificent views, business, and entertainment opportunities. That is why the demand for housing in its framework is mainly based on the desire to move to this place. Still, it is also critical to take into consideration the fact that natural changes in population make people move. For example, due to births and deaths in families, individuals start looking for smaller or larger residences. Socio-economic factors are also critical as they lead to the same outcomes because people can obtain an opportunity to spend more money on housing or they may lack costs.

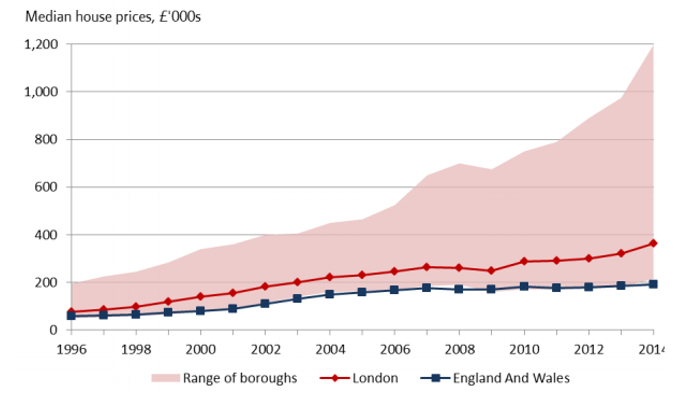

However, for the market to operate appropriately, increased demand caused by the mentioned factors should be met by the increased supply. As the economic situation in London has recently improved, more people became able to afford new housing, which means that its quantity should be increased (Paz 2014). Focusing on previous experiences, it can be seen that stable prices were observed during the 1990s. Still, as the population of the UK and London, in particular, started to increase at the end of the 20th century, the limits of supply were noticed. Such a tendency can be seen even today. The increased house process is accompanied by modest growth in the number of houses. In this way, it can be claimed that house prices become higher with time so that fewer people can have an opportunity to buy them (see Fig. 1).

Shifts in demand and supply in the housing market can be caused by different factors. One of the main causes of this imbalance is the economy. Not so long ago there was a great recession due to the economic crises. Even though not all countries were affected by it greatly, negative influences could be observed globally. Because of international relations and business agreements, all parties had to deal with financial problems. As the housing market requires a lot of investment, it suffered from its lack. In addition to that, the unemployment rate that changes from time to dime due to the global situation. In addition to that, mortgage availability does not remain the same. During the first decade of the 21st century, banks had relaxed lending criteria so that more individuals had an opportunity to get the money needed for a mortgage. However, those economic issues discussed above made this process more complicated. Even though there were not so many people willing to get a mortgage due to a tough financial condition, banks would refuse to work even with this limited amount of clients. At this time, banks also could create more money due to the loans (McLeay, Radia & Thomas 2014). As a result, lending turned into one of the key factors that triggered the increase in housing costs.

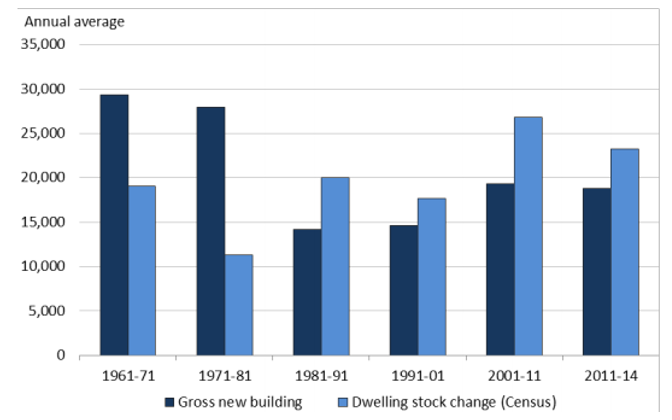

The amount of money spend on housing, and its changes are claimed to reveal alterations in client preferences as well. For instance, when people receive an opportunity to spend more due to the increased wages, they tend to buy dwellings instead of rating them so that demand increases. However, a fixed supply fails to satisfy people’s needs and causes increases in house costs. In London, the representatives of the general public had an opportunity to satisfy their housing needs only until the 1980s. With time, the majority of the population had to rent dwellings, as there were not enough new buildings for everyone (see Fig. 2).

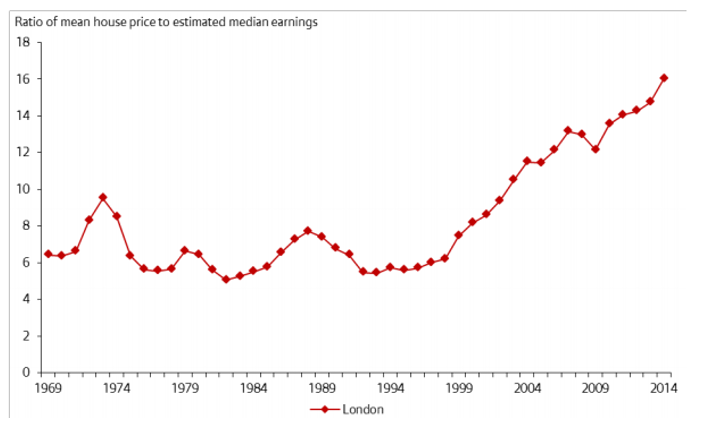

When paying attention to the demand elasticity for housing, it can be stated that it tends to grow as the demographics of the population changes and more people become able to afford the things they want. This tendency can be observed in Fig. 3.

Still, it is significant to take into consideration the fact that research by the Institute for Fiscal Studies notes “that typical estimates lie in the range 0.5 to 0.8, which means that demand for housing tends to rise less than proportionately to income” (p. 33). Thus, it can be claimed that alterations in income have a critical influence on demand. The fact that people started using the property as an investment also influenced the housing market in London. The prices became higher because a greater number of people from all over the world started buying houses in London. Even though there is not enough evidence to develop this idea, it cannot be doubted that foreign ownership increased demand. In general, the number of houses is expected to increase when their prices become higher because professionals can observe the potential to build more and increase personal profit. However, in the majority of cases, it turns out that such supply is rather inelastic. It does not respond in an ideal way to increased demand because of fear of lack of clients.

London dealt with the price bubble in the housing market some time ago, which caused additional issues. Speculative behavior led to financial problems and increased unemployment rates. Young people lost their opportunity to own their homes because of the increased costs. In this way, the banks were the only parties that benefited from the price bubble, as people resorted to mortgages more (Bayar & Neilson 2011).

Social and Economic Consequences

House prices in equilibrium fail to be rather stable when focusing on London. The issue is that they depend on the balance of demand and supply, which can be hardly observed in this place currently. Supply does not respond to the increased prices, which makes them unaffordable. As a result, additional pressure is also made on wages and business costs. Still, even if the equilibrium was reached, a lot of people would be not able to afford appropriate housing because they will not have enough money. As a result, the representatives of the general public need to work more to obtain an opportunity to have a house. In addition to that, the absence of affordable housing can lead to health and wellbeing issues. Those people who have no appropriate conditions for a living usually have a limited possibility to maintain hygiene procedures, which makes them more vulnerable when speaking about diseases. Needless to say, those people who cannot afford any house suffer even from weather changes.

The lack of proper housing may also place a person in a dangerous region where the majority of residents are representatives of some minorities and criminals. Due to the increased housing costs, some people prefer to live with their extended families and even friends. On the one hand, it allows them to interact more and to support one another. However, on the other hand, these people can spoil their relations due to the least household misunderstandings. In addition to that, if one of them is ill, others are likely to catch the same disease and then spread it, which affects the whole community.

London, as well as the whole country, may suffer from the implementation of sub-standard living conditions. The representatives of the general public may consider that their place of living is good enough, but it does not meet the requirements developed by the Building Safety Department. It means that there may have a possibility that the dwelling can ruin one day. Overcrowding can also be considered from this point of view. When houses are built, professionals tend to indicate the weight they can deal with. However, the lack of affordable housing and increased prices can make people ignore these precautions.

Policy Intervention and Recommendations

In the framework of housing, a range of market failures can be faced:

- In London, a lot of young people who start living on their own are not able to buy a house due to a great discrepancy between their income and housing prices.

- Poor standards tend to increase the expansion of social problems.

- Inequality between housing externalities.

- Instable price due to the changes in demand and supply that lead to a lack of elasticity.

- The possibility of recession because of price reduction that affects macroeconomy.

- Issues connected with geographical location. London is a big city, and it is rather difficult for people who live and work in opposite territories to travel from one place to another every day.

- Environmental issues. New buildings are mainly put in the territory that is considered to be a green space.

Still, it is possible to overcome these drawbacks. Policymakers and the government should focus on the lack of supply. They can encourage additional investment so that the shortage of housing can be overcome. They need to develop a range of standards that can be easily met and do not require excessive financing but also ensure that the representatives of the general public will live in a safe environment that is not likely to affect their health and wellbeing. Finally, they need to do their best to avoid price volatility.

In this way, a lot of positive changes are likely to be observed in the housing market in London. As the unemployment rate in London gradually decreases when looking at long-term changes, more people are expected to have an opportunity to afford appropriate housing. The number of loans and mortgages decreased in 2015 by 3% and 6% correspondingly so their increase can be faced (Nationwide 2017). As a result, banks will be able to make more money. Even though this alteration tends to increase prices, providing enough supply, professionals will be able to overcome this issue. In addition to that the fact that dwellings in London and England’s neighborhoods became similar, people will have an opportunity to buy a house in the location that meets their needs better instead of selecting a cheaper variant. As London’s rates have recently grown by more than 4%, there is a possibility that they will slightly fall while purchases will increase. Deposit rates may affect the owner’s occupation less, providing an opportunity for first-time buyers to afford something to their likening. The orders for private housing started to decrease about two years ago so it may be easier to balance demand and supply right now (London Housing Market Report 2015).

Thus, it can be concluded that the housing market in the UK faces a range of issues that are widely discussed by both professionals and the general public. People are not able to afford a house because of the lack of supply and increased costs. The financial crisis and money created by banks affected the affordability of house prices negatively and led to instability in the market. Demand also increases because people English people and foreigners want to live and work in London. Policymakers should implement alterations to improve the current situation because it has negative social and economic consequences, including those connected with the macroeconomy and people’s wellbeing. Thus, it will be advantageous if professionals think of those initiatives targeted at the maintenance of stability in the housing market.

Reference List

Bayar, O & Neilson, W 2011, ‘The peculiar economics of housing bubbles’, Contemporary Economic Policy, vol. 29, no. 3, p. 374.

London Housing Market Report. 2015. Web.

Marsden, O 2015, House prices in London – an economic analysis of London’s housing market, The Queens Walk, London.

McLeay, M, Radia, A, & Thomas, R 2014, Money creation in the modern economy. Web.

Nationwide 2017, House price index report archive. Web.

Paz, P 2014, ‘New housing supply and price reactions: evidence from Spanish markets’, Journal of European Real Estate Research, vol. 7, no.1, pp. 4-28.