Abstract

This paper focuses on the peculiarities of efficient implementation of M&A. First, various measurement strategies are analyzed, and it is acknowledged that researchers come to different conclusions due to the use of different methodologies. The existing measurement methods involve stock-market-based measures, accounting-based measures, managers’ perceived performance strategies, expert informants’ assessments and divestment measures (Wang & Moini, 2012). Zollo and Meier (2008) identify two major dimensions: the level of analysis (with task level, transaction level, and firm level) and the level of time (short-, medium- and long-term levels).

The paper also addresses main execution issues such as the lack of communication, unclear and unrealistic expectations and goals, too many compromises associated with organizational structure, the absence of the strategic plan and concepts, the lack of top management commitment, the lost momentum, and the failure to address IT issues in a timely manner. The two integration imperatives (urgency and execution) are also considered.

Finally, the acquisition plan developed is enhanced in accordance with one of the metrics mentioned above. Major execution issues are analyzed. It is concluded that the new plan manages to address all the issues effectively.

Different Methods Employed to Assess the Performance

Mergers and acquisition (M&A) have been seen as effective strategies to improve companies’ performance. However, researchers stress that the findings concerning the effectiveness of this approach may differ due to the different measurements. Wang and Moini (2012) and Zollo and Meier (2008) identify and evaluate major methods utilized to assess M&A.

Event Studies

For instance, Wang and Moini (2012) note that event studies or the stock-market-based measures has been employed since the 1970s. This approach identifies abnormal stock price effects (if any) related to M&A as stock reflects all the changes during the following period based on the new information (Wang & Moini, 2012). There can be short- and long-term event studies. The event study is grounded on three basic assumptions. First, the stock prices change when the information concerning the event becomes available to the stakeholders (traders, investors, and so on).

Secondly, the event is not expected, but M&A can often be anticipated. Thirdly, there were no other influential factors during the window period. It is clear that these assumptions unveil certain limitations of this approach. Other disadvantages include the fact that expected instead of actual synergies are measured, it cannot be applied to private companies, it focuses on the company level. The advantages of the method include the fact that the information can be assessed publicly. More so, the approach is relatively objective, abnormal return is measured, some outside effects can be evaluated.

Accounting-Based Measures

Accounting-based studies compare accounting statements before and after M&A as it is assumed that the benefits associated with M&A will be reflected in accounting statements. According to Wang and Moini (2012), the advantages of this measurement include the focus on realized synergies, it is easier to carry out than the event study, more data can be obtained to measure the company’s benefits (cash flow, productivity, sales rates, assets, profit/sale ratio, and so on). The shortcomings of this approach involve the focus on past (not present) expectations, the fact that accounting standards often change which make accounting data less relevant, the effects of other factors are included, accounting data can be manipulated, the performance of the entire organization rather than M&A effects are evaluated.

Managers’ Perceived Performance

This approach focuses on the executives’ perspectives concerning the realization of their objectives several years after M&A. Zollo and Meier (2008) note that this is not a widely used method. The advantages of this approach include the use of private data, reduction of “the outside noise,” the executives’ perceptions often affect the strategies they use, the method can be used in all types of M&A. The downsides of the managers’ perceived performance are as follows: it is often biased, the results can be distorted by inaccurate recollection, the original objective of M&A can affect executives’ perspectives.

Expert Informants’ Assessment

Wang and Moini (2012) identify another type of assessment. This approach is similar to the previous one, but instead of executives’ opinions, expert informants’ perspectives are utilized. Some studies focus on assessments of a security analyst, while others often employ a set of data obtained from several analysts as well as executives. The advantages and disadvantages of this method are similar to the ones mentioned above. However, it is necessary to add that another downside is the lack of information while the advantage is the ability to assess M&A on the project level.

Divestment Measure

Another approach identified is divestment measure. The method implies that the acquired company is divested after M&A. Wang and Moini (2012) note that researchers reported different data on divestment, but it is clear that from one-third to a half of the companies were divested after M&A. This approach is simple to employ as detailed data are unnecessary.

Other Measurement Paradigms

Zollo and Meier (2008) identify slightly different measurement paradigms. The researchers first put two dimensions to the fore. The first dimension is the level of analysis. They point out that researchers can measure M&A on the task level. This means that researchers analyze the effectiveness of every process included into M&A. Thus, the extent to which goals are met defines the effectiveness of the overall M&A. The transaction level implies the focus on the value generated by M&A. Zollo and Meier (2008) stress that the evaluation of goals is analyzed as they were set during the transition.

The firm level is the dimension that concentrates on the performance of the company before, during and after M&A. Zollo and Meier (2008) add that this is the most common approach. The second dimension is the “time horizon” (Zollo & Meier, 2008, p. 58). In this dimension, three measurement types exist. These are short-, medium- and long-term measures. Short-term metrics cover one or two years after the completion of M&A. It is quite difficult to draw particular boundaries for the other two types (Zollo & Meier, 2008). The researchers also try to use major levels to obtain empirical data and find that the paradigm is rather effective but still needs to be improved.

Major Execution Problems

Arthur, MacDonald and Herd (2003) explore main problems that can undermine the effectiveness of M&A. Different management styles employed by the merging companies (or the acquirer and the target firm) also cause many problems and may affects the entire process negatively. One of these negative factors is the inability to employ strategic leadership. Some companies fail to develop the strategic vision and see M&A as an operational issue handled by particular groups. There should be a strong leader committed to implement the process within the set timeframe and goals set. Arthur et al. (2003) also stress that the leader should be able to articulate the goals as well as methods that will be utilized. Otherwise, other stakeholders will feel lost or uninterested. Of course, the agenda articulated should be complete realized. It is also important to take into account possible legal issues that can affect the process of M&A.

Another crucial aspect to consider is communication, which has to be effective with all the stakeholders. Proper communicative patterns should be utilized to make employees engaged. The leader should make sure that the employees understand the need for M&A, the peculiarities of the process as well as possible negative conditions. It is essential to monitor key staff losses, and try to prevent them. It is vital for the acquirer as well as the target company which will operate more efficiently if committed and experienced people continue working. Proper communication strategy is also central to the development of relationships with customers. Customer retention should be one of the major priorities. They should also understand the benefits of M&A, and they should be ready to or, at least, informed about possible impairments in work (fewer services during a particular period).

Ironically, culture can be a significant obstacle as the clash of organizational cultures is likely to disrupt the M&A process. The inability to focus on quick gains and prompt results makes M&A inefficient as the majority of M&A projects are effective if they are completed within a year or two. Some companies are “overly ambitious” as they try to acquire companies although other acquisitions are not accomplished (Arthur et al., 2003, p. 43). They lose the focus on proper execution of M&A, which leads to failure.

Two M&A Integration Imperatives

According to Arthur et al. (2003), urgency and execution are two main integration imperatives. As for the first imperative, it has a number of dimensions. First, the process should be implemented within a short period (one to two years) or it is likely to fail. If a company decides to merger with or acquire a firm, it should be done at once. The focus on short-term wins is beneficial for this process. The sense of urgency is another dimension. The leader should create the sense of urgency for the change. The leader should inform all the stakeholders involved about the benefits of M&A. Arthur et al. (2003) stress that the leader should mention some problems that may arise, which will make other stakeholders more focused, committed and engaged.

The other imperative is execution. The researchers emphasize that the vast majority of failed M&A became a result of inefficient execution. M&A requires strong leadership that has a particular strategic vision. Strategic leadership is associated with the development of manageable goals and terms. It is also imperative to follow the plan developed. The leader should be ready to address the following problems: improper communication, unrealistic/unclear synergy expectations, too many compromises associated with the organizational structure, a missing major plan, missing momentum, the lack of top management commitment, unclear strategic concept, IT issues addressed in an untimely manner (Arthur et al., 2003).

Another important aspect is proper articulation of the plan. The leader should provide major details to all the stakeholders. Employees should be motivated and committed, which can be achieved through the provision of all the necessary data on the benefits of M&A as well as associated risks. There can be no room for uncertainty as it tends to lead to staff turnover. Arthur et al. (2003) also add that customer should be aware of the peculiarities of M&A. Benefits as well as risks should be voiced.

Enhanced Execution Plan

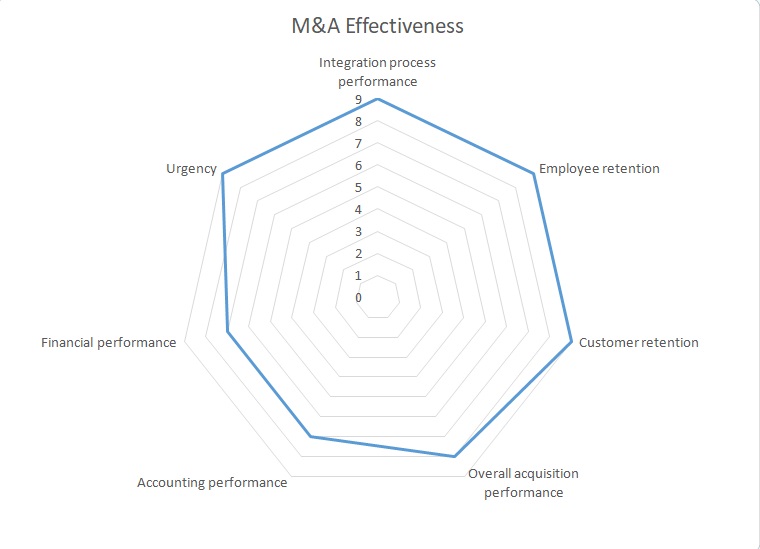

The execution plan developed earlier can be enhanced with the use of a modified metrics offered by Zollo and Meier (2008). The researcher developed a measurement metrics that included seven major components: integration process performance, employee retention, customer retention, overall acquisition performance, accounting performance, financial performance, short-term event study measures. However, it can be beneficial to change the last component to ‘urgency’. These seven components will help evaluate the effectiveness of the suggested plan (see fig. 1). Notably, the measurement will involve expected synergies.

The initial M&A process included the initial stage of planning, which is the development of a detailed strategic plan. This critical stage affects the overall efficiency of M&A (Arthur et al., 2003). The development of the working group should still imply the existence of the strong leadership. Estimation of the potential synergies should be accompanied by the analysis of possible risks. These data should be available to all the stakeholders (employees as well as customers of both firms). Addressing the target company should be implemented in terms of these changes. The leader should also create the sense of urgency through articulation of major aspects to the stakeholders.

The leader should pay specific attention to opinions of employees (especially the key staff) and customers. Employees should understand that acquisition will not lead to redundancy. On the contrary, it can result in certain growth as the target company will have to provide additional services (associated with the delivery of specific materials). The target firm’s employees should also understand that they will obtain training in such spheres as communication, IT, project management and so on, which will be a part of the merger (Lasher, 2016).

Thus, they will be able to develop additional skills. The target company is a comparatively small local firm but it has loyal customers who should also understand that they will be able to obtain high-quality services in the future. As for the communication with customers, these stakeholders should be aware of the goals, benefits and possible impairments in the provision of some services. The should be informed about possible delays that can arise in the course of integration (IT issues and so on).

Importantly, the overall process should be reduced to one year or 18 months. This is the period when the company can realize main synergies (Arthur et al., 2003). During this period, the following phases should take place: business plan, acquisition plan, search, screen, first contact, negotiation, integration plan, closing, integration and evaluation (DePamphilis, 2015).

Initially, a lot of effort was planned to be invested in the staff training. This is an important and beneficial measure. It will make the employees aware of the changes (benefits as well as potential risks). It will also be instrumental in avoiding the clash of cultures. The target company is rather small but it has an organizational culture (About us, 2014). The cultures of the two companies are quite similar and due to the size of the target company as well as similarity of values the clash of cultures can be avoided.

It is possible to assess the efficiency of this project using the mangers’ perceived performance measurement. There can be certain bias but it can be reduced through the analysis of such objective components as the company’s revenues and so on. As has been mentioned above, a seven-component measurement can be employed (see fig. 1). As seen from the graph, the project is expected to be efficient. The most challenging areas will be the financial and accounting performance as they acquirer does not expect dramatic changes in the financial and accounting performance as the target company will cover only a part of operations. The project will add flexibility to the company but will not cover all the supply chain issues. However, the goals set are consistent with these expectations.

Such components as urgency, employee retention, and customer retention will be the most successfully implemented due to effective communication and strong leadership. The leader will create the sense of urgency and will explain benefits as well as possible downsides of the project. This will make the stakeholders more positive about the project and more committed.

The New Plan and Execution Issues

According to Arthur et al. (2003), insufficient communication is one of the most crucial execution issues. The new plan addresses the issue quite effectively. The leader articulates the objectives, expected benefits as well as potential risks to the stakeholders. Specific attention is paid to key staff and customers who will be aware of the changes. Of course, the information concerning the acquisition will also be provided to the acquirer’s employees who will be ready to develop proper communication channels with the target firm’s personnel. The issue of the lost momentum is effectively avoided as the project is implemented within a short period (12 months), and leader manages to create the sense of urgency.

The issues concerning unrealistic or unclear goals is also met. First, the goals are quite clear as the acquirer sees the acquisition as a way to improve its flexibility associated with the supply chain management. The expectations are also rather realistic. The acquisition is not expected to affect the performance of the acquirer dramatically but will lead to such synergies as reduced costs, better image and so on. The target company also expects to realize such synergies as the investment (manifested in training, possible staff growth and technological upgrade) as well as improved image as it will become a part of the big local enterprise.

The issue concerning the organizational structure is unlikely to occur due to the size of the acquirer and the target firm. More so, there is no need in reorganizing the target company as it will operate as a provider of particular services rather than a specific part of the company. The issue related to the absence of the ‘master plan’ is avoided through the use of a detailed strategic plan that addresses all the stages of the project. This plan also helps the company to have a clear strategic concept. Finally, the issues associated with the sphere of IT are also addressed as the integration process involves training, upgrade of the necessary hardware and software.

References

About us. (2014). Web.

Arthur, B., MacDonald, T., & Herd, T. (2003). Two merger integration imperatives: Urgency and execution. Strategy and Leadership, 31(3), 42-49.

DePamphilis, D. (2015). Mergers, acquisitions, and other restructuring activities. San Diego, CA: Academic Press.

Lasher, W.R. (2016). Practical financial management. Mason, OH: Cengage Learning.

Wang, D., & Moini, H. (2012). Performance assessment of mergers and acquisitions: Evidence from Denmark. E-Leader Berlin. Web.

Zollo, M., & Meier, D. (2008). What is M&A performance? Academy of Management Perspectives, 22(3), 55-77.