Introduction

Snowdon and Vane define macroeconomics as a concept that delves into the global economic factors (123). This report paper focuses on the effects of increasing government spending specifically including a study of the effect of government spending on unemployment, government debt, inflation and government borrowing where the 10% increase in government spending in the three variables (education, health, and defense) will be analyzed together. Later a mix of macroeconomic policies is tested using the UK economic model, and the consequences analyzed with an aim of coming up with a sound economic policy mix.

Analysis of the Impact of the Policy

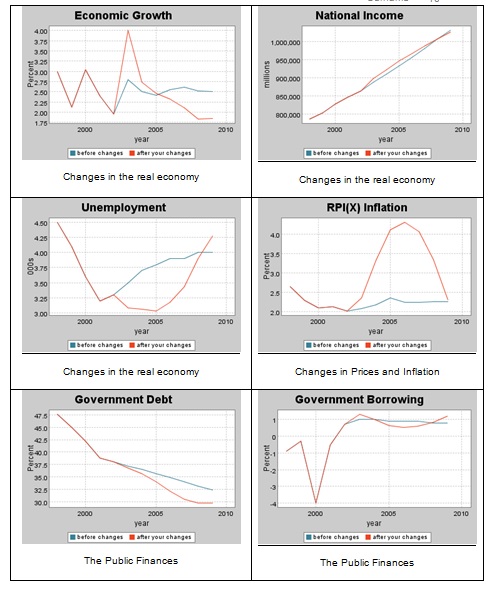

The department of health, education and employment (DFEE) and the department of defense each have an increase of 10% in government spending. In the event that there are these changes to these variables, the graphs presented in appendix 1 are a show of what is anticipated to happen to the core macroeconomic elements of the economy. These areas of change and transformation are observed to be key in the field of performance, structure, behavior and decision making in different issues in the economy. There are considerable changes in the key economy areas like employment, price indices, national income, consumption, inflation, savings and investment.

Analysis

From the preceding presentation, when there is a 10% increase done simultaneously in the three variables, this analysis shows the quantifiable changes that are anticipated in different macroeconomic areas of the economy as a result of that increase.

Table 1: Table of unemployment caused by the 10% increase in the three Variables.

These changes as were done and recorded from 2003 to 2009 brought effect to the economy where it is observed from the above table that unemployment rate had changed during the years 2003 to 2009 from its 2003 highest of 3.50 percent to 3.08 percent. The same trend was seen up to 2009 where unemployment rate had increased from its lower prior 4.00 to the lower 4.27 percent. The average unemployment rate had declined from its prior average unemployment rate, for the years 1998 to 2009, of 3.79 percent to a new overall rating of 3.55. The rest of the details are shown in table 1 above.

Table 2: Table of Inflation caused by the 10% change in the three Variables.

In the same way, table 2 shows that these increases also had effect on the inflation rate where the inflation rate had changed during the same period. The 2003 inflation rate had been reduced from its higher prior 2.07 percent to the lower 2.35 percent and this was the same throughout up to 2009 where the inflation rate had increased from its lower prior 2.25 percent to the higher 3.30 percent. The average inflation rate had increased from its prior average inflation rate of 2.23 percent to a new overall rating of 2.92. The rest of the changes are shown in table 2 below.

Table 3: Table of Government Debt caused by the 10% increase in the three Variables.

Table 3 shows that there was a significant change in the government debt rate during the years 2003 to 2009 due to these changes. The 2003 public sector net cash requirement as a percentage of GDP (Borrowings) rate had declined from its prior 37.20 percent to the lower 36.81 percent and this decline is consistent up to 2009 as shown in table 3. In terms of statistics, there is a weak correlation or no correlation between government spending and the community’s inflation rate. In fact, too much government spending to an amount that exceeds the government’s revenues from taxes, tariffs, duties, and other cash inflow sources.

Table 4: Table of Government borrowing caused by the 10% increase in the three Variables.

The results in table 4 above indicate that there was a change of government borrowing between the years 2003 to 2009 due to the adjustments of the macroeconomic variables. As a result, the 2003 public sector net cash requirement on borrowing as a percentage of GDP increased from 1.00 to 1.01 and this trend was duplicated in the year 2004. The trend changed in 2005 to 2007 with 2005 recording a decrease from 0.90 to 0.63 indicating government budget surplus. Government borrowing resumed an increasing tread in the last two years of analysis (2008 to 2009) with an increase of 0.42 in 2009. This government tread of borrowing will lead to substantial inflation, less government debt and reduced rate of unemployment.

Base Rate as a Monetary Policy

Following the outcome of the above 10% increase in government expenditure, a combination of different policy tools are used in addition and experimented using the UK economic model. Under the income tax, the basic rate thresholds in pounds per year were increased to £1880 and £ 29400 per annum respectively. The base rate used as the monetary policy was reduced by a half while the three variables (education, healthcare and defense) were increased by ten percent simultaneously. For indirect taxes under specific duties, the VAT was reduced to 18 and then the virtual economy model was run to yield the following results.

From the 2003 results, the exchange rate (Table A) required decreased from 101.60 to 101.25 and this decrease was consistent throughout up to 2007 but there were slight increases in 2008 and 2009. The averages recorded a drop from the former 104.48 to 101.24, thus a drop index of 0.24. This decrease in exchange rates is not bigger than the former one thus the adjustment slightly affects the former results negatively. In conclusion the -0.24 exchange rate after combination of different policy tools is not better than 10% first adjustment (-1.04).

As regards unemployment (Table B) as an element of macroeconomic factor under test here, this combination resulted in notable changes that showed general decrease from 2003 from 3.50 to 3.10, which was consistent up to 2006 in the unemployment index. The years 2007 to 2009 saw some consistent slight increases. This was a -0.03 decrease in the unemployment index occasioned by the combination of these policy tools in the economy. This was a lesser difference than before and this means that the adjustment slightly increased unemployment.

In the inflation rates (Table C), the adjustments affected inflation by first having a consistent increase in inflation index but there was a great fall in 2009 from 2.25 to 1.20. This is a good indication since inflation takes time to adjust. The final average increase 0.43 is; however, lower than that of 0.67 with 10% adjustment.

The government borrowing (Table D) as a percentage of the GDP decreased in 2003 and 2007, and then increased sharply in 2008 and 2009 but gave an average drop of – 0.10. When compared to the former -0.02 on 10% adjustment, we can deduce that this policy adjustment greatly reduces government borrowing on average. This negative difference means that there is a surplus in the government budget which is a good thing as it indicates that there is more money to strengthen the economy.

As a result of this policy mix, the annual economic growth (as a percentage of the GDP) (Table E) recorded some variations. There were slight decreases in the in the annual economic growth as a percentage of the GDP for the first five years then the economy picked again in 2008 and 2009 with grease increases. These leaps have some future promises for the economy. The overall performance of the economy as a a result of policy adjustments recorded am average increase of 0.16. This increase shows that although the policy adjustments affected exchange rate and unemployment, it will just be a matter of time and every variable will go back to normal. This is how economy works because the macroeconomic factors have to adjust to some equilibrium where the growth is to the optimum.

These results, therefore, shows that fiscally aggressive and monetarily passive economic policies mix give, on top of the 10% adjustment, a logical economic outcome that positively favors the macroeconomic variables discussed, and economy in general. This is because the outcomes are in line with the IMF statement in The UK Article IV Consultation 2010, which suggested that the UK economy is on the mend when appropriate adjustments are made to its macroeconomic variables such as the ones shown above (HM Treasury 1). This stability is shown in the increased average of the economic growth of 0.16 as a percentage of the GDP. It is therefore observable that the kind of stability that the UK economy can enjoy is determined by altering the different tax related variables in the virtual economy model that would give a general pointer to what is expected in the general economy.

Works Cited

“HM Treasury”. UK Article IV Consultation. hm-treasury.gov, 2010. Web.

Snowdon, Brian, and Howard Vane. Modern Macroeconomics: Its Origins, Development and Current State. New York: Edward Elgar Publishing, 2005. Print.

Appendices

Appendix 1: Tables

Table A: Exchange Rate: Real Effective Exchange Rate, index – 1990=100.

Table B: Unemployment: UK Unemployment, using the “claimant count” measure, as a percentage of the total labor force.

Table C: RPI(X) Inflation: Inflation (% average annual increase) in the RPI, minus mortgage interest payments.

Table D: Government Borrowing: The Public Sector Net Cash Requirement as a percentage of GDP.

Table E: Economic Growth: Annual rate of growth as a percentage of Gross Domestic Products.

Appendix 2: How changing government spending on healthcare, defense and education by 10% together would affect families and the economy