Within an economic activity characterized by fixed prices through out the economic cycle, any changes in the investment bring various contagious issues in the state of equilibrium. The assumption of the equilibrium state within national income will hold and that the supply in national income is equal to the demand for the same income. Assuming that the economy is closed with no external influence of export and import, any structural changes to the internal economic variables are voted to affect the state of the broad national equilibrium. Let the national income function be Y=C+ I + g ; where Y is the national income, C is the level of consumption, I is the investment level and g is the government expenditure. (Ahmad, Tanzi, 2002, p. 52)

With an increase with the investment level, the gross national income will increase through the multiplier effect. Investment serves to increase the state of national economic activity. Through such investment the national income will subjectively be increased.

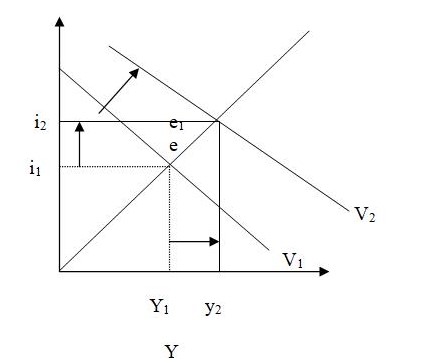

e- is the original state of equilibrium before, increased investment.

x-axis represents the income level

Y-axis represents the investments variable

When the level of investment increases from i1 to i2 the new level of income pushes from y1 to y2 with the equilibrium becoming e1. The equilibrium e2 shows an improved state of economic activity with the state of national income y2 been higher than the former state y1

V2 shows the shift from the original investment function V1 due to the increased state of investment activity (Harisson, 1996, p.33).

The changing level of national income is as a result of the multiplier effect. This is a fractional phenomenon which shows the relative increase in the broad national income activity due to an independent variable factor of the national income. However, the increase in the national income from the effect of the increase in investment is an implication if an increasing multiplier. The ratio 1/k where k implies the share response in the multiplier effect of the investment to the national income becomes increasingly more.

Generally, the individual income is a function of consumption an investment where y=b(c) + r(I), with y being the consumption level, c is the consumption, b is the marginal propensity to consume, I is the level of investment and r is the marginal propensity to save.

However, every increase in the national income implies an increased level of both consumption and savings by the citizens’ population. The increasing state of the investment multiplier will however imply an increased national value of the marginal propensity to save. Economically, investment income is taken as a dependent variable of the savings. Every increasing investment will imply an increasing state of saving where the saved income will provide capital for the investment process. The marginal propensities to consume and to save are reciprocals of one another where an increase in one will automatically imply a decrease in the other. This is because the personal income is a function of consumption and savings. Increasing national income through the investment multiplier will imply an increasing level of the personal savings and a decreased consumption. However, the increasing state of national income will implicitly imply increase in the individual income. Corresponding to this, both the levels of consumption and saving also increases relatively to the increase in the personal income. (Harisson, 1996, p.38)

Changes in government expenditure results to an increase in the broad national income. This is through the fiscal policy influence on the economic activity. Generally, fiscal policy entails government spending and the taxation policy. For this hypothetical case, the £3000 million government deficit will hold. Elsewhere, government expenditure of £500 million on purchase of goods and services above that of tax will be assumed. At one level, an increased state of government expenditure will increase the national income through government expenditure multiplier. Since government deficit is £3000 million and expenditure is £ 500 million, the multiplier will be 3000/500 =6. Therefore, the increase in the government income through the multiplier effect will be 6 x 500 =£3000.

This implies that, the change in the government expenditure by £500 million will offset the government deficit. Either, the tax variable plays a predominant role in any economic activity. In the fiscal policy system, changes in the level of taxes results to changes in the levels of national incomes. Tax relief to the economic activities helps to increase the levels of the national income. However, a decrease in the level of tax (through tax relief to the taxable units within the economy will result to an increase in the broad national income. This is through the influence of the tax multiplier. (Penq, 2004, p. 1) The national income through the fiscal policy structures changes accordingly to the levels of the taxing schedules. An increase in £500 million will automatically imply a decrease in the level of national income. The multiplier becomes £3000/£500 = 6. Therefore, the national income will reduce by 6 x 500 =3000. This will imply a total government national income deficit of £3000 + £3000 = £6000 million.

The changes in the national income as a result of the increase in the government expenditure and taxes will have various implications on the government budget positions. At one level increased government expenditure will imply an increase in the total government budget. This will show an increased state of activity within the broad economic parameter.

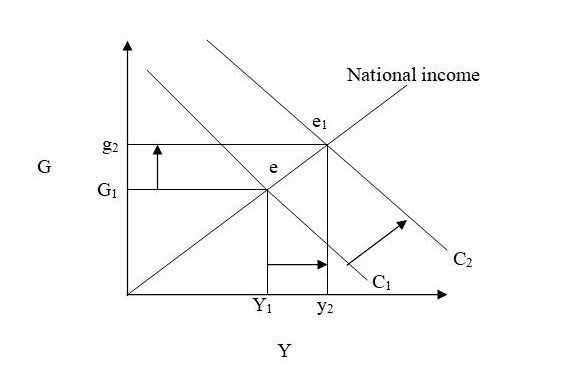

Y-axis-represent government expenditure

X-axis-represent national income

e1-original income equilibrium

e2-new income equilibrium position after increased government expenditure.

Increase in government spending results to a shift in the government expenditure curve from C1 to C2. The original equilibrium position was e1 but it now shifts to e2 after the change in government spending. The corresponding shift in the national income from y1 to y2 is an implication of the increasing level of the same income as a result of the shift of government spending fro g1 to g2. This is an implication of the increased state of income which offsets the existing government deficit. Equilibrium point e1 implies the economic point of deficit offset (with government income being zero (o) i.e. the existing deficits has now being offset by the government spending multiplier effect). (Ahmad, Tanzi, 2002, p. 72)

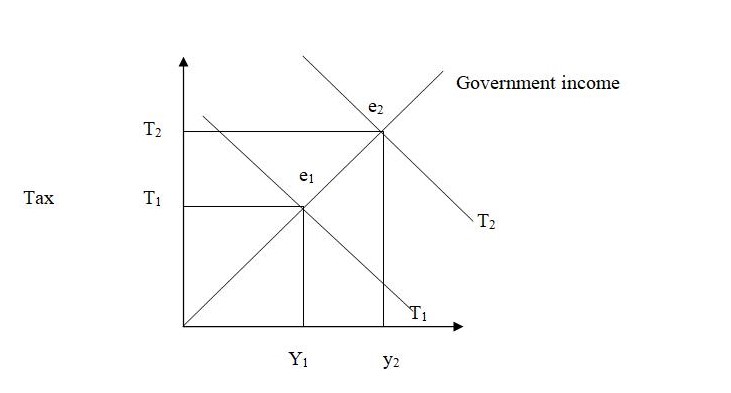

Alternatively increase in the tax levy by the government will imply an increase in the level of deficit in the government budget. This is a loss to the economic activity through unfavorable tax multiplier.

Original budget equilibrium point is e1, with a government deficit of £3000 million. After an increased tax levy of £500 million, the equilibrium shifts to e2 which is a lower state of government deficit (now £ 6000 million).

An open economy is prevalent to the effect of the import and export factors. An imbalance in both of them (the import and export) impacts the equilibrium of the balance of payment through either favoring it or dis-favoring it. Higher exports than imports help to improve the state of BOP, while higher imports than exports negate the state of the BOP.

However, with the increase in the government spending by £2 billion, the government budget position is increased. To return the same to the original position, taxation policy should be used adequately. Generally, high taxation will help to reduce the level of government budget. This is through the negative influence of the multiplier. Through the domestic consumption, an equilibrium national income would bring disequilibrium in the good market where the aggregate demand will be higher than the aggregate supply. (With the factor of fixed prices holding). (Adjibolosoo, 1999, p.68)

Higher lump-sum taxes will reduce the broad national activity through the economic structural implication of adverse fiscal policies. The result of the increased government spending has brought an imbalance in the state of imbalance between the saving and investment. The higher spending has led to an increased consumption with need for higher savings to cater for this increased state of aggregate demand. From the impact of the increasing state of government spending, the people will be supplied with more income to consumption than what the economy can sustain. High state of demand will sustain due to the fixed price levels. Either, with higher income and fixed prices, people will be more interested in involving themselves in foreign trade in imports of the shortage commodities from what cannot be supplied by the domestic economy. High import than the state of export in the economy brings imbalance in the export and import levels. Higher import and export implies unfavorable BOP.

High government spending will lead to a distorted equilibrium level in the national income. Various implications of the multipliers will imply a higher supply of national income than what the activity of the economy can accommodate. However, higher taxation will help to ransom this condition. A higher national income implies an increase in the personal income which is a constituent of both consumption and investment. However, the fixed price with an increased state of national income is a de-motivation to increased supply which should be an increasing factor with that of the money supply. Investors will however be de-motivated of the fixed prices in the domestic economy. The high income will imply higher savings and lower investment. This is the most influential hallmark that will develop between the high saving and low investment within the domestic boundaries. (Anderson, 2002, p. 1)

With the high income, domestic investors will be motivated by the favorable prices in the foreign countries. They will therefore cross their national boundary for foreign investment due to the factor of high savings domestically accompanied by low investments. This will imply capital outflow from the country. Foreign investments will bring high import (capital importation) than exports which is an imbalance. Either way, foreign investment may take the opportunity of domestic investment from foreign export. This will imply higher exports than imports. However, higher taxation will help to balance the disequilibrium in these conditions.

Bibliography

- Ahmad, E & Tanzi, V. (2002) Managing Fiscal Decentralization. London, Routledge.

- Adjibolosoo, S (1999) Rethinking Development Theory and Policy: A Human Factor Critique. Mahwah, NJ, Praeger.

- Anderson, G. (2003) Toward Economic Democracy. International Journal of World Peace, Vol. 20

- Harisson, F (1996) Economic Development: Theory and Policy Applications. Mahwah, NJ, Praeger.

- Penq. M (2004) Identifying the Big Question in international Business Research. Journal of International Business Studies, Vol. 35