Overview of macroeconomic variables

Gross domestic product

The gross domestic product is a useful indicator of the status of the economy of a country. Measuring GDP is a challenge for economists all over the world because it is often difficult to quantify all the economic activities in the region. When analyzing the GDP of a country, it is important to distinguish between nominal and real GDP. Real GDP eliminates the effect of inflation, and it uses constant prices for the products.

For those reasons, the real GDP is used when comparing the GDP for several years. Nominal GDP is the market value of the goods and services produced in that year using the same prices of the given year (Bortot, 2003). Therefore, the nominal GDP includes the effects of inflation on GDP. In addition, it is essential to use the real and nominal GDP per capita to account for population growth. This section will analyze the real and nominal GDP per capita of Argentina for the period of twenty-three years.

Nominal GDP of Argentina

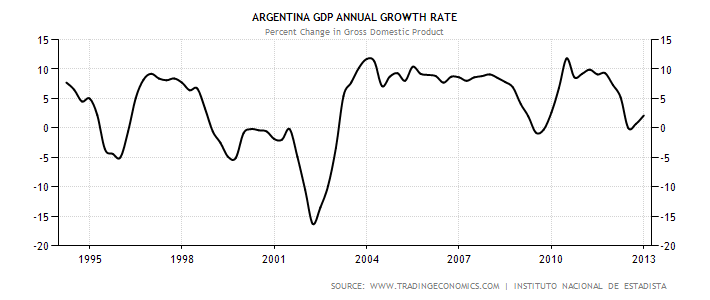

The GDP of Argentina is erratic. According to the graph presented above, the GDP per capital amounted to $7415.903 per person in 1980. Its value then declined to $6540.54 per person in 1983. Then, it fluctuated between 1980 and 1991. Hence, the value of real GDP per capital was quite erratic. This was attributed to political instability in the country. This was due to the invasion by foreigners and lack of political structures. In particular, the country experienced hyperinflation in 1990 owing to rampant malpractices within the country.

Ranging from massive evasion of tax by companies to money laundering, it became apparent that Argentine Peso had lacked competitiveness against the US dollar. This prompted massive unemployment levels leading to further deterioration of the economy. However, the national government through the Central Bank of Argentina was able to curb the high rates of inflation and restored the value of the country’s currency. As such, the country’s nominal GDP and real GDP grew substantially through the 1990s.

By the end of the 20th century, the country’s economy suffered unprecedented effects of violent protests, resignations and soaring national debt. According to various economists, the country was suffering from the impacts of monetary and economic policies that it had erected in the early 1990s in an attempt to curb negative economic growth (Bortot, 2003).

By 2001, the country’s national debt increased tremendously surpassing 50% of the GDP. To curb the rising debt, the International Monetary Fund advocated that Argentina should erect austerity measures to attract foreign direct investments (FDI). While this was happening, the economic growth had stalled. GDP growth shrank by 0.8% while the interest rates increased to reach 20%.

Due to bleak future of the economy, resignations became common. The country’s president Carlos Alvarez resigned. Other critical ministers also succumbed to the pressure from rioters and protesters. Finally, Argentina failed to meet its debt obligation to scare the investors even more. Nonetheless, the country stabilized by 2003 after the austerity measures began to yield fruits.

At the wake of the global economic crisis of 2008 and 2008, Argentina’s economy was largely unaffected. Economists point out that Argentina’s economy was not integrated fully into the global financial markets to experience the adverse effects of the economic crises. In addition, the agricultural sector was thriving in the country.

This enabled the country to increase its export function and minimize the effects of increased imports. To that end, Argentina’s GDP continued to rise until now. It is important to note that the country experienced steady growth in the value of real GDP per capital between 1991 and 2012.

This was despite several periods of recession that the country experienced. In fact, the country’s GDP increased from $ 6169.77 per person in 1991 to $11490.79 per person in 2012. The increase in GDP was because of implementation of policies such as import substitution and setting up structures in the government in addition to austerity measures.

Consumer price index (CPI)

The inflation rate is a measure of the general rise in the price level in the economy. It is a significant measure since inflation has an impact on the purchasing power of individuals and all other macroeconomic variables. The CPI measures the price level of all new goods produced in the home country (Jutta, 2006). An increase in the value of the CPI implies that there is an increase in the rate of inflation.

The value of the CPI has been increasing over the years. The consumer price index in 1985 was just above zero. The value increased to 84.37 in 1992. From 1993 to 2000 (1993 as the base year), the CPI was quite stable at 107.061. The rate of inflation rose from 133.422 in 2002 to 465.674 in 2012. Despite the growth in the real GDP of the country, the aforementioned statistics shows a consistent rise in the rate of inflation in the country.

High rates of inflation have serious economic implications on the key players in the economy. Particularly, the households and the firms in the country will experience severe and negative effects of high inflationary rates. At the outset, a high rate of inflation implies that the cost of purchasing goods and services will increase subsequently. Since the incomes of households remain constant in the short run, high percentage of the disposable income will go to the consumption function.

This has a negative impact on the savings that accrue the households. Many households will lack enough savings to purchase such services as health insurance and medical covers (Gomez, 2009). To that end, high rates of inflation lead to reduced disposable income accruing the households. This is in the lieu of the fact that the rates of people without health covers rose sharply between 2000 and 2012.

On the other hand, high rates of inflation will imply that local industries will sell their products at high prices. The rationale is that the raw materials and the general cost of production are high. The prices that the companies will charge the consumers will be uncompetitive when compared to imported goods. As such, high cost of production due to escalating inflation will not only endanger local industry but also increase the rate of importation.

Despite the general rise in the rates of inflation over the last twenty years, there was stability between 1991 and 2000. This was because of the introduction of peso convertibility system that ensured that the rate of exchange between the dollar and the peso remained at 1:1. The persistent increase in the CPI index between 2001 and 2012 was because of implementation of strategies such as import substitution, increased foreign debt and privatization (Gomez, 2009).

These strategies distorted the currency of the country leading to an unprecedented rate of inflation. The rate of inflation was so high that it amounted to a hyperinflation. The rationale is that the rate of inflation in the country increased by 200% within a period of a single fiscal year (between 2001 and 2002).

Unemployment Rate

Unemployment rate measures the number of people in a country who are not engaged in an economically productive activity even though they are willing and able to work. The rate of unemployment is computed relatively to the labor force in the country. The following graph below shows the erratic trend of the employment rate in Argentina for the past few decades.

The unemployment rate of the country increased from 3% in 1980 to 22.45% in 2002 due to political instability caused by Spanish conquerors. During this period, the rate of unemployment had risen significantly within a short time. Political leaders were unable to find the appropriate macro and microeconomic policies to address the rising unemployment rates.

Resignations became common as the problem of unemployment soared in the country. The highest rate of unemployment of the country was recorded in 2002 (Bortot, 2003). Consequently, the government instituted a number of measures to curb the rate of unemployment in the country. Prior to the Argentine economic crises of 2002, the rates of unemployment had increased to 20% in 1992.

This was due to the economic crises precipitated by high rates of tax evasion and money laundering (Gomez, 2009). From 2003, the country experienced drastic decline in the unemployment rate. The value declined from 17.25% in 2003 to 7.169% in 2012. Through import substitution, the government set up a number of industries. This led to a considerable decline in unemployment rates within the period.

Macroeconomic analysis of the economy

The discussion above reveals that the government has been able to manage GDP function and the rates of unemployment. There has been a significant increase in real GDP for the past ten years. Through effective policies, the government controlled the unemployment rates.

Notwithstanding the high rate of unemployment in 2002, the country has been able to reduce the rates in the recent past (Jutta, 2006). This was despite the world economic crises of 2008 and 2009. In fact, the country reported improved performance and high amount of GDP. During this period, the country’s unemployment rates dropped significantly. Nonetheless, it is clear that the country has a problem of managing rates of inflation.

As indicated by the consumer price index (CPI), inflation rate of Argentina has increased at a high rate in the recent past. As mentioned above, the high inflation rates weaken the economy since it distorts the interest rates, exchange rate, money demand, money supply and foreign trade. Besides, it affects the consumer’s consumption pattern. High inflation rates also make investors and households lose confidence in the institutions’ set up by the government to control inflation.

The austerity measures recommended by the international monetary fund (IMF) had a negative effect in the short run. The country’s microeconomic structures were weak and irresponsive to the austerity measures (Bortot, 2003).

As such, the rates of unemployment and inflation continued to soar in the short run. As indicated in the unemployment graph, the rates of unemployment in Argentina peaked at approximately 25% in 2002. Nonetheless, the austerity measures began to yield benefits for the country in the year 2003. Despite the reduction in the unemployment of the country between 2002 and 2012, the inflation rates have continued to increase (Gomez, 2009).

This implies that the country will grapple with high rates of poverty and uncompetitive local industries in the future. The rationale is that the impacts of high rates of inflation will only begin to appear in the long term. That notwithstanding, Argentina has instituted effective economic policies to counter high rates of unemployment and increase productivity. The country has been able to maintain the rates of unemployment at their minimum in the last decade and increase GDP modestly.

Policy recommendations

Argentina can institute various policies in order to mitigate the increasing inflation rates. A number of fiscal and monetary policies can be used to control inflation. Some of the fiscal policies entail reducing disposable income by increasing direct taxes reducing government taxes. Besides, the government ought to reduce its expenditure by reducing the amount of government borrowing.

The effect of these policies is to reduce the aggregate demand of the economy (Jutta, 2006). This will not only push the prices of goods and services downwards but also ensure that the rate of inflation is low. Hence, the government ought to recognize and implement other policy measures that help in reduce the aggregate demand of the economy (Bortot, 2003). Some critics point out that reducing the aggregate demand within an economy constrains the rate of GDP growth.

It is important to note that reducing the aggregate demand of the Argentinean economy will allow the economy to grow moderately, measurably and modestly (Bortot, 2003). This way, it is easy to keep the rates of inflation and unemployment at their very minimum. This causes the price level to decline resulting in a reduction in the rate of inflation. The GDP also declines. Therefore, there is a tradeoff between inflation and GDP.

Apart from fiscal policy, the government can also put in place monetary policies such as open market operations, discount rate, and reserve requirements. All of these tools are critical in controlling interest rate and inflation rate. Besides, such measures are important in reducing unemployment rates and increasing disposable income accruing the households. For example, it is essential to raise the level of interest rate to curb inflation.

At the outset, open market operations involve selling or buying securities to reduce or increase money supply. For instance, if the unemployment rate was so high in Argentina, the central bank of Argentina will buy the government securities in the market. This will cause the deposits and savings in banks to increase leading an increase in money supply (Gomez, 2009). Subsequently, interest rates will decrease.

When interest rates are low, most businesses will expand and increase their activities in the country. These businesses will need more employees and the unemployment rate will decrease significantly. Amid the crises that typified Argentinean economy, the central bank of Argentina has attempted to reduce the unemployment rates in the last decade. However, it overlooked the tradeoff that occurs between reducing the unemployment rate and increasing the rate of inflation over time.

In addition, discount rate is the interest rate for obtaining loans by a regular bank from the central bank. By manipulating and controlling discount rates, the central bank will be able to control money supply in the market.

If the government through the central bank of Argentine decreased the discount rate, most banks will be attractive to borrowers (Jutta, 2006). This in turn will cause an increase in money supply. Further, reserve requirement is the amount that central bank of Argentina requires the commercial banks to hold as a reserve. The bank cannot lend below specific minimum.

This reserve requirement helps to prevent the crises and bank run from happening. In addition, increasing the reserve requirement will decrease the money supply in the market and vice versa. Therefore, the central bank can control the interest rates in order to have a predictable economic trend and increase the productivity of its economy. To this end, the central bank will design policies that will allow the economy to achieve efficiency and attract investors (Jutta, 2006).

Conclusion

In essence, Argentina’s economy has improved tremendously over a period of two decades. The real GDP increased tremendously from $ 6169.77 per person in 1991 to $11490.79 per person in 2012. Despite the increase in GDP, Argentina is still grappling with high rates of inflation over the past few years. The rate of inflation in the country has scared away investors in addition weakening the local industries. Argentina has also experienced some of the worst economic crises in the early 1990s and 2002 (Gomez, 2009).

Unemployment rates have dropped significantly over the past decade in the country. However, reduction of the unemployment rates has consequently made inflation rates to increase. The consumer price indices have also soared implying that the country will continue to experience high rates of unemployment. To that end, It is important to institute various policies in order to reduce aggregate demand in the economy.

References

Bortot, F. (2003). Frozen Savings and Depressed Development in Argentina. Savings and Development, 27(2), 23-89.

Gomez, G. (2009). Argentina’s Parallel Currency: The Economy of the Poor. New Jersey: Prentice Hall Press.

Jutta, M. (2006). Hyperinflation, Currency Board, and Bust: The Case of Argentina. New York: Peter Lang Publishing.